Market update: US dollar gains as yields in Japan and treasury markets rise

The US dollar resumed strengthening again today as yields go north; the Fed’s Kashkari hit the wires warning of potential labour market strains and the Bank of Japan is allowing bond yields to go higher.

The US dollar has found strength to start the week against most major currency pairs except for the Aussie and Kiwi dollars after some firm Chinese PMI data.

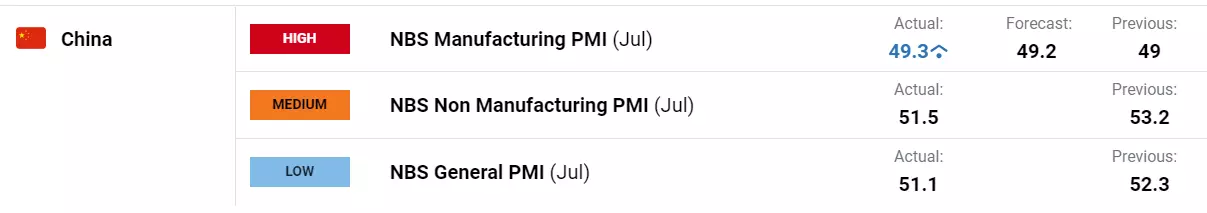

China's manufacturing PMI spurs regional growth

The market tends to place more emphasis on manufacturing PMI due to the wider implications for economic activity. Economists had expected a print below 49.0. A rosier outlook for China has led to growth-linked sectors in the region receiving a boost. The Korean KOSDAQ and the Hang Seng China Enterprise indices took the lead, adding over 2% today. The broader Hang Seng Index (HSI) reached a three-month high.

Commodity prices shift amid USD strength

Gold trended lower, heading toward US $1,950, as a result of a stronger USD, while crude oil also dipped. The WTI futures contract hovered slightly above US $80 bbl, while the brent contract was near US $84.40 bbl at the time of writing.

US Federal reserve and JGBs impact the market

On Sunday, Minneapolis Federal Reserve President Neel Kashkari appeared on US television, subtly shifting from his previously strong hawkish perspective. He commented on inflation moving in the right direction, potentially at the cost of the labor market.

Concurrently, Treasury yields rose by a few basis points across most of the curve. The ten-year Japanese Government Bond (JGB) traded at its highest yield since 2014 above 0.60%, following Friday's Bank of Japan adjustment to yield curve control (YCC).

The Bank declared an unscheduled bond-buying program today of 300 billion yen in the five-to-ten-year section of the yield curve.

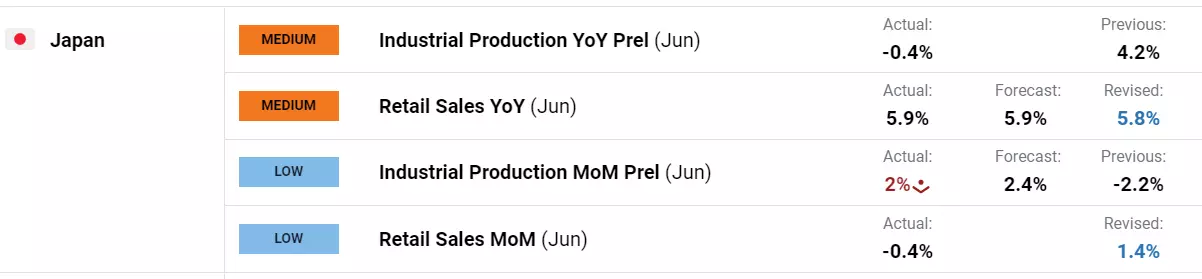

Japanese yen lags behind amid mixed economic data

The Japanese yen underperformed, with USD/JPY heading toward 142.00 once again. This occurred amid mixed economic data from Japan, with retail sales exceeding expectations while industrial production fell short.

Upcoming key decisions and reports

Euro-wide GDP and CPI data will be released today. Following this, the Reserve Bank of Australia (RBA) is set to make a decision on monetary policy, ahead of the Bank of England on Thursday.

USD technical analysis

The DXY (USD) index stabilized again today after reaching a two-week high last Friday. Remaining above the ten-and 21-day simple moving averages (SMA), this could suggest that short-term bullish momentum may further develop. The next resistance levels might be at the 55-and 100-day SMAs in the 102.40 – 102.60 area.

The 103.60 – 103.70 zone may also offer resistance, with a previous peak and the 200-day SMA in that region. Support could emerge at the breakpoint zone near 100.80 or below at the 15-month low of 99.58, just above the April 2022 low of 99.57.

USD daily cahrt

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.