Gold’s overview remains volatile, oil finishes the week higher

Conformist breakout strategies outperform heavily in the precious metal, oil’s price gains following output cuts and inventory drawdowns have to contend with lockdown news.

Gold Technical analysis, overview, strategies, and levels

Big volatility last week for gold prices, aiding Weekly conformist breakout strategies heavily in both directions, but more so for the downside on its breach of key Support levels, and now below all its main short-term Weekly moving averages. The gains were big for Daily conformist breakout strategies as well, a break late last week to give sell breakouts the outperforming win. The US dollar enjoyed strength, equities rallied, and crucially, yields on long-term bonds are climbing back up, especially that of the US. Expect volatility to persist on the question of whether recent risk-related gains are sustainable, and as euphoria reaches extreme levels.

IG client* and CoT** sentiment for Gold

As for sentiment, retail bias has jumped further into extreme buy levels starting the week at 87% (silver retail at 93%, platinum at 90%), more than that of CoT speculators who with an increase in longs by 8,134 lots and a reduction in shorts by 2,312 lots are up a notch to 83% (silver at 72%, platinum 79%).

Gold chart with retail and institutional sentiment

Oil WTI Technical analysis, overview, strategies, and levels

Strong gains for oil prices, breaching last week's Weekly (and late last week's Daily) levels for a move above its previous 2nd Resistance level. Risk-on and euphoric moves in the stock market on expectations of government stimulus combined with big drawdowns in oil and a unilateral 1m barrel per day output cut from Saudi Arabia seemed to push the energy commodity's price to break out of oscillatory levels. On the other end though, lockdown action and rising coronavirus cases are clearly an item to contend with in the mid to long-term. Oil data last Friday out of Baker Hughes showed the active rig count for the US rising again, from 267 to 275.

IG client* and CoT** sentiment for Oil WTI

It's no surprise retail short bias has risen, though remains in relatively moderate sell territory at 61% opting not to heavily short these levels, while CoT speculators consistently hold an extreme buy 81% bias.

Oil WTI chart with retail and institutional sentiment

*The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 8am for the outer circle. Inner circle is from the previous trading day.

** CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

Be sure to request IG’s Weekly & Daily Market Report when you open an account with IG Dubai and get access to the full information on the FX majors, commodities, indices, and Bitcoin.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

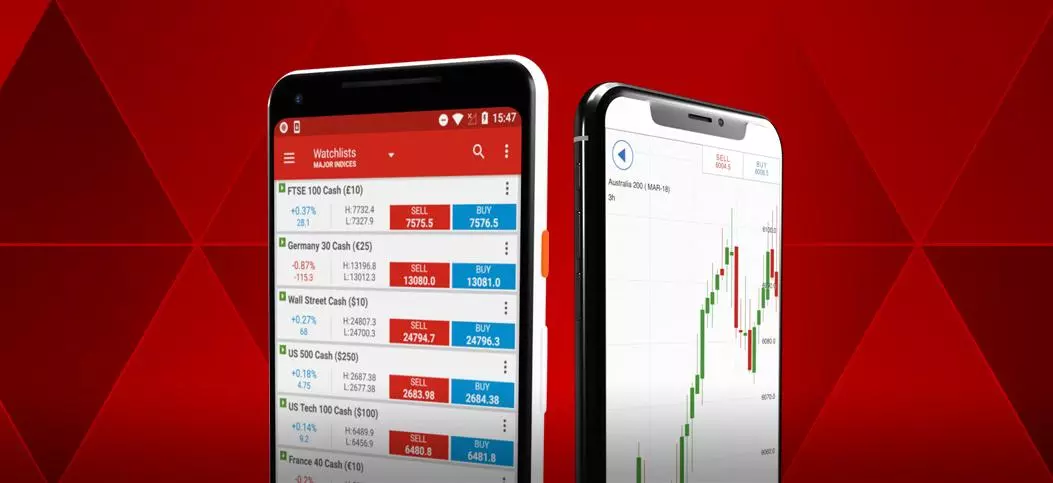

See an opportunity to trade?

Go long or short on more than 17,000 markets with IG.

Trade CFDs on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.