Stop vs limit orders: what are the types of orders in trading?

Stop and limit orders are a great way to manage your trades without having to constantly monitor the market yourself. But which type of order should you be using on which trade? Find out in our guide to the types of orders.

What is an order in trading?

An order is simply an instruction to open or close a trade. You give an order to your provider so that they can execute the trade on your behalf – saving you time, as well as enabling you to lock in profits or guard against loss.

The order level refers to the price at which you want to enter or exit a market, enabling you to set a point at which you want to buy or sell at. It is not a guaranteed level, but rather a price through which the market has to move before your order is triggered.

Types of orders in trading

There are two main types of order: entry orders and closing orders. An entry order is an instruction to open a trade when the underlying market hits a specific level, while a closing order is an instruction to close a trade when the market hits a specific level.

Entry orders are used to open a trade at a particular price, without having to constantly monitor the market. Closing orders, on the other hand, are used to lock in profits if a market is moving in your favour or to cap losses if its price moves against you.

Both orders to open and orders to close come in two different varieties:

- Stop orders

- Limit orders

Stops vs limits

A stop order is an instruction to trade when the price of a market hits a specific level that is less favourable than the current price. If you were buying a market, this would be below the current market price, and if you were selling a market this would be above the current market price.

On the other hand, a limit order is an instruction to trade if the market price reaches a specified level more favourable than the current price. If you are looking to buy a market, this will be lower than the current market price, whereas if you are looking to sell it would be higher.

There is no reason to only use one or the other type of order – both are extremely useful tools for a trader. In fact, some platforms go so far as to combine both orders into a single ‘stop-limit order’. This would enable traders to predefine their conditions for trading, entering a trend at a certain price level and exiting the trade once they’ve taken a certain amount of profit.

So, it is important to understand both stops and limits, and how you can use them in your trading.

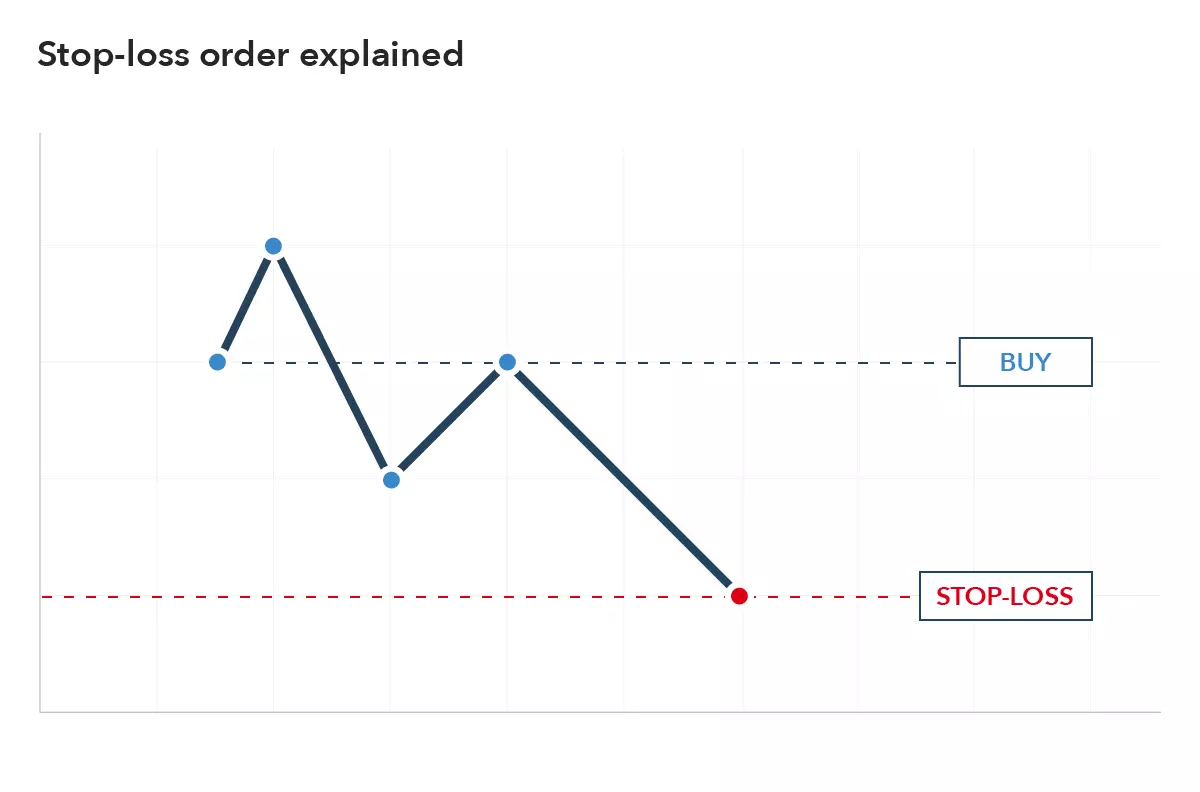

Stop orders explained

You can use stop orders to close positions and to open them, by using either a stop-loss order or a stop-entry order.

- A stop-loss order is the common term for a stop closing order, an instruction to close your position when the market value becomes less favourable than the current price

- A stop-entry orders enables you to open a position when the market reaches a value that is less favourable than the current price

Although it may seem strange to open a trade at a worse price, stop-entry orders can enable you to enter a trade once a trend has been confirmed. This helps you take advantage of market momentum.

Let’s look at an example. Say you own 100 shares of a company that you bought at 370p a share.

The chief executive officer (CEO) of the company announces his retirement, causing the share price to decline. While you expect this decline to be temporary, if the price continues to drop you don’t want to risk losing too much money. So, you decide to place a stop -loss order at 320p.

The price continues to decline, and passes 320p, at which point your stop order is carried out. Though you have lost £50 (100x 50p), if you hadn’t put a stop- loss in place it could’ve been considerably more.

Learn more about what a stop-loss order is

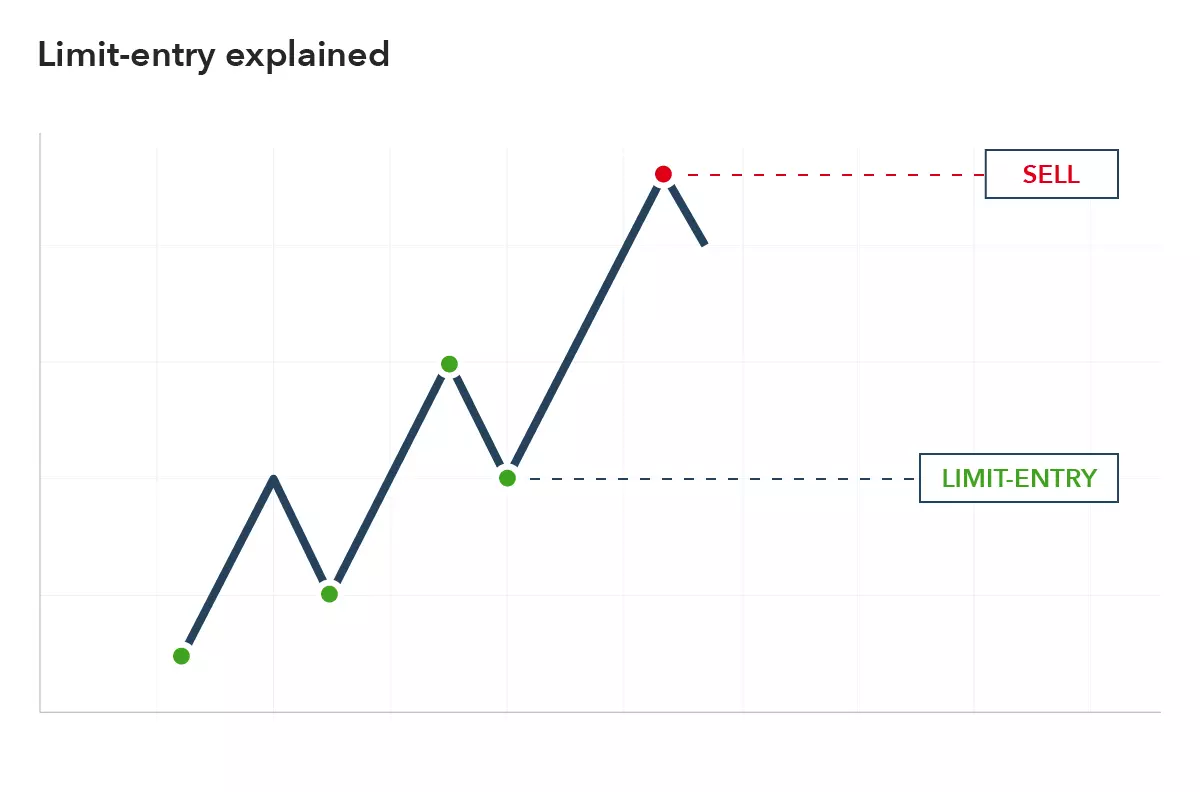

Limit orders explained

Like stop orders, limit orders can be used to open and close trades. There are two types:

- A limit-entry order enables you to enter a trade when the market hits a more favourable price, and are generally used when you know the price you want to pay for an asset

- A limit-close order enables you to close a long position at a higher level than the current price, or a short position at a lower level

The major drawback of limit orders is that there is the possibility it will not be filled if the market never reaches your order level – in this case the order would expire. If you had placed a limit-entry order, it is possible that your trade would never be executed. And if you had placed a limit-close order, your trade would not be closed automatically.

For example, say Brent is currently trading at $63.50. Your technical analysis has shown that $64.00 is a significant level for this market, suggesting that if it hits this level it will continue moving upwards.

You decide to buy Brent if it reaches $64.80 and place a stop-entry order at this level. Two hours later, and the market reaches $64.80, so your broker executes your stop and opens your trade. If the market price didn’t reach your price level, your order would never be executed.

What you need to know before placing a stop or limit

Before you start to trade using stops and limits there are a couple of key factors to consider, including the duration of your order, and the influences of gapping and slippage on execution.

Order duration

Order duration refers to the length of time your order will remain open until it expires. You can choose to leave your order open until you decide to close it or set an expiry date. These two types of order duration are called good 'til cancelled (GTC) and good 'til date (GTD).

- Good ‘til cancelled: GTC orders remain working until you cancel them yourself, or until they have been filled

- Good ‘til date: GTD orders require you to select a specific date and time that you want your order to run for – if it has not been filled by this date, it will be cancelled

Gapping and slippage

It’s worth noting that stops don’t always close your trade at exactly the level you specify. The market may 'gap', which means it jumps from one price to another with no market activity in between.

This is most likely to happen when you keep a trade open overnight or over the weekend, when the market’s opening price may differ from its previous closing price. In this situation, your trade will be closed at the best available price, meaning you risk losing more money than you’d anticipated. This is known as experiencing slippage. You can mitigate the risk of slippage by using a guaranteed stop, as explained in the section that follows. A small premium is payable if a guaranteed stop is triggered.

Limit orders will usually be filled at your chosen price, or sometimes even a better price if one is available at the moment the order becomes filled – this is called positive slippage.

How to place a stop order

The method for placing a stop order depends upon whether you’re placing a stop-entry or stop-loss.

To place a stop-entry order, you would need to open your deal ticket, select ‘order’. You would then enter a price level that is higher than the current market price if you want to take a long position, or lower than the current market price if you want to go short.

If you’re placing a close order instead, then how you will need to trade depends on which type of stop-loss order you will be using. With IG, there are three types of stop-loss order:

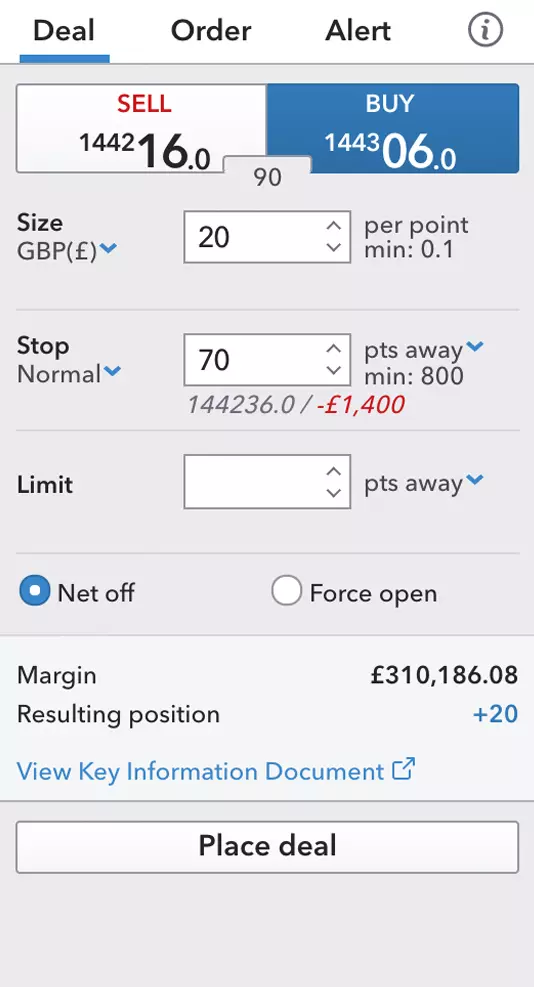

Placing a basic stop

Basic stop-loss orders trigger when the market reaches your set order level. You can add stops to new trades using the deal ticket by clicking where it says ‘stop’ – it should read ‘normal’. There will be a minimum distance you have to place your stop from the current market price.

To add a stop to an existing trade, click on the market name under ‘open positions’ on the platform, and you’ll be presented with a deal ticket.

Remember, your trade can be closed at a worse price than the level you requested if the market moves quickly, so you risk losing more money than anticipated.

Placing a guaranteed stop

Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. If your guaranteed stop is triggered there will be a small premium to pay.

To place a guaranteed stop with IG, you would select the drop-down menu underneath the ‘stop’ option on the deal ticket. Instead of the ‘normal’ stop, you’d select ‘guaranteed’.

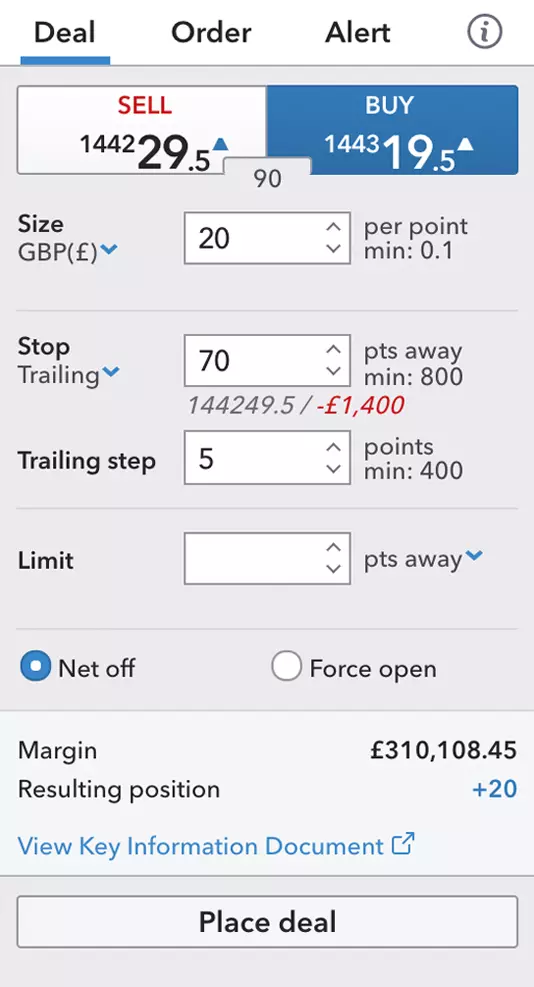

Placing a trailing stop

Trailing stop-loss orders follow the market if it moves in your favour, and lock if it moves against you. You decide exactly how closely the stop follows the market price by entering a trailing step size.

Now you should be able to set a trailing stop within the same drop-down list on your deal ticket – instead of the ‘normal’ option, you’d select ‘trailing’. You would then need to set your step size. This dictates how closely the trailing stop moves with the market price. So, if your step size is five points, then every time the market moves up five points, your stop will move five points to follow it.

How to place a limit order

Placing limit orders can be done in much the same way as a stop, and will also depend on whether you are placing a limit to open or a limit to close.

For limit-entry orders, you would select the ‘order’ tab of your deal ticket. If you wanted to go long, you would enter a buy-price level that is lower than the current market price, and if you wanted to short the market, you would enter a sell level that is higher than the current market price.

For limit-close orders, you would use the main deal tab of the ticket, and you would simply fill in the level at which you want to execute your order in the ‘limit’ section.

Using orders correctly can be great way to save time and effort when trading, with the potential to maximise profit as well as reduce risk – but it should form just one part of your overall trading strategy.

Become a better trader by working through free interactive courses on IG Academy.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.