The stock market: what is it and how does it work?

The stock market enables you to become a shareholder by investing in company shares. Find out what the stock market is, how it works, what the possible benefits and risks are, and how you can buy company shares.

What are stocks?

Stocks are a type of financial asset you can buy – they represent a share of ownership in a company. The unit of ownership you’ll purchase is referred to as ‘shares’.

Buying shares of a company on the stock market makes you a shareholder and gives you a stake in that company. This means you’re entitled to voting rights in business decisions, if they’re granted. It also often means you share in the company’s successes by receiving dividends, if the company you’ve invested in pays them (some don’t) and you’re eligible.1

What is the stock market?

The stock market is where shares are bought and sold. It’s the universal marketplace where company shares are exchanged between parties. Rather than a physical place, eg one with vendors at various stalls, the stock market is a single abstract concept that refers to all the sales of stocks around the world.

What is a stock exchange?

A stock exchange is a physical building and legal entity. Stock exchanges are within various countries—they're the platforms where publicly listed companies' shares are bought and sold by shareholders, stockbrokers, funds, and other ‘shoppers’.

Companies typically list on an exchange using a process called an initial public offering (IPO). But some companies choose to list in alternative ways, eg via a direct listing or special purpose acquisition company (SPAC) merger.

Examples of stock exchanges

| Stock exchange name | Number of listed companies2 |

| Nasdaq | 3,400+ |

| Stock Exchange of Hong Kong (SEHK) | 2,600+ |

| New York Stock Exchange (NYSE) | 2,200+ |

| Shanghai Stock Exchange | 2,200+ |

| Australian Securities Exchange (ASX) | 2,000+ |

| London Stock Exchange (LSE) | 1,800+ |

There are different ways of comparing stock exchanges. These include number of listed companies, average daily trading volume, total market capitalisation of companies and size of individual listings.

How does the stock market work?

Picture a traditional marketplace – vendors selling their products, while buyers look at what’s on offer, negotiating pricing and purchasing goods, or trading one item for another. This is very much the way the stock market works – just in a digital, online form.

For a business’ shares to be available to be bought and sold publicly, the company must list on a stock exchange. Some of the main reasons a company may choose to list are to raise additional capital, enhance its credibility and improve its corporate governance processes.

Stock exchanges are public venues—so a company must list its stock on an exchange as a public entity. Companies are publicly listed and usually ‘debut’ on an exchange via an IPO.

Primary market

The primary market is a specific time in the lifecycle of a stock. The first time stocks are publicly traded is on the primary market (via the IPO process). n the primary market, share price—also called the issue price or offer price—is determined through a systematic price discovery process called book building. Note that we do not offer primary market IPO trading.

Once an IPO has been completed and a stock is officially listed on an exchange, its shares can be publicly traded on that stock exchange. This is known as the secondary market.

Secondary market

Previously issued securities are exchanged between buyers and sellers on the secondary market. This is where everyday trading happens. In the secondary market, share price is determined by supply and demand, overall market conditions and other factors.

Learn more about the drivers of stock prices

If you’re interested in owning shares of a listed company, you can buy them through a trading provider like us. When you’re ready to sell your investment, you’ll either make a profit or incur a loss. If you sell your shares for an amount that’s higher than what you paid to buy them, you’ll make a profit. If you sell your shares at a price that’s lower than the original buy price, you would incur a loss. Note that you can only trade IPOs via the secondary marlet with us.

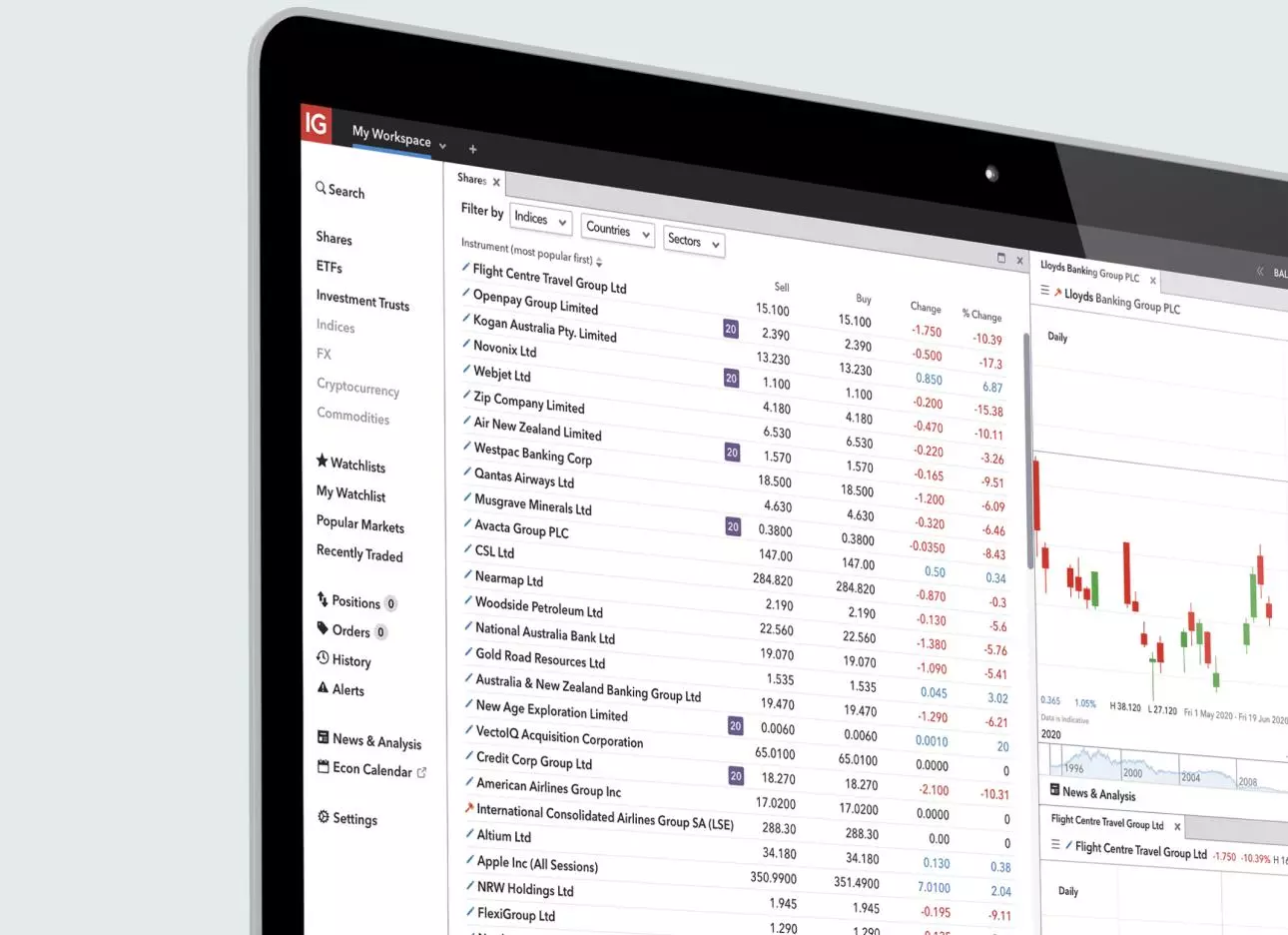

How to trade shares online

There are two ways to buy and sell stocks online with us. You can speculate on share prices using our leveraged trading product, or invest in stocks directly via our share trading services.

Investing in stock exchange assets with us

With us, you would invest using a share trading account. Your funds to buy and sell shares will be held in this account. The account is also where any dividends that you’re entitled to will be paid into.

You can invest in local and international stocks on our platform. You can also invest in other exchange-listed assets such as exchange-traded funds (ETFs) and investment trusts with us. To become a shareholder, you must commit the full value of your position upfront.

While you could profit – from possible price appreciation and a passive income through dividends (if they’re offered and you’re eligible to receive them) – you might incur a loss instead. The total amount you put towards your investment is the most that you could lose.

Trading stock exchange assets with us

With us, you would use a contract for difference (CFD) trading account to speculate on a market’s price movement without owning the asset. You would go long if you think an asset’s price will rise or go short if you think it will fall. If the market moves in your favour, you’ll make a profit; if it doesn’t, you’ll incur a loss.

CFD trading gives you access to leverage, which enables you to open a bigger position using a relatively smaller deposit, but it also amplifies your profit and loss potential. You can lose more than your initial outlay, making it important for you to manage your risk diligently.

In addition to stocks, you can trade other share-related assets such as ETFs and indices with us. Stock indices are benchmarks for the performance of certain groupings of stocks, but they aren’t listed on exchanges in their direct form.

While stock indices such as the S&P 500 or ASX 200 (known on our platform as the US 500 and Australia 200 respectively) measure how specific groups of stocks are performing, you can't buy or sell them directly on a stock exchange. However, you can gain exposure to indices through investment products like ETFs that mirror an index’s performance. Additionally, you can access indices through derivative products, eg futures and options, that are traded on specialised exchanges.

3. Place your order

Having done your due diligence, you can use the funds you deposited into your account to open positions on our share trading platform. You would place an order on your chosen stock, specifying the number of shares you want to buy.

4. Monitor your position

Once you’ve placed your deal, you’ll need to keep an eye on your stock investment to determine when the right time to close your position is. You would profit if you sell your shares at a higher price. If you sell them at a lower price, you would incur a loss. If you’re eligible, you’ll receive dividends while holding your shares (if the company offers them).

What affects the prices of stocks?

Stock prices are affected by investors’ willingness to buy or sell a company’s shares. This is influenced by market sentiment and investor confidence, both of which determine supply and demand levels. When there’s more supply than demand for a stock, its price will typically go down. When there’s more demand than supply for it, its price will normally go up.

Key factors that drive prices of stocks through their impact on market sentiment and investor confidence include:

- Financial results: how well the company is performing financially, measured through revenue growth, profit margins, debt management and return on investment (ROI)

- Leadership credibility: the effectiveness of management in setting direction, executing plans, showing strong leadership and managing difficult situations

- Growth potential: revenue performance and its drivers, market share dynamics and potential obstacles to growth

- Competitive strength: how strong the company's market position is, including its competitive edge, ability to adapt and capacity to keep its market share

- Innovation and sector trends: the company's research capabilities, opportunities for expansion and how well it can lead – or adjust to – industry changes

- Corporate updates: significant company news, including changes in leadership, performance reports and possible impacts of new regulations

- Economic environment: changes in broader economic factors like consumers spending, interest rates, international trade, etc.

What is market volatility?

Volatility can also affect stocks’ prices significantly. Volatility reflects the size and rapidness of an asset’s prices changes. A market is considered volatile when its price tends to change sharply and suddenly.

The more volatile a market is, the more profits and losses you can make and the faster they can happen. Because of this, stocks with low volatility could be a better choice for beginner investors.

What are the risks of investing in stocks?

There’s no reward without risk – for all the benefits of investing in stocks, there are risks, too. So, while aiming to reap the potential rewards of being a shareholder, it’s important to also manage your risk.

Here are some of the main risks of investing in stocks:

- Investment risk: the blanket term for all of the possible risks your holding will face. It simply means the danger of incurring losses or a lower-than-expected ROI

- Business risk: challenges faced by the company you’ve invested in that could affect the share price

- Unsystematic risk: also known as idiosyncratic risk or specific risk, this refers to risks that are unique to a particular company, rather than the entire market

- Headline risk: the danger that negative publicity could have an adverse effect on a company’s share price

- Liquidity risk: the risk that you won’t be able to buy or sell an investment quickly enough to prevent or minimise a loss

- Market risk: risk that affects the market in general and can typically not be eliminated through diversification

- Systematic risk: risks that affect all securities and companies in the financial system to some degree

- Commodity price risk: a type of systematic risk that occurs when extreme fluctuations in commodities’ prices have a knock-on effect on stocks’ prices

- Inflation risk: the chance that a country’s rising inflation – which causes the value of money to decrease – could lessen the worth of your stocks

- Legislative risk: the chance that a government’s decisions, for example increased regulatory requirements for corporates, will affect companies’ stock prices

FAQs

How do I buy stocks?

To invest in stocks, you can buy shares in a company via a trading provider’s platform – for example, with us. On our platform, you can buy and sell domestic and international shares commission-free with a share trading account.3 A 0.7% FX fee applies to international trades.

Can anyone buy stocks?

Yes, anyone with a live share trading account can buy stocks. As an individual investor, you can’t buy stocks through a stock exchange directly.

Where is the stock market?

The stock market is an abstract term that encompasses all of the world’s stock exchanges, including the stocks listed on them. It refers to all the companies’ shares that are available for the public and institutional investors to buy and sell.

Is there a minimum amount for stock investing?

There’s no minimum you’ll need to start investing in stocks, as long as you have enough funds for the shares you want to buy, as well as any additional fees (eg commission). To start investing in stocks with us, you can set up a set up a share trading account at no charge to you.

Is stock investing risky?

Yes, there’s risk associated with investing in stocks – but without risk there are no rewards. The chance to make a profit goes hand in hand with the possibility of making a loss. The trick is to know the potential risks and put measures in place to manage them.

Try these next

Discover why investors choose to become shareholders of listed companies.

Find out how to start investing in stocks, including how to manage your risk.

Explore the key factors to consider when looking for an investment platform.

1 When investing with us, you’ll do so via our share trading platform using our custodial model. This means that we manage, hold and safeguard securities you choose to buy and sell on your behalf. Via our custodial model, you’ll be able to buy and have a stake in actual assets – for example, shares in an ASX 200-tracking ETF or ASX 200-constituent company. You’ll also be entitled to dividends if any are paid, and granted voting rights if applicable.

2 Statista, 2024

3 $0 commission applies to clients who trade on the IG share trading account and opt for the default setting of ‘instant currency conversion’. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher. Other fees and charges may apply, please see our share trading cost and charges page.