Pros and cons of trading daily options

Pick your own leverage

Choose your strike and trade size to determine your leverage and match your risk appetite, bearing in mind profit/loss will still be calculated based on your full position size.

Low spreads

Trade daily options with new reduced spreads as low as one point – the same as regular spot markets.

Go long, short or non-directional

Speculate based on rising, falling or neutral prices with your strategies in the ever-changing market

Limited risk on buying, substantial risk on selling

Buying options is inherently limited-risk – you’ll only risk as much as the margin you pay when buying an option. With selling call or put options, your risk of loss is potentially unlimited.

Increased flexibility

Hold your bought position even when markets move against you. Until expiry there is always potential for a worthless bought option to become profitable.

24-hour trading

You can trade daily options around the clock on our most popular markets.1

No spread at expiry

Unlike other providers, we won’t charge you any closing spread to close an option if you hold it to expiry.

Make sure you understand the differences between options and spot markets before you trade.

What are daily options?

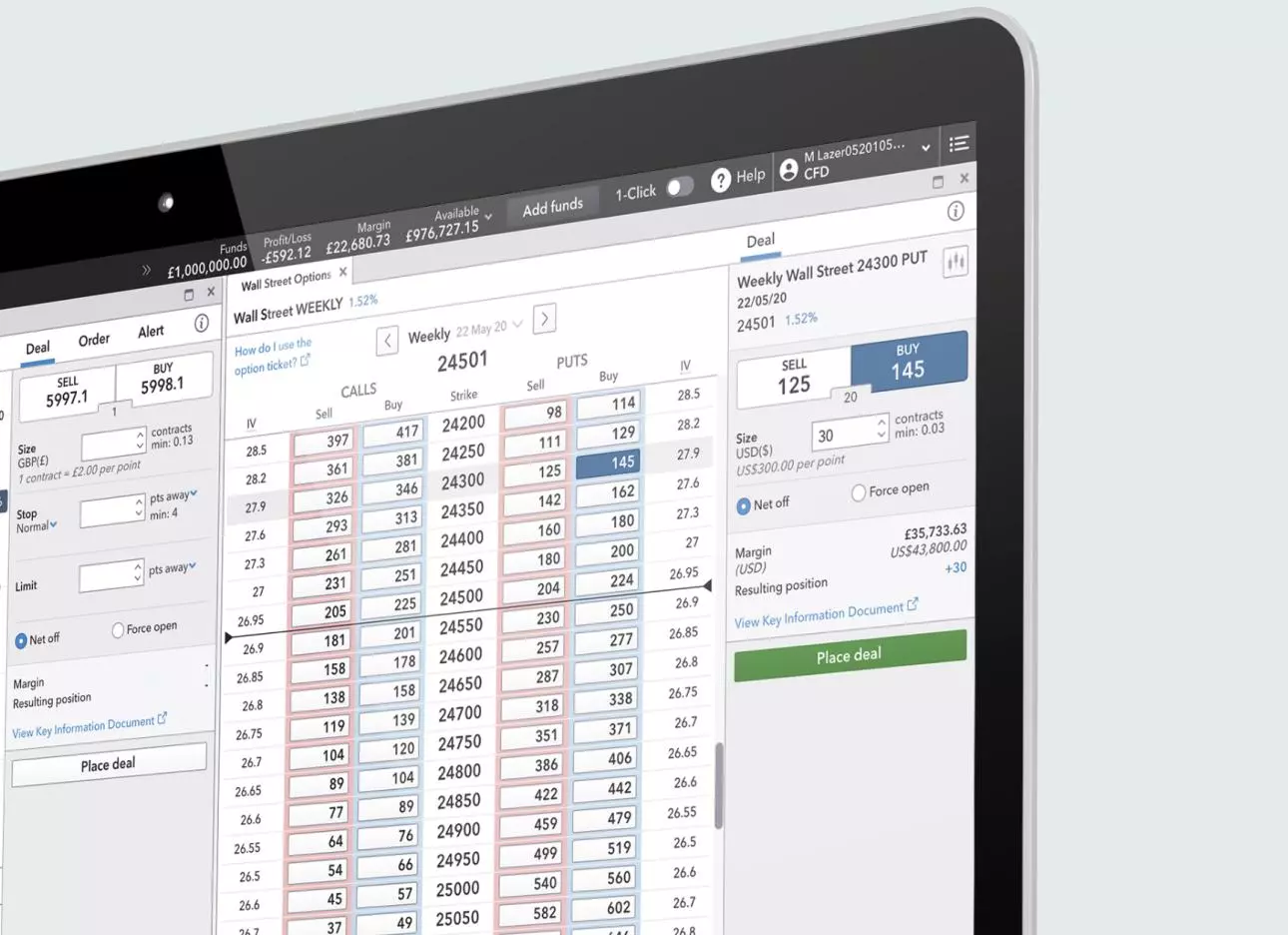

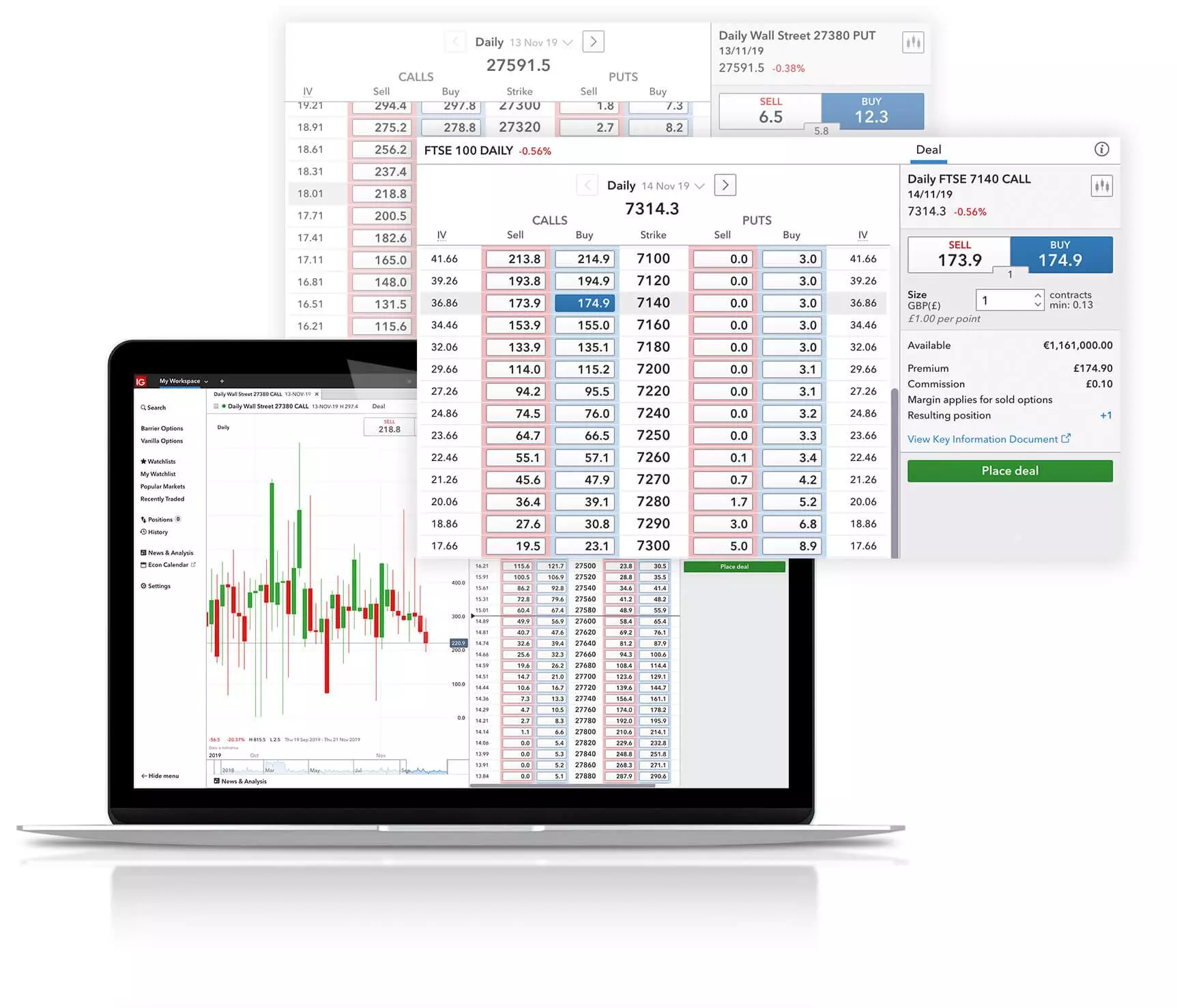

Options are contracts that let you trade on the price movement of an underlying asset. With us you can take OTC options positions via CFDs. You’ll never risk more than your initial payment when buying, just like trading an actual option, and your CFD positions will always be cash-settled at expiry while listed options are sometimes settled physically.

You can use daily options to take a view on whether you think a market will be above or below a certain level – the strike price – at the option’s expiry. For daily options, this is at market close on the same day that you open your trade.

The cost to open a position is based on the strike price and trade size you choose. This means the amount you pay to open your position can be significantly less than when trading on spot markets.

Types of daily option

There are two types of daily option – calls and puts.

- If you think the market is going to rise, you’d buy a call

- If you think the market is going to fall, you’d buy a put

Find out more about types of options and how to trade them here.

Open an account today

Fill in our simple online form

We’ll ask a few questions about your trading experience.

Get swift verification

We aim to complete the verification process as quickly as possible so you can start trading on a huge range of markets.

Fund your account and trade

Or practice on a demo if you’d prefer.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

FAQs

How much does an option cost?

Our daily option prices are set by our dealing desk, based on the following three factors: the time to expiry, the current level of the underlying market and the volatility of the market.

The more likely it is that the underlying market will be above a call option’s strike price at expiry, the higher the option’s margin will be.

Likewise, the more likely it is that the underlying marketing will be below a put option’s strike price at expiry, the higher the margin will be.

The margin is calculated as trade size x daily option price.

How does selling options differ to buying them?

Selling options carries a much higher risk profile than buying them.

When you sell an option, you have the obligation to buy or sell at the strike price, and there’s no predicting how far past the strike the underlying may be at expiry. This means that when you sell call options the risk is potentially unlimited.

Learn more about the risks involved in options trading.

How do I trade options?

Trading options via CFDs is similar to trading them on the open market. For instance, you can buy the right to trade ten FTSE 100 CFDs at 7100. You’ll pay a margin at the outset, where on a traditional option you’d pay a premium, but it functions in the same way – when buying, you won’t risk more than your initial payment. All CFDs on our options are cash-settled on closing – you’ll never have to deliver, or take delivery of, the underlying.

What’s the difference between margin and premium?

When you trade on margin, or trading CFDs on a spot market, you get greater exposure to a market than the amount you deposit to open the trade. However, as well as the potential for magnified gains, you could also experience magnified losses exceeding your initial deposit.

When you buy IG options you still pay a margin to open your position, but it works like the premium of a traditional option. You’ll get greater exposure to a market than the amount you originally deposited to open the trade, but your risk is limited to that initial payment.

When selling traditional options, you receive the premium upfront. When you sell IG CFD options, you’ll pay a margin upfront – your maximum profit if your trade works out. However, you’ll be left open to potentially unlimited losses if the market doesn’t go your way.

You might be interested in…

You can also trade longer expiries with our weekly, monthly and quarterly options.

Speculate on financial markets without buying or selling any underlying assets.

Follow our four-step guide to trading shares, from how the market works to making your first trade.

Open an account today

1 Find IG's trading hours here.