Why is the FTSE 100 rising when other indices are falling?

FTSE 100 outperformance gains traction as other global stock indices slip.

FTSE 100 outperformance gains traction as other global stock indices slip

Wednesday’s sharp fall in global equity indices on the back of a higher-than-expected US Consumer Price Inflation (CPI) print only briefly affected the FTSE 100 which, unlike its peers on both sides of the Atlantic, ended the day in positive territory.

The reason for the stock indices decline, i.e. that persistently high inflation is making it more difficult for the US Federal Reserve (Fed) to attribute higher month-on-month inflation to 'seasonal effects’ and that inflation is 'transitory', paring back rate cut expectations, is clear to market participants but some didn’t understand how the FTSE 100 could end up in positive territory regardless.

Several factors are at play

First of all the FTSE 100 tends to underperform its peers during times of rising stock prices, especially at times when Artificial Intelligence (AI) and technology stocks outperform as the UK blue chip index doesn’t have any of these as constituents.

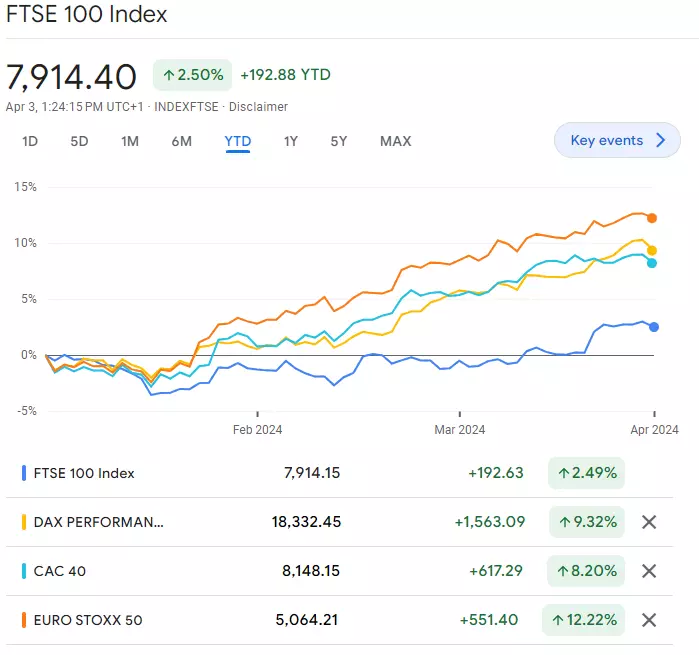

FTSE 100 versus its peers year-to-date performance chart

Instead the FTSE 100 is dominated by financials, consumer staples, industrials, energy and healthcare which make up nearly 75% of the index’s weighting and which tend to do well in bear markets. Banks, for example, benefit from interest rates remaining higher for longer, as seems to be the case in the US and the UK at the moment.

During the Covid years and the 2022 global bear market the FTSE 100 ended the year in slightly positive territory whilst its peers dropped by over 20%.

Following Wednesday’s sharp fall in European and US stock indices, the FTSE 100 held its ground, as it has done for the past month as its peers started to keel over and gave back some of their strong year-to-date gains.

FTSE 100 versus its peers one-month performance chart

This outperformance by the FTSE 100 when stock indices decline, together with the historically and current low valuation of the FTSE 100 from a price-to-earnings ratio (P/E) perspective compared to other global stock indices, makes buying UK stocks relatively cheap.

Investors in US stocks with high valuations rotated some of their investments out of the ‘expensive’ US stocks into the ‘cheap’ UK stock market which explains the FTSE 100’s positive close on a very negative sentiment driven day for the rest of the world on Wednesday.

The FTSE 100 has the second lowest P/E ratio after the Hang Seng at 11.50 which compares favourably to the Euro Stoxx 600s 13.90 and the S&P 500s 23.12. When looking at estimates for next year’s P/E ratios the FTSE 100 still offers good value with a P/E ratio at 11.68 compared to the S&P 500s 21.18.

Investing in the FTSE 100 when stock indices are in a consolidation mode, such as they are at present, might be a good strategy over the coming months when western equity indices tend to historically underperform from a seasonal point of view.

This may explain why the FTSE 100 has been outperforming its peers over the past month or so and when global stock indices fell off a cliff on Wednesday following the higher-than-expected US inflation print.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices