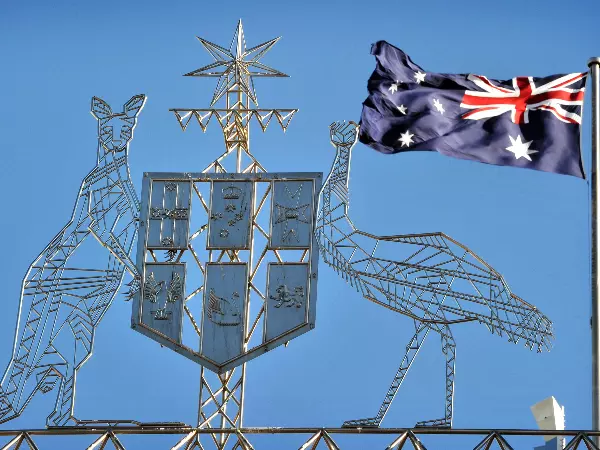

Australian stocks surge to new record highs as investors dive into the market

Australian stocks surge to new record highs, Reserve Bank of Australia minutes suggests all policy tools remain on the table ahead of July review and Federal Open Market Committee meeting approaches.

The Australian stock market has surged to new record highs to kick-off this truncated trading week, with the Australia 200 adding just shy of 1% at time of writing, in what’s been a very robust rally today. Volumes have been well above average, with intraday breadth solid – especially among the market’s large-cap stocks.

Though this assessment is only a crude induction based on those facts, it would seem that investors are anxious to get involved in a stock-market that, at from a price point of view, is going from new high to new high.

The ASX200’s solid performance comes amidst a backdrop of more subdued, and probably slightly mixed price action in broader stock markets. The Nikkei 225 Bear -1x ETF has also outperformed, itself rallying nearly 1% at time of writing. But Chinese indices and the Hang Seng Bank Ltd are down significantly, after the People's Bank of China rolled over its medium term lending facility without pumping in additional liquidity to the China’s financial markets.

Despite Asia’s mixed trading session, things are looking quite rosy for European and US stocks: our prices are currently indicating a 0.44% and 0.54% pop at the open for the FTSE 100 and Germany 40, and a modest 0.1% gain for the US 500 when Wall Street trade kicks-off.

The highlight of the economic calendar today was the Reserve Bank of Australia's minutes from its most recent meeting

There wasn’t too much new information contained in the document. However, the AUD/USD did briefly dip back below the 0.7700 handle after it was published, it would appear off the back of some open-ended messaging from the Reserve Bank of Australia (RBA) about what it intends to do with its QE program and YCC program at next month’s meeting. The general view continues to crystallize that the RBA will extend its QE program with another $100bn package – albeit, possibly with some flexibility to adjust the size and timing of those purchases – while the tone of today’s minutes implied that an extension of the YCC target from the April 2024 to the November 2024 isn’t off the table yet.

With sentiment looking buoyant, even ahead of Thursday morning’s big Federal Open Market Committee meeting, attention turns this evening to US Retail Sales along with US PPI figures tonight.

The retail sales numbers have been volatile lately, and been tough to use as a reliable guide for consumer activity in the US, given the impacts of lumpy stimulus payments to US households. The PPI data will probably be of greater import given the markets’ preoccupation with inflation-risks right now – though with the consensus view that price pressures will be transitory, the bar might be set high for a shock. Nevertheless, the data comes as the USD Index, despite clear fundamental headwinds, still shows signs of bottoming, in maybe an indicator of a burgeoning reversion for the greenback.

Want to trade with IG?

Create an IG trading account or log in to your existing account to get started now.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Be ready to act on ECB opportunities

Learn how the ECB’s monetary policy announcements affect interest rates and price stability ahead of its next meeting.

- How might the next meeting affect the markets?

- What are the key rate decisions to watch?

- Why is the Governing Council announcement important for traders?

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.