Market update: XAU/USD may rise as retail traders become bearish

Gold prices extend recent push higher to trendline and retail traders are becoming slowly more bearish.

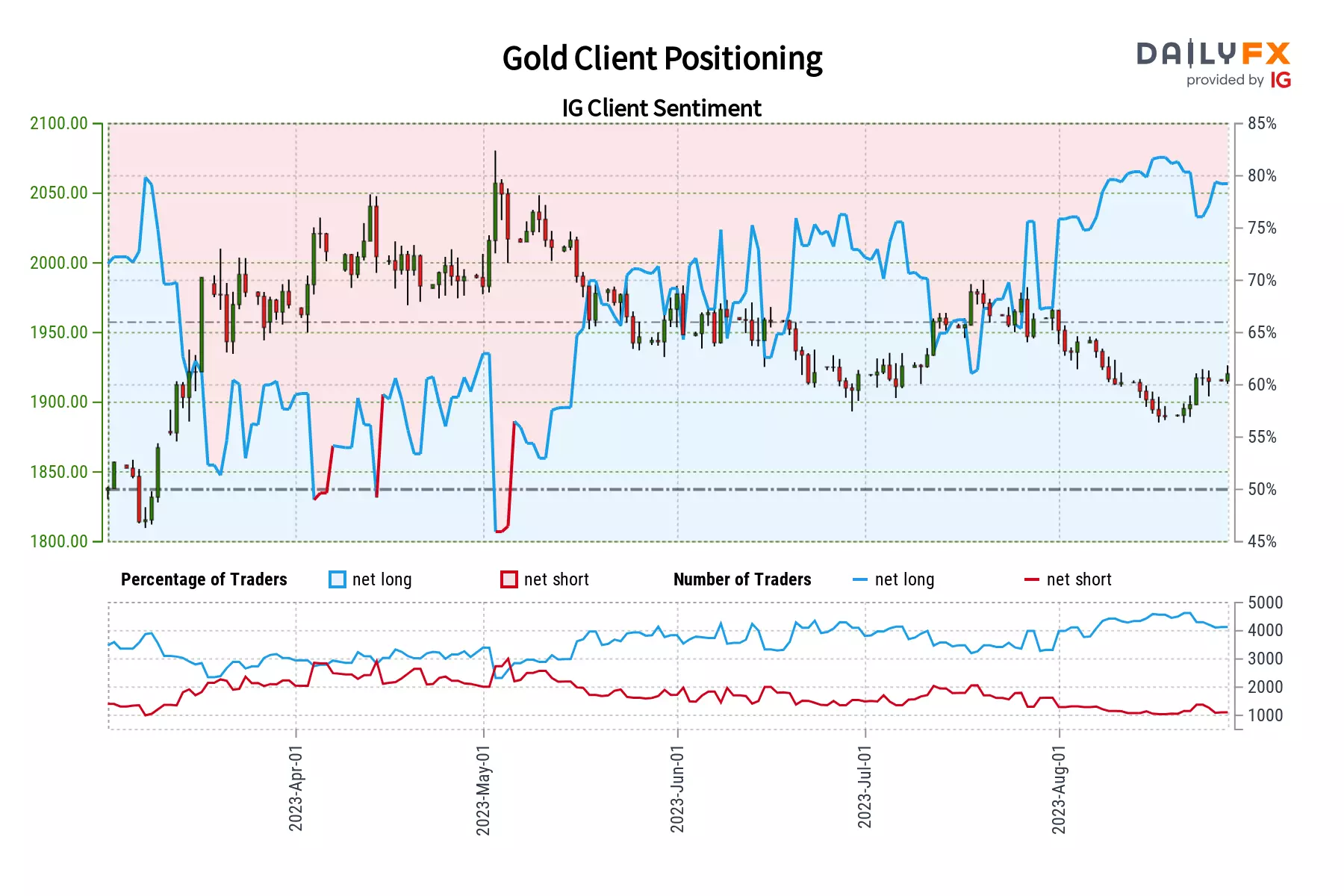

Gold prices have been aiming higher in recent weeks. In response retail traders have been cautiously increasing downside exposure. This can be seen by taking a look at IG Client Sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, could further upside progress be in store for the yellow metal in the coming sessions?

Gold sentiment outlook - bearish

The IGCS gauge shows that about 75% of retail traders are net-long gold. Since most of them are biased to the upside, this hints that prices may continue falling down the road. Meanwhile, downside exposure has increased by 23.58% and 26.59% compared to yesterday and last week, respectively. With that in mind, recent changes in positioning hint that the price trend may soon reverse higher despite overall exposure.

IG client sentiment chart

XAU/USD technical analysis

On the daily chart below, gold has extended a cautious push higher above the 38.2% Fibonacci retracement level of 1903.46. That is now placing the focus on the falling trendline from earlier this year. The latter could reinstate the broader downside focus, pushing XAU/USD back to the mid-August swing low of 1884.89.

Otherwise, clearing above the falling trendline, as well as the 1936.90 inflection zone, exposes the 23.6% level of 1971.63 as key resistance. Extending gains beyond that could open the door to revisiting the 2048.79 – 2081.82 resistance zone.

XAU/USD daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.