What is a special purpose acquisition company (SPAC)?

Special purpose acquisition companies (SPACs) are gaining in popularity as a way for businesses to go public. Here, we’ll take you through what a SPAC is, how they’re different to IPOs, and how to trade a SPAC.

.jpg/jcr:content/renditions/original-size.webp)

What is a SPAC?

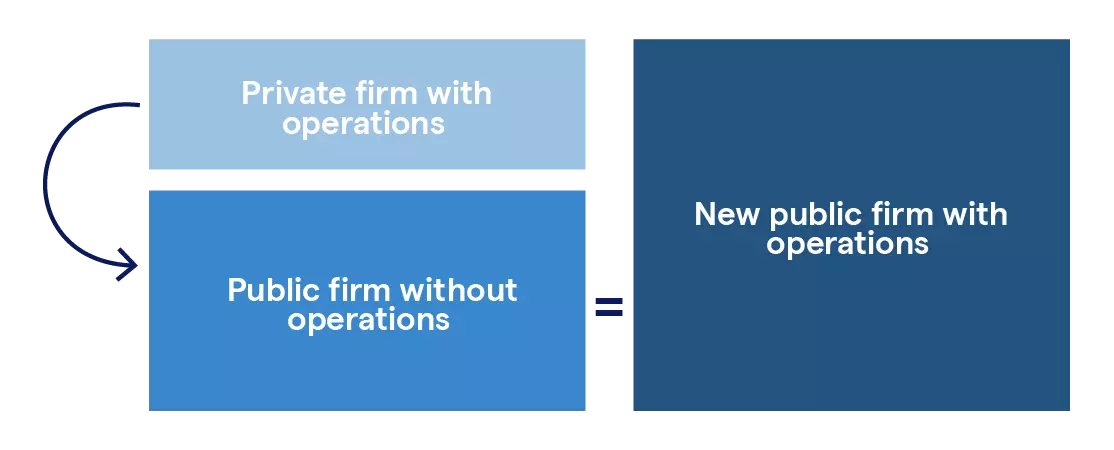

A special purpose acquisition company (SPAC) is a company that’s been set up with the sole purpose of raising money through an IPO, and then using this money to acquire and merge with a private company. A SPAC will have initial ‘sponsors’ in the form of venture capitalists, hedge funds and other corporate entities.

In many respects, SPACs are shell companies because they usually don’t have any operations of their own. Their only operation, so to speak, is to find a private company with strong growth prospects and to take that company public through what is sometimes referred to as a reverse takeover.

SPACs, IPOs and Dutch auctions: what are the ways to go public?

SPACS, IPOs and Dutch auctions are all ways for a company to go public. An IPO is the more conventional way, but SPACs have become increasingly popular in recent years. Dutch auctions are perhaps the least known of the three, but they’re still important to cover.

SPACs

A SPAC is a company that’s created with the sole purpose of carrying out an IPO, and using the funds that the IPO raises to acquire and merge with a private company. This’ll make the private company public, and it’ll give the SPAC’s initial sponsors large shareholdings in that private company, meaning they could stand to reap a considerable profit.

In that sense, a SPAC can be referred to as a shell company, and the acquisition process is sometimes called a reverse takeover. With a SPAC, the IPO is already completed – all that’s happening is a public company is negotiating with a private company, and then the two companies are merged.

IPOs

An IPO is an initial public offering, and it’s the more traditional way for a company to go public. IPOs involve a company listing on a stock exchange, and offering its shares directly to the public. But, the traditional IPO process can be lengthy and carry a degree of risk.

For example, depending on the company and its outlook, investors can choose to buy the shares – which might drive the price up. But, short sellers can also choose to speculate on the share price falling if the outlook for the company is bad, which could affect its profitability. Plus, there’s no knowing exactly what the company’s valuation will be until the IPO has been completed.

Dutch auctions

A Dutch auction is a way for potential investors to place bids on what they are willing to pay for a company’s shares and the number of shares they wish to buy, before the company is public. For example, one investor might submit a bid for 100 shares at $50 a share, while another might submit an offer for 50 shares at $25 a share.

Once all the bids are in, the shares are assigned at the highest price for which all the shares will sell (ie at the price of the lowest successful bid). So, even if you bid $50 a share for 100 shares, your bid could be filled for a better price – perhaps $25 a share.

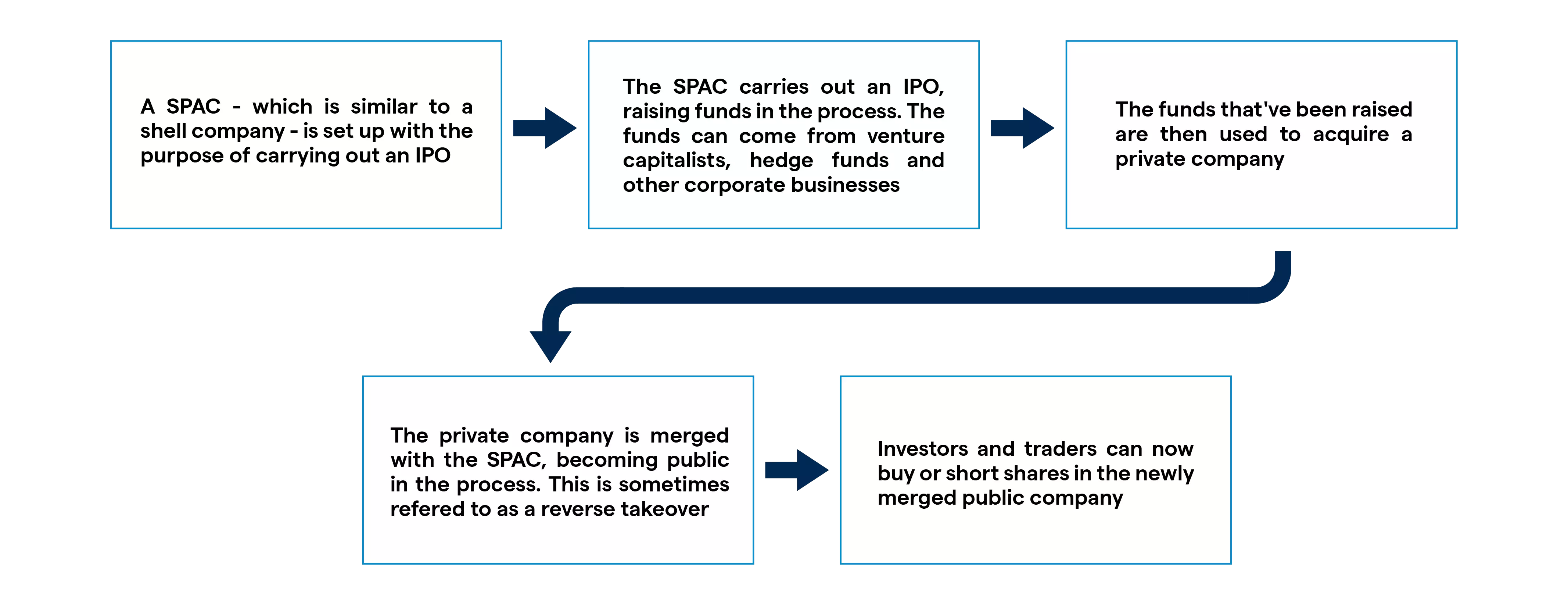

How does the SPAC process work?

The SPAC process can seem daunting, and some people find it hard to understand. So, we’ve broken it down in these step-by-step bullet points.

- A SPAC – which is similar to a shell company – is set up with the purpose of carrying out an IPO

- The SPAC carries out an IPO, raising funds in the process. The funds can come from venture capitalists, hedge funds and other corporate businesses

- The funds that’ve been raised are then used to acquire a private company

- The private company is merged with the SPAC, becoming public in the process. This is sometimes referred to as a reverse takeover

- Investors and traders can now buy or short shares in the newly merged public company

Pros and cons of listing with a SPAC

There are several pros and cons of listing with a SPAC, and we’ve gone through them in the following section.

Pros of a SPAC

Here are some of the pros of listing with a SPAC:

- Some of the risks associated with a traditional IPO – like uncertain listing values – might be avoided

- Going public through a SPAC is generally quicker for the private company than the traditional IPO process because the IPO has already taken place

- SPACs can benefit from the knowledge and expertise of the initial sponsors, who could receive seats on the board of the private company once it goes public

- SPACs can be a good opportunity to get exposure to ‘unicorn’ companies, some of which are seen as being long overdue for a public listing

Cons of a SPAC

Here are some of the cons of listing with a SPAC:

- The benefit from the long-term expertise of the initial sponsors might not be realised if they sell their stake shortly after the merger is completed

- SPACs can be more expensive than traditional IPOs, as the underwriters of the IPO will usually charge around 5.5% of the funds that are raised

- The sponsors of the SPAC will receive a large chunk of stock, sometimes up to 20%. If they decide to sell shortly after the merger to realise a gain, the share price could fall

- SPACs don’t require the same level of due diligence as the traditional IPO process

Examples of SPACs and reverse takeovers

The first example of a SPAC that we’ll look at is Pershing Square Tontine Holdings – owned by billionaire Bill Ackman. The company is a SPAC that hit headlines when it completed its IPO on 22 July 2020 with a share price of $20.

Ackman hasn’t yet used Pershing Square Tontine Holdings to carry out a merger, but he’s reportedly been looking at ‘established unicorns’. The company is an interesting SPAC to watch, not least because of its bankroll of over $4 billion – raised through the IPO that took the company public, in which around 200 million shares and warrants were bought by investors.

Another high-profile SPAC – Social Capital Hedosophia – was used in 2019 to take Virgin Galactic public. In the process, Virgin Galactic became the world’s first publicly traded commercial human spaceflight company.

The new company is named Virgin Galactic Holdings, and its shares trade on the New York Stock Exchange under the SPCE ticker.

How can you trade or invest in a SPAC or IPO?

There are several options for market participants looking to trade or invest in a SPAC or IPO with us. We’ve gone through them below.

Trading or investing in a SPAC

You can trade or invest in a SPAC in the same way you would any other company. A SPAC is after all, just a publicly traded shell company. This means that while it doesn’t have any operations itself, the SPAC has been set up with purpose of acquiring an operating company that will hopefully perform well in the public market.

While investing and trading mean similar things, there are important differences. Investing in a SPAC means that you’ll be taking direct ownership of the company’s shares. This will make you a shareholder, and you’ll earn a profit if the shares increase in value from the price level at which you bought them.

Trading a SPAC means that you’ll be taking a speculative position on the direction of the company’s shares with financial derivatives like CFDs. You’ll be able to speculate on the price rising by going long, or falling by going short.

Trading or investing in an IPO

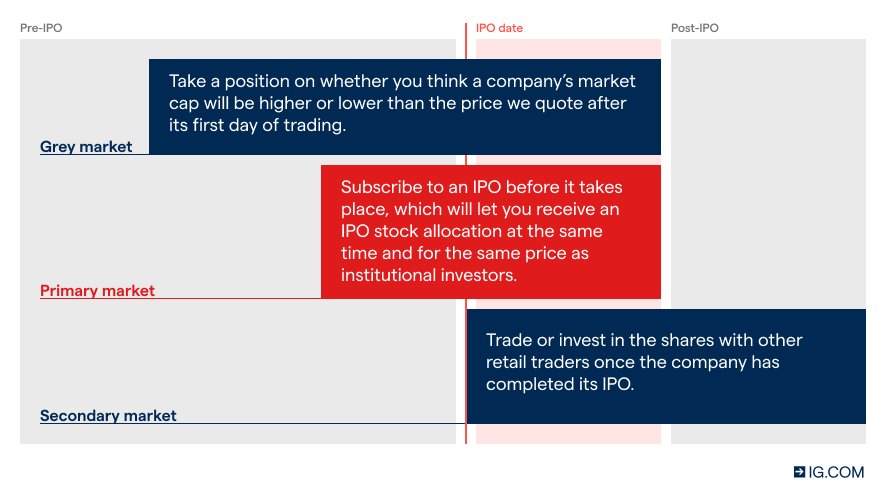

Trading or investing in an IPO is slightly different to trading or investing in a SPAC. We’ve outlined the main ways to trade an IPO below.

Trade or invest in the secondary market

The secondary market is where the majority of share trading takes place, and it’s where both traders and investors get the opportunity to take a position on a company’s shares after its IPO.

Trading means you’ll be speculating on the share price rising or falling with CFDs. To trade, you’ll need to create a trading account.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

Please see important Research Disclaimer.

Explore the markets with our free course

Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course.