FOMC meeting preview: a done deal with surprises in store

This week, all eyes will be on the highly-anticipated FOMC meeting. While it appears highly likely that the Fed will keep interest rates unchanged, the upcoming meeting might hold unexpected surprises.

This week, all eyes will be on the highly anticipated FOMC September meeting. While it appears highly likely that the Fed will keep interest rates unchanged, the upcoming meeting might hold unexpected surprises. What other critical signals could potentially steer the market's course in the months ahead?

FOMC meeting key watch: a no-surprise pause

The Federal Open Market Committee (FOMC), tasked with formulating monetary policy for the world's largest economy, will be in the spotlight on September 20th as they decide their next move in their year-long journey to combat inflation through a restrictive monetary policy framework.

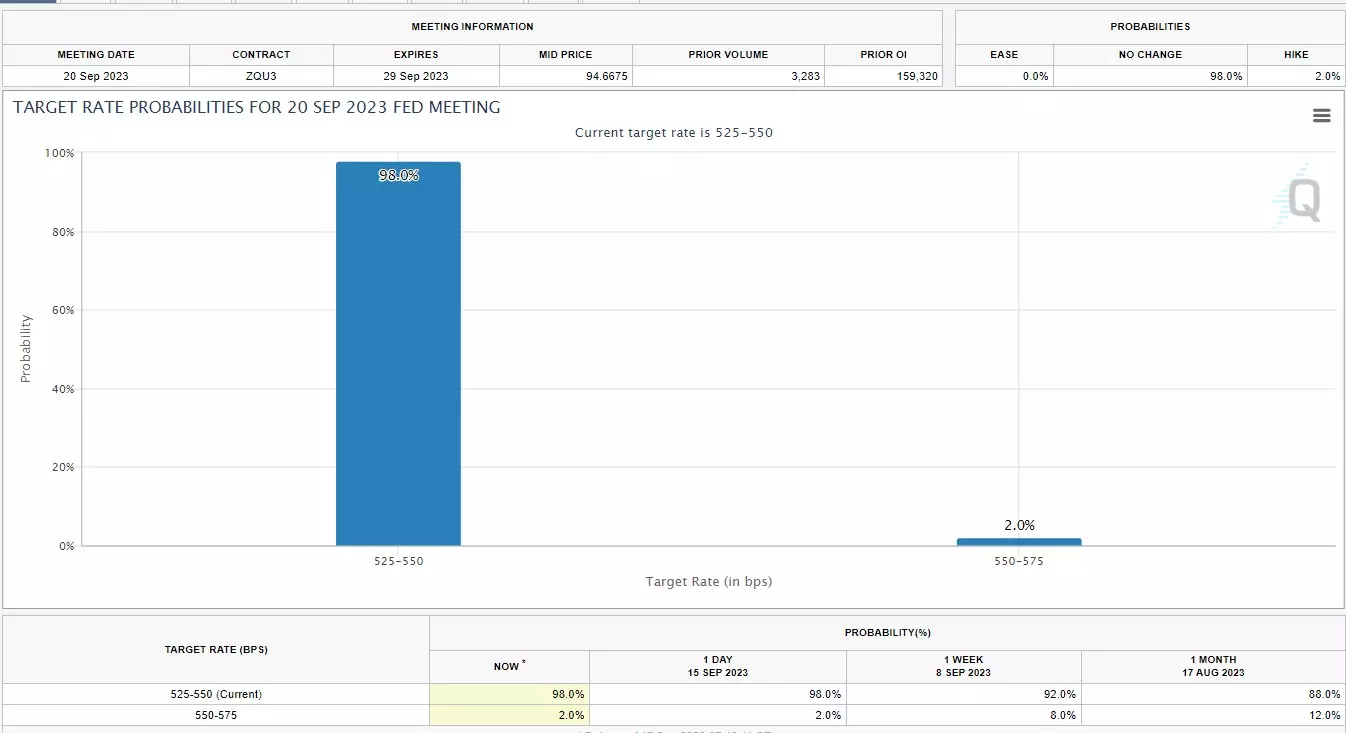

In recent speeches, Federal Reserve officials have clearly expressed their preference for maintaining the current interest rate during this meeting. They emphasize the significance of assessing the delayed impact of the 11 previous rate hikes on the economy before bringing in any further interest rate increases. As decision day approaches, the market has priced in the expectation of a pause this month with a 98% chance.

FOMC meeting key watch: next rate hike?

However, concerns regarding inflation continue to linger, and the sustained economic strength suggests that the Fed is more likely to reiterate its hawkish stance in the Septmber meeting.

In August, inflation once again picked up pace, with the Consumer Price Index rising by 3.7% year-on-year, marking a significant rebound from 3.1% in July. This surge was primarily attributed to increasing gasoline and housing prices. Additionally, producer prices also accelerated, reaching their highest level since June 2022.

Consequently, it appears that the US central bank won’t be ready to declare a "peak rate" anytime soon. In fact, the Fed appears to be leaning towards maintaining flexibility for additional rate hikes. Currently, the market is predicting a one-third probability of the Fed raising rates by another 25 basis points in November's meeting. The message conveyed during this week's FOMC meeting will undoubtedly play a pivotal role in reshaping that probability.

FOMC meeting key watch: is a soft landing guaranteed?

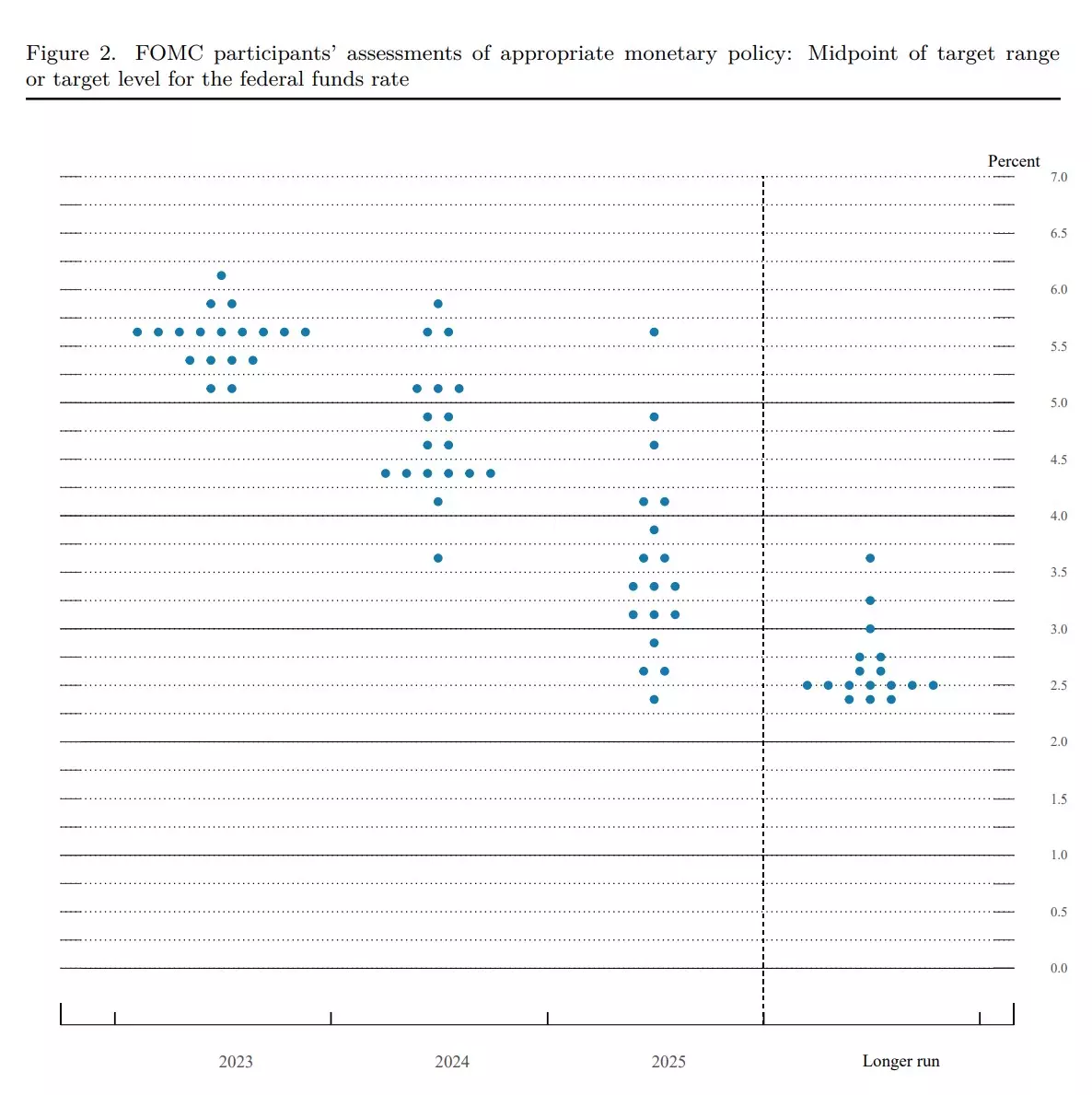

Another pivotal aspect to monitor closely during this meeting will be the Federal Reserve's forthcoming update of its economic projections, including the well-known dot plot, which outlines the expected interest rate trajectory.

In the June’s meeting, the Fed indicated a primary expectation of the interest rate peaking at 5.6% this year. Any adjustment to this projection will be interpreted as a strong signal regarding the Fed's next course of action.

Additionally, the central bank's perspective on economic growth, unemployment rates, and inflation rates over the next 12-18 months will provide further insights into the prevailing and highly debated question: Can the US navigate its way past a hard landing if interest rates are projected to stay higher for longer?

USD dollar

The USD has demonstrated a consistent upward trend over the past two months, appreciating by more than 5%. Based on the daily chart, the US dollar seems to have comfortably followed an ascending path toward the March high, recently surpassing the 104 mark. In the short term, a significant resistance level is noticeable at 105.4. Conversely, on the downside, a support confluence is formed by an ascending trendline and the 20-day moving average (MA), providing crucial support at the 104.20 level.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

See an opportunity to trade?

Go long or short on more than 13,000 markets with IG.

Trade CFDs on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.