What is a stop-entry order and how do you place one?

Stop-entry orders are a way to enter the market at a predetermined price. Explore important information that you need to know about stop-entry orders in trading.

What is a stop-entry order?

A stop-entry order, sometimes called a stop order, is an instruction to your trading broker to open a trade when the market level reaches a worse, predetermined price. If you’re buying, ‘worse’ means a higher price but if you’re selling, it means a lower price.

You can place a good-till-cancelled or good-till-date order – but selecting a price that’s worse than the current price will always be a stop-entry order. If the price you select is better than the market price, it’s a limit-entry order.

The bid price is the best price to sell at, and the ask price is the best price to buy at.

What’s the difference between a stop-entry order and a stop-loss?

While a stop-entry order is a type of working order to enter a position, a stop loss is a risk management tool that you can attach to a trade to set a predetermined level to close your position if the market is against you.

For example, for a long position on DBS Group Holdings shares, you can set a stop-loss at a lower price that will automatically close out your position if the share price drops to this level or beyond. You can place a stop-loss on a contract for difference (CFD) stop-entry order, but it won’t come into effect until the price is reached and the trade is filled.

What’s the difference between a stop-entry order and a market order?

The main difference between a stop-entry order and a market order is the entry price level that you accept to open your position at.

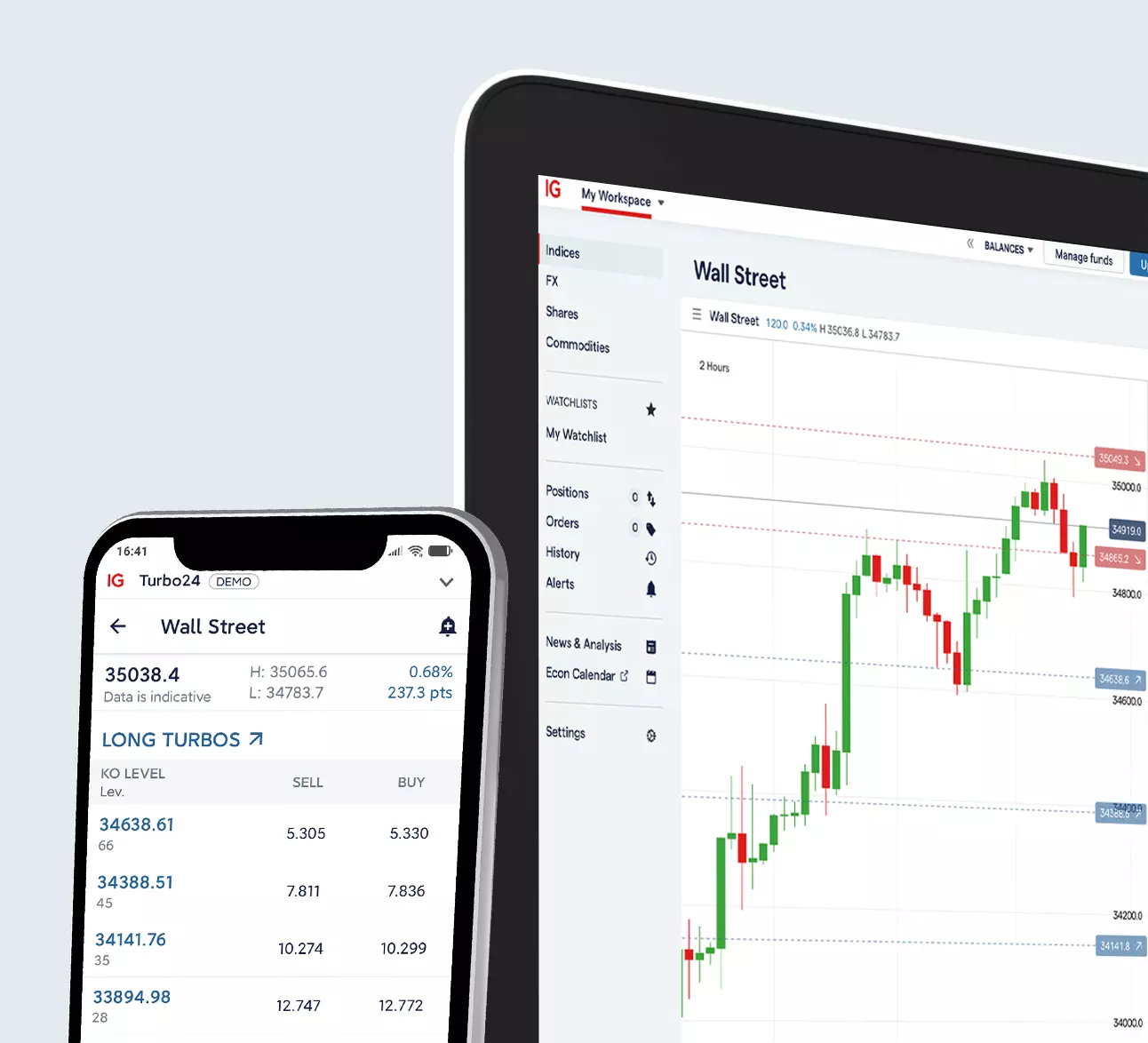

A stop-entry order is a type of working order – that’s set via the ‘Order’ tab of the deal ticket on our platform – to enter a position once a specific, less favourable price level has been reached.

A market order is an instruction to open a trade immediately, irrespective of the price (whether it’s at the same level you placed your order at, a more favourable price or a less favourable price). So, the trade will be opened at the best available market price, which could be worse than the price you see on the deal ticket. This means that your position could be subject to slippage. A market order can be placed using the 'Deal' tab of the deal ticket on our platform. In summary, a stop-entry order is fill-later; a market order, on the other hand, is fill-now.

With stop and limit orders, your trade could be filled partially if your preferred price level is reached – this is based on liquidity, i.e. whether there are enough willing buyers or sellers to counter your position.1 You have to ‘accept partials’ in your settings. With market orders, your trade will be opened at the full position size you set – liquidity and the size of the order will be taken into consideration.1

How does a stop-entry order work?

Once set, stop orders are designed to work automatically1. This can be useful, especially in volatile markets when prices change suddenly and you don’t have time to manually open a trade during a short window of opportunity.

Remember, if you’re buying, your stop-entry order level will be above the current price. If you’re selling, your stop-entry order will be below the current price.

How to place a stop-entry order

- Open a trading account to get started, or practise on a free demo account

- Conduct technical and fundamental analysis on the market you want to trade

- Select the 'Order' tab on the deal ticket of the market you're trading on

- Decide whether you’re going long or short

- Put in your position size

- Pick your price level – the ‘worse’ price at which you want your stop entry to be triggered – and place your order (based on the opening price that you choose, our platform will show you whether it’s a stop or limit order on the ‘Place order’ button)

- Choose between a ‘Good till cancelled’ stop entry, which will run until the predetermined price level is met (unless you cancel it), and a ‘Good till date’ order, which will close out automatically on a predetermined future day if the order isn’t executed

- Click on the ‘Place stop order’ button

- Your position will normally open automatically when the market hits your price level1

Example of a stop-entry order

Let’s say you want to go long on Tesla shares and place a stop-entry order. You’ve conducted your own analysis and believe that Tesla shares will likely rise after reaching a certain price level. Your prediction is that this will happen when the Tesla share price, which is currently at 247.50, goes up to 249.00.

So, you decide to open a CFD trade and set up a stop-entry order to buy (go long on) 10 Tesla shares when the price hits 249.00.

If the Tesla price reaches 249.00, you’ll have an open position as your stop-entry order will be executed. You decide to manage your risk based on the amount of loss you’d be prepared to weather, so you also place a stop-loss order at 245.00. If the Tesla share price drops by this much, your stop-loss order will close out your trade, preventing further losses.

If your stop-loss were to kick in at 239.00 due to the market gapping, for example, you’d incur a loss of $100.00 (10 x [249.00 – 239.00]). However, if the Tesla share price rallies to 259.00, you’d make you a profit of $100.00 (10 x [249.00 – 259.00]).2

Benefits and risks of stop-entry orders

Benefits of using stop-entry orders

- Stop-entry orders are designed to work automatically –1 this can be useful as you don’t have to open positions manually at your preferred price, especially in volatile markets when prices change rapidly

- A stop-entry order could act as a stop loss if you set a working order to ‘net off’.3 While this is possible on a CFD trading account with us, it’s generally not an efficient way to go about it, as you could place a stop loss to a position instead of opening a separate position, unless the aim is to partially close an existing position

Risks of using stop-entry orders

- There’s the chance that a position may never be opened, which could affect your trading strategy, because a stop-entry order is ‘your price or worse’

- Stop-entry orders don’t protect against losses (like stop-loss orders) when the market moves against your position – unless you select ‘net off’ to close a trade fully or partially based on another position that you have open on the same underlying asset,3 but with the opposite market assumption

- Stop-entry orders don't guarantee a fill at your chosen price. When using a non-guaranteed stop to close a position, it might be triggered at a less desirable price if the market suddenly moves beyond your set price (slippage)

Try these next

Discover key factors to consider when choosing a trading broker

Explore the differences between trading and investing.

Explore how amplified exposure works, including the pros and cons

1 With limit and stop-entry orders, the entire order may not get filled (depending on market liquidity). Whichever order type you use (including market orders), positions may not open automatically, depending on size and liquidity. In the case of limit and stop-entry orders, positions may also not open automatically due to partials.

2 The commission fee and other applicable costs apply.

3 When you have ‘net off’ selected on the deal ticket, it means that we’ll close existing opposing positions in the same market before opening a new trade, which will decrease your exposure to that market. If you have ‘force open’ selected on your deal ticket, can hold positions on the same market in opposing directions, which enables you to hedge your existing exposure.