What are knock-outs and how to trade them

A Knock-Out is a type of limited-risk position which gives you full control over your margin and your risk. Discover everything you need to know about knock-outs, including how they work and how to trade them.

What are Knock-Outs?

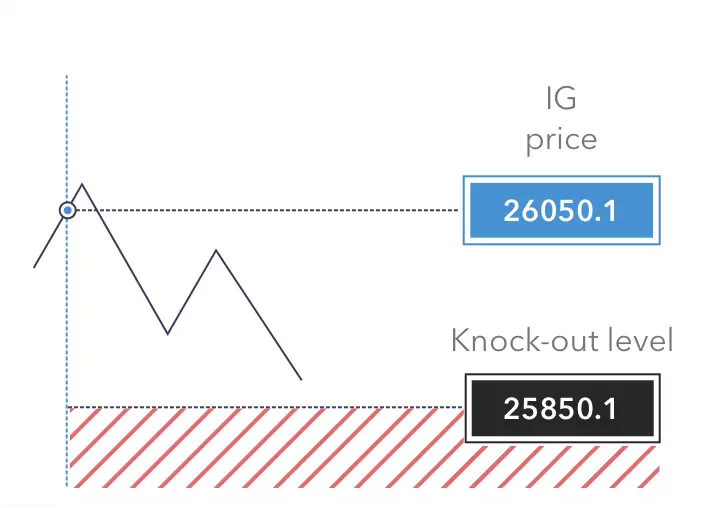

Knock-Outs are a CFD trade on an option. They automatically close – or get ‘knocked out’ – if your provider’s underlying market price reaches your knock-out level. They move one-for-one with the underlying market – meaning that for every point the underlying moves, the price of the knock-out moves the same amount.1 By setting your own knock-out level and your trade size, you have full control over your margin and your risk.

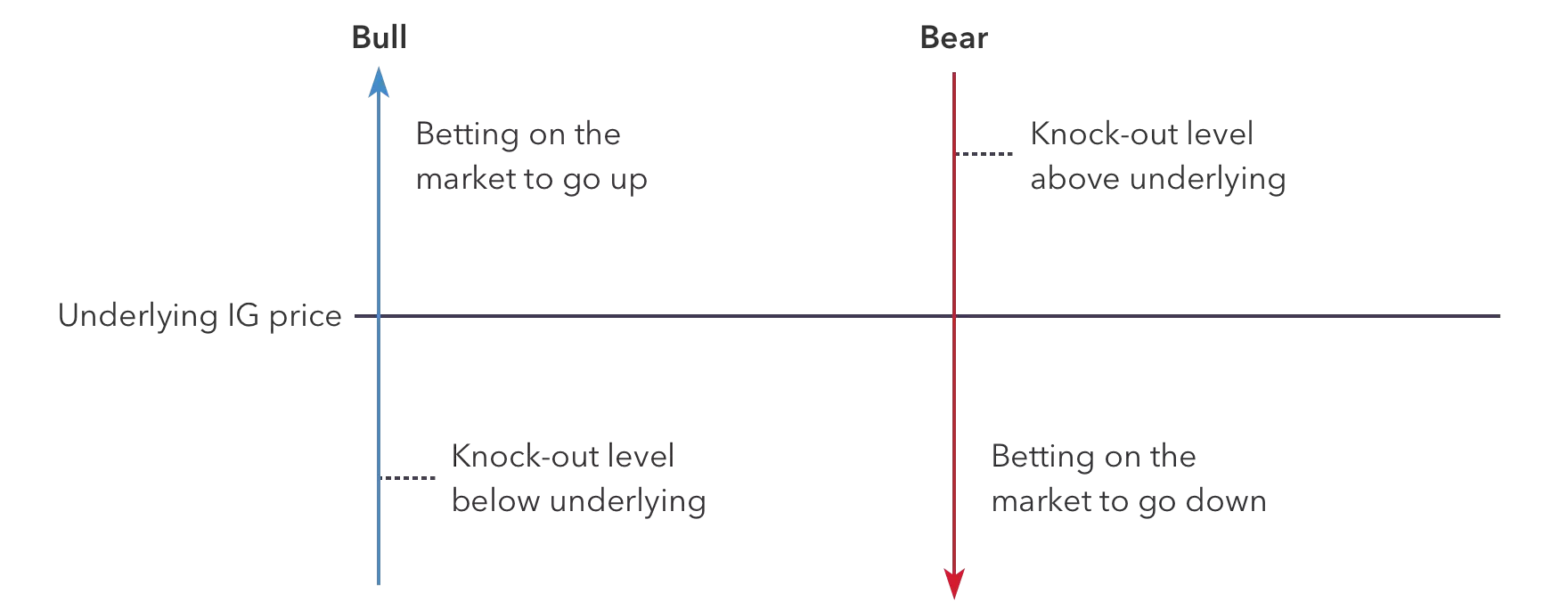

Knock-outs can only be bought to open (not sold to open). To enable you to go long or short on the market price, there are two types of knock-out available: bull and bear.

- You’d buy a bull knock-out if you believe the price of the underlying market will rise

- You’d buy a bear knock-out if you believe the price of the underlying market will fall

In both cases you make a profit if the market moves in your chosen direction, and a loss if the market moves against you. You can close your position at any time before expiry – unless the knock-out level is reached, in which case the position will be automatically closed.

How do I trade Knock-Outs?

When opening a knock-out position, the first decision you will have to make is whether you are buying a bull or a bear.

If you believe that the market price is going to increase, you’d buy a bull and set a knock-out level below the opening market value. Alternatively, if you believe that the market price is going to decrease, you’d buy a bear and set a knock-out level above the opening market value.

You can then select the specific knock-out level at which your position will be closed out if the market goes against your prediction.

Once you have made these two decisions, the opening price of the position will be calculated as follows:

- Bull: (your provider’s underlying offer price – knock-out level) + knock-out premium*

- Bear: (knock-out level – your provider’s underlying bid price) + knock-out premium*

*A knock-out premium is your guarantee against slippage. You’ll receive it back if you close the trade without the knock-out level being triggered.

Your maximum risk is the opening price multiplied by your stake size, so you always have control over how much you stand to lose if your position is knocked out.

Example Knock-Out trade

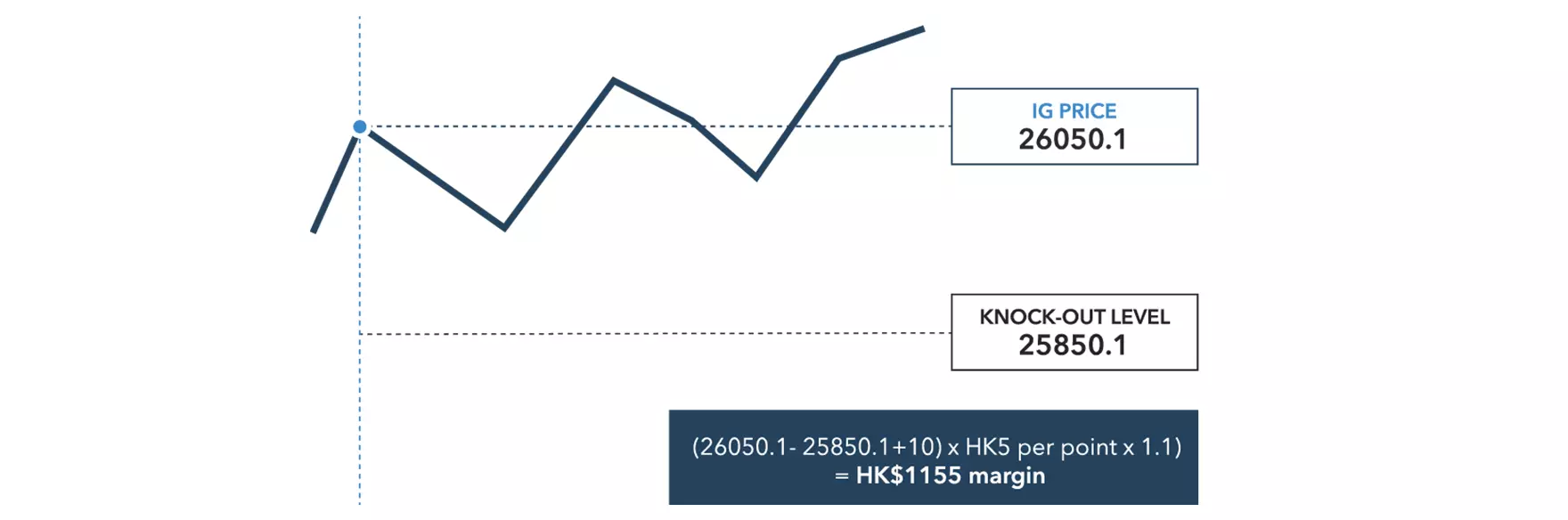

Let’s say the Hong Kong HS50 is currently trading with an offer price of 26050.1. You decide to go long, by opening a bull position at HK$5 per point with a knock-out level at 25850.1. If the current knock-out premium is 10, the margin you’ll need to pay is as follows:

The knock-out price will move one-for-one with the underlying IG market – so for every point our underlying price moves, the knock-out price moves exactly the same amount.1

- If the HS50 rises and the current bid becomes 26150.1, your running profit would be +500.

- If the HS50 drops and the current bid becomes 25950.1, your running loss would be -500.

- If the HS50 drops to your knock-out level, your realised loss would be -1050, which includes the 10 point knock-out premium.

If the market moves in the way you predict, you could close your knock-out at any time before expiry and collect your profits. You could even set a limit order to close your trade when it has reached your target level of profit.

You can find a full list of our knock-out fees here.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

You might be interested in…

Learn more about leveraged trading and how we can help you to manage your risk

Discover our transparent fee structure – including spreads, commissions and margins

Get some tips on how to get started trading CFDs

1 This is not the case when the knock-out premium changes. If the knock-out premium changes, the price of the knock-out will move by the amount the premium changes.