How to trade and invest during a recession

Recessions have been a concern over the last few years, as a result of Brexit, Covid-19 and the post-pandemic recovery. Here, we’ve broken down recessions, looking at what they are and the stocks to watch during a recession.

What is a recession?

A recession is a period of reduced economic and industrial activity in which an economy’s gross domestic product (GDP) contracts for two consecutive quarters. Recessions will often cause markets to become more volatile, representing opportunities for traders and investors who are aware of the risks.

How does a recession impact stock markets?

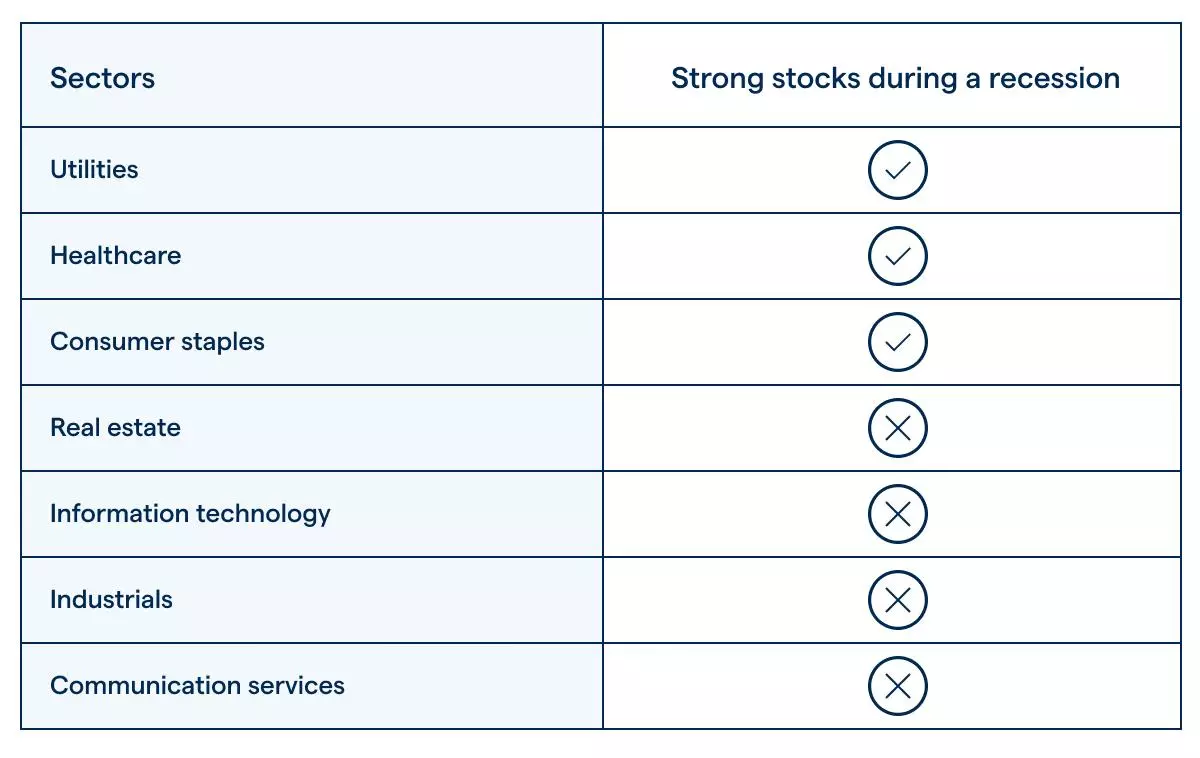

Recessions will impact different stocks differently, depending on the type of company you’re looking to trade. Some companies will remain stable during a recession, like those of utility companies, healthcare companies and consumer staples companies. Others tend to underperform and their value will drop, including travel companies, and industrials.

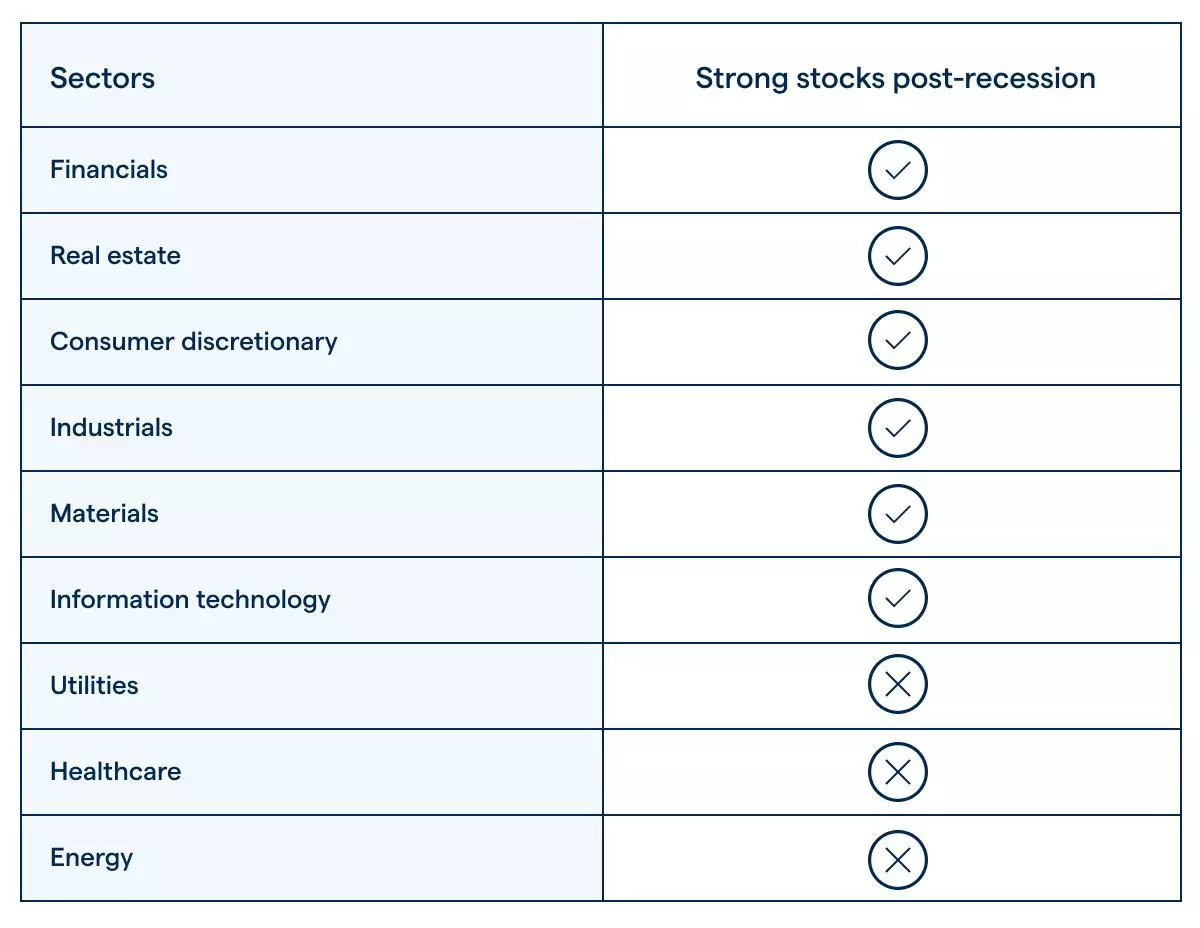

Other sectors, usually those which will underperform during a recession, will perform well in a post-recession recovery. Examples include financials, real estate, consumer discretionary, industrials and materials.

You can trade the increased market volatility that recessions cause by creating a trading account and taking a position with CFDs. These are financial derivatives, which enable you to speculate on markets rising by going long, as well as falling by going short.

Stocks to watch during a recession

The stocks to watch during a recession will depend on your appetite for risk. For traders that are willing to go short as well as long, there are considerable opportunities.

We’ve put together this table to show the stocks to watch during a recession, with reasons why in the following sections.

| Stock type | Short or long |

| Cyclical stocks | Possible short |

| Defensive stocks | Possible long |

| Speculative stocks | Possible long or short |

| Cash-rich stocks | Possible long |

Cyclical stocks

Cyclical stocks tend to be hit badly during recessions. These companies and sectors tend to be sensitive to the contemporary economic climate – meaning they tend to increase when markets are on the rise, and decrease when markets are on the fall. So, during recessions when markets are falling, cyclical stocks could present good opportunities to go short.

Defensive stocks

Defensive stocks are often used in a portfolio to hedge against risk and market declines. That’s because they’re generally seen as stocks that will weather an economic downturn. Sectors to look for include utilities and energy, which are always in high demand given their use in society. So, during recessions, defensive stocks could present a good opportunity to go long.

Speculative stocks

Speculative stocks can be seen as either opportunities to go long or short. That’s because, depending on the current economic situation and a particular company’s performance, speculative stocks could rise or fall in value. Many traders consider penny stocks to be more speculative, than other stock trading opportunities.

Cash-rich stocks

Cash-rich stocks, that is companies that have a lot of cash in reserve, can be an uncertain bet. On one hand, strong cash reserves usually indicate high revenues – particularly if the company’s cash reserves are experiencing positive gains year-on-year (YoY). But, stagnant cash reserves might indicate that a company’s management team are unable to think of ways to spend it – which could hinder growth and have long-term negative consequences for the company’s performance.

During a recession however, companies with higher cash reserves will likely be able to weather a short-term economic downturn by relying on the reserves of cash that they have held back. This can be used for a range of purposes, but most likely it’ll be to keep the company moving during times of reduced consumer demand. So, cash-rich stocks might be potential opportunities to go long during a recession.

Regardless of the type of stock that you’re looking to trade during a recession, you should look out for the following stock risk factors which can be amplified when trading or investing during a recession:

- High company price to book (P/B) and price to earnings (P/E) ratios

- High levels of company debt relative to equity

- Weak company balance sheets

- Low market liquidity

How to trade and invest in a recession

- Go short to seize opportunity in falling markets

- Go long as the market recovers

- How to hedge your risk in a recession

Go short to seize opportunity in falling markets

Shorting is a way to seize opportunity in markets that are falling. Many traders will use financial derivatives like CFDs to go short. These enable you to take a speculative position on an asset’s price movements without having to take direct ownership of the asset.

Create a trading account to get started with CFDs

So, let’s say for the purpose of this example that we’re in a recession. You’ve identified some companies that might not be able to weather the storm, and you think their share price will suffer. As a result, you decide to open a short position on that company’s shares – which will make a profit if the share price drops.

Go long as the market recovers

Going long during a recession can be risky, especially if you time it too soon and the market falls even more. What many traders and investors will do is wait for the initial rebound, when many stocks will be at their lowest point for several years. Then they’ll buy at this level, in the hopes of reaping the maximum reward from the eventual post-recession recovery.

You can go long with CFDs, just as you can use them to go short. Or, you can profit from a post-recession recovery by investing directly in a company’s shares. This’ll make you a shareholder, eligible to receive voting rights and dividends if the company pays them.

Create a trading account to go long with CFDs.

How to hedge your risk in a recession

Traders might consider using a hedging strategy to manage risk in a recessionary environment.

A hedging strategy includes the use of more than one asset in its formation. For example, an investor who has an underlying portfolio of blue chip stocks listed on the London Stock Exchange Group PLC might consider trading the FTSE 100 index to hedge or protect their portfolio.

If the investment portfolio had a total value of £100,000 then the investor could take a short position of equal size on the FTSE 100 index.

Learn more about risk management

If the broader market fell, the loss in value of these blue chip stocks should be at least partially offset by the gains from the short position on the index. The use of an index to protect or hedge a portfolio will often be a more cost-effective solution to the alternative cost of liquidating the entire equity position.

Sector indices can also be used to hedge sector-specific stocks. For example, a banking index could be traded against a portfolio of banking stocks, and a resource index could be used to hedge against a portfolio of mining stocks.

Create a trading account to get started or learn more about financial instruments that people use to hedge.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

Please see important Research Disclaimer.

Explore the markets with our free course

Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course.