Year-end rally: US markets surge as fast money drives recovery

Swift recovery of US equity markets led by fast money; Nasdaq up 44%, uncertainties for slower funds, all eyes on Fed, economic events, earnings.

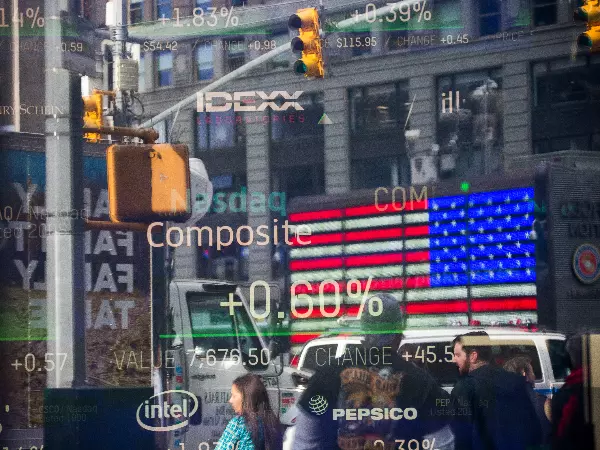

With six weeks remaining in 2023 and despite a mid-year stumble, US equity markets are poised to end the year positively. The Nasdaq has surged 44% year-to-date (CYTD), the S&P 500 is up 17.57% (CYTD), and the Dow Jones has gained 1800 points CYTD, equivalent to 5.43%.

We also suspect the recent weeks' rally is believed to be driven significantly by short covering from agile fast money accounts, responsive to recent economic indicators like the soft non-farm payrolls or CPI print.

Fast money dynamics: short covering fuels recent rally

We also suspect the rally has likely left a lot of large, slower-moving funds on the sidelines. Funds that may have adopted a defensive position in stocks earlier this year, due to the uncertain macro backdrop or alternatively shifted out of equities into fixed income for the higher yields on offer.

Certainly, there have been enough weight of evidence to suggest they should be looking to reinvest in stocks; however, some may still be holding fire, waiting for the Fed to remove its tightening bias at the mid December FOMC meeting.

This week, the key economic events in the US are Wednesday's FOMC meeting minutes and Saturday morning's S&P Global Flash PMI. Earnings season wraps up this week, with reports set to drop from Nvidia, Zoom and John Deere.

What is expected from Wednesday's FOMC meeting minutes?

As widely expected, the Fed maintained its target rate for the Fed Funds at 5.25%-5.50% at its November meeting.

While the FOMC statement was mostly unchanged, and the Fed left the door open for rate hikes, the Fed noted that tighter financial conditions were likely to weigh on activity. It also noted that the risks of doing too much vs too little on inflation were “more balanced.”

The minutes will likely reiterate the Fed's more cautious tone, and if needed, it will raise rates further. Following the softer run of data, the market will likely look through the comment that warns of further rate rises.

Fed funds rate chart

S&P 500 technical analysis

While the decline from the July 4634.509 high to the 4122.25 low overshot our 4200-pullback target, its corrective characteristics were clear to see, and we moved back to positive bias following its prompt rebound back above the 200-day moving average in early November.

The rally has since stalled ahead of the September 4566 high, which isn’t surprising given how quickly the rally from the 4122 low unfolded. After further consolidation, we expect a break of the 4566 high before a test and a break of the July 4634.50 high. Above here, there is blue sky to the November 2021 4740.50 high, followed by the January 2022 4808 high.

On the downside, we expect dips to be well supported towards 4430/00 and again at 4350.

S&P 500 daily chart

Nasdaq technical analysis

The Nasdaq has followed the road map to perfection in recent months, bottoming as expected in the 14,200/14,000 support zone before a stunning rebound.

After the current period of consolidation is complete, we expect to see a test and break of the July 16,062 high before a push towards 16,400/500, just ahead of the all-time high from late 2021.

On the downside, we expect dips to be well supported towards 15,450 and again at 15,000.

Nasdaq daily chart

- Source Tradingview. The figures stated are as of 20 November 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.