Ahead of the game

Your weekly financial calendar for market insights and key economic indicators for April 24, 2023.

Reading time: 4 minutes

FOLLOWING THE BANKING crisis last month, there was an expectation that central bank rate hikes would soon give way to rate cuts or, at worse, a pause. However, central bank communique this week and mixed data suggest central banks have unfinished business in their battle to tame inflation.

- RBA minutes confirmed a close decision to pause rate hike cycle, with Australian interest rate pricing in 25% chance of 25bp rate hike in May

- UK inflation remains high, with BoE expected to raise rates by 25bp to 4.50%

- US inflation expectations rose to 4.6% in April

- Fed officials have mixed views on interest rates, with Bullard favoring 5.5-5.75% range, while Bostic prefers one more rate rise then hold

- Q1 2023 earnings reports have started, with Netflix and Tesla seeing share price drops after reporting

- VIX index fell to 16.5, its lowest since Jan 2022

- RBA Review released key recommendations, including continuation of 2-3% inflation target and creation of separate Monetary Policy and Governance Boards.

↵

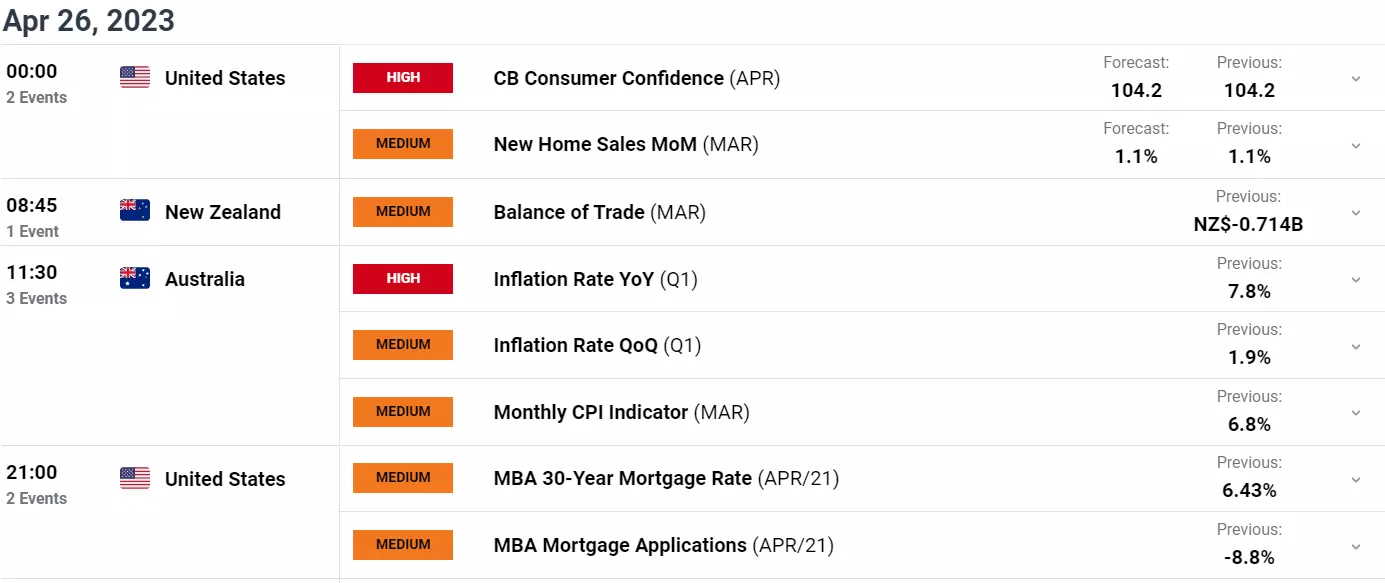

Wednesday, April 26 at 11.30am AEST: AU CPI

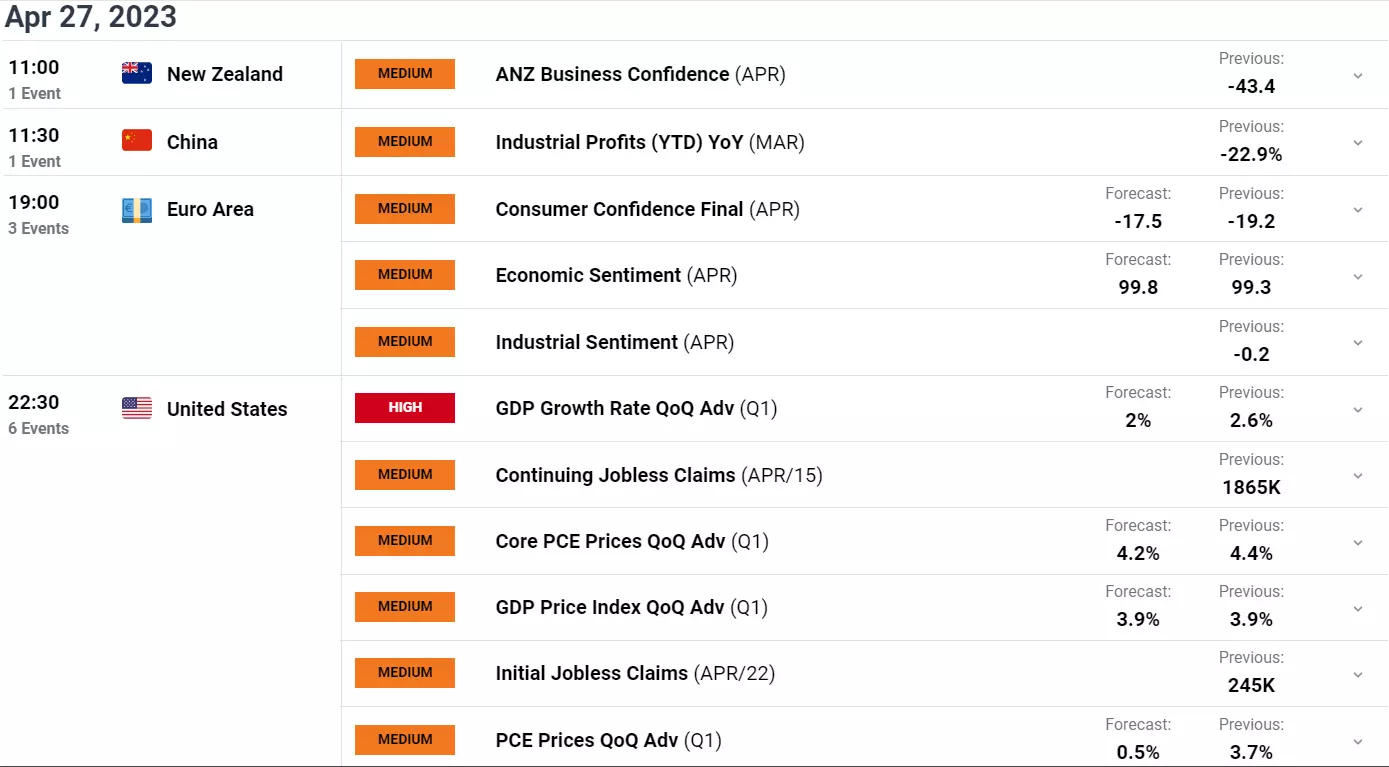

Thursday, April 27 at 11.30am AEST: ANZ Business Confidence

- Friday, April 28 (no set time): Bank of Japan Interest Rate Decision

Wednesday, April 26 at 12.00am AEST: Consumer Confidence

Thursday, April 27 at 10.30pm AEST: Q1 GDP Advanced

Friday, April 28th at 10.30pm AEST: Core PCE Price Index

Friday, April 28th at 6:00pm AEST: EZ and DE - Q1 GDP flash

Friday, April 28th at 10:00pm AEST: DE - Inflation

-

Australia + NZ

Q1 2023 CPI report

Wednesday, April 26th at 11.30am AEST:

As revealed in the RBA meeting minutes for April, the Board discussed the various pros and cons of raising rates by a further 25bp on top of a substantial 350bp of rate rises or keeping rates on hold at 3.60%.

“[O]n balance, [we] agreed that there was a stronger case to pause at this meeting and reassess the need for further tightening at future meetings.”

The minutes reiterated “that it was important to be clear that monetary policy may need to be tightened at subsequent meetings” and, in the final paragraph, noted the Board’s future cash rate decisions would depend on developments in the global economy, trends in household spending and the outlook for inflation and the labour market.”

The release of stronger-than-expected labour market data in mid-April confirmed that the labour market remains extremely tight.

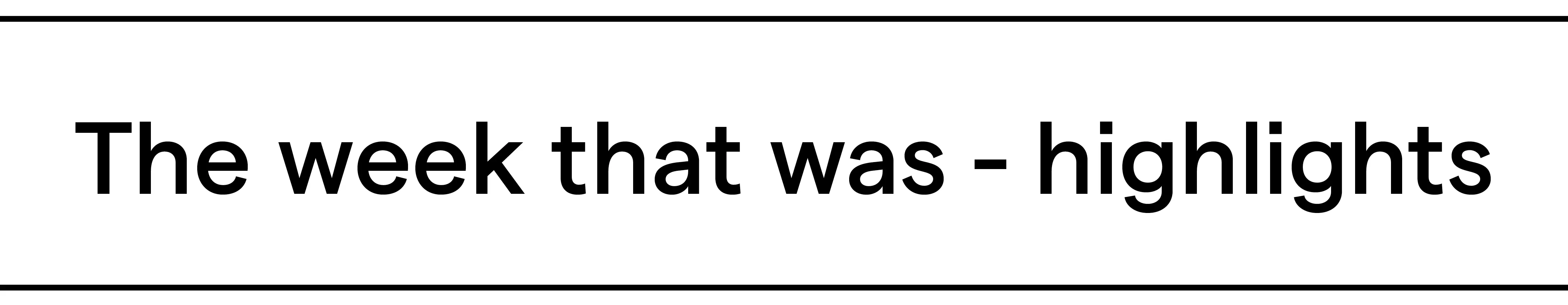

Should next week’s all-important CPI print fail to confirm that inflation is falling as quickly as anticipated, the RBA may act on its tightening bias and hike the cash rate again as soon as next month.

The key numbers:

- Headline CPI is expected to increase by 1.3% in Q1 2023 for an annual rate of 6.9%, falling from 7.8% in Q4 2022.

- Trimmed mean is expected to rise by 1.4% in Q1 2023 for an annual rate of 6.7%, falling from 6.9% in Q4 2022

Trimmed mean chart

-

Japan

BoJ interest rate decision

Friday, April 28th – no set time:

The new Bank of Japan Governor, Kazuo Ueda, began his five-year term earlier this month tasked with the responsibility of exiting the ultra-loose monetary policy of his predecessor Kuroda and delivering a “soft landing”.

While no adjustment to YCC policy is expected this month, a surprise move cannot be ruled out, which would send both the Nikkei and USD/JPY (大口) sharply lower.

Bank of Japan

-

US

Q1 2023 earnings reports

Earnings reports are set to flow in the coming week from Megatech companies, including Alphabet, Meta, Microsoft and Amazon, as well as Coca-Cola, PepsiCo, McDonald’s, Boeing, Exxon and Chevron.

Core PCE Price Index

Friday, April 28th at 10.30pm:

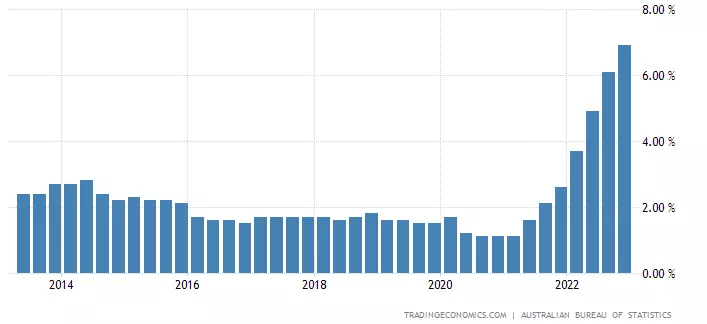

The Feds preferred measure of inflation, the Core PCE Price Index, is expected to fall to 4.6% in March from 4.7% in February. This would be the lowest reading in sixteen months.

A higher-than-expected number would all but seal the deal for a 25bp rate hike at the upcoming May FOMC meeting and raise concerns that higher rates are needed to tame inflation.

Core PCE Price Index chart

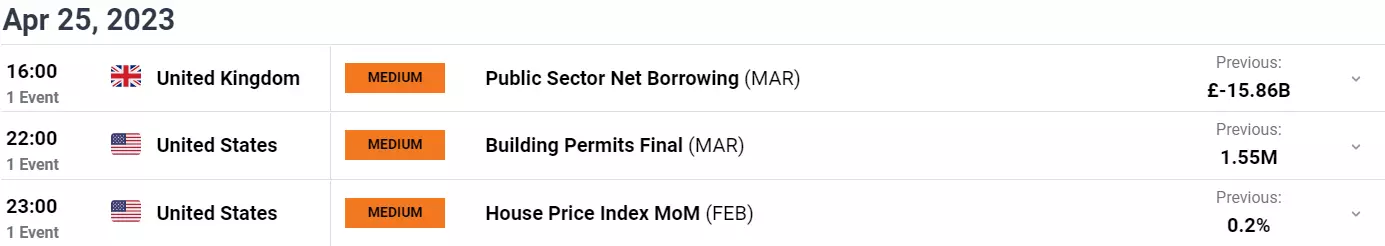

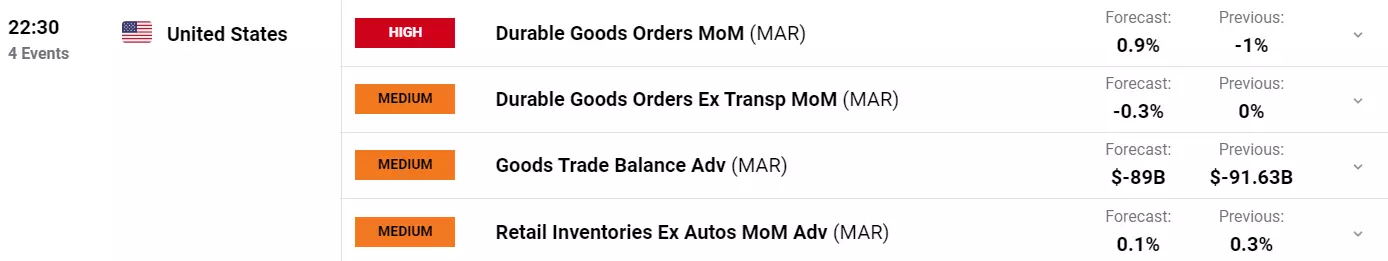

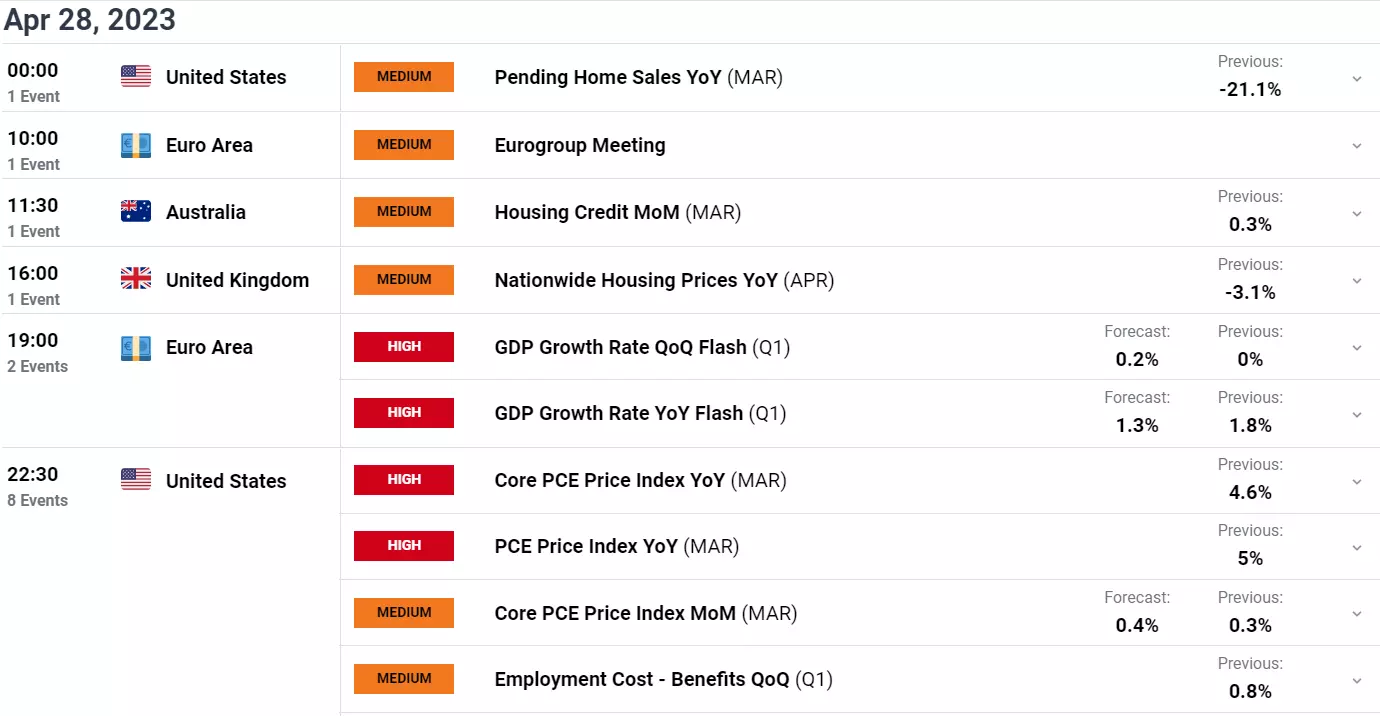

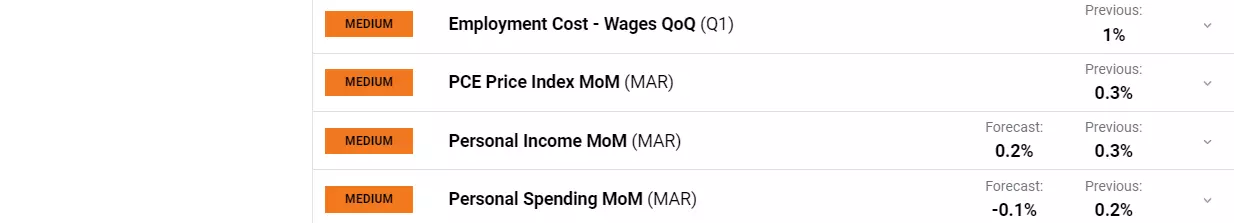

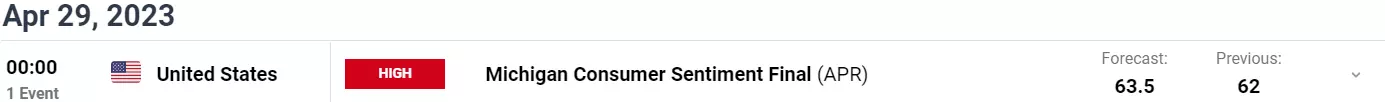

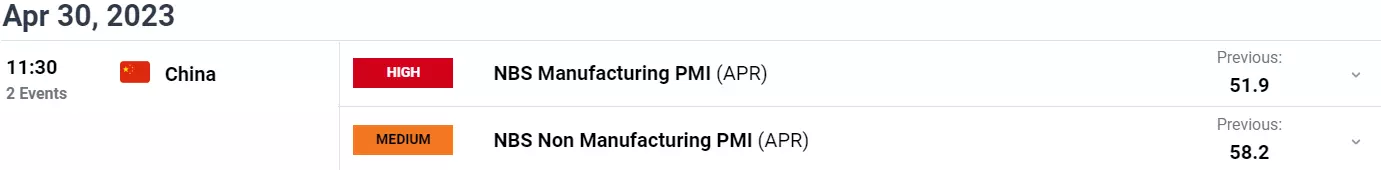

Economics calendar

All times shown in AEST (UTC+10) unless otherwise stated.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.