Singapore banks Q4 2023 earnings – Goldilocks conditions to remain

The three local banks are set to report their Q4 2023 earnings over the coming weeks.

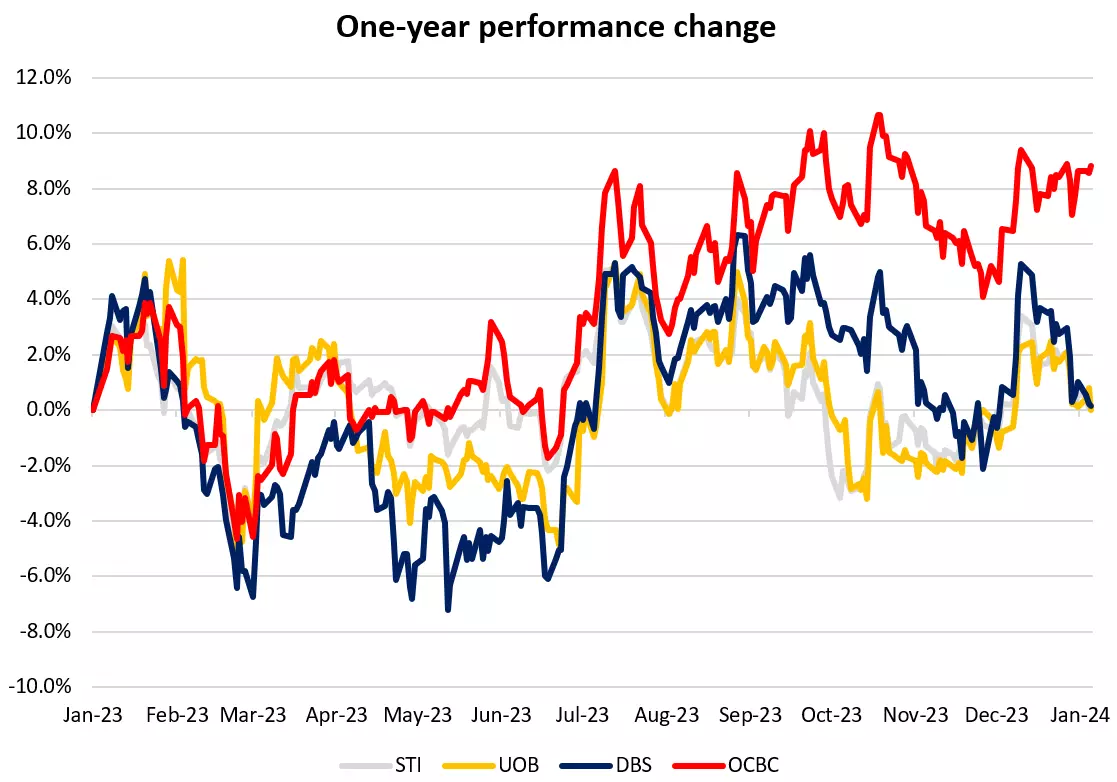

The three local banks are set to report their Q4 2023 earnings over the coming weeks. Based on their one-year return, OCBC has been the outrunner, with its +8.8% gain towering above the other two banks. Returns for DBS (+0.2%) and UOB (+0%) have been largely in line with the broader Straits Times Index (STI), which only manages to eke out a 0.1% return over the past year.

Peak interest rate cycle to see net interest margin resume its gradual tapering

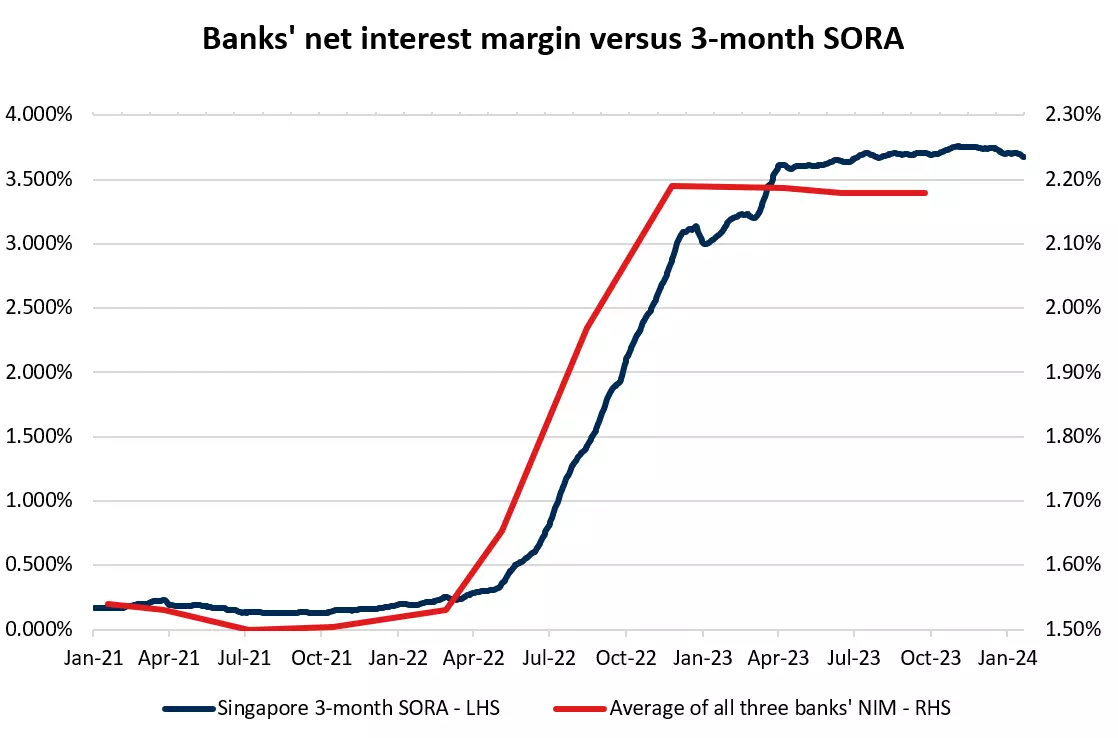

With further confirmation that the US Federal Reserve (Fed) is at the peak of its hiking cycle, the Singapore Overnight Rate Average (SORA) and other benchmark lending rates have seen a slight drift lower in 4Q 2023. But at least, the pace of moderation remains gradual, which may translate to a more measured tapering of the banks’ net interest margin ahead.

Back in 3Q 2023, DBS continued to see an expansion in net interest margin (up 3 basis points (bp) from 2Q), but the same cannot be said for OCBC and UOB, seemingly presenting a divergence that is down to individual bank’s ability to balance loan repricing and funding costs.

With that, Refinitiv estimates are looking for contraction in net interest income from UOB and OCBC this time round. While year-on-year growth in net interest income for the banks has already been slowing for three straight quarters due to a higher base effect from last year, this may mark the first time where we see a contraction.

Any guidance on outlook will also be on watch. DBS CEO Piyush Gupta previously guided that higher-for-longer interest rates will be a net benefit to earnings in the coming year, but with rate expectations currently pricing for six rate cuts from the Fed through 2024, focus will be on whether his view still hold.

Slight rebound in lending activities on renewed confidence

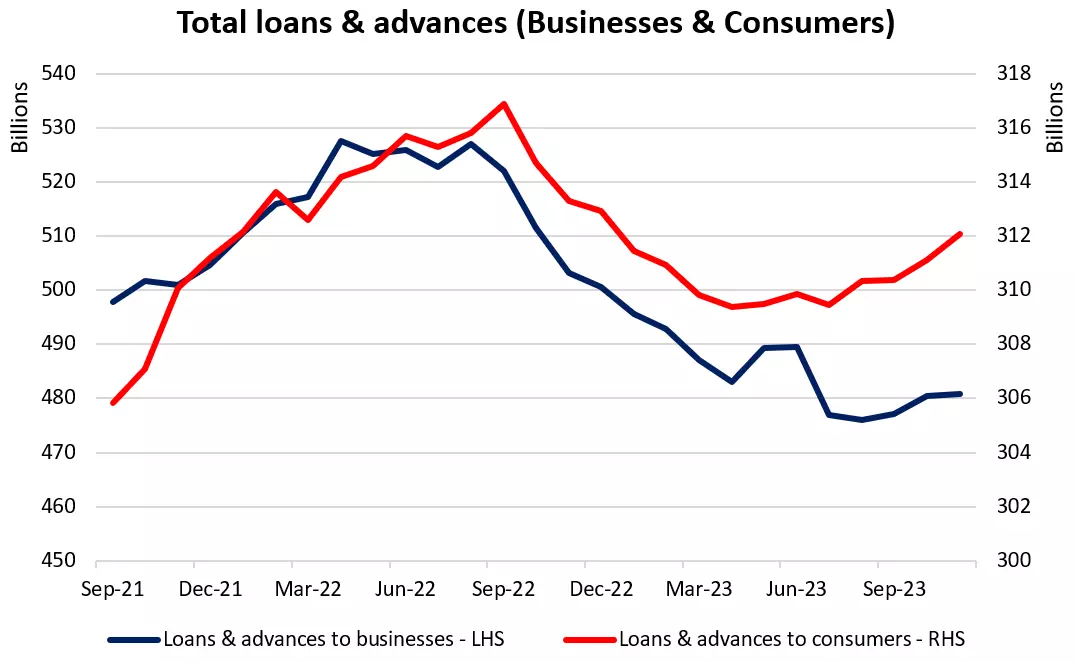

Loan volume in Singapore for October and November 2023 reflected a slight rebound in lending activities from the third quarter, overall suggesting that the slump in lending since September 2022 is stabilising. Greater conviction of a peak in the global interest rate cycle and resilient economic conditions pushing back against recession concerns could renew some confidence in 4Q 2023, and with loan demand contracting year-on-year for two previous quarters, whether it can stabilise in 4Q 2023 will be in focus.

Improvement in non-interest income may be set to continue

The banks have witnessed a broad-based recovery in its net fees and commission income in 3Q 2023, which may be set to continue into the fourth quarter. For the quarter, market conditions have improved significantly amid a risk-on environment, which could aid to support an increase in wealth management activities.

Air traffic statistics also point to robust travel momentum in the fourth quarter, with Singapore’s airport passenger movements surpassing 90% of the level recorded in 2019. That may help to support fee income from credit card as well.

Guidance from the banks’ management in 3Q 2023 has been optimistic, with UOB CEO saying that consumer sentiment remain strong and see rising investment flows in the Southeast Asia region. DBS CEO also guided for his bank's 2024 net interest income to be around this year's level, and fee income momentum to be sustained by wealth management and cards.

That said, we may expect the banks to still exercise some prudence in its loan loss provisions, given that we are still in uncharted waters around geopolitical tensions, while economic environment still faces some degree of uncertainty. A more measured build-up in provisions is likely for the fourth quarter, with OCBC and UOB already lowering their provision amount quarter-on-quarter back in 3Q 2023.

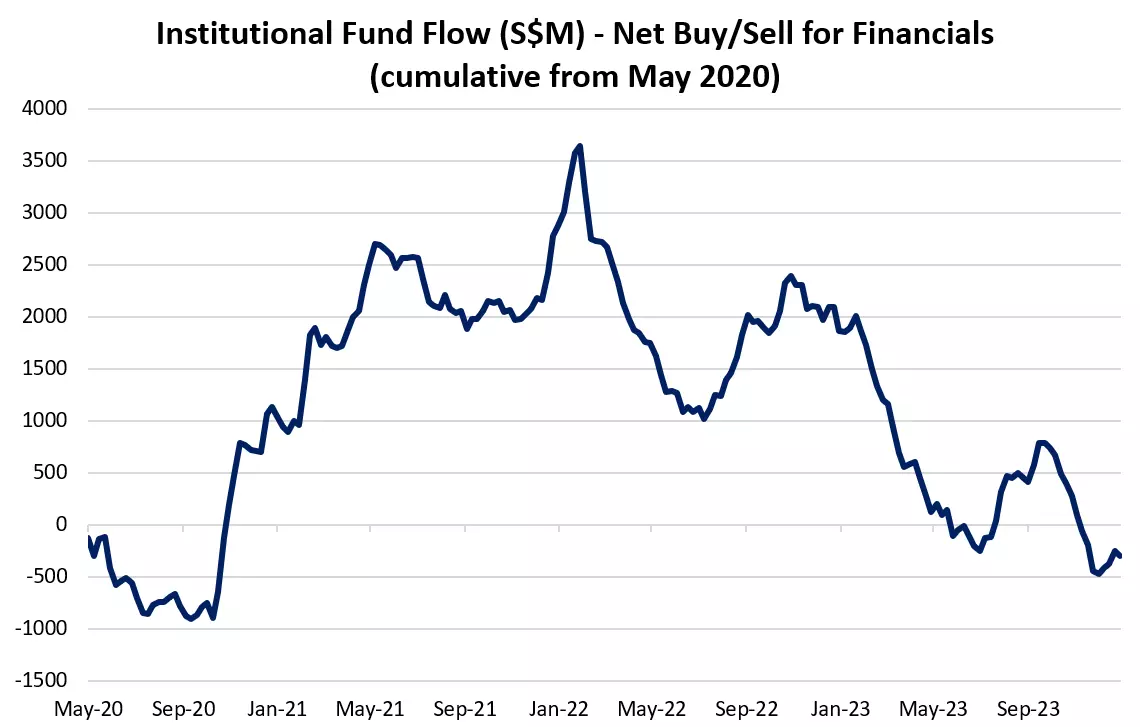

Fund flow data revealed ongoing net outflows over past months

The Singapore Exchange (SGX) fund flow data has revealed a trend of net institutional outflows for the financial sector in 4Q 2023, unwinding all of its net inflows of close to S$800 million in the third quarter. For the full-year 2023, the three local banks led the net institutional outflows within the STI with S$2.6 billion of net institutional selling. This is followed by the REITs sector, which saw close to S$1 billion of net institutional outflows.

DBS share price: Technical analysis

DBS seems to be trading on some broader indecision, with the formation of higher lows and lower highs keeping its share price in a symmetrical triangle pattern. Any break of the upper trendline resistance may be on watch to provide conviction of buyers in greater control. On the downside, the $31.20 level may serve as immediate support to hold, where the bottom trendline stands.

OCBC share price: Technical analysis

OCBC has been holding up so far, with a series of higher lows formed since July 2022. Near-term upward bias remains intact, with its relative strength index (RSI) on the daily chart defending the key 50 level since December last year. Ahead, a break above the $13.00 level may see prices move to retest the $13.23 level – a key horizontal resistance in 2023. On the downside, the $12.64 level will serve as trendline support to hold.

UOB share price: Technical analysis

UOB has been trading somewhat in a range, but with past two days seeing some renewed traction. Ahead, the $29.20 level may be a key level to watch, where a downward trendline resistance stands. On the downside, support may be found at the $27.70 level, where a retest of its Ichimoku cloud zone on the daily chart saw prices hold up.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.