What are the best timeframes in forex trading?

Timeframe analysis is a key skill for forex traders. It involves reading charts and developing strategies to anticipate market movements for profit. Read on for more info on the best forex trading timeframes.

What are timeframes in forex trading?

A timeframe in forex trading can refer to any designated unit of time in which trading takes place. Typically, forex timeframes will be measured in minutes, hours, days or weeks. You will choose the timeframe that is most suited to your trading strategy.

Once you’ve done your market research and know which type of trader you intend to be, you can start to trade forex using timeframe analysis. This will allow you to open a position during forex market opening hours, and work within a specific timeframe to exercise your plan.

What forex timeframe should I trade?

There is a direct correlation between different forex timeframes and trading styles. But if you are wondering which timeframe is the best for forex trading, first you need to know what type of trader you want to be. Some traders – such as scalpers – work within very short timeframes; while others trade across a longer period of time. The best forex timeframes to trade will depend up on the type of trading style you choose.

Best forex timeframes for scalpers

Scalping is a trading style that involves identifying small price changes in the forex market and then buying and selling high volumes of currency over very short periods. By repeating this strategy over time, scalpers aim to build up a series of little gains that add up to a decent day’s profits.

Scalpers usually work within very small timeframes of one minute to 15 minutes. However, the one- or two-minute timeframes tend to be favoured among scalpers.

To action this strategy, you must choose a highly liquid currency pairing, and then you can open an account with us.

Buy into the market and watch the market movements, and use trend analysis to identify an appropriate entry point. You can then buy a certain amount of your chosen currency and wait for it to tick up very slightly within a one-minute window. Once it ticks up, you sell your holding and bank the profits, then start the process all over again. If it doesn’t tick up by the end of the one-minute timeframe, you’ll sell at a small loss before trying again to profit from a new one-minute timeframe.

You can minimise your risk of losses by establishing a strict exit strategy that protects your small gains from being wiped out by one large loss.

Read our beginners guide to forex scalping strategies

Best forex timeframes for day traders

Day traders tend to take a short-term approach, with most choosing timeframes lasting from 15 minutes to four hours. The benefit of being a day trader is that you can choose from a range of different timeframes, depending on the liquidity of your chosen market, the amount of time you have to make your trades, and your preferred trading strategy.

For instance, a time-poor forex trader might use a 15-minute timeframe to make quick gains in a liquid market across a shorter window of time. A full-time day trader might use daily and hourly timeframe analysis to identify emerging trends and choose the best market entry point. However, day traders must be careful to set tight exit points once they have entered their chosen market, and to monitor these price movements closely. One poorly-chosen trade has the potential to wipe out a whole day’s worth of profits.

Find out more about day trading by reading our guide

Best forex timeframes for swing traders

Swing traders tend to choose longer timeframes, which allow them to benefit from analysing price trends and patterns over time. These timeframes might last from a couple of days to a few weeks, or even as long as several months. Swing traders might use a stop loss and profit target to make their gains, or they might act on price action movements or other technical indicators.

The philosophy behind swing trading is to benefit from a general price movement over time by monitoring macro trends and using technical analysis to choose the best entry points. This strategy rewards patience and market expertise, and works best with less volatile currency pairs.

Learn more about swing trading and how to identify the best swing trading indicators

Best forex timeframes for position traders

As the name suggests, position traders will take a position in a particular forex market and hold it in the hopes that it will increase in value across a particular period of time. These traders will not actually make very many trades, and they are likely to work within very long-term timeframes, of several weeks or months – even as long as a year.

Unlike traditional ‘buy and hold’ investors, position traders are not simply locking their money away indefinitely. They are trend followers, and their aim is to identify a trend, buy into it, and sell out when the trend reaches its peak.

How to perform multiple timeframe analysis

Multiple timeframe analysis involves looking at a particular currency pair across several different periods of time simultaneously in order to find as many trading opportunities as possible.

Most traders will start by choosing one longer timeframe and another shorter timeframe. As a general rule, traders use a ratio of 1:4 or 1:6 when performing multiple timeframe analysis, where a four- or six-hour chart is used as the longer timeframe, and a one-hour chart is used as the lower timeframe. The longer timeframe can be used to establish a trend, while the shorter timeframe can be used to identify ideal entry points into the market. A third, medium-term timeframe can then be added in to allow for more granular analysis of the market trends.

Multiple timeframe analysis techniques can help you to manage several trading positions at one time, without increasing your risks. Indicators can also be used to aid with this trading strategy.

How to get started with forex trading

To get started with forex trading, you should follow these steps:

- Create or log in to your account

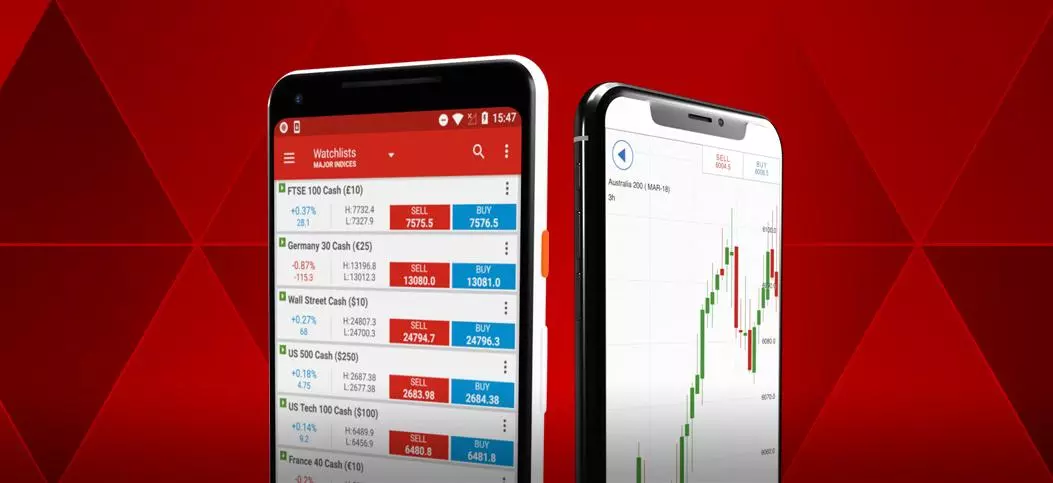

- Navigate to our trading platform

- Select that market you want to trade

- Decide whether you want to go long or short

- Take steps to manage your risk

- Open and monitor your trade across your desired timeframe

Forex timeframes summed up

- Timeframe analysis is a useful skill for forex traders

- Different trading strategies work best within specific timeframes

- Scalpers tend to use the shortest timeframes

- Day traders generally follow timeframes of four to six hours, within forex market trading hours

- Swing traders can benefit from even longer timeframes

- Position traders might hold their position for several months

- Multiple timeframe analysis can help traders to identify trends and ideal entry points

- Open an account to start trading forex

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

See an opportunity to trade?

Go long or short on more than 17,000 markets with IG.

Trade CFDs on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.