Dow and S&P 500 price setup: earnings vs momentum

Earnings estimates continue to be downgraded; however, the upward momentum in the DJIA and S&P 500 index has improved in recent weeks.

The upward momentum in US equities is improving just as earnings downgrades continue as the reporting season picks up steam. Will earnings undermine the turnaround in stocks?

2023 consensus EPS estimates continue to fall, now down over 10% since mid-2022 as analysts continue to downgrade their estimates for 2023 and 2024 amid recession risks. The S&P 500 is reporting a year-on-year decline in earnings of -6.5% for Q1 2023, which would make this the largest earnings decline since Q2 2020.

However, the actual earnings growth rate has exceeded the estimated earnings growth at the end of the quarter in 37 out of the past 40 quarters for the S&P 500 companies.

Moreover, actual earnings reported by the index constituents have exceeded estimated earnings by 6.4% on average over the past 10 years, according to FactSet.

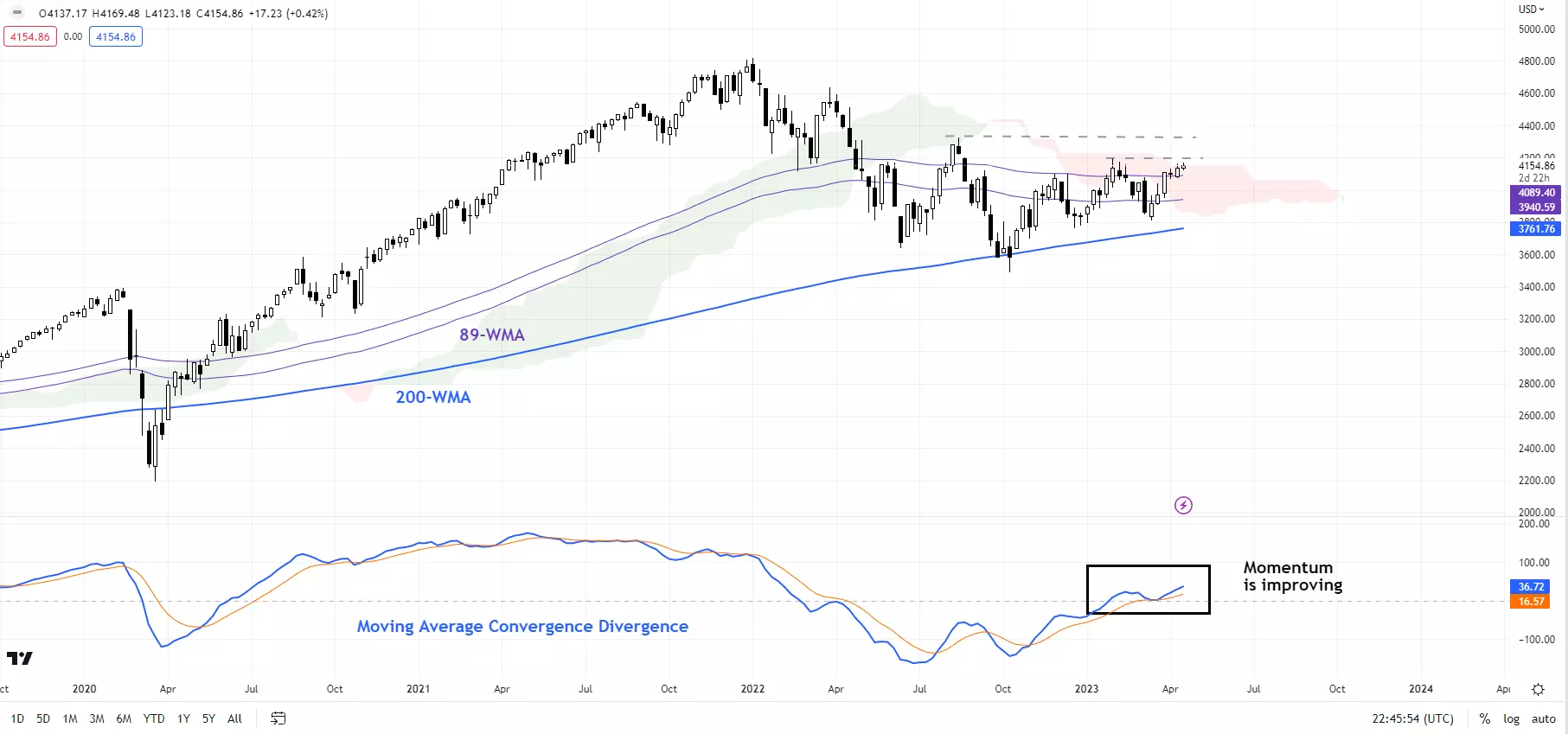

S&P 500 weekly chart

So far, first-quarter earnings reported have come in contrary to pessimistic expectations - of the companies reported so far, 90% have exceeded EPS estimates while 73% beat in sales, making this the best upside surprise in the first week of a reporting period since 2012, according to reports.

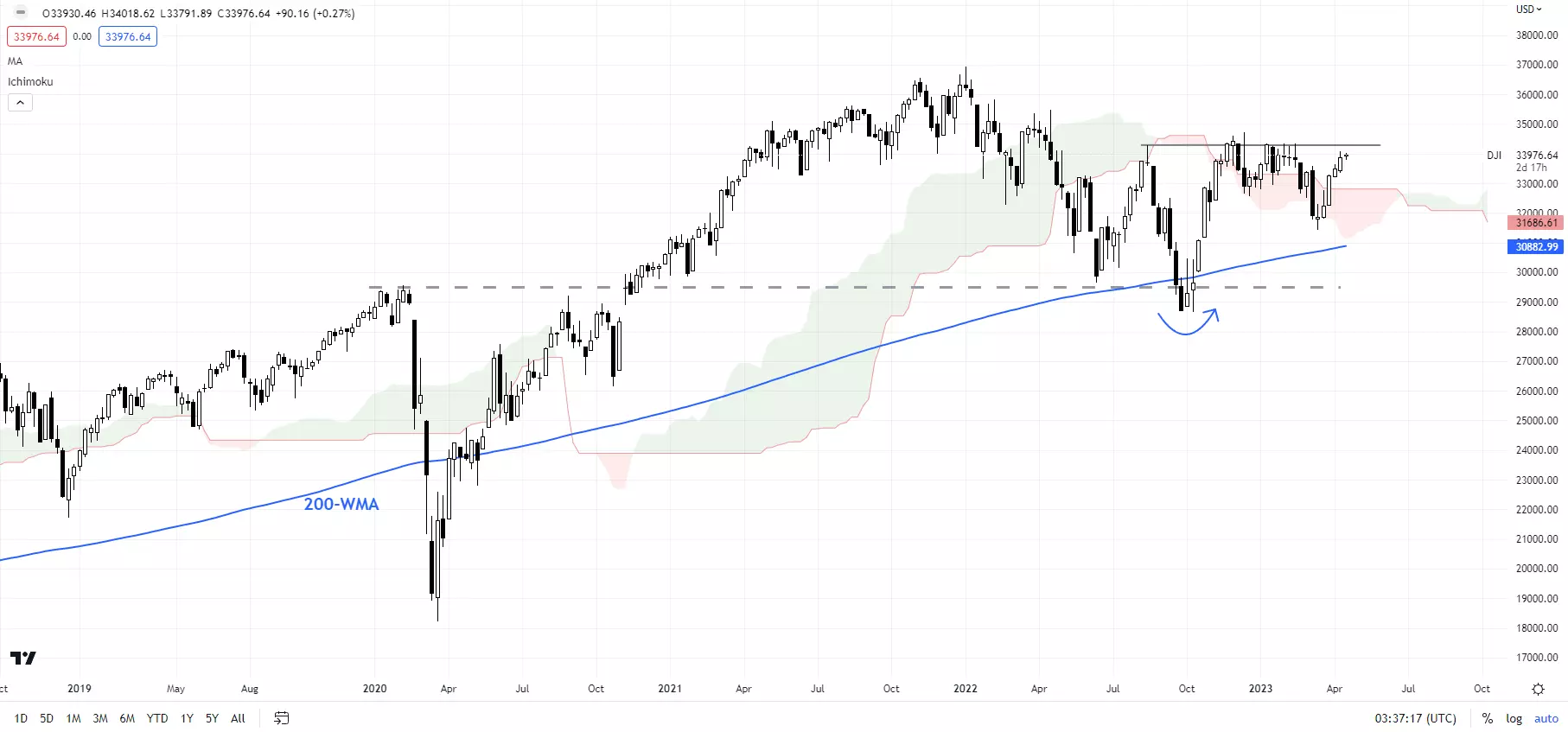

Dow Jones industrial average daily chart

This comes in as breadth and momentum indicators have improved in recent weeks as risk appetite has stabilized from the low levels hit in March on fading banking sector concerns and hopes of a mild/shallow US recession.

If the historical trend of actual earnings surpassing estimated earnings holds, there could be room for equities to cheer given investors have withdrawn from US equities in 11 out of 15 weeks this year, while cash allocations of private investors are high.

In terms of market breadth, 61% of the members of the S&P 500 index are above their respective 200-day moving averages, while 70% of the members are above their 10-day moving averages, suggesting the rebound since has been broad-based. Wider participation of members tends to raise the likelihood of a sustainable trend.

S&P 500 daily chart

Note: In the above colour-coded chart, blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, or around a support/resistance and/or in sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

S&P 500: bullish phase

From a trend perspective, the S&P 500 is in a bullish phase – see colour-coded chart based on trend/momentum indicators, first highlighted in January.

Bullish momentum in the S&P 500 index has improved in recent months – see the Moving Average Convergence Divergence indicator on the weekly charts. The index is now testing a vital hurdle at the February high of 4195.

A decisive break above could pave the way initially toward the August high of 4325.

Dow Jones industrial average: testing a crucial barrier

On technical charts, despite the downturn last year, the big-picture trend for the Dow Jones Industrial Average is bullish. That’s because the index has held major support on the 200-week moving average, coinciding with the 2020 high of 29,570. The V-shaped rebound from October is a sign that the multi-month downward pressure is fading.

However, the index remains capped at key resistance on a horizontal line from August 2022 at about 34,300. The index needs to break above the barrier for the downward pressure to reverse.

On the downside, any break below the March low of 31,430 would accentuate downside risks toward the 2022 low of 28,715.

Dow Jones industrial average weekly chart

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.