Wall Street update: inflation and FOMC meeting influence market sentiment and rate cut forecasts

With the recent surge in inflation data and bond yields, Wall Street braces for the upcoming FOMC meeting. The technology sector, led by Nvidia, is eyed as a potential market mover amidst financial turbulence.

US equity markets ended last week on the defensive, affected by strong inflation data and increasing bond yields. The Nasdaq declined by 1.17%, the S&P 500 fell by 0.13%, and the Dow Jones dropped by 8 points (-0.02%).

Market response to inflation and interest rate speculation

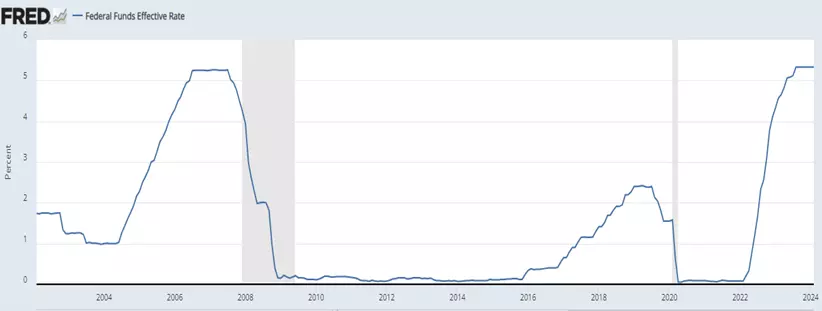

In anticipation of this week’s Federal Open Market Committee (FOMC) meeting, the recent hot Consumer Price Index (CPI) and Producer Price Index (PPI) data will be at the forefront of Fed members' considerations. Although the prevailing view is that the Fed will disregard the robust inflation data due to seasonal and New Year effects, there is a risk that the Fed's median projections will indicate only two rate cuts in 2024, a reduction from the three cuts forecasted in December.

Currently, the interest rate market is factoring in 71 basis points of cuts for 2024, the lowest since October 2023 and 100 basis points less than what was anticipated two months ago. The possibility of a rate cut at the June FOMC meeting is now uncertain.

We must allow for the possibility that last week’s firmer inflation data and rising bond yields could have a lasting impact on equity markets, with Nvidia potentially influencing the sentiment once more. Nvidia’s GPU Technology Conference (GTC), featuring CEO Jensen Huang as the keynote speaker, is notable for its history of revealing new product developments and is scheduled for this week.

What is expected from FOMC meeting

Date: Thursday, 21 March at 5am AEDT

At its previous meeting in late January, the FOMC maintained the Federal Funds rate at 5.25%-5.50% for the fourth consecutive meeting. The Fed indicated its openness to interest rate cuts but expressed a desire for more substantial evidence that inflation is consistently moving towards the 2% target.

The Fed has stated it will not consider reducing the target range until it is confident that inflation is on a steady path towards 2%.

In the upcoming meeting, the FOMC is anticipated to maintain the Federal Funds rate at 5.25%-5.50%. The accompanying statement is likely to echo the sentiments from January, noting that while rate cuts are expected in 2024, there is no immediate urgency. The number of rate cuts projected for 2024 will be a focal point of interest.

Fed funds rate chart

S&P 500 technical analysis

The "loss of momentum" candle that formed in the S&P 500 cash two weeks ago was followed by a second weekly candle last week, which indicates further indecision/loss of momentum.

While these types of weekly candles don’t necessarily guarantee a pullback, they formed at new highs and in the area of a possible Wave V high within our preferred Elliott Wave Framework. As such we are watching closely for a turn lower.

After Friday's break and close below uptrend support from the October 4103 low, we are now watching for a sustained break of a band of horizontal support coming from recent lows at 5060/40ish, which warns that a deeper pullback initially towards 4900 is underway. Until then, a retest and break of the recent 5189 high is possible.

S&P 500 daily chart

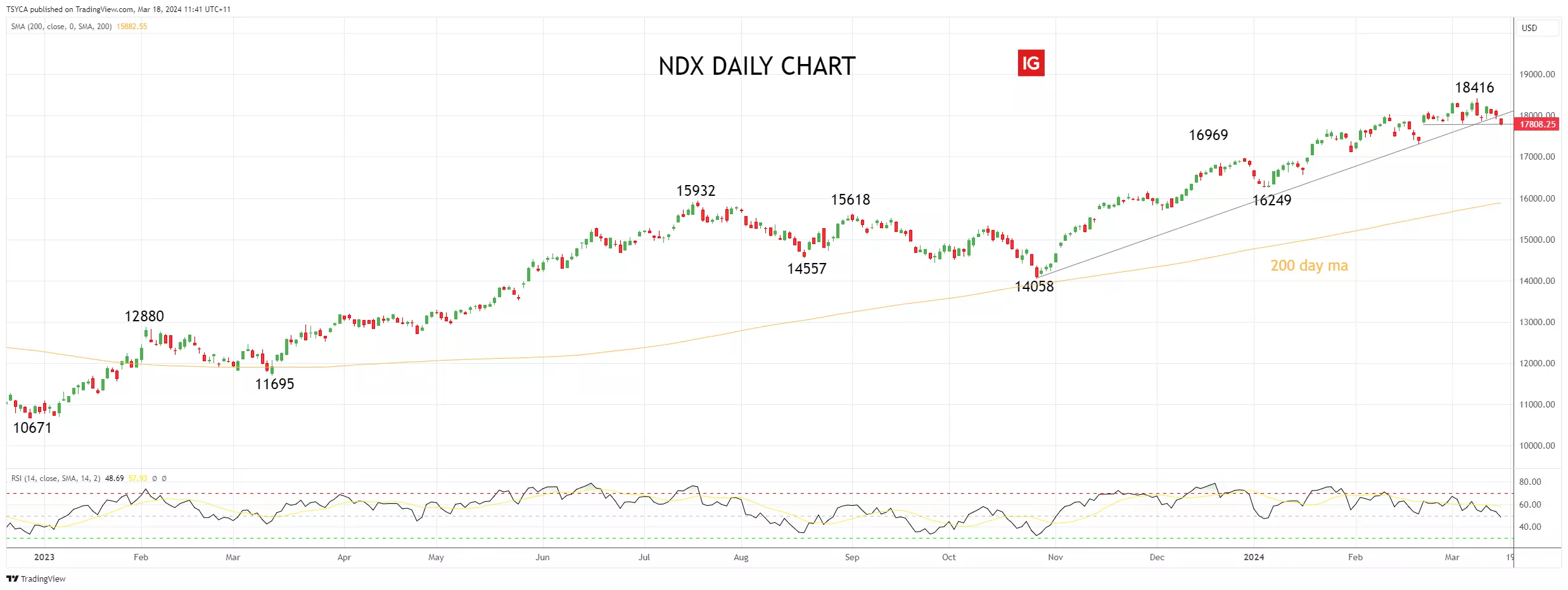

Nasdaq technical analysis

Similarly, the Nasdaq exhibited a 'loss of momentum' candle two weeks ago, with subsequent downside movements leading to a close below the uptrend support from the October low of 14,058.

Should the Nasdaq sustain a break below the uptrend support and recent lows at approximately 17,800/750, it could indicate an impending pullback towards 17,000. However, there's still potential for a retest and surpassing of the recent 18,416 high.

Nasdaq daily chart

- Source: TradingView. The figures stated are as of 18 March 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.