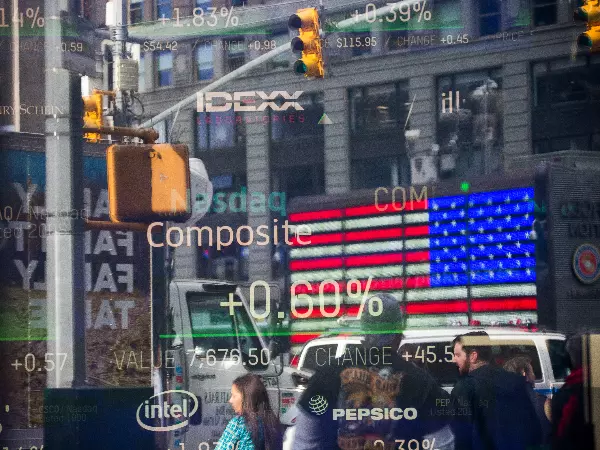

Dow Jones, Nasdaq 100, S&P 500 forecast

Dow Jones, Nasdaq 100, S&P 500 took a few steps back last week; Fedspeak and US retail sales underscored a hawkish central bank and liquidity dries up for Thanksgiving, but will volatility remain low?

Stocks fundamental forecast: neutral

Overall, Wall Street finished lower this past week as recent upside momentum since October slowed.

The Dow Jones Industrial Average, which is comprised of mostly blue-chip, large-cap companies, was left unscathed. Meanwhile, the tech-heavy Nasdaq 100 fell 1.18 percent as the broader S&P 500 weakened 0.74%.

The focus for stock markets last week was mostly on Fedspeak, a couple of notable US economic data and even the UK’s government budget proposal. In terms of the former, Fed officials have been stressing that despite a slowdown in the pace of tightening, further hikes are likely necessary. St. Louis Fed President James Bullard offered notable comments, showing he wants to see rates at a minimum of 5%.

US retail sales for October also crossed the wires, and the data surprised higher. That continued hinting at resilient consumption in face of rising interest rates. All this meant that markets added back Fed interest rate hike projections for 2023. On the chart below, we are back to traders anticipating at least 50-basis point hikes next year. This likely explains the divergence between the Dow Jones and Nasdaq 100.

2023 fed rate hike bets

Thanksgiving holiday means illiquidity, but what about volatility?

The trading week ahead is shortened due to the US Thanksgiving holiday. While markets will be closed just on Thursday, expect reduced trading activity both the day before and after the break. This does mean that low levels of liquidity will be with us, but does that mean low volatility? The US economic docket is light outside of the FOMC meeting minutes on Wednesday.

The details of the report might continue underscoring the need for tightening despite a slowing pace of rate hikes seen ahead. Of course, data will be a key driver, which is notably absent this coming week. That said, a glance at Atlanta Fed GDPNow estimates shows that in recent days, estimates have been slowly climbing since October.

The latest reading is for real GDP at 4.2% for the fourth quarter, which is a seasonally adjusted annual rate. If that is the case, it will continue to speak of the resilience of the economy despite surging interest rates. At the end of the day, that may keep expectations of a Fed pivot restrained. As such, it remains difficult to prescribe a bullish outlook for equities.

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. This information Advice given in this article is general in nature and is not intended to influence any person’s decisions about investing or financial products.

The material on this page does not contain a record of IG’s trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.