Brexit

Learn how you could trade the market volatility caused by Brexit - and hedge your portfolio and exposure to sterling- with the world's No.1 CFD provider.1

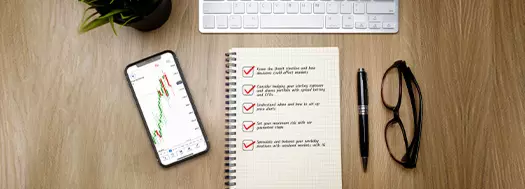

Tips for trading Brexit

Tips for trading Brexit

Set price-change alerts to notify you of significant movements

Cap your maximum risk by placing guaranteed stops on your positions

Consider hedging your portfolio with GBP exposure or other asset classes

Be ready to go long or short whenever opportunities arise, even at the weekend

Download our Brexit trading tips, explaining how to:

Why trade Brexit with IG?

Deal GBP/USD from just 0.9 points

Go long or short on a range of currency pairs including all major GBP, EUR and USD crosses

Take a position on over global markets

Speculate or hedge on a range of CFDs – including 24/5 indices, commodities, FX, equities and more

Free risk protection

Take control with our guaranteed stops2, limits and alerts

Choose from a range of price alerts

Stay informed of market movements with percentage and point-based price alerts- exclusive to IG

What is Brexit and what opportunities does it offer traders?

A simple Brexit definition is that it is a contraction of ‘British exit’, and it is a word used to define the United Kingdom’s departure from the EU. So far, the withdrawal process has caused widespread market uncertainty, which in turn has created opportunities for profit. With CFDs, you can speculate on markets rising as well as falling – meaning you have a wider scope to take advantage of the Brexit volatility.

Markets to watch during Brexit

You can trade on any Brexit news or developments by trading financial markets such as shares, forex pairs and indices. Many of these assets will be highly sensitive to the outcome of negotiations during the transition period, with the FTSE 100 UK stocks, GBP/USD and gold all likely to experience some movement.

CFDs enable you to profit from markets that are falling as well as rising, giving you plenty of opportunity to capitalise on volatility without ever having to take ownership of the underlying asset.

How will Brexit affect GBP?

How Brexit affects GBP will depend on the state of negotiations during the transition period, which ends on 31 December 2020. The UK will attempt to ‘roll over’ the existing free trade deals that are in place between the EU and other countries, such as Canada. It also has the task of negotiating a new trade deal with the EU, which will take effect once the transition period ends.

The UK will remain a member of the EU customs union during the transition period – so GBP could behave much in the same way as it has since the 2016 referendum. This means the pound will likely remain volatile, especially given the possibility of new trade deals with the US and other leading global powers.

How do I hedge Brexit risk?

Share portfolio risk

We enable you to go short on major indices and over 16,000 shares, so you can protect your entire portfolio from downside risk.

Sterling volatility

We offer forex pairs including GBP/USD, EUR/GBP and GBP/EUR, enabling you to insulate yourself from currency risk.

Use our platform tools to stay ahead

Guaranteed stops

Take control with free guaranteed stops, which only incur a fee when triggered.1

Price alerts

Set alerts with the only provider to offer percentage and point-based monitoring.

Indicators

Stay ahead of volatility with indicators including average true range and Bollinger bands.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade seamlessly, wherever you are

Trade on the move with our natively designed trading app

Feel secure with a trusted provider

With over 45 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today's opportunity in a huge range of markets.

Markets to watch during Brexit

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

How will Brexit affect the FTSE 100, UK shares and gold?

- Indices

- Shares

- Gold

How will Brexit affect the UK stock market?

The impact of Brexit on the UK stock market largely depends on the outcome of any trade deals between the UK, the EU and other countries around the globe. The degree of access to international markets that these deals grant will have a direct effect on the UK stock market.

- Persimmon (PSN) – is one of the UK’s largest new home builders, with considerable operations across the UK

- Travis Perkins (TPK) – is the UK’s largest builders’ merchants, supplying over 23,000 trade products to many companies which consider it a go-to for building supplies

- Lloyds Banking Group (LLOY) – has primary operations in England and Wales, so stands to gain from a smooth transition

How will Brexit affect gold?

As ever in times of uncertainty, investors look to commodities such as gold to provide a haven. After experiencing a spike following the initial referendum in June 2016, gold’s price has largely settled over the last couple of years. That is not to say that it couldn’t spike again, especially given the uncertainty surrounding the next steps for the UK’s departure.

Get the Latest Brexit news

NO ARTICLES

Unable to display results at this time.Create an account

Take a position on how Brexit is affecting the FTSE and the pound.

You might be interested in…

Discover our award-winning web-based platform and natively-designed apps for tablet and mobile

The latest analysis and insights from our in-house experts

Learn how to trade the reaction to Brexit across 90 currency pairs

1 Based on revenue (published financial statements, August 2024)

2 A small premium is payable if a guaranteed stop is triggered.