Macro Intelligence: crystal-ball gazing into the new year

In this week’s edition of IG Macro Intelligence, we take a look at the year that was, what’s to come in 2024 and “stocks for your stockings”.

The Year that was: 2023

The year 2023 was defined by peak interest rates, better than expected growth, inflationary pressures, geopolitical conflict and the acceleration and adoption of AI.

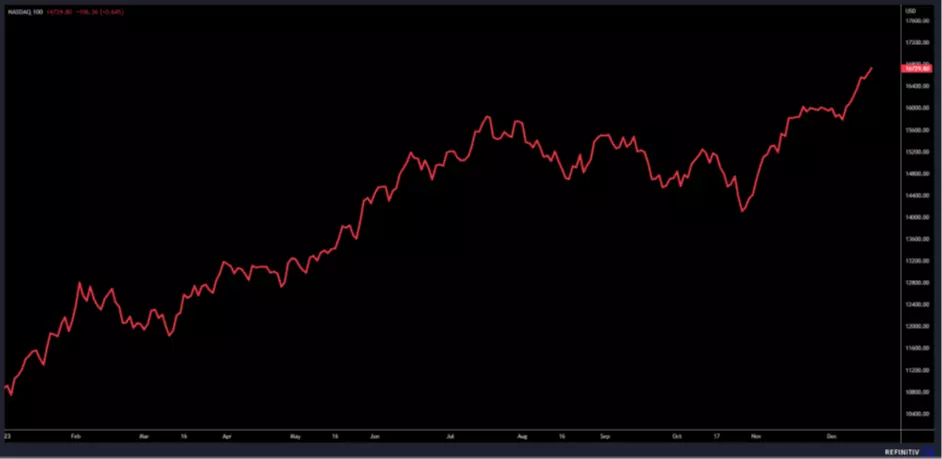

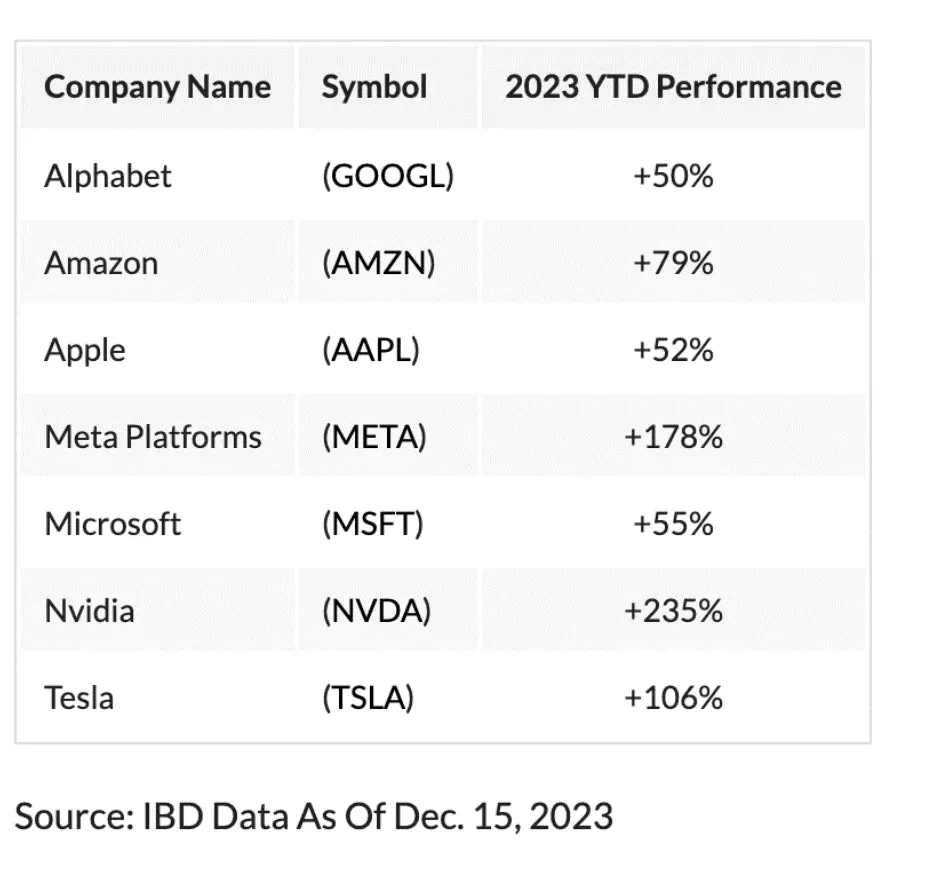

US stocks outperformed the S&P/ASX 200; with tech stocks or the so-called “Magnificent Seven” providing the biggest returns.

At the time of writing (late December), the NASDAQ 100 was up over 40% year to date.

Shares in Nvidia powered higher by more than 230% while Facebook parent Meta Platforms rose almost 180%.

The broader S&P 500 Index posted a year to date gain of around 24%. Again, much of that growth was driven by the “Magnificent Seven.”

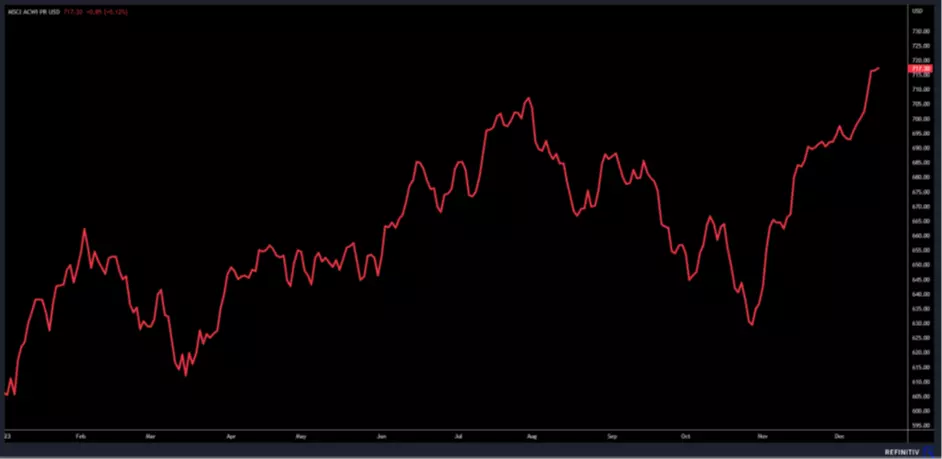

In Aussie dollar terms, an index of global shares returned around 21% in 2023, after contracting by 12.5% in 2022.

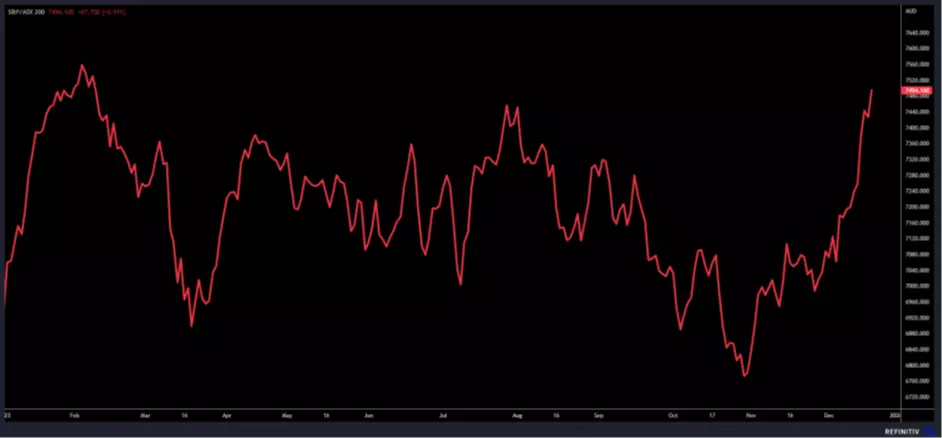

After outperforming in 2022, the Australian market traded fairly flat for most of the year, until the year end “Santa Claus” or “Fed pivot party” rally. At the time of writing, the ASX 200 was up around 6% year to date.

Worries about China, high interest rates and a weaker Australian dollar for much of the year, impacted sentiment.

Crystal-ball gazing into the new year

Most forecasters anticipate a better 2024 for the S&P/ASX 200, helped by expected falling rates. However gains could be limited due to an expected pick-up in volatility associated with the risk of an economic downturn.

AMP’s chief economist, Dr Shane Oliver, expects more attractive valuations could help the ASX 200 outperform global peers. Pending a recession, he tips the ASX 200 will end 2024 around 7,500 points. Meanwhile, Oliver says global shares will return a far more constrained 7% than the 21% gain they had in 2023. This is due to weaker growth and less attractive valuations than at the end of 2022.

UBS has a year-end 2024 forecast of 7,600 for the S&P/ASX 200. CommSec chief economist Craig James has a forecast of between 7,300-7,600 by June 2024.

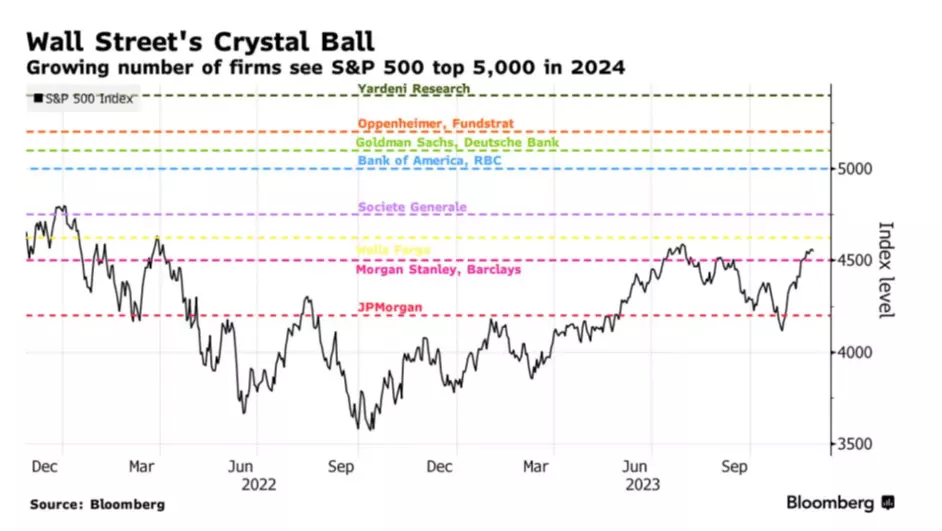

For US markets, Goldman Sachs has raised its year-end 2024 S&P 500 Index target from 4700 to 5100, representing an 8% upside.

And it seems the “Magnificent Seven” of mega-cap growth and tech stocks may have had their day (or year) in the sun. Goldman analysts anticipate growth in 2024 will come from cyclical sectors and companies with smaller market capitalization.

Bank of America and Oppenheimer Asset Management also forecast fresh records for 2024, according to Bloomberg data. On the flipside, Morgan Stanley expects the S&P 500 to end 2024 at 4,500; implying a decline from current levels.

Stocks for your stockings

ausbiz expert guests have been telling us what stocks they forecast will outperform in 2024.

Jessica Amir from Moomoo says after underperforming in 2023, watch for outperformance from small caps. She says “animal spirits will bring them back to life in 2024” while she also expects IPO and M&A activity to pick up.

Her stock pick for 2024 is American tech firm Block (SQ2). Jess points out Block’s rollout across merchants through the square terminal is increasing around the globe. She also says it’s a company with a strong cash position, no debts maturning until 2025, and generates around 40% of its income from Bitcoin which is tipped to rise in 2024.

Martin Crabb from Shaw and Partners is bullish on the continued travel recovery. His stock pick for 2024 is one he claims “we love to hate” - Qantas (QAN). The chief investment officer reckons the airline is turning around under its new CEO and management, and is managing yield well with full planes while moving towards returning to full capacity after the pandemic. Crabb points out the travel

‘bug’ is back; and Qantas has a dominant share in both the domestic and international markets.

“Buy now, pay later” firm Zip (ZIP) has almost doubled from where it was trading a few months ago. Henry Jennings from Marcus Today says it’s a controversial and perhaps risky bet, but is tipping BNPL will take off in 2024. He also thinks Zip has a control of its bad debts, with a total transaction value of around 1.3%.

Shawn Hickman from Market Matters thinks the Magnificent Seven will underperform next year and is instead bullish on the China recovery story. He thinks investors should stay away from tech, and instead focus on companies exposed to the China infrastructure theme. His favourite commodity pick is copper and thinks Sandfire Resources (SFR) looks good for 2024.

The weight-loss narrative has hit some healthcare companies hard in 2023, and many analysts predict the investment theme will gather momentum in coming years. However Ben Clark from TMS Capital thinks the market has been “way

over-reactive” to the threat from weight-loss drugs and is tipping Resmed to make a recovery in 2024. Short-sellers targeted the stock mid-year, but Ben says there are 910 million people in the world with undiagnosed sleep apnoea who could benefit from RMD’s CPAP machines. Ben says Resmed has strong earnings growth and is in the “box-seat” to perform well next year.

These are just some stock tips from ausbiz experts and of course as always, this information is not intended as, and does not constitute financial advice.

Happy holidays from the ausbiz team, and we hope you have a profitable and happy 2024.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Explore the markets with our free course

Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this index strategy article, and try it out risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Get fixed spreads from 1 point on FTSE 100 and Germany 40

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider – 26 in total

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.