What are knock-outs and how to trade them

Knock-outs are limited-risk CFD trades that automatically close when the market reaches your chosen level, helping you manage risk while maintaining profit potential.

Key Takeaways

Fixed maximum loss determined upfront

Positions move one-for-one with underlying market

Single premium payment required

No ongoing margin requirements

Automatic closure at predetermined levels

What are knock-outs?

Knock-outs (sometimes called knock-out options) are the simplest way to trade with limited risk. These limited-risk CFD products work like having a safety net - if the market moves against you, your trade automatically closes to protect you from losing more than you planned.

Perfect for beginners

- Can't lose more than you invest

- No surprise costs or margin calls

- Easy to understand

- Great way to learn leveraged trading safely

How knock-outs work?

Choose your market - Pick any market like Apple shares or EUR/USD

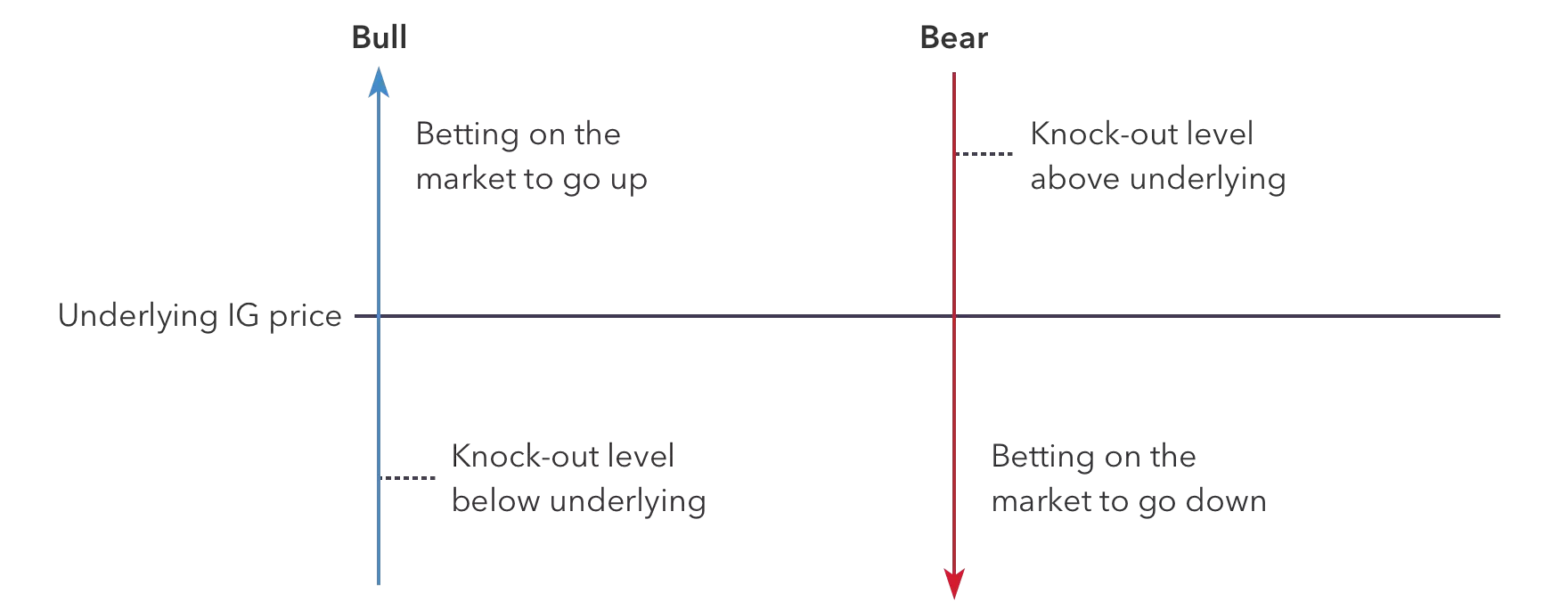

Pick your direction - Up (bull) or down (bear)

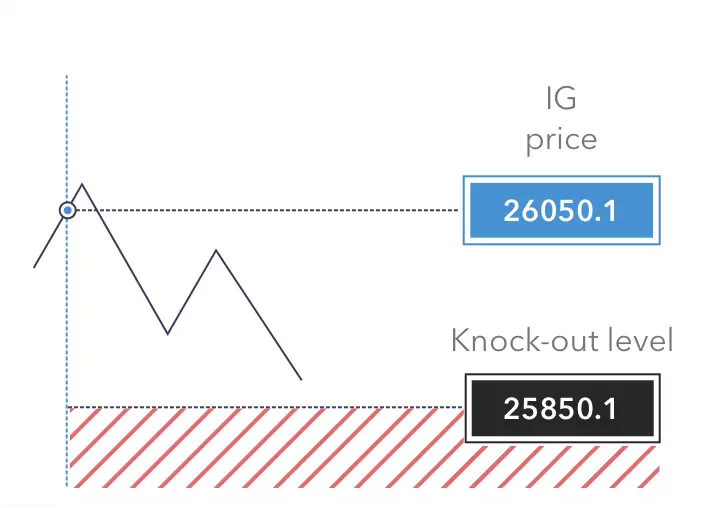

Set your knock-out level - This is where your trade will automatically close

Pay your premium - One upfront cost covers everything

Bull knock-outs = you think prices will rise

Bear knock-outs = you think prices will fall

Simple real-life example (hypothetical)

Your observation:

Apple shares are $150 per share.

You believe:

That the share price will rise soon.

Your trade:

- You choose a bull knock-out

- Set your knock-out level at $145

- You invest $100

Possible outcomes:

- If Apple rises to $155 → You make a profit

- If Apple falls to $145 → Trade closes, you lose $100 (but no more)

Singapore market example

Imagine the Singapore Blue Chip index is at 3,200 points. You believe it will rise, so you buy a bull knock-out with a knock-out level at 3,150 and invest S$100. If the index rises to 3,250, you profit. If it falls to 3,150, your trade closes and you lose S$100 (but no more).

How to trade knock-outs with IG Singapore

Go to the ‘markets’ section and select ‘knock-outs’

Choose the market you want to trade

Decide if you want to go long (bull) or short (bear)

Set your knock-out level

Enter your position size

Check the knock-out premium

Click ‘place deal’ to open your trade

FAQs about knock-outs

How much money do I need to start trading knock-outs?

The minimum depends on the market and your chosen knock-out level. Always start small while learning.

Can I lose more than I invest in knock-outs?

No. The maximum you can lose is your upfront premium. Unlike regular trading where losses can exceed your deposit, knock-outs cap your risk.

Are knock-outs good for beginners?

Yes - they're actually designed for risk management. You know your maximum loss upfront and can't get margin calls, making them safer than traditional leveraged trading.

What's the difference between knock-outs and regular CFDs?

Knock-outs automatically close at your safety level and require one upfront payment. Regular CFDs can result in bigger losses and ongoing costs.

Do knock-outs expire?

Yes, but expiry dates are typically months or years away. You'll usually close your position manually for profit or loss before expiry.

How complicated are knock-outs to understand?

They're actually simpler than most leveraged products. Market moves $1, your position moves $1. Hit your safety line, trade closes. That's it.

Are knock-outs the same as knock-out options?

Yes, knock-outs are sometimes called knock-out options. They're limited-risk CFD products that automatically close at your chosen safety level, protecting you from losing more than your initial investment.