Credit rating agencies: everything you need to know

Credit rating agencies have one of the most important roles in the financial markets. Here, we talk about what credit rating agencies are, how they work, some of the different agencies and who regulates them.

What are credit rating agencies?

Credit rating agencies can give a credit risk rating to individual companies, stocks, government, corporate or municipal bonds, mortgage-backed securities, credit default swaps and collateralised debt obligations. Credit risk shows how likely a borrower is to default on their obligations to repay a loan.

The rating that one of these securities has been given can be used to determine whether the security is an investment or speculative opportunity. Higher rated securities are investment grade, and lower rated securities are more speculative.

This means that a market participant may wish to buy outright or go long on investment grade securities, but they may wish to use financial derivatives such as CFDs to speculate on the price movements of securities which might have a higher implied rate of credit risk.

CFDs enable you to go long and speculate on the price of the underlying rising, as well as short and speculate on the price falling. This makes them popular financial products through which market participants take a position on securities with a more speculative credit rating.

How do credit rating agencies work?

Credit rating agencies assign a value to the credit risk of different securities such as bonds and loans. For example, AAA is seen as the industry standard as the highest rating, and AAA, AA, A and BBB are widely seen as investment-quality securities.

Ratings of BB or below are speculative grades which denote a higher credit risk or risk of default in the underlying security, but this often comes with a potentially higher return on an initial investment.

While they use alphabetical ratings, credit rating agencies will often not give a numerical probability to the risk of default such as 10%, 20% or 30%. Instead, they will use statements such as ‘the obligor’s (borrower’s) capacity to meet its financial commitments on the obligation (to repay the lender) is extremely strong’.1

However, it is generally accepted that AAA and AA rated securities have a default risk of less than 1%, and the probability of default increases for each subsequent rating.

Credit ratings agencies usually have analysts who recommend a rating, and then a committee which votes on the recommendation. Analysts will use information such as background data, management forecasts, risk reports and performance forecasts.

They can also consider macroeconomic data, data provided by a company, bank or government which is being reviewed, or any information which is publicly available about the security which is being reviewed for a rating. Once the analysts have gathered enough data and information to give a recommendation, there will be a pre-committee and then a committee stage.

The pre-committee stage serves to assess whether the full rating process should proceed – if there is not enough information available to grant a recommendation, then the ratings process may be suspended. If it is decided that the process should proceed, then the recommended rating will be submitted to a committee for review.

The committee is often provided with a review package which contains the analysts’ findings and rationale for a recommended rating. The committee will consider the findings in the review package and determine whether the recommendation provided by the analysts is correct.

This determination will be achieved through a vote of the committee members, who are chosen based on experience and seniority – but different agencies might have slightly different criteria for selecting committee members. The members will then vote on the recommended rating and agree on either that rating, or they’ll assign a different credit rating based on a majority decision.

The ratings themselves are also only ever presented as opinions of a particular agency, but market participants will use multiple agencies to determine an aggregate credit risk rating.

The Big Three credit rating agencies

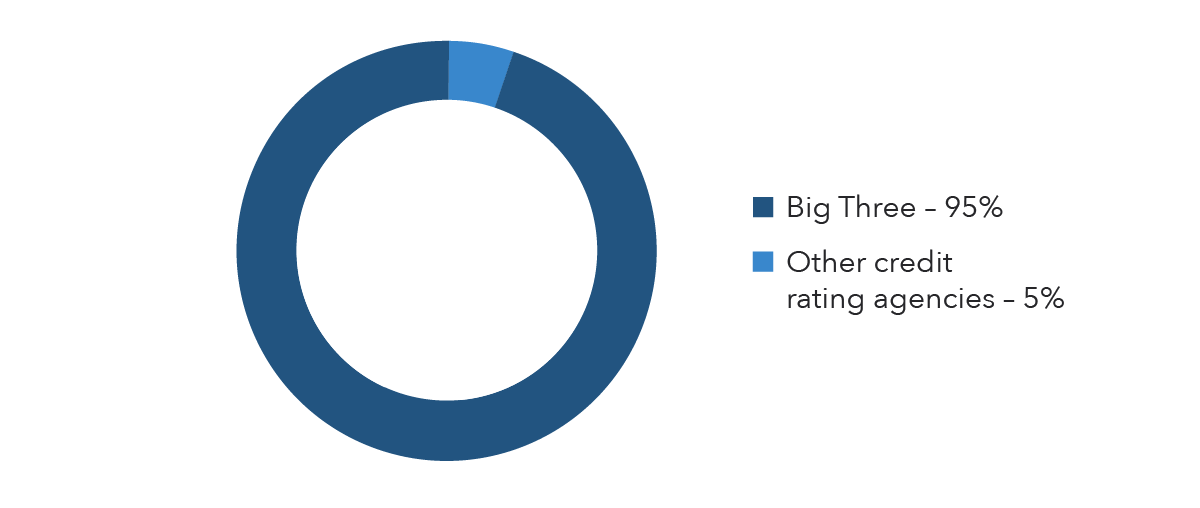

The Big Three credit rating agencies, Moody’s, Standard and Poor’s (S&P) and Fitch Ratings, control around 95% of the credit ratings in the financial markets. Other credit rating agencies that perform similar roles to the Big Three are Dunn and Bradstreet, DBRS and Bureau van Dijk. There is further information about the Big Three and their respective ratings systems below.

H2: Moody’s

Moody's (MCO) is the first of the Big Three that we’ll talk about here, and it was founded in 1909. Moody’s is listed on the New York Stock Exchange (NYSE), and it is also a component of the S&P 500 stock market index – which measures the performance of the 500 largest companies in the US.

Moody’s gives ratings for both investment quality and speculative quality – with investment quality ranging from Aaa to Baa and speculative quality ranging from Ba to C. This is slightly different to the S&P and Fitch ratings scale, which will become clear in later sections.

Moody’s adds numerical modifiers of 1, 2 and 3 to its rating classifications from Aa through to Caa, which changes how strong the rating is. The number 1 indicates that the rating is in the higher end of the classification, while 2 is in the middle and 3 is at the bottom. For example, Moody’s could give a rating of Aa2 in the Aa classification, which would have a lower level of credit risk than Aa3.

The Moody’s grade rating scale denotes the level of implied credit risk, and the ratings are as follows:

Moody’s investment grade

| AAA | Lowest level of credit risk |

| Aa1/Aa2/Aa3 | Very low level of credit risk |

| A1/A2/A3 | Low level of credit risk |

| Baa1/Baa2/Baa3 | Moderate credit risk |

Moody's speculative grade

| Ba1/Ba2/Ba3 | Substantial credit risk |

| B1/B2/B3 | High credit risk |

| Caa1/Caa2/Caa3 | Very high credit risk |

| Ca | Likely in or very near default, but there is a chance of recovering capital |

| C | In default, with little chance of recovering capital |

Market participants may choose to buy bonds, stocks or other securities ranked as Aaa to Baa3 outright because these are given the lowest probability of credit risk and repayment for an initial investment is highly likely. Alternatively, they could speculate on the price of these investment-quality bonds with bond futures.

Bond futures can still fluctuate in price up and down, regardless of the rating of the underlying bond, because their value is derived from the bond in question – they are not the physical bond themselves.

Learn more about trading bond futures

For speculative grades, market participants may choose to go short on certain securities and bet that borrowers will be unable to repay their financial obligations. In this scenario, a speculator will need the loans to default in order to profit. This could happen if a government fails to repay the full value of a bond at its maturity, or if consumers fail to make their mortgage payments.

There are also bond futures for many speculative grade investments, which offer the same opportunity to go long or short on the underlying bond regardless of the rating of the physical bond.

Standard and Poor’s (S&P)

Standard and Poor’s (S&P) as it is currently known was founded in 1941. The company is a subsidiary of S&P Global which is listed on the NYSE and is a component of the S&P 500. S&P as a ratings agency provides financial research and analysis on a range of securities and markets including bonds, stocks, companies and commodities.

One of the Big Three, S&P uses a slightly different ratings system to Moody’s. For example, S&P uses modifies such as ‘+’ or ‘–’ to denote a higher-quality rating within the same category, and It applies these modifiers to ratings from AA to CCC.

The S&P rating scale is as follows, where financial obligations refer to the ability of the borrower to repay the value of a loan:

Standard and Poor's investment grade

| AAA | Extremely strong chance that a borrower will meet their financial obligations |

| AA+/AA/AA- | Very strong chance that a borrower will meet their financial obligations |

| A+/A/A- | Strong chance that a borrower will meet their financial obligations |

| BBB+/BBB/BBB- | Adequate chance that a borrower will meet their financial obligations |

Standard and Poor’s speculative grade

| BB+/BB/BB- | Extremely strong chance that a borrower will meet their financial obligations |

| B+/B/B- | Very strong chance that a borrower will meet their financial obligations |

| CCC+/CCC/CCC- | Strong chance that a borrower will meet their financial obligations |

| CC | Highly vulnerable and default is a virtual certainty |

| SD or D | The borrower has already defaulted on one or more of their financial obligations |

With S&P’s ratings, market participants would likely prefer to buy bonds or loans ranked as AAA to BBB- outright because they have a higher chance that the borrower will not default on their loan obligations. Securities rated as BBB- can often have a more appealing return on an initial investment because of the slightly higher implied risk of default than other investment-rated securities.

These investments could be better suited to market participants with a higher appetite for risk or who prefer securities which might be slightly more volatile. If this is the case, it is important to have an effective risk management strategy in place before committing money to these sorts of loans, companies or bonds.

Bonds and other securities rated BB+ or below are known as high yield, because the risks are higher than investment grade securities, but so are the potential returns. This is why these ratings are known as speculative.

Fitch Ratings

Fitch Ratings was founded in 1914, and the company is a subsidiary of Hearst Communications. Because Hearst Communications is a privately held company, investors and traders cannot get exposure to its stock on an exchange.

Fitch Ratings assigns the same modifiers as S&P of ‘+’ or ‘–’ to their ratings to denote a higher-quality rating within the same category from AA to CCC. Fitch’s ratings denote whether there is a risk of default on an underlying bonds, loan or other financial obligation.

Fitch’s credit rating grades are as follows:

Fitch Rating's investment grade

| AAA | Extremely low risk of default |

| AA+/AA/AA- | Very low risk of default |

| A+/A/A- | Low risk of default, but slightly vulnerable to economic conditions |

| BBB+/BBB/BBB- | Low risk of default, but more vulnerable to economic conditions |

Fitch Rating's speculative grade

| BB+/BB/BB- | Possible risk of default, vulnerable to economic conditions |

| B+/B/B- | Elevated risk of default |

| CCC+/CCC/CCC- | Real possibility of default |

| CC | Default is likely |

| C | Likely in or very near default |

| RD or D | There has been a default |

With Fitch, market participants may choose to buy or invest in securities rated as AAA to BBB- outright because they have the lowest risk of default and are seen as the ‘safest’ option to see a return on an initial investment.

Speculative ratings from Fitch could indicate possibly higher returns, but the risk of default is far greater. For example, in October 2019, Fitch Ratings downgraded Metro Bank’s (MTRO) credit rating to BB from BB+ after the bank miscategorised loans in January 2019, and a cancelled 7.5% bond offering in late September 2019. This downgrade from Fitch shows that Metro Bank was considered to have a slightly higher risk of default following the failure of its high yield bond offering.

Learn more about Metro Bank’s share price

The role of credit rating agencies in the financial crisis

Many market commentators agree that credit rating agencies contributed to the 2008 financial crisis. The Big Three miscategorised various ‘junk’ loans and mortgages – known as subprime – as AAA, AA, A or BBB investment quality. These loans were discovered to be worthless after the US housing bubble burst, which caused the subsequent financial crisis.

To explain this properly, we should look at what exactly happened to cause the 2008 financial crisis. As early as 1999, banks started to sell an increasing number of subprime mortgages to customers. Any loan which is classed as subprime is generally sold to consumers with a low credit rating or with lower than average savings. As a result, there is an inherently high risk of default with subprime loans.

However, many banks and financial institutions identified that they could pool these subprime mortgages into a single security called a mortgage-backed security (MBS). These proved to be popular with investors, and the market was highly profitable so long as house prices continued to rise, and homeowners continued to make their mortgage payments on time.

Many of the mortgage-backed securities were assigned a rating of BBB or above. Firstly, this was because they were backed by credit default swaps, which is a form of insurance for the lender of a loan in case the borrower defaults and fails to repay the lender.

Secondly, if one credit rating agency didn’t give a high rating, banks or firms could simply go to their competitors to get the rating that they wanted. The banks and firms believed the risk of default to be extremely low because people simply didn’t default on their mortgages.

However, many of these subprime mortgages were adjustable rate mortgages (ARMs). The interest rates on ARMs starts off small – making the mortgage initially attractive to buyers – before rising steadily over time. Because of this, many borrowers didn’t fully understand the terms of the loans they were taking out, and they began to default on their obligations as the interest rates increased.

As people began to default on their mortgages, the housing bubble began to burst and the entire market for mortgage-backed securities and credit default swaps collapsed along with it.

It is argued that if credit rating agencies had not given high ratings to the mortgage-backed securities at the heart of the financial crisis, there would never have been a market for them, and banks or firms would have struggled to sell them to investors.

By giving these mortgage-backed securities investment grade ratings, the credit rating agencies stamped them with their seal of approval which made market participants believe that they were not open to excessive levels of credit risk. In fact, these mortgage-backed securities were deceptively risky.

Investors who spotted the unsustainable growth and made bets against the US housing market managed to cash in heavily. This was at the expense of American consumers defaulting on their mortgage payments and losing their homes.

Who regulates credit rating agencies?

Regulations were increased on credit rating agencies following the 2008 financial crisis. This was most notable in the US by the introduction of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was passed in 2010.

The legislation created requirements with the aim of preventing any bank to become too big to fail, as well as reviewing the Federal Reserve (Fed) bank bailouts and monitoring high-risk derivatives. It also established a number of new agencies which were responsible for oversight within the US and global financial system, in the hope that increased scrutiny in the US would help to prevent a repeat of the 2008 financial crisis.

Credit rating agencies are regulated by different organisations depending on the geographical area. For example, the Securities and Exchange Commission (SEC) is responsible for regulating credit rating agencies based in the US.

For Europe, the European Securities and Markets Authority (ESMA) regulates credit rating agencies; in the UK, this role will be performed by the Financial Conduct Authority (FAC) once the UK leaves the EU. In its regulatory capacity, ESMA has the goal of ensuring ‘integrity, responsibility, good governance and independence of credit rating activities to ensure quality ratings and high levels of investor confidence’.2

Credit rating agencies summed up

- Credit rating agencies provide an assessment of the implied credit risk for companies, stocks, government, corporate or municipal bonds, mortgage-backed securities and collateralised debt obligations

- There are three main credit rating agencies, known as the Big Three: Moody’s, Standard and Poor’s and Fitch Ratings

- Standard and Poor’s and Fitch Ratings use the same rating scale and modifiers as each other, while Moody’s uses slightly different modifiers to denote similar information

- Many believe that credit rating agencies were responsible in some part for the 2008 financial crash by incorrectly assigning low-risk ratings to high-risk mortgages and loans

- Following the crash, the credit rating agencies were put under greater scrutiny, and the agency responsible for oversight varies depending on the geographical location

Footnotes

1 S&P Global Ratings, 2019

2 ESMA, 2019

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.