Ahead of the game: 11 December 2023

Your weekly financial calendar for market insights and key economic indicators.

US stock markets showed a slight upward movement in anticipation of the upcoming release of significant data in the coming week. These key indicators, such as Non-Farm Payrolls, CPI, FOMC, and Retail Sales, have the potential to influence the market trend as the year draws to a close.

Meanwhile, in Australia, the ASX 200 experienced a notable surge after the Reserve Bank of Australia (RBA) announced a dovish decision to maintain current interest rates, coupled with underwhelming GDP figures. This has led to growing expectations of RBA rate cuts in the latter half of 2024.

- In the US, ISM Services PMI rose to 52.7 in November from 51.8 prior

- JOLT's Job Openings eased to 8.73m, the lowest level since March 2021

- In Europe, dovish comments from ECB board member Isabel Schnabel raised expectations of rate cuts in 2024

- Eurozone GDP contracted by 0.1% in Q3 of 2023, revised lower from 0.1% in a previous estimate

- The RBA kept rates on hold at 4.35% in Australia and retained a weak tightening bias

- AU GDP in Q3 slowed to 0.2%, below the 0.4% expected. Prior revisions saw the annual rate tick up to 2.1% from 2% prior

- The Bank of Canada held its official cash rate at 5% for a third consecutive meeting

- Another volatile week for crude oil, which fell over 6% below $70 before stabilising

- A wild week for gold, surging to all-time highs at $2148 before reversing lower back to $2030

- Wall Street's gauge of fear, the VIX index, is trading at 13, near four-year lows.

- AU: Westpac Consumer Confidence (Tuesday, December 12th at 10.30 am AEDT)

- AU: NAB Business Confidence (Tuesday, December 12th at 11.30 am AEDT)

- NZ: Q3 GDP (Thursday, December 14th at 8.45am AEDT)

- AU: Employment Report (Thursday, December 14th at 11.30 am AEDT)

- CH: Industrial Production (Friday, December 15th at 1.00 pm AEDT)

- CH: Retail Sales (Friday, December 15th at 1.00 pm AEDT)

- US: CPI (Wednesday, December 13th at 12.30 am AEDT)

- US: PPI (Thursday, December 14th at 12.30 am AEDT)

- US: FOMC Meeting (Thursday, December 14th at 6 am AEDT)

- US: Retail Sales (Friday, December 15th at 12.30 am AEDT)

- UK: Unemployment (Tuesday, December 12th at 6 pm AEDT)

- GE: ZEW Economic Sentiment Index (Tuesday, December 12th at 9 pm AEDT)

- UK: GDP MoM (Wednesday, December 13th at 6.00 pm AEDT)

- UK: BoE Interest Rate Decision (Thursday, December 14th at 11.00 pm AEDT)

-

AU

Employment report

Date: Thursday, 14 December at 11.30 am AEDT)

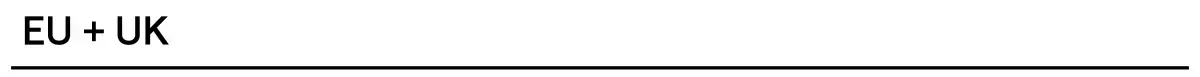

In October, the Australian economy added 55k jobs vs. the 20k expected. The unemployment rate increased to 3.7% from 3.6%, as the participation rate increased to 67% from 66.8%.

Bjorn Jarvis, ABS head of labour statistics, said: "The large increase in employment in October followed a small increase in September of around 8,000 people. Looking over the past two months, these increases equate to average employment growth of around 31,000 people a month, which is slightly lower than the average growth of 35,000 people a month since October 2022."

In November, the market is looking for a +10k rise in employment and for the unemployment rate to rise to 3.8% from 3.7%. The participation rate is expected to remain unchanged at 67%. The repercussions of the RBA's dovish hold and sub-par Q3 GDP now have RBA rate cuts priced into the Australian rates market by September 2024. Next week's labour market data has the potential to see the timing pulled forward if the jobs data is cooler than forecast or pushed back if it's hotter than expected.

AU unemployment rate chart

-

US

Consumer price index (CPI) report

Date: Wednesday, 13 December 2023, 12:30 am AEDT)

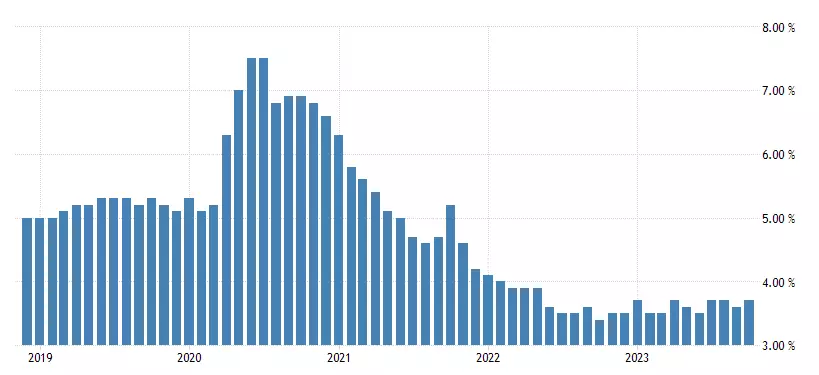

US inflation has been on a downward trend over the past year, moderating from its peak of 9.1% in June 2022 to 3.2% in October 2023. Similarly, the core aspect has also softened to its one-year low at 4.0% in October 2023.

However, with core inflation still double that of the Fed’s 2% target, the November Fed minutes showed that US policymakers still worry that inflation could be stubborn, leaving the door open for more to be done. Fed Chair Jerome Powell asserted that “if it becomes appropriate to tighten policy further, we (Fed) will not hesitate to do so”.

Further inflation progress will be closely watched to anchor down views of a rate hold in the December FOMC meeting, and more importantly, to validate the dovish market pricing for 125 basis-point worth of rate cuts in 2024. Consensus are for US headline and core CPI to increase 0.1% and 0.2% month-on-month respectively. Year-on-year, headline inflation is expected to tick lower to 3.1% from previous 3.2%, while core inflation may stay unchanged at 4.0%.

US core and headline CPI % YoY chart

FOMC statement

Date: Thursday, 14 December at 6:00 am AEDT)

As widely expected, the Fed maintained its target rate for the Fed Funds at 5.25%-5.50% at its November meeting. While the FOMC statement left the door open for rate hikes, the Fed noted that tighter financial conditions would likely weigh on activity. It said that the risks of doing Too Much vs Too Little on inflation were "more balanced" because policy is "clearly restrictive."

Since the November FOMC meeting, Fed commentary has been dovish. Economic data has mostly come in cooler than expected, leading to expectations within the interest rate market of 125 bp of Fed rate cuts in 2024.

With the Fed widely expected to keep the Federal Funds target rate unchanged at 5.25%-5.50% in December, most of the interest will be on the tone of the Fed’s statement and the summary of economic projections (SEP or Dots).

While it's hard to gauge consensus expectations around the “dots”, if the Fed’s updated forecast shows three rate cuts in 2024, it would go a good way to validating that the Fed finished its rate hiking cycle in July and that the market is on the right track, looking for rate cuts in 2024.

Fed funds rate chart

-

CN

Industrial production

Date: Friday, December 15th at 1.00 pm AEDT)

Recent purchasing managers index (PMI) and trade data continues to show that China’s recovery momentum remains uneven, with the lack of a discernible improvement in economic conditions amplifying calls for more policy support from authorities. Just this week, the Hang Seng Index has pushed to its one-year low, with its performance diverging significantly from other major global indices.

Ahead, consensus is for China’s industrial production to improve to 5.6% from previous 4.6%. November retail sales is expected to bounce to 12.5% from previous 7.6%, while fixed asset investment is expected to tick marginally higher to 3% from previous 2.9%. Some degree of base effects may be at play, while market participants will continue to seek for the conviction of a bottoming in economic conditions over the coming months.

China's retail sales, fixed asset investment, industrial production % YoY chart

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.