Discover the main differences between CFDs and investing, as well as the unique advantages and disadvantages of each.

What’s the difference between CFDs and investing?

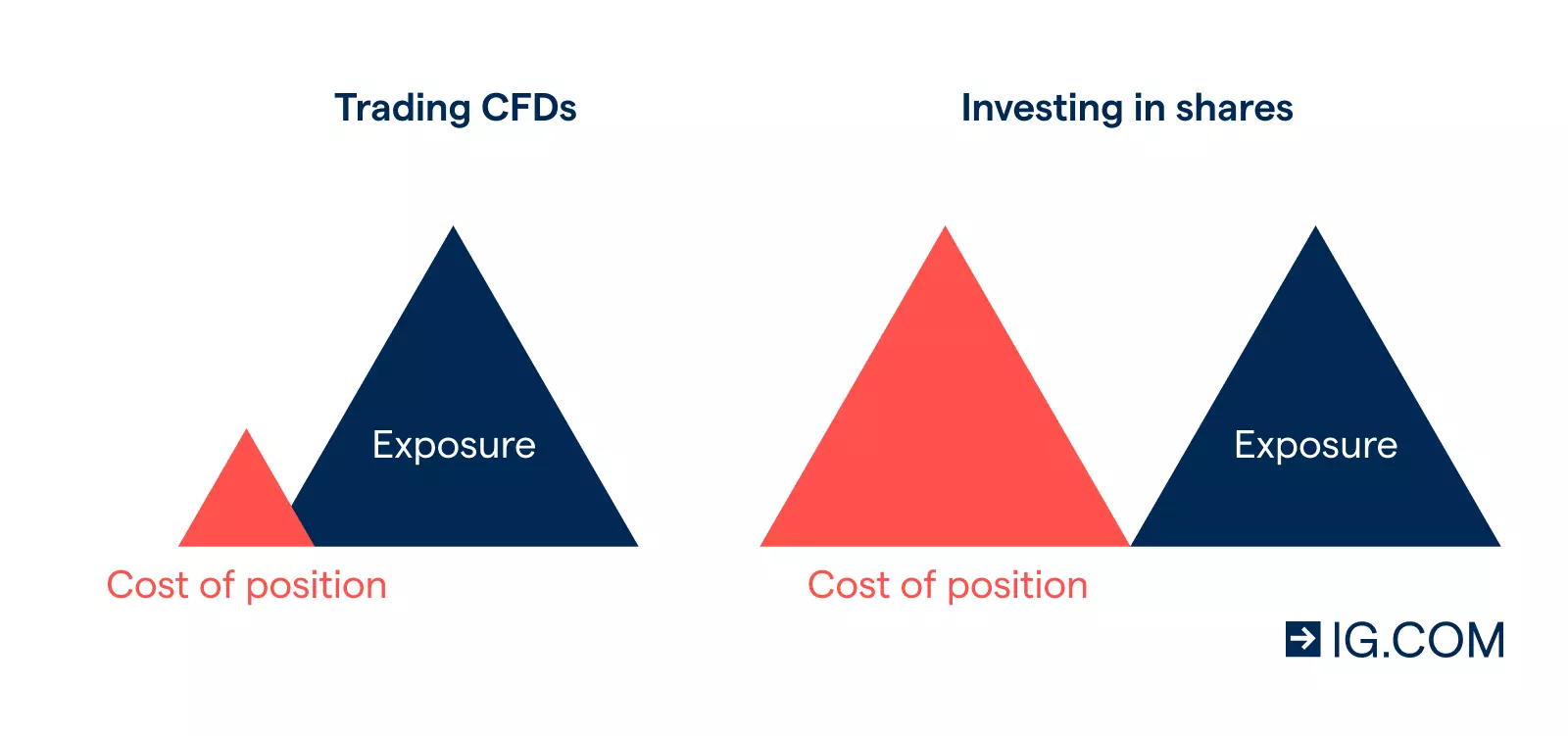

The main difference between CFDs and investing is that CFDs are leveraged, while investing is non-leveraged.

- With CFDs, you’ll be speculating on price movements – without taking ownership – and putting a margin amount down as leverage to open your position. This increases both profits and losses

- When investing in shares, known as stock trading with us, you’re taking direct ownership of the asset, for example company shares. You’ll need the full value of the position upfront

We offer CFD trading on shares, indices, commodities, cryptos, forex, options, futures and more. Stock trading is available for investing in shares and ETFs.

CFD trading explained

When you trade CFDs, you’re entering into a contract for difference (CFD), which is an agreement to exchange the difference between the opening and closing price of your position.

CFDs are advantageous if you’re a trader with a short-term outlook. This is because CFD trades enable you to speculate on the price of an asset by going long (buying) or going short (selling).

One of the main benefits of CFD trading is the ability to use leverage, giving you full market exposure while only having to commit a deposit to open your position (known as a margin). So, if you wanted to open a $100 CFD trade on HSBC shares, you’d put down a margin (often 20%) to trade the movement of HSBC’s share price – an initial sum of $20.

But, trading with leverage carries risk. While it can amplify your profits, it can also magnify your losses. That’s because any profit or loss is calculated using the full size of the position, rather than your margin amount. So, with our HSBC example, your profit or loss would be calculated on the full $100, not your $20 margin.

Investing explained

When you invest, you’re taking direct ownership of shares in a company or ETF. Because of this, investing is popular among those who have a positive long-term outlook on that share or ETF. Any person who buys shares outright will also receive possible dividend payments and gain voting rights.

Leverage isn’t available when you’re investing directly, so you’ll have to commit the full value of the position upfront. But, this also means that your maximum risk is capped at the total cost of your investment. For example, if you bought $1000 worth of shares, the maximum you could lose is $1000 – assuming that the share price falls all the way to zero.

Remember that, when you invest, you can only profit when share prices or the value of an ETF rises above the price that you opened your investment. This is different to CFD trading, which enables you to profit from shares or ETFs that are rising or falling in value.

CFD trading vs investing: a comparison

| CFD trading | Investing | |

| Which markets are available? | 18,000+ markets including shares and ETFs, indices, forex pairs, cryptos, commodities and more |

17,000+ global shares and ETFs |

| What is the deposit required to open a position? | Initial outlay for leveraged trades is 20%-25% of the total position size or, in the case of forex CFDs, from 3.33.1 However, with share CFDs, it’s important to remember that you would pay a commission amount after opening the position |

You’ll pay the full value of the position upfront |

| Can you go short? | Yes, you can go long and speculate prices rising, as well as go short to speculate on prices falling |

Not as standard. To short stocks with traditional short-selling, you’d need to borrow shares, likely from a broker, sell those shares and then buy them back later. However, we don’t offer this |

What are the trading or dealing hours? |

24-hour CFD trading on forex and major stock indices.2 Choose from 700 US stocks 24/53 and 140+ US stocks out-of-hours. We also offer weekend trading on selected markets. However, all spot positions left open after 10pm UK time are subject to additional overnight funding charges. |

Access our exclusive extended hours. Choose from 700 US stocks 24/53 and 140+ US stocks out-of-hours. Otherwise, deal when the underlying exchange or market is open |

Do you get shareholder privileges and dividends? |

No shareholder privileges, but positions are adjusted to offset changes from dividends |

With shares and ETFs, you’ll receive dividends if they’re paid. Owning shares may also grant you voting rights in company decisions |

FAQs

Can I open a position on a company’s shares by using CFDs or investing?

With us, you can take a position on shares with CFDs (contracts for difference) and via stock trading (investing). Investing lets you take direct ownership of shares, while CFD trading lets you speculate on share prices without having to own them. When you invest, you can profit if the share price rises above what you bought them for. When you trade CFDs, you can profit from prices that are rising by going long, or from prices that are falling by going short.

What is the difference between share CFDs and stock trading?

One difference is that trading share CFDs won’t give you ownership of the shares in question, while stock trading will. But share CFDs do enable you to speculate on share prices rising by going long, as well as falling by going short. This isn’t available when investing in shares, but you can profit from upwards movements in a share’s price.

For this reason, CFDs are also more complex financial products, which can be higher risk trades than stock trading. This is because, with CFDs, your profits and losses can far outweigh your initial outlay.

Develop your knowledge of CFD trading with us

Find out more about CFD trading and test yourself with our range of online resources.

Try these next

1 View our margin rates.

2 This excludes the 10 hours from 10pm Friday until 8am Saturday (UK time). Only selected indices and forex pairs are available for weekend trading.

3 24 Hours Stocks will run from 4am Monday to 1am Saturday (GST). This corresponds to 1am Monday to 10pm Friday (UK time). These times are subject to change when daylight savings ends/starts in the UK.