Pullback off the highs for Dow, Nasdaq, and DAX

Last week’s gains late in session largely undone as focus shifts to fallout from the fire sale.

Dow Technical analysis, overview, strategies, and levels

Volatility picked up a bit towards the end of last week, and where conformist buy-on-reversal strategies won out in both time frames as the Daily and Weekly 1st Support levels managed to hold, conformist buy-breakout for the former on a breach of its previous 1st Resistance level also yielding plenty as the Dow powered to a fresh close. Inteland Cisco (upgrade on office return and spending on networking) were the outperforming components by Friday's close, only a few in the red with the losses led by Boeing. As for US data, there was plenty of it, final GDP a beat and unemployment claims at lows unseen since the pandemic began, but where its merchandise-trade deficit was a record and both personal spending and income contracting.

IG client* and CoT** sentiment for Dow

As for trader bias, its back in heavy sell territory for retail traders due to the price gains, while CoT speculators have reduced their majority short bias from a heavy 67% to 62%.

Dow chart with retail and institutional sentiment

Nasdaq Technical analysis, overview, strategies, and levels

Oscillatory week for the Nasdaq, and where its price failed to successfully breach its previous Weekly 1st Resistance level, giving contrarian reversals on its stalling bull trend weekly overview the edge, and failing to offer a play late last week on the Daily as the short-term technical boxes are all neutral. Chipmakers were on top with Applied Materials Inc (24 Hours), ASML, KLA, and Lam Research outperforming, few of its components in the red on Friday by the close and where Fox, Tesla, and Comcast suffered the most. Last week's block trades news regarding the selloff of Chinese internet stocks and US media companies have been attributed to an overleveraged family office offloading, though the story is yet to be confirmed. Should that be the case, and the damage for those that are listed here (such as Chinese stocks that originally were thought to be weakened due to delisting risks) would be more limiting.

IG client* and CoT** sentiment for Nasdaq

CoT sentiment for US indices is majority short Dow and Nasdaq, majority buy Russell and S&P.

Nasdaq chart with retail and institutional sentiment

DAX Technical analysis, overview, strategies, and levels

Fresh highs for the DAX and keeping all its technical boxes in both Daily and Weekly time frames flashing green, within the levels of the latter but aiding conformist buy-on-reversal and buy breakout strategies for the former on the 1st Support holding and 1st Resistance breaking respectively. Covestro, Deutsche Wohnen, and Delivery Hero relatively outperformed amongst its components, only a few in the red by Friday's close and where the losses were minimal. Sentiment data was better than expected, GfK's consumer climate still negative but improving, and ifo surpassing estimates on business climate, current assessment, and expectations. Lockdowns, rising infections, and warnings of the intensity of the third wave are what's taking the attention, and for car companies it's been a case of more announcements in terms of halting production due to chip shortages.

IG client*sentiment for DAX

As for sentiment, retail bias is back in extreme sell territory, starting at 83%.

DAX chart with retail and institutional sentiment

*The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 8am for the outer circle. Inner circle is from the previous trading day.

** CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

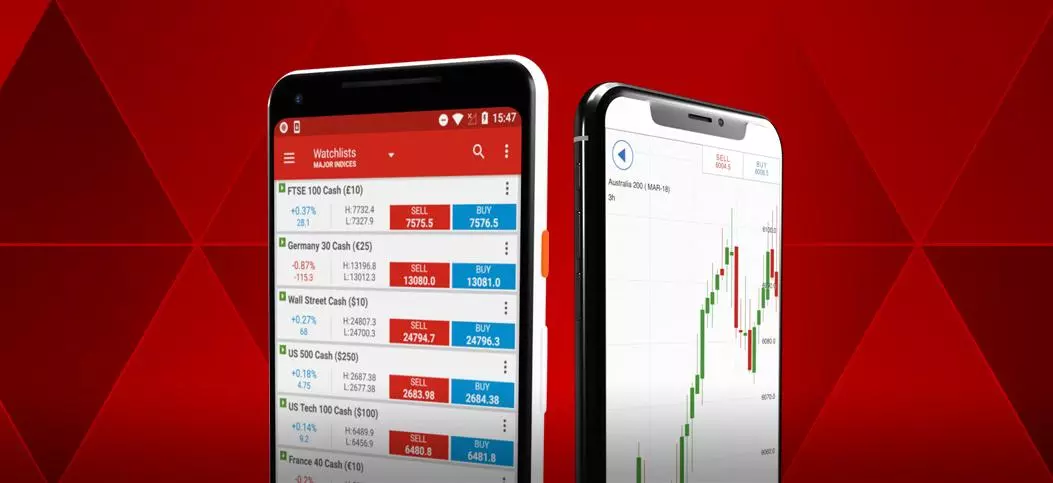

Be sure to request IG’s Weekly & Daily Market Report when you open an account with IG Dubai and get access to the full information on the FX majors, commodities, indices, and Bitcoin.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

See an opportunity to trade?

Go long or short on more than 17,000 markets with IG.

Trade CFDs on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.