How to invest in shares in Australia: everything you need to know

You can buy and own a portion of the brands you value when you open a share trading account. Learn how to invest in shares with us, without paying commission

What’s on this page?

- Three steps to start investing in shares

- How to invest in shares

- Why do you need a broker?

- How do you open a brokerage account?

- How does a brokerage account work?

- How do you invest using our share trading platform?

- What are the risks of investing in shares?

- Learn more about the basics of share investing

Three steps to start investing in shares

To start investing in shares, you’ll need an account with a broker – like us. Our share trading account enables you to buy and sell physical company shares.

To invest, you’ll place your orders with us, and we’ll execute them on your behalf. Dividends earned (if any) will be deposited straight into your share trading account.

Open a share trading account with us

Fund your account in minutes

Buy and sell shares on our platform or app

How to invest in shares

After opening an account with a broker, you can use their trading platform to buy and sell shares and funds.

When investing, you have two main options: you can choose to purchase a specific number of shares in a company or fund, or you can decide on a fixed amount of money to invest.

For example, if a stock is trading at $0.50 per share, you could buy 100 shares for $50, or you could invest $250 to receive 500 shares. Keep in mind that these calculations don't include any associated fees, which vary by broker and should be factored into your investment decisions.

Why do you need a broker?

The main reason why you need a broker is to access shares listed on an exchange (eg the Australian Securities Exchange (ASX 200)). That’s because only registered brokers can access the exchange, place orders and execute deals.

A broker can be seen as the middleman between buyers and sellers of shares. Brokers often have high-performing technologies available to them that enable investors to get exposure to a variety of shares; charging a fee for their service.

You can invest in Aussie, US and UK shares without paying commission with a forex conversion fee of just 0.7% on international trades.1

Commission costs on an IG share trading account

| Australian shares | Free* |

| US shares | Free* |

| UK shares | Free* |

| European shares | Free* |

*For all fees, please see our share trading cost and charges page.

How do you open a brokerage account?

How you open a brokerage account will depend on the broker you choose. With us, you can open a share trading account in just a few minutes. Here’s how:

- Fill in an application form. We’ll verify your identity almost immediately

- Once open, you can deposit funds into your account

- You’re now ready to buy and sell shares

How does a brokerage account work?

You can usually log in to your brokerage platform to fund your account, buy and sell shares, place market orders and view statements. Not all accounts work in the same way, but with us it works as follows:

When you have a share trading account with us, you’ll use it to buy and sell shares on our platform, as long as the markets are open. Note that we offer 700 US shares 24/52.

You can trade US and UK shares without paying commission, with a forex conversion fee of just 0.7%.1 Your shares – and their value – will be stored in your account.

You’ll be able to see the number of shares you own, as well as what they’re worth when you log in. If the value goes up or down in the share market, this will reflect in your account, too.

Any dividends owing to you will also be paid into your share trading account. So, any profits and losses, as well as earnings from dividends, will be kept here. You can reinvest these dividends – ie use the money to buy more shares, or you can withdraw it whenever you want.

Our platform also offers content to power your investing journey, including real-time news from Reuters, expert analysis from our analysts, stock research from TipRanks and our economic calendar.

How do I fund my account?

You can fund your account – and withdraw these funds – quickly and easily, using a variety of methods. Choose between using a debit or credit card, Apple Pay, PayPal account, PayID or via BPAY. The minimum deposit required is A$100 for credit/debit card, Apple Pay and PayPal and A$10 for BPAY or PayID. You can deposit money whenever you’re ready.

If you want to withdraw money from your share trading account, you can do so at any time, without any fees. We’ll pay the money to you via the same card or account you used to fund. BPAY can take up to 2 working days, and EFT payments up to 3 working days to be allocated to your account. Successful card and PayPal payments are deposited immediately.

How do you invest using our share trading platform?

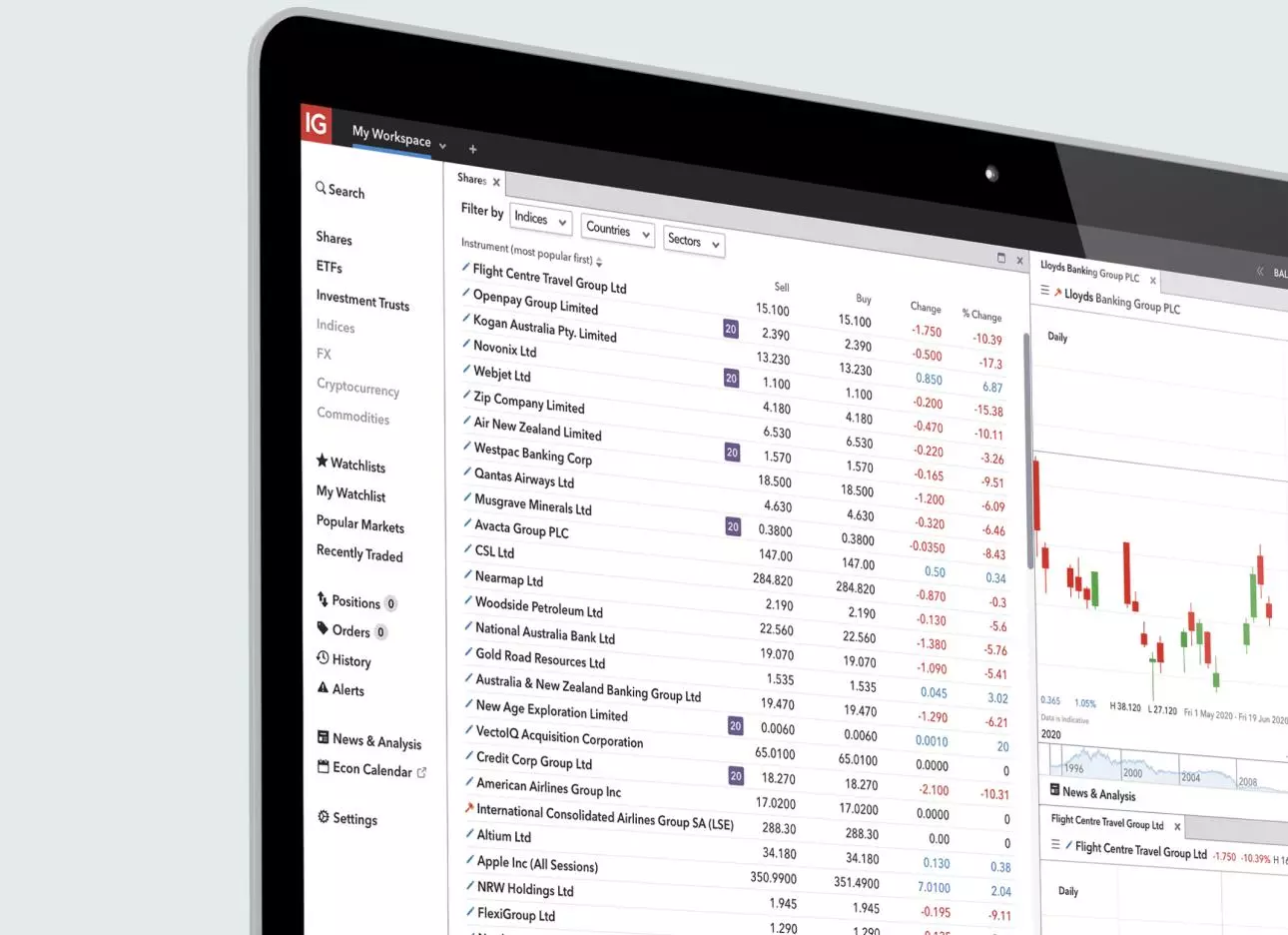

Log in to your account and go to our share trading platform. From there, you can invest in thousands of popular shares, from exchanges across the world.

Simply search for your preferred company shares or ETFs on our platform, open its chart and place your deal in the deal ticket.

How much should I invest?

How much you should invest is completely up to you. There’s no minimum amount required to invest with us, but there may be certain deposit requirements. You should only ever invest an amount that you’re willing to risk, as the markets could move against you.

Find out how to manage your risk before investing in any shares.

Why invest in shares with us?

- Access extended hours on US shares: we offer 700 US shares 24/52.

- Get started within minutes: you can open your share trading account quickly and easily, and use a funding method that suits you

- Reach us 24 hours a day: get dedicated help and support from our team, from 1pm Saturday to 7am Saturday

Other investment products

If you don’t want to invest in individual stocks, we also offer exchange traded funds (ETFs) where you can invest in a basket of assets and themes, such as tech stocks or green energy, from a single position.

What are the risks of investing in shares?

There are different types of risks when investing in shares. Some shares are riskier or more volatile than others. But one thing is certain – no matter the type of investment – there will always be a degree of risk involved.

Investment risk

This is the most general type of risk when you own shares. The price of the underlying asset can fluctuate based on supply and demand. This means the value of your investment can go down, and you could get back less than you put in. If you want to invest in company shares, consider how much you’re willing to risk before you place your deal.

Market risk

As the name suggests, this type of risk affects the entire market, and not specific company shares. So, even if you have a diverse portfolio of shares, you could be exposed to market risk. It can be linked to general economic turmoil, natural disasters, interest rate changes, etc.

Other risks

Some of the other risks to be aware of when investing include currency risk, liquidity risk and business risk. With currency risk, you’re at the mercy of the exchange rate between countries. Liquidity risk comes into play when there is low demand for (or supply of) a certain asset. Lastly, business risk is the risk that a company won’t generate a profit or stay afloat.

Note that this isn’t an exhaustive list– make sure you conduct thorough research on all possible risks before investing.

How to manage your risk when investing

Here are a few ways you can manage your risk when investing in stocks:

- Learn as much as you can about investing on IG Academy

- Create a trading plan

- Do technical and fundamental analysis

- Set stop orders to cap your losses

- Hedge your positions

Remember, while buying and owning shares can be risky, there are also possible rewards if the market moves in your favour.

Learn more about the basics of share investing

- What are shares, stocks and equities?

- Why do companies issue shares?

- What is a stock exchange?

- What is the stock market?

- What are dividends?

- Why invest in shares?

1. What are shares, stocks and equities?

It’s important to note that ‘shares’, ‘stocks’ and ‘equities’ are related, but not entirely the same. Equity is the term for a total ownership stake in the company after the repayment of any debt, while a share or stock describes a single unit of ownership. The plural term shares usually refers to units of ownership in a specific company, while equities and stocks are terms generally used to refer to portions of ownership multiple companies.

2. Why do companies issue shares?

Companies will issue shares for different reasons. Some may simply want to raise their public profile. Others might want to raise money to fund business expansion, pay debts, attract talent or monetise its assets.

3. What is a stock exchange?

A stock exchange is a marketplace where financial instruments, like shares, are bought and sold. is a marketplace where financial instruments, like shares, are bought and sold.

The NASDAQ (known on our platform as the US Tech 100) is a popular example of a stock exchange. Companies often need to meet specific standards before they can be listed on a stock exchange – these standards can vary depending on the stock exchange.

A stock exchange’s opening hours will depend on where in the world it’s located. We offer 700 US shares 24/52.

4. What is the stock market?

The stock market is a slightly more abstract concept than a stock exchange, as it’s not a specific place. Rather, it represents every exchange, and the space where all buyers and sellers participate in the financial markets.

So, as an example, if you hear news terms like ‘stock market crash’, it means that practically all financial assets and markets are facing a serious downturn.

5. What are dividends?

Dividends are payments made to shareholders by the companies in which they’re invested. If a company makes a profit, and they choose to pay dividends, shareholders will receive a portion of the profit. Not all companies pay dividends.

You can reinvest your dividends – ie use the money to buy more shares in the company – or withdraw it as cash. With us, dividends received from your investments are paid directly into your share trading account.

6. Why invest in shares?

Many people choose to invest in shares because it’s a way to own a portion of the brands you value. If you invest in shares, you can make a profit if you sell them for a higher price. You can also earn a passive income from dividends (if paid) and receive voting rights, enabling you to have a say in company matters.

When you invest in shares with us, you’ll get:

- Competitive dealing costs: Pay $0 commission per trade on Aussie, US and UK shares,1 with a foreign exchange fee of just 0.7% on international trades

- A huge choice of investments: choose from 11,000+ shares and ETFs

- Longer market hours: access 700 US shares 24/5¹.

Learn more about why people invest in shares

FAQs

How can I start investing in shares?

To start investing in shares, you’ll need to open an account with a broker. You can open a share trading account with us within minutes and access 11,000+ shares to invest in, including big names such as Apple, Netflix and Tesla.

You have no obligation to fund the account until you’re ready to invest.

Can anyone invest in shares?

Yes, anyone with a funded brokerage account can invest in shares. The main reason why you need a broker to access listed shares is because only registered brokers can access an exchange, place orders and execute deals.

How much is the minimum I can invest in stocks?

There is no minimum – you can invest however much you can afford. Just remember that investments are risky and past performance is no guarantee of future results, so you could get back less than what you put in.

Do I need a broker to buy shares?

Yes, you need a broker to buy shares. You can’t buy or sell shares directly on an exchange – you’ll do so ‘over the counter’, using a broker. Only registered brokers will have access to an exchange where shares are listed.

Is it expensive to invest in shares?

Whether or not it’s expensive to invest in shares is completely subjective. All shares have different values, and all investors have different amounts of capital on hand. You should only ever invest what you can afford to lose.

Try these next

Learn about risk management tools including stops and limits.

Learn more about ETFs and how to invest.

Discover the key differences between trading and investing.

1 $0 commission applies to clients who trade on the IG share trading account and opt for the default setting of ‘instant currency conversion’. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher. Other fees and charges may apply, please see our share trading cost and charges page.

2 Trading hours run from Monday 10am to Saturday 7am (AEST). During daylight savings, hours shift to Monday 9am to Saturday 6am (AEDT).