The complete guide to trading strategies and styles

There will always be different ideas about how often to trade, how long to hold a position and when to enter or exit the market. But, there are four main styles and strategies at the core of trading.

What is a trading style?

A trading style is a set of preferences that determine how often you’ll place a trade and how long you will keep those trades open for. It will be based on your account size, how much time you can dedicate to trading, your personality and your risk tolerance.

Although your trading style will be unique to you and the aims set out in your trading plan, there are four popular styles you can choose from. In order of duration, these are:

| Trading style | Timeframe | Common holding period |

| 1. Position trading | Long term | Months to years |

| 2. Swing trading | Short to medium term | Days to weeks |

| 3. Day trading | Short term | Intraday only |

| 4. Scalp trading | Very short term | Seconds to minutes |

Position trading

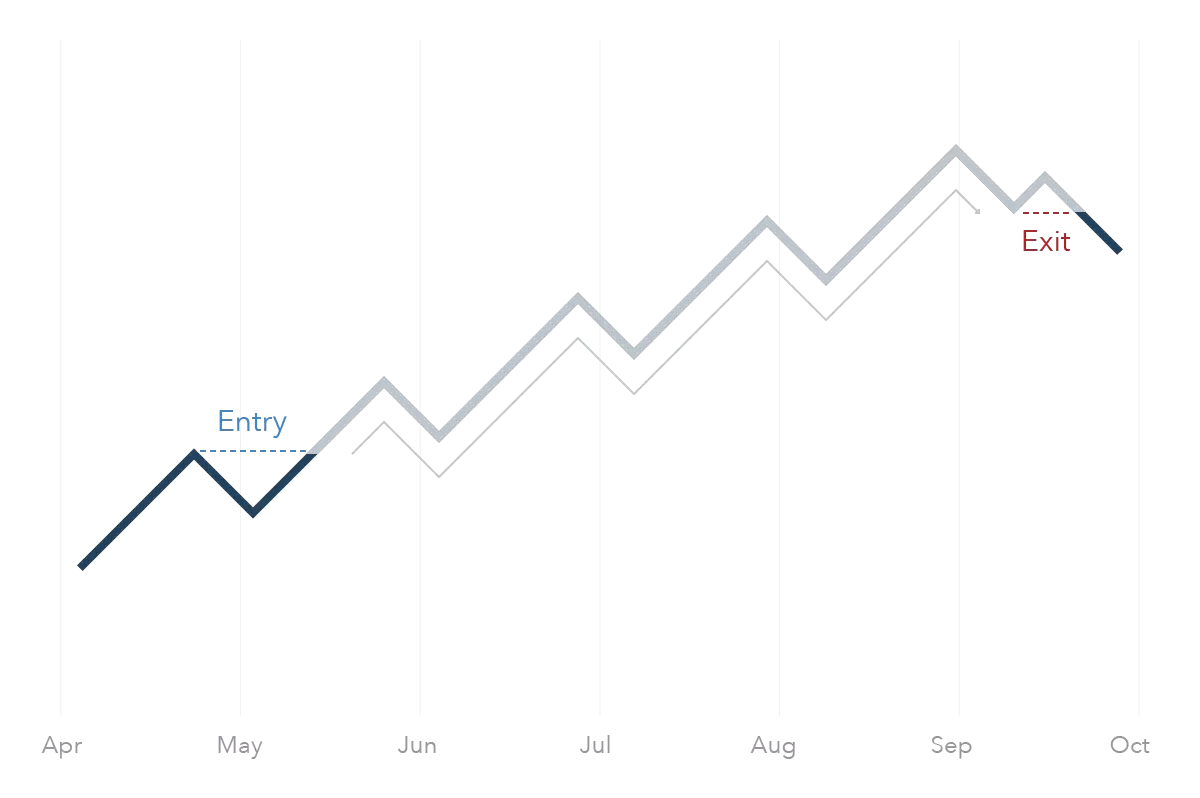

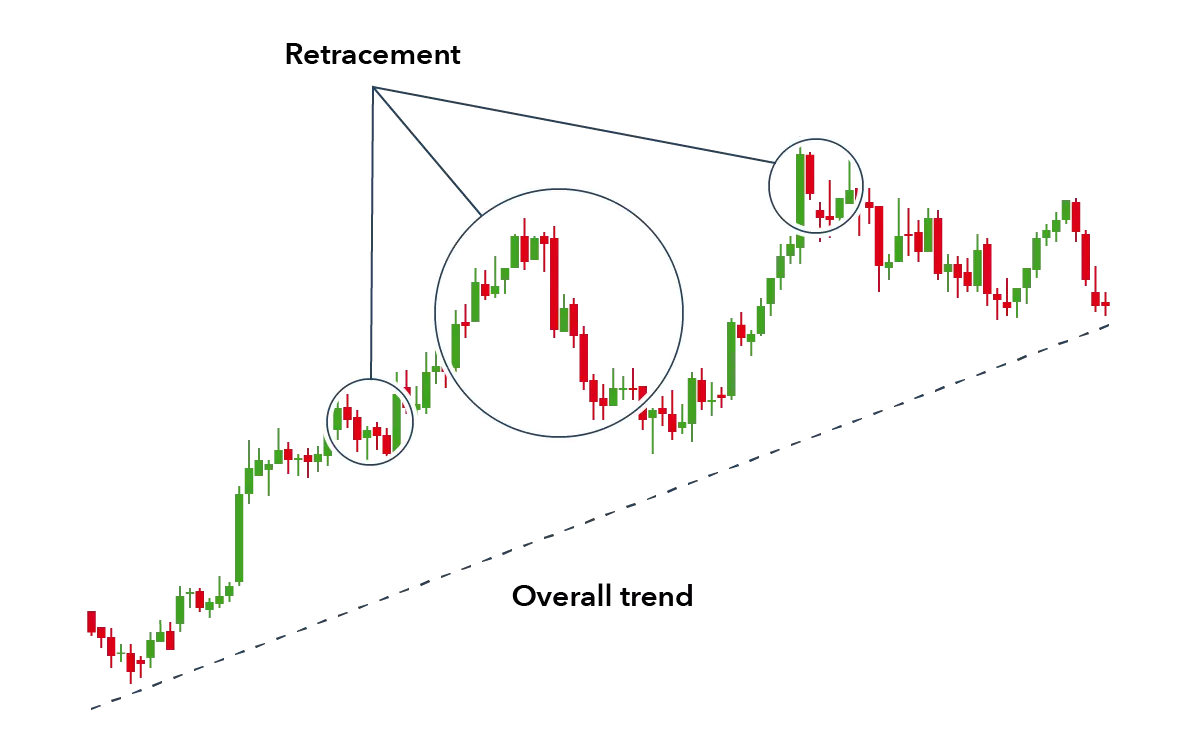

Position trading involves holding a trade for a long period of time, whether this is weeks, months or even years. Position traders are unconcerned with short-term market fluctuations – instead they focus on the overarching market trend.

Source: IG charts

Investing is perhaps the most recognised form of position trading. However, an investor would deploy a ‘buy and hold’ strategy, whereas position trading can refer to short positions – to sell an asset – as well.

Position trading involves opening fewer trades than other trading styles, but the positions will tend to be of higher value. While this increases the potential for profit, it also increases the trader’s exposure to risk. Position traders need to have a large amount of patience to stick to the rules laid out in their trading plan – knowing when to close a position and when to let profits run.

Typically, position traders will rely on technical analysis – using tools such as a Fibonacci retracement which allows them to identify periods of support and resistance.

Swing trading

Swing trading is a style that focuses on taking a position within a larger move. It involves holding a trade over several days or weeks, in order to take advantage of short- to medium-term market movements.

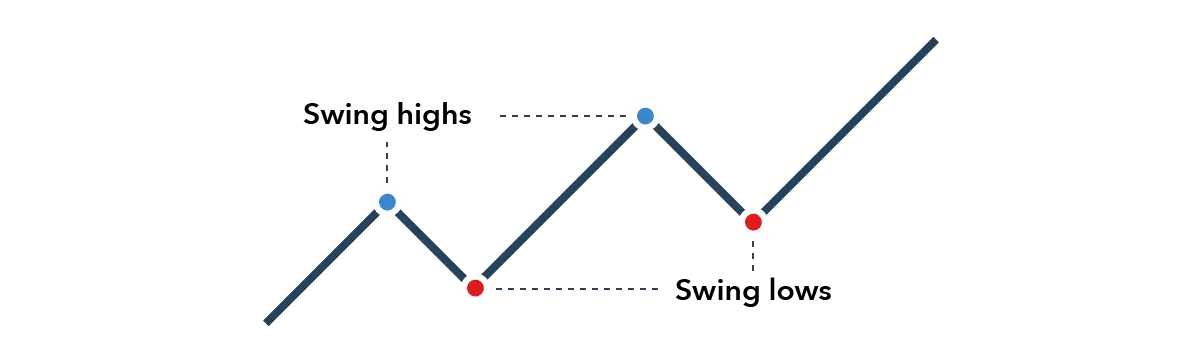

The overarching goal of swing trading is to spot a trend and then capitalise on dips and peaks that provide entry points. A swing trader will use technical analysis to identify these key price points. They are looking for two types of market movement: a ‘swing high’, which is when the price moves upwards, and a ‘swing low’, which is when the market price declines.

A swing low indicates an opportunity to buy into a long position or sell a short position, while a swing high is an opportunity to sell a long position or open a short position. Swing traders often search for markets with a high degree of volatility, as these are the markets in which swings are most likely to occur.

Source: IG charts

There is no given timeframe for swing trading, as it is completely dependent on how long each trend lasts. This could be as short as an hour or as long as a week. Swing trades will only be exited when a profit target is reached, or the position is stopped out. It is the preferred method for traders who don’t want to spend all day monitoring the market, but don’t want to enter a longer-term position.

Day trading

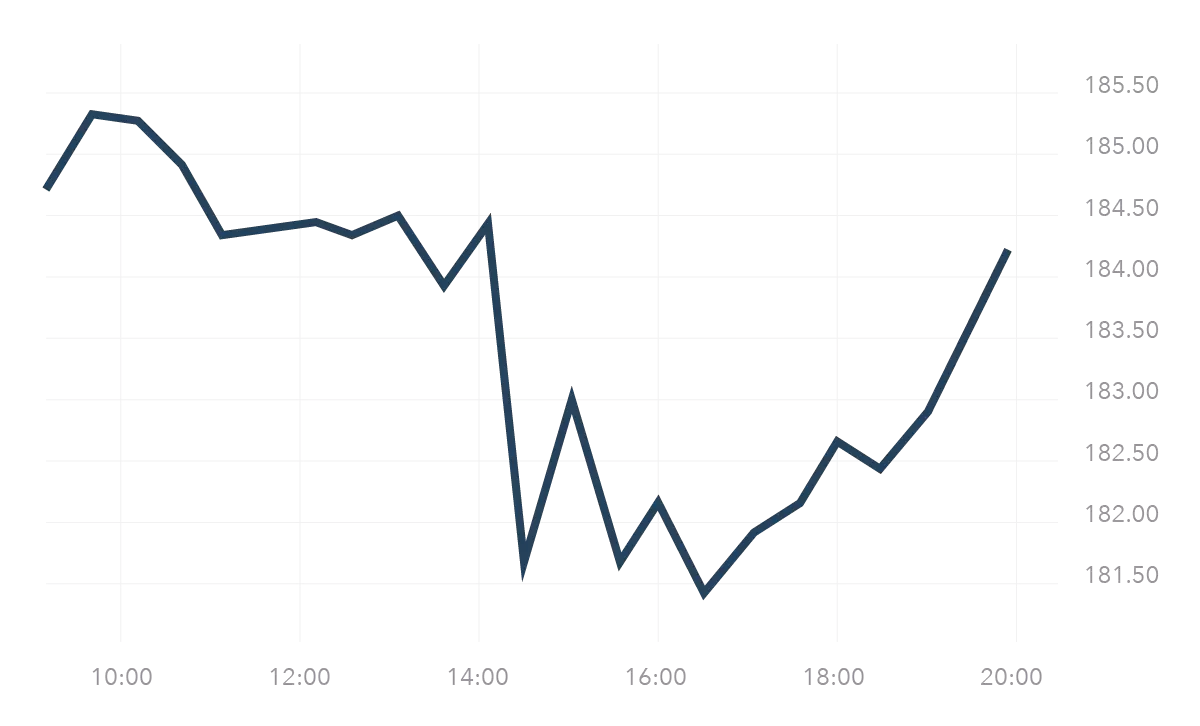

Day trading is a style that specifies a trader will open and close all their positions before the markets close each evening. Day traders will buy and sell multiple assets within the trading day, or sometimes multiple times a day, to take advantage of short-term market movements. In doing so, they avoid some of the risks and added costs associated with holding a position overnight.

Intraday trading takes time, focus and dedication to a trading plan. It involves executing a large number of trades for relatively small profits compared to position trading – this makes it vital that day traders do not fall prey to the temptation of letting a losing trade run, as it can eat into their profits. To mitigate the risk of losses, day traders often use stops and limits. Attaching a stop-loss to a position will enable a trader to keep their risk at a known level, while limits will lock in any profits.

Source: IG charts

Other types of trading styles can fall within the category of day trading – such as swing trading and scalping – as they often involve opening and closing positions in a single day.

Scalping

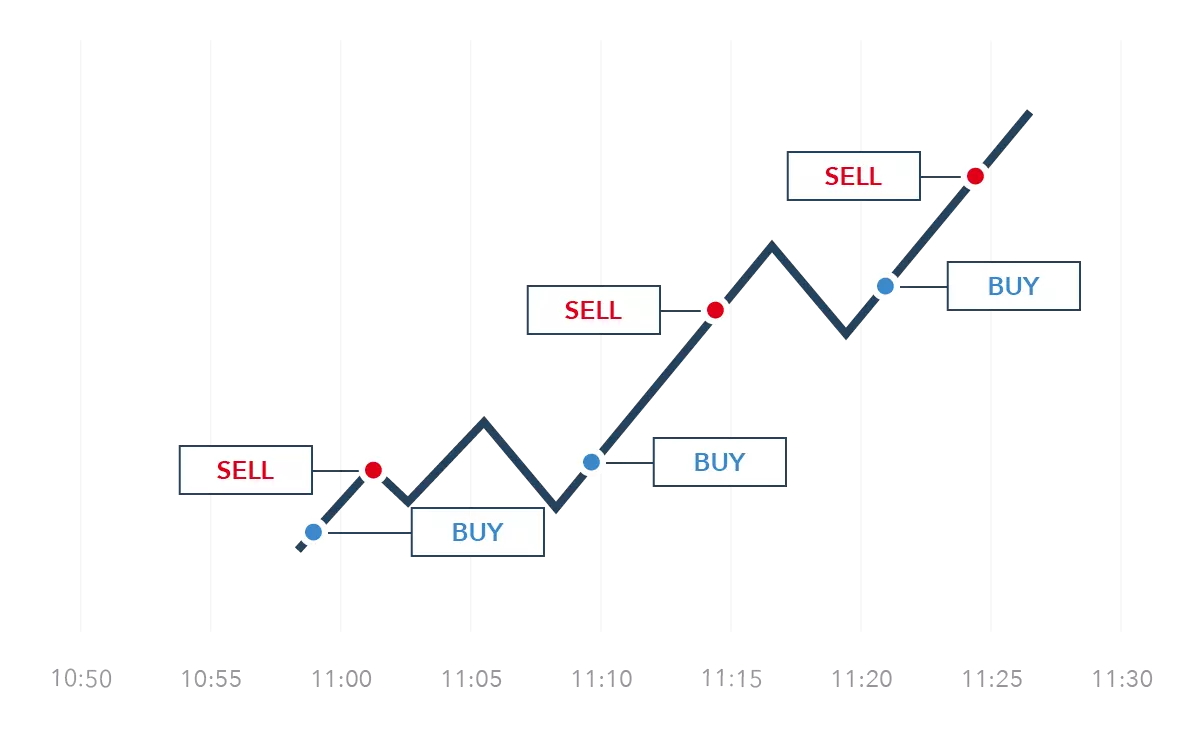

Scalping is a trading style that involves opening and holding a position for a very short amount of time, from a few seconds to a few minutes at most. The idea is to open a trade and exit it as soon as the market moves in your favour – taking small but frequent profits.

Scalping is often considered a much quicker and more intense form of day trading. It requires traders to focus on markets that are extremely liquid and are experiencing strong trends. This enables traders to open positions quickly and then get out of them as soon as the market moves.

Source: IG charts

Scalping is extremely time intensive. The style is not generally used by part-time traders as it requires a lot of dedication to monitoring the market and performing analysis.

High-frequency trading

As some of these styles require traders to have extremely fast reactions, there has been a growing interest in high-frequency trading (HFT). This is an algorithmic method of trading that large organisations use to execute a huge number of orders in a matter of seconds.

However, it is not widely classified as a trading style, as it relies on the underlying technology to fulfil trades, rather than a trader’s personal preferences or plan. HFT is also not widely available to individual traders, which means that they just cannot keep up with large institutions.

You can practise using these trading styles in a risk-free environment by opening an IG demo account. Or if you feel confident enough to start trading on live markets, you can open a trading account with IG.

What is a trading strategy?

A trading strategy will use analysis to identify specific market conditions and price levels. While fundamental analysis can be used to predict price movements, most strategies focus on specific technical indicators.

Although there is a lot of confusion between ‘style’ and ‘strategy’, there are some important differences that every trader should know. While a style is an overarching plan for how often you will trade, and how long you will keep positions open for, a strategy is a very specific methodology for defining at which price points you will enter and exit trades.

Best trading strategies

We’ve looked at some of the most popular top-level strategies, which include:

Trend trading

A trend trading strategy relies on using technical analysis to identify the direction of market momentum. This is usually considered a medium-term strategy, best suited to position traders or swing traders, as each position will remain open for as long as the trend continues.

The price of an asset can trend both up and down. If you were going to take a long position, you’d do so when you believe the market is going to reach higher highs. If you were going to take a short position, you’d do so if you thought the market would reach lower lows. Derivative products – such as CFDs – are popular choices for trend-following strategies, because they enable traders to go both long and short.

Trend traders will use indicators throughout the trend to identify potential retracements, which are temporary moves against the prevailing trend. Trend traders will often take little notice of retracements, but it’s important to confirm it is a temporary move rather than a complete reversal – which is a signal to close a trade.

Source: IG charts

Some of the most popular technical analysis tools included in trend-following strategies include moving averages, the relative strength index (RSI) and the average directional index (ADX).

Range trading

Range trading is a strategy that seeks to take advantage of consolidating markets – the term to describe a market price that remains within lines of support and resistance. Range trading is popular among scalpers, as it focusses on short-term profit taking, however it can be seen across all timeframes and styles.

While trend traders focus on the overall trend, range traders will focus on the short-term oscillations in price. They will open long positions when the price is moving between two clear levels and is not breaking above or below either.

It is a popular forex trading strategy, as many traders work off the idea that currencies remain in a tight trading range, with significant volatility in between these levels. This means that short-term traders can seek to take advantage of these fluctuations between known support and resistance levels.

.png/jcr:content/renditions/original-size.webp)

Source: IG charts

There are a range of other indicators that range traders will use, such as the stochastic oscillator or RSI, which identify overbought and oversold signals. Range traders will also use tools, such as the Bollinger band or fractals indicators, to identify when the market price might break from this range – indicating it is time to close the position.

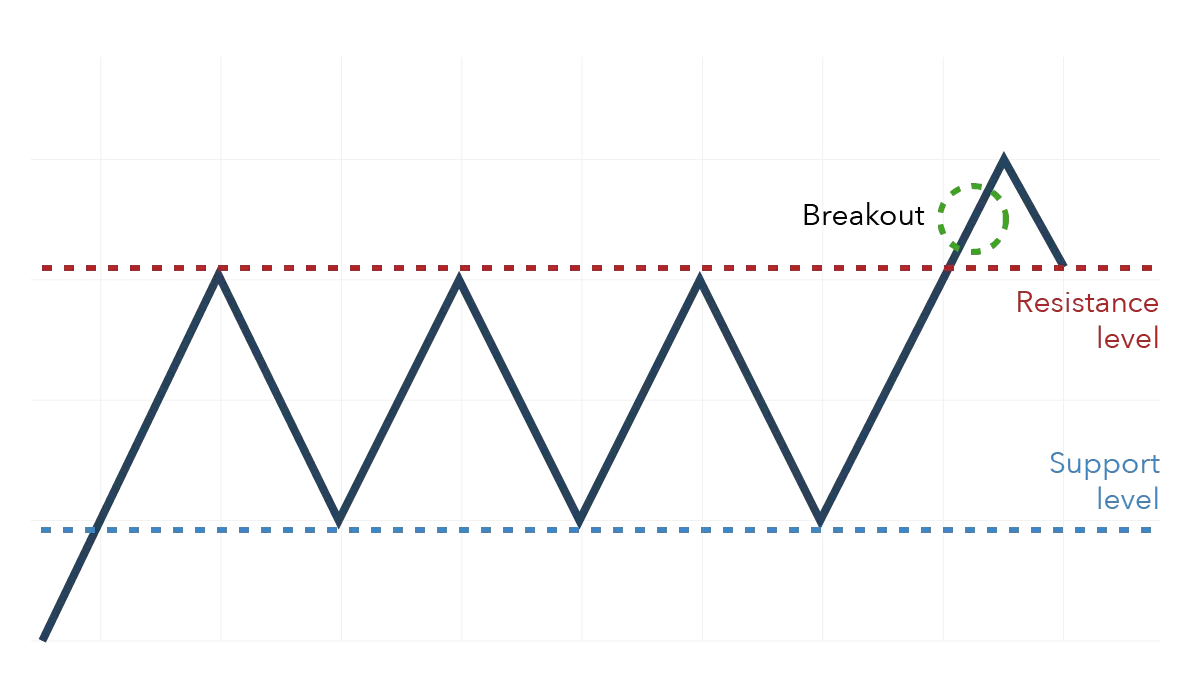

Breakout trading

Breakout trading is the strategy of entering a given trend as early as possible, ready for the price to ‘break out’ of its range. Breakout trading is commonly used by day traders and swing traders, as it takes advantage of short to medium-term market movements.

Traders who use this strategy will look for price points that indicate the start of a period of volatility or a change in market sentiment – by entering the market at the correct level, these breakout traders can ride the movement from start to finish. It is common to place a limit-entry order around the levels of support or resistance, so that any breakout executes a trade automatically.

Most breakout trading strategies are based on volume levels, as the theory assumes that when volume levels start to increase, there will soon be a breakout from a support or resistance level. As such, popular indicators include the money flow index (MFI), on-balance volume and the volume-weighted moving average.

Source: IG charts

Reversal trading

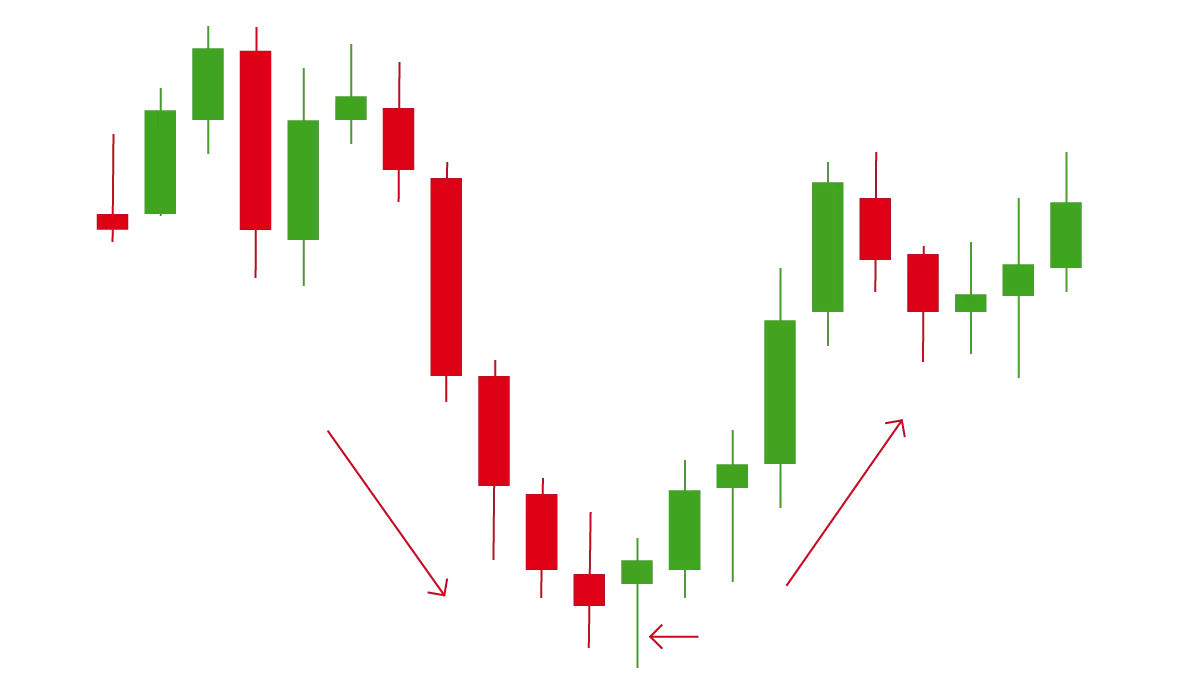

The reversal trading strategy is based on identifying when a current trend is going to change direction. Once the reversal has happened, the strategy will take on a lot of the characteristics of a trend trading strategy – as it can last for varying amounts of time.

A reversal can occur in both directions, as it is simply a turning point in market sentiment. A ‘bullish reversal’ indicates that the market is at the bottom of a downtrend and will soon turn into an uptrend. While a ‘bearish reversal’ indicates that the market is at the top of an uptrend and will likely become a downtrend.

Source: IG charts

When trading reversals, it is important to make sure that the market is not simply retracing. The Fibonacci retracement is a common tool, used to confirm whether the market surpasses known retracement levels. It is worth noting that some consider Fibonacci retracements to be a self-fulfilling prophecy, as many orders will congregate around these levels and push the price in the desired direction.

It is important to combine technical indicators with other forms of analysis, whether this is other technical tools or fundamental analysis.

Ready to start building a trading strategy? Open an account with IG to trade on live markets or practise trading first with an IG demo account.

Learn more about styles, strategies and trading plans with IG Academy’s range of online courses.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.