Dow 30: futures little changed after a record close

Technical overview remains bullish, and in sentiment CoT speculators upping their heavy buy bias.

Strong headline labor data

Plenty to digest last Friday out of the US: (1) Non-Farm Payrolls (NFP) for the month of January showed growth of 353K, smashing the roughly 180K estimates with higher revisions for the two months that preceded it; (2) the unemployment rate held at 3.7% instead of rising, but household survey divergence again as it showed a drop of 31K, and the U6 was a notch higher at 7.2%; (3) the labor force participation rate held at 62.5%; (4) the employment-population ratio was a notch higher at 60.2%; and (5) wage growth month-on-month (m/m) was a much hotter 0.6%, taking it higher year-on-year (y/y) to 4.5%, but came with weakness in overall hours worked.

UoM's figures generally improved, and the reaction to Big Tech’s earnings was net positive

There were also revised figures out of UoM (University of Michigan), with consumer sentiment improving to 79 and, more importantly, their inflation expectations holding for the 12-month at 2.9%, even if a notch higher for the five-year to the same level. And more from Big Tech in terms of earnings last Thursday: (1) Apple’s figures beat but sales in China were disappointing, and potentially weaker iPhone sales this quarter resulted in its share price declining; (2) Amazon saw decent gains after its earnings and revenue beat, which came with strong guidance for the current quarter; and (3) Meta was the clear outperformer, with its share price closing over 20% higher after managing to beat estimates, announcing a $50bn share buyback program, and its first-ever dividend payment.

Key stock indices enjoyed another positive weekly finish, while over in the bond market, we saw mixed performance for Treasury yields that finished lower on the further end (even after Friday’s jump) while the more policy-sensitive closed higher, and market pricing (CME’s FedWatch) with far more clarity on a hold this March.

Week ahead: Services PMIs, auctions, Fed member speak, and more earnings

As for the week ahead, it’s a relatively quiet one when looking at the data, and where it’ll be busier for some early on. We’ll get services PMIs (Purchasing Managers’ Index) later today out of the US from both S&P Global and ISM (Institute for Supply Management), both expected to remain in expansionary territory. There’s also the Federal Reserve’s (Fed) loan officer survey for the fourth quarter of last year to see how bank lending and conditions have been faring. A few auctions over the next three days with the 3-year tomorrow, 10-year on Wednesday, and 30-year on Thursday, and Fed member speak on all three days, earlier its chairman Powell in an interview on reducing “interest rates carefully” with a strong economy. We’ve got the weekly items like inventory data, mortgage applications, and claims, but that aside and on the earnings front in the US, there are a few notable ones including McDonald’s today, Eli Lilly and Uber tomorrow, Disney on Wednesday, ConocoPhillips on Thursday, and PepsiCo on Friday.

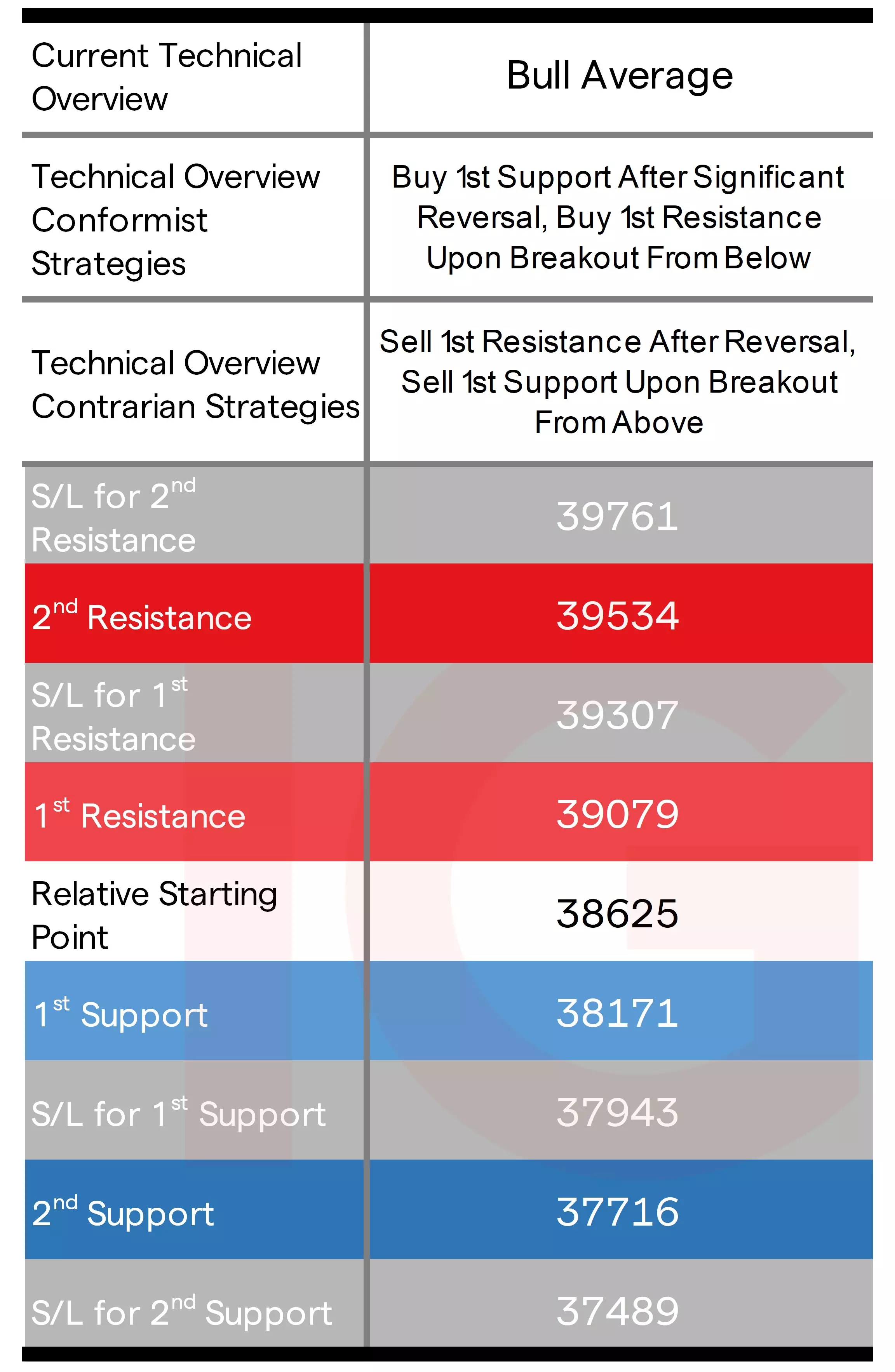

Dow technical analysis, overview, strategies, and levels

Its previous weekly 1st resistance level might have initially held, favoring contrarian sell-after-reversals, but the moves after going past it and stopping them out give conformist buy-breakouts the eventual win. The higher close keeps key technical indicators green, and so too does its overview as bullish in both weekly and daily time frames.

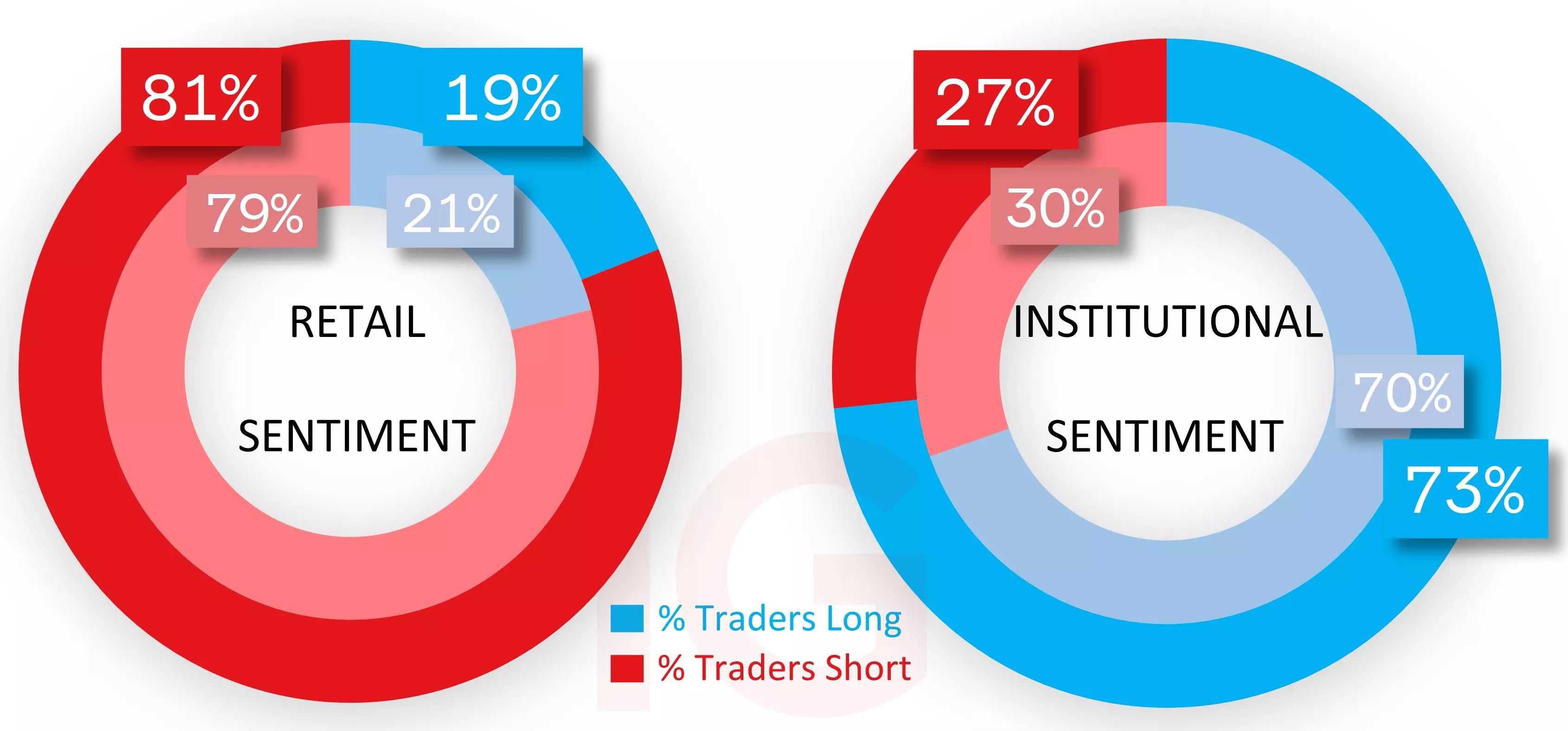

IG client* and CoT** sentiment for the Dow

IG clients remain in extreme sell territory and have raised that bias to start the week off at 81%. Although is lower than the more extreme levels seen prior, there will likely be further caution on shorts getting in until a more pronounced pullback in price is witnessed. CoT speculators are an opposite majority buy and have raised their heavy long bias again, this time to 73% (longs 6,790 lots, shorts 21), momentum likely raising it while shorts generally holding.

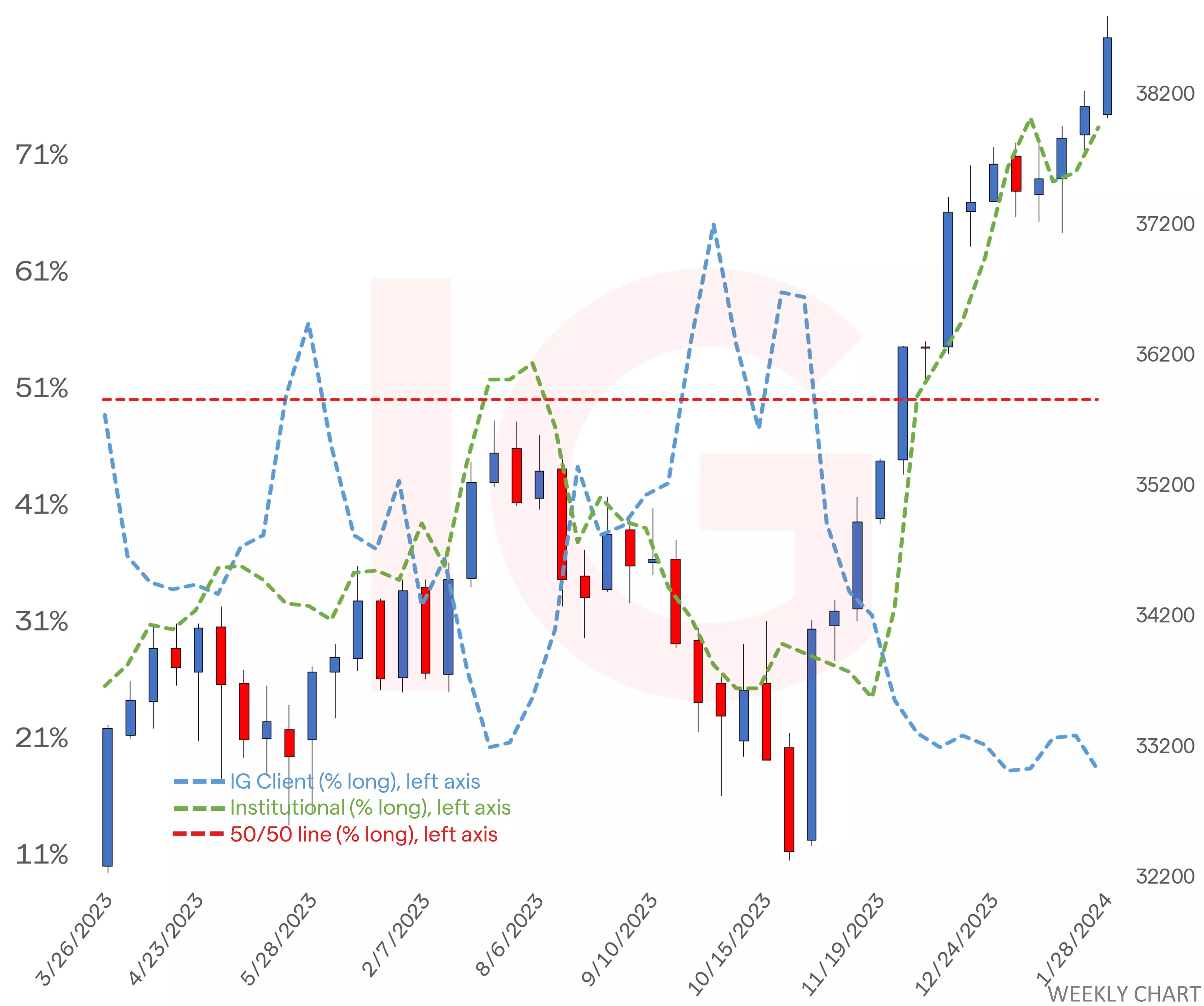

Dow chart with retail and institutional sentiment

- *The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of the start of this week for the outer circle. Inner circle is from the start of last week.

- **CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.