Breakout strategies outperform as DAX suffers, ECB up next

Weeks of majority short retail sentiment ends with a shift to slight buy as averaged in shorts work their way out.

Sign up for IG's Daily and Weekly Market Report to receive this information and more, in an elaborate and comprehensive report recounting the forex majors, commodities and indices before the European open.

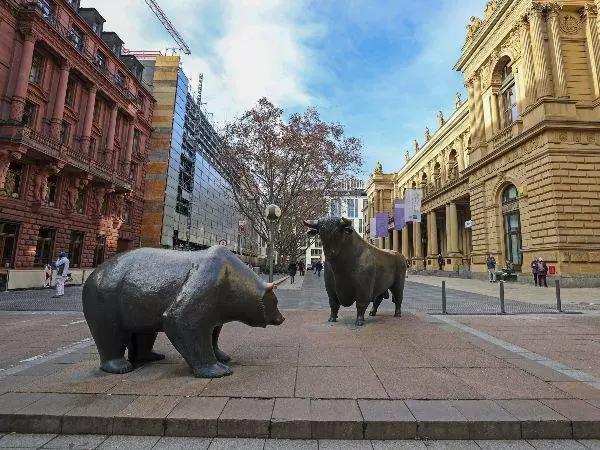

DAX technical analysis, overview, strategies, and levels

When the volatility gets going here, it can be swift and easily give breakout strategies the net edge, and such has been the case when it comes to the Germany 40, conformist strategies in play and outperforming heavily with a move beneath both of its previous support levels, and as with the FTSE 100 and Wall Street tilting some technical boxes into the red on the daily time frame, a negative DMI cross occurring with prices not far off another key long-term moving average.

Only a handful of its components finished in the green and even then the percentage gains were small, the clear majority in the losses led by Siemens Energy (JP Morgan Private Equity Ltd cut to neutral), car companies also suffering.

In terms of the economic calendar, there was a German bond auction yesterday showing a worsening bid-cover ratio, and up next we get trade data with Consumer Price Index (CPI) figures tomorrow, though none of it is expected to be as impacting as today's European Central Bank (ECB) monetary policy announcement, where although no changes are expected in rates, there might be a monthly purchase reduction for PEPP, and where projections on growth and inflation will be closely watched following what has been disappointing data and year on year CPI at 3% for the Eurozone.

Want to trade the Germany 40?

Create an IG trading account or log in to your existing account to get started now.

Current technical overview |

Consolidation - Volatile |

| Technical overview conformist strategies | Buy first resistance upon breakout from below, sell first support upon breakout from above |

| Technical overview contrarian strategies | Sell first resistance after reversal, buy first support after reversal |

| S/L for second resistance | 15832 |

| Second resistance | 15789 |

| S/L for first resistance | 15747 |

| First resistance | 15704 |

| Relative starting point | 15619 |

| First support | 15534 |

| S/L for first support | 15491 |

| Second support | 15449 |

| S/L for second support | 15406 |

IG client* sentiment for the DAX

In sentiment, range-trading is known to be heavy (if not heaviest) when it comes to retail traders and the Germany 40, and the oscillations have helped plenty of shorts that were stuck average out. Yesterday’s big price drop has caused the bias to shift from majority short 62% to a slight buy 52%, ending sell bias held by them since July.

DAX chart with retail sentiment

*The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 8am for the outer circle. Inner circle is from the previous trading day.

**CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.