Steps to trading in silver

Are you ready to trade in silver? Take your position in just three steps:

Choose a silver market to trade

Trade on silver’s price or a selection of silver stocks and ETFs.

Decide how to trade

Decide to take a position on silver over the short term or build up your confidence first in a demo account.

Open a live account

Create a CFD trading account with our online form.

Learn more about the difference between silver trading with our extended steps below.

- Discover what silver trading is

- Learn about the relationship between silver and gold

- Understand what moves the price of silver

- Decide how you want to trade in silver

- Create your silver trading account

- Find your silver opportunity

- Open your first silver trade

- Monitor your trade and close your position

Discover what silver trading is

Silver trading is a method of gaining exposure to the price of silver. Trading in silver is purely speculative. There are a variety of silver markets available to trade in, including:

- Silver bullion

The traditional means of investing in silver would be to buy actual bars or coins.* Over the years, the costs of storing bullion and insurance have caused the method to decline in value

- Spot silver

The spot price is the price at which silver is currently trading – buying at this price would mean the asset could be exchanged and delivered ‘on the spot’. The market enables traders to get exposure to the price of silver without taking ownership of bullion

- Silver futures

Silver futures are contracts to exchange the metal at a specific price on a date in the future. Both parties in the contract – the buyer and seller – have the obligation to uphold their end of the deal

- Silver options

Silver options are contracts that give the holder the right – but not the obligation – to trade silver for a set price, on a set date. Call options give the right to buy silver, while put options give the right to sell it

Learn more about trading options

- Silver ETFs

Exchange traded funds (ETFs) can track the movement of physical silver bullion or a basket of the shares of companies within the silver industry. Trading in silver ETFs gives you a broader exposure than you’d get from a single position

- Silver stocks

Trading in stocks can be a great way to get indirect exposure to the precious metals. You can find a variety of opportunities in every element of the industry, including mining, production, funding and sales

Learn more about trading shares

*Remember, with us you can only trade derivatives via CFDs.

Learn about the relationship between silver and gold

The comparison between gold and silver dates back centuries, with silver literally coming in ‘second place’ to the rarer metal – marking the runner-up in competitions since the 1800s. Both precious metals are considered safe-haven assets, although gold is – again – the more popular choice.

The relationship between the two can be monitored using the gold-silver ratio, which shows the amount of silver it takes to buy one ounce of gold.

For example, if the ratio is 20 to 1, then at the current market price it would take 20 ounces of silver to buy an ounce of gold. If silver’s value is up, then the ratio would narrow as it takes less silver to make the purchase. When the ratio narrows or widens, it can be a good indicator of an opportunity to buy or sell gold and silver.

A higher ratio indicates a good time to buy silver, as it is cheaper in comparison to gold. A lower ratio indicates a good time to buy gold, as silver is becoming more expensive.

Historically, the price ratio was fixed at 15:1, as it was believed that it would help stabilise the global economy. However, in 1873, it started to fluctuate once the gold rush caused an oversupply in the market – leading to the hoarding of silver.

Although the price ratio is no longer fixed, there remains a strong correlation between the two. The relationship is now based on their uses, rather than the policy of world governments.

Understand what moves the price of silver

Silver, like any market, is driven by supply and demand. However, the price of silver is often far more volatile than other metals, as it has a variety of different uses and factors that can impact its value, including:

- Use in industry

- The US dollar

- Safe-haven investments

- Inflation

- Demand for other metals

The properties of silver make it uniquely positioned for use in industry – it’s highly conductive, anti-bacterial, malleable and ductile. As such, silver is used in batteries, LED chips, dentistry, water purification and medicine. All of this creates a steady demand for the metal that isn’t dependent on investment.

Silver is denominated in US dollars, which means that the two generally have an inverse relationship. So, if the dollar weakens, silver becomes cheaper to purchase, which can lead to increased demand and higher prices. Alternatively, if the dollar strengthens, silver becomes more expensive and demand is likely to fall.

As both silver and gold are used as safe-haven investments, their prices are influenced by economic performance and political stability. As silver is seen to retain its value far better than paper currencies and other assets when the economy declines, investors often flock to it as a store of value.*

Conversely, in periods of economic growth, silver can decline in value as investors turn to other assets that generate higher returns. There’s also increased demand from consumers, who are seeking to buy luxury goods such as jewellery.

*Remember, with us you can only trade derivatives via CFDs.

Silver is seen as a great hedge against inflation. While inflation normally erodes the value of paper currency, silver can provide protection as its price is more heavily impacted by different factors.

Silver is commonly found in the process of extracting other metals from the ground. For example, copper ore mining accounts for 26% of all silver finds – so if demand for copper spikes, it can lead to a rise in silver supply. Increased supply, without the subsequent increase in demand, could cause the market to be flooded. But as the demand for silver is fairly stable, this isn’t usually an issue.

Decide how you want to trade in silver

Discover how you can take a position on silver.

- Silver ETFs

- CFDs

CFDs

Trade CFDs to predict on whether a silver ETF will rise or fall in price – without having to own the shares. You can offset losses against profits for tax purposes1, making CFDs a useful hedging tool.

Learn moreCreate your silver trading account

Start trading silver stocks and ETFs by filling out our online application form. You could be ready to trade CFDs.

If you’re not ready to trade, you can build up your confidence in a demo account.

Find your opportunity

Discover your first silver trade with a range of tools available in-platform.

Expert analysis

Get automatic notifications when your silver price target is met

Technical indicators

Discover silver trends with popular indicators such as moving averages

Trading alerts

Get automatic notifications when your silver price target is met

Trading signals

Receive actionable ‘buy’ and ‘sell’ signals based on silver analysis

Open your first trade

You can trade our proprietary silver spot prices, futures contracts and options via CFDs. Alternatively, you can get indirect exposure via silver company stocks and ETFs by trading.

Once you’ve decided how you’ll take a position, it’s important to think about whether you want to buy or sell silver, the position size you’ll take and how you will manage your risk.

- Spot silver

- Silver futures

- Silver options

- Silver stocks and ETFs

Our spot prices are based on the prices of the two nearest silver futures. As there are no fixed expiries, you can use these undated contracts to take shorter-term positions. Plus, you can see silver trends more clearly with continuous pricing across the market’s entire history – rather than just the duration of a single future.

Once you’ve created your account and logged in, you can trade silver spot prices by:

- Searching for silver or finding it under ‘commodities’ in the left-hand menu

- Selecting ‘spot’ at the top of the deal ticket in the right-hand panel

- Choosing your trade size

- Opening your position by clicking ‘buy’ or ‘sell’

When you trade silver futures with us, you’ll actually be trading CFDs on the underlying market price. This means you won’t be entering into a futures contract, but deciding on whether it will become more or less valuable before it expires.

After you’ve opened your account and logged in, simply:

- Search for silver or find it under ‘commodities’ in the left-hand menu

- Choose ‘futures’ at the top of the deal ticket in the right-hand panel

- Select the expiry you’re interested in

- Pick your trade size

- Open your position by clicking ‘buy’ or ‘sell’

At expiry, we’ll roll over your futures contract into the next month, unless you close your position. It’s important to note that there may be a difference in the price for the next month’s contract.

Predict on whether silver options will rise or fall in value by a certain date. Once you’ve created your account and logged in, you’d just need to:

- Select ‘options’ from the menu on the left

- Tick ‘commodities’ and choose between silver daily, weekly or monthly options

- Pick the option type, strike price and trade size you want

- Open your first position

Take a position on silver stocks and ETFs to get indirect exposure to silver.

Go long or short on the underlying price of a stock or ETF with CFDs – you won’t take ownership of the asset, which has tax advantages in some countries.1

Choose whether to go long or short on silver

When you trade silver assets via CFDs, you can open a position to buy or sell the market – known as going long or short. You’d buy if you expected the market value to rise in a given timeframe, and you’d sell if you thought it would decline.

Monitor your trade and close your position

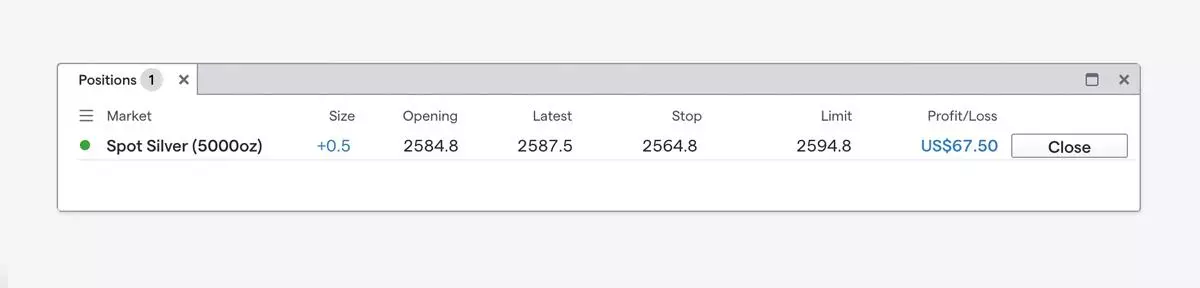

Once you’ve opened your position, you can see your trade in the ‘positions’ section of our platform – enabling you to monitor your running profit and loss.

It’s important to keep an eye on silver market news while your position is open and continue to perform technical analysis so that you can identify key turning points in the market.

Ready to open your first trade? Create an account now

When you decide it’s time to close your position, you can simply click ‘close’.

FAQs

Can I profit from trading in the silver price?

Yes, if the position you take on whether silver’s price is correct you would generate a profit. Trading silver markets with derivative products means you can take advantage of rising and falling market prices.

How do you trade in silver?

You can trade in silver with our spot markets, futures, options, stocks and ETFs. To open a position, you’ll need a CFD account.

What moves silver markets?

Silver is incredibly volatile as there are a wide range of factors that can influence its price, including its use in industry, the value of the US dollar, its status as a safe-haven investment, inflation and the demand for other metals.

When can I trade silver?

Our silver spot market is available between 11pm Sunday and 10pm Friday (UK time). Silver futures can be traded 24 hours a day, five days a week, except between 10pm to 11pm (UK time). Daily silver options trade between 7.30am on Monday until 9.15pm on Friday (UK time).2

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

2 International times may vary.