How to buy, trade or invest in ETFs and funds

Access an extensive selection of markets from just a single position. Discover how to trade or invest in ETFs and other investment funds with us – Australia’s No.1 CFD provider.1

If you’re ready to open a position on an ETF or investment fund, follow these three steps:

Decide whether you want to trade or invest

Trading lets you speculate on prices using derivatives; investing lets you take direct ownership of ETF or fund shares

Select your opportunity

Choose from our offering of over 3400 ETF markets

Take your position

Create an account with us to open your trade or investment

How to buy ETFs and funds in Australia: trading and investing

Learn more about ETFs and funds

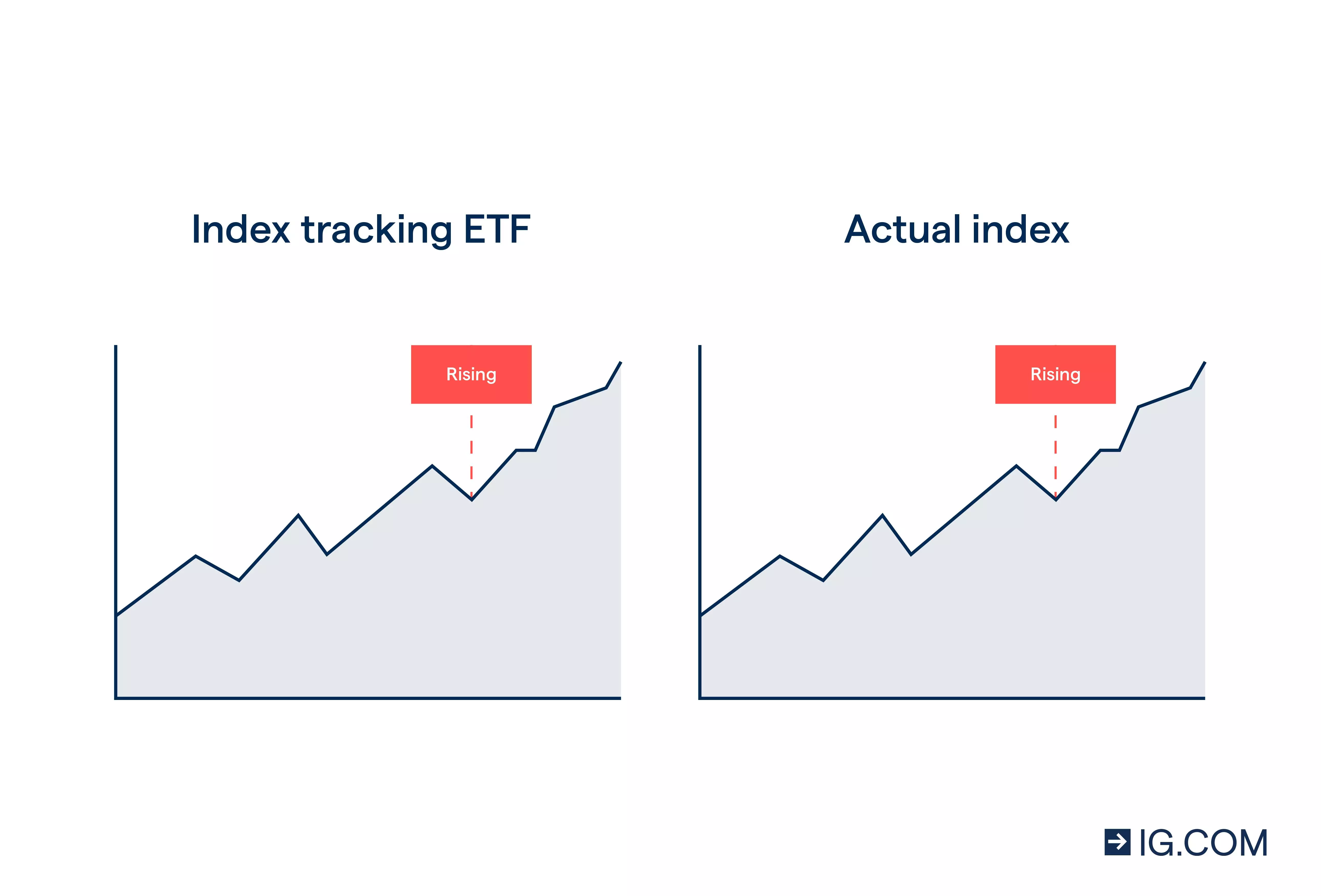

Exchange traded funds (ETFs) give investors access to a wide range of markets and assets through a single point of entry – an ETF share. They achieve this by tracking the movements of an underlying index, commodity, basket of stocks or financial instrument, such as bonds.

ETFs will either buy assets – eg stocks appearing in an index – or use derivative instruments like futures contracts to mimic the performance of the underlying. This means that the value of an ETF depends largely on the values of the assets it tracks.

In the event a particular stock index like the FTSE 100, for example, shows positive growth, a FTSE 100 tracking ETF will mirror that growth as closely as possible. Similarly, a thematic ETF tracking artificial intelligence (AI) and robotics stocks will appreciate if the prices of the stocks it holds increase.

.jpg/jcr:content/renditions/original-size.webp)

Like most investment funds, an ETF issues shares to investors in exchange for capital. This capital is pooled and used by the fund’s manager to make investments on behalf of its shareholders. ETF shares can be traded on an exchange and bought and sold like any other company stocks.

ETFs vs other funds

There are four main types of funds in Australia, and they differ based on 1.) whether they’re listed on a stock exchange or bought and sold from the fund itself, and 2.) whether they try to track the market passively or to actively beat its performance.

The four main categories include:

- On-exchange, passively managed funds like exchange traded funds (ETFs) and exchange traded commodities (ETCs)

- On-exchange, actively managed funds like investment trusts, real estate investment trusts (REITs) and closed-ended mutual funds

- Off-exchange, passively managed funds like index tracker funds

- Off-exchange, actively managed funds like unit trusts and open-ended mutual funds

Here’s a brief explanation of some of these differences.

On-exchange vs off-exchange

- On-exchange funds

- Off-exchange funds

On-exchange funds are listed on a regulated stock-exchange, making them highly transparent and accessible. Investors can buy into the fund or exit it quickly as trades are near instant in liquid markets.

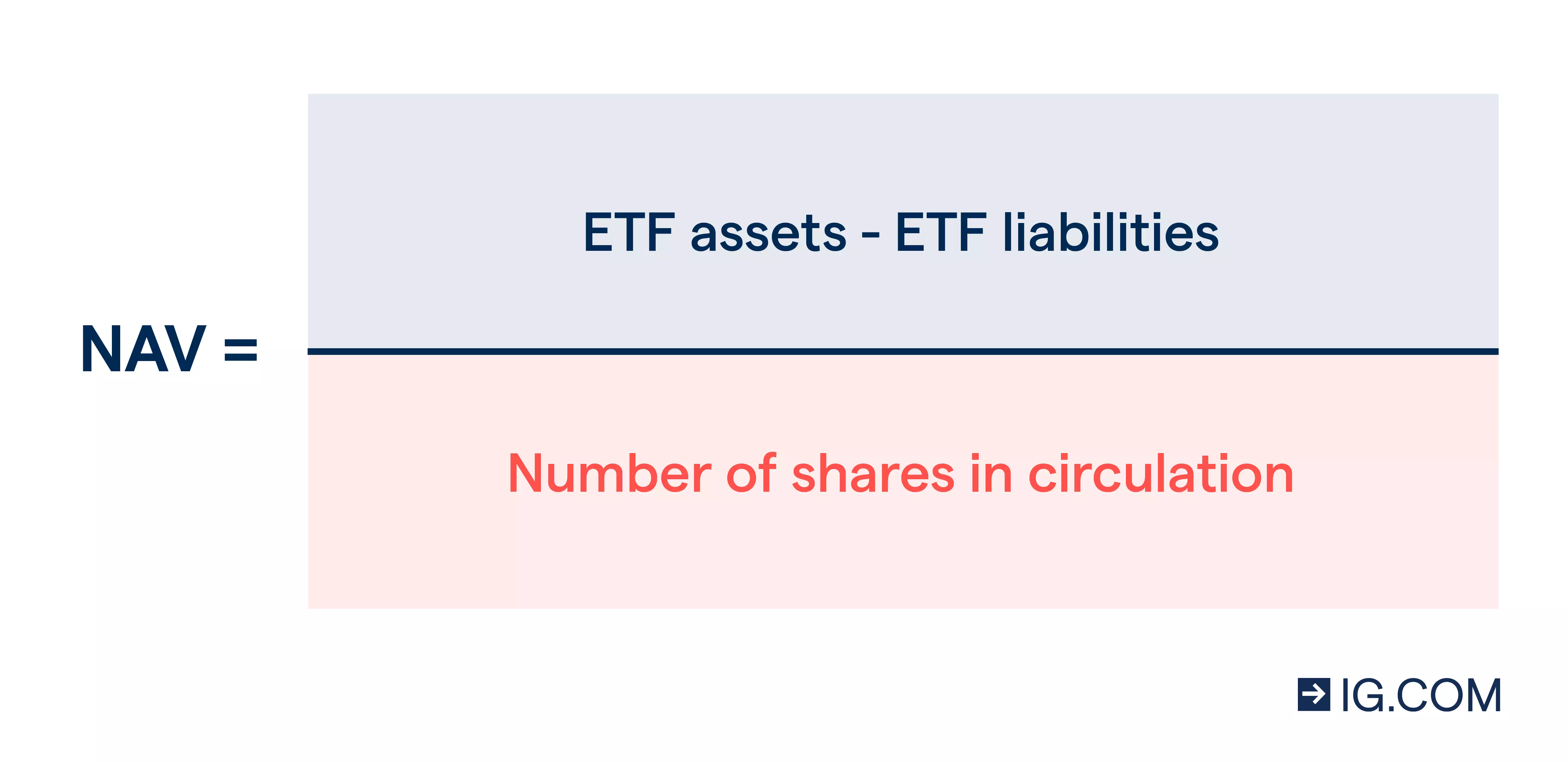

In addition to the total value of a fund’s assets, on-exchange funds’ share prices are also subject to the market forces of supply and demand. This means that they may trade either above or below their net asset value (NAV).

The NAV of a share is the total value of the fund divided by the number of shares it has issued.

Like most investment funds, an ETF issues shares to investors in exchange for capital. This capital is pooled and used by the fund’s manager to make investments on behalf of its shareholders. ETF shares can be traded on an exchange and bought and sold like any other company stocks.

Off-exchange funds don’t trade on a regulated stock exchange, and are instead bought and sold over-the-counter (OTC) from the fund itself. These funds issue and redeem shares from investors directly. This happens after the value of a share is established by first evaluating the fund’s total assets under management (AUM) at the close of each business day.

Here, share prices are not subject to market forces, and are always traded at their NAV. The convenience does come at a premium, though: these funds have to keep cash on hand to cover withdrawals, so not all monies within the fund are productively invested in assets.

Passively managed vs actively managed funds

- Passively managed funds

- Actively managed funds

Passively managed funds seek to simply track the performance of their chosen underlying assets, securities or benchmark by following strict guidelines about what trades to execute, when.

They generally incur lower operating expenses than actively managed funds and have lower fees. This is often seen as an advantage and research indicates that, over time, few actively managed funds consistently beat the market – meaning that their higher fees may not be justified in terms of better returns.2

Actively managed funds will try to outperform a benchmark indicator – like an index – requiring a fund manager to analyse markets and pick assets that they believe will generate better-than-average returns.

As active funds will incur additional expenses in both operations and increased labour, their management fees will typically be higher than passively managed funds. Several actively managed funds will also charge a performance fee for positive results. These will be available to view in their prospectuses.

There is no guarantee that actively managed funds will return market-beating results.

With our live trading and investment accounts, you’ll have a selection of on-exchange investment products from which to choose, including:

Type of investment fund |

Example |

Exchange traded funds (ETFs) |

|

Exchange traded commodities (ETCs) |

|

Real estate investment trusts (REITs) |

|

Investment trusts |

Discover why people trade and invest in ETFs and funds

There are several reasons why investors look to ETFs and funds. Two primary drawcards, however, are investment returns and the sheer breadth of exposure that can be obtained through a single fund.

The above graph plots the return on a share of the SPDR® S&P/ASX 200 Fund (STW) over a 10-year period. This is set against the return of an equal investment in a savings account earning an annualised interest of 1.75% over the same period.

Whereas the data show a higher return on the ETF, it’s important to remember that cash savings don’t incur the same risks associated with trading and investing.

With this said, the wide exposure to a variety of assets provided by a fund means that you stand to mitigate a portion of this investment risk by diversifying your portfolio. Moreover, you’ll have access to the potential growth of an entire industry or economy. For example, in Australia, you might take a position on:

- ASX 200 index-tracking funds like the SPDR® S&P/ASX 200 Fund (STW). Given the number of companies appearing in the index, and their role in the economy, an ASX 200 tracker will give you exposure to the health and performance of the Australian economy as a whole

- ASX listed property funds like the SPDR S&P ASX 200 Listed Property Fund. Property is often seen as a hedge against inflation, and exposure to the market can diversify a portfolio

- ASX resource funds like the BetaShares S&P ASX 200 Resources Sector ETF. The resource sector is a major contributor to the Australian economy, and ETFs focusing on the sector try to balance the advantages of diversification with exposure to a select set of vital industries

- ASX dividend funds like the iShares S&P ASX Dividend Opportunities ETF, offer exposure to the country’s best dividend paying opportunities. This enables you to earn an income or reinvest for greater exposure to stable, established companies

The possible advantages to be gained from investing in funds include:

Broad exposure in a single trade

Pooled funds are a good way to gain exposure to an entire selection of stocks from just one entry point. To achieve the same result as an index tracking ETF, you’d need enough capital to not only buy each stock, but enough of each to build proportions that mirror the index weightings. For most, this is simply too expensive and logistically impossible.

Mitigation of risk

A well-diversified portfolio lessens risk by including as many uncorrelated assets as it can. That is, if you only buy a small selection of stocks, your risk profile is higher than it would be if you instead opted for a wider range of shares from several sectors that are independent of each other. An index ETF is one of the most effective ways to diversify, thereby mitigating a portion of the risk of holding just a few, concentrated assets.

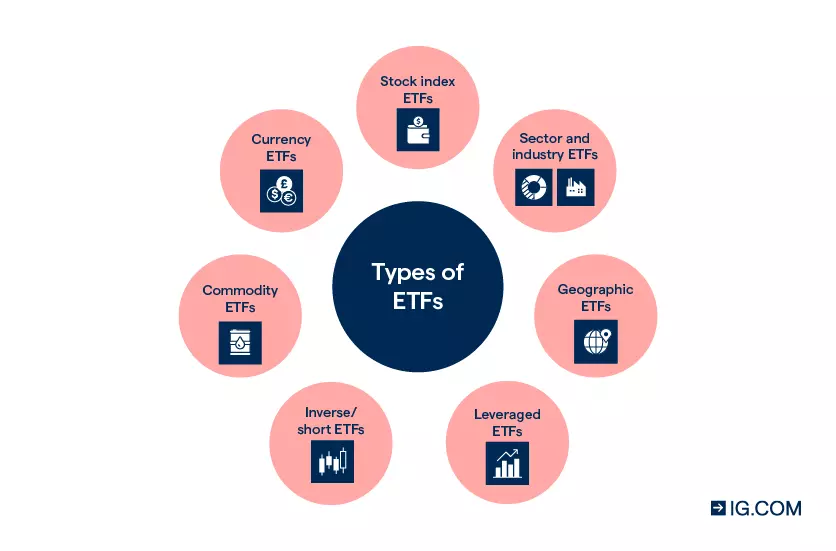

Wide choice of markets

Pooled-fund investment vehicles and exchange traded products like ETFs and ETCs aren’t restricted to shares. You can gain entry to a variety of markets that have traditionally been off-limits to many traders and investors. These include commodities, currencies, corporate and government bonds, interest rates and real estate.

Low fees on passively managed funds

Because passively managed funds only incur the operating expenses and fees needed to track a chosen benchmark – like the ASX 200 – their fees are significantly lower than actively managed funds. Active funds will also often charge performance fees for achieving above-market returns, which are largely omitted in passive funds like ETFs.

Liquidity and instant execution for on-exchange funds

Funds that are traded on-exchange are highly liquid – meaning that you can enter and exit the fund easily and quickly. While several on-exchange funds may trade at either more or less than each share’s net asset value (NAV), the prices of ETFs are less subject to the forces of supply and demand. This means that they trade very close to their NAV.

Choose how you want to buy ETFs or funds: investing or trading

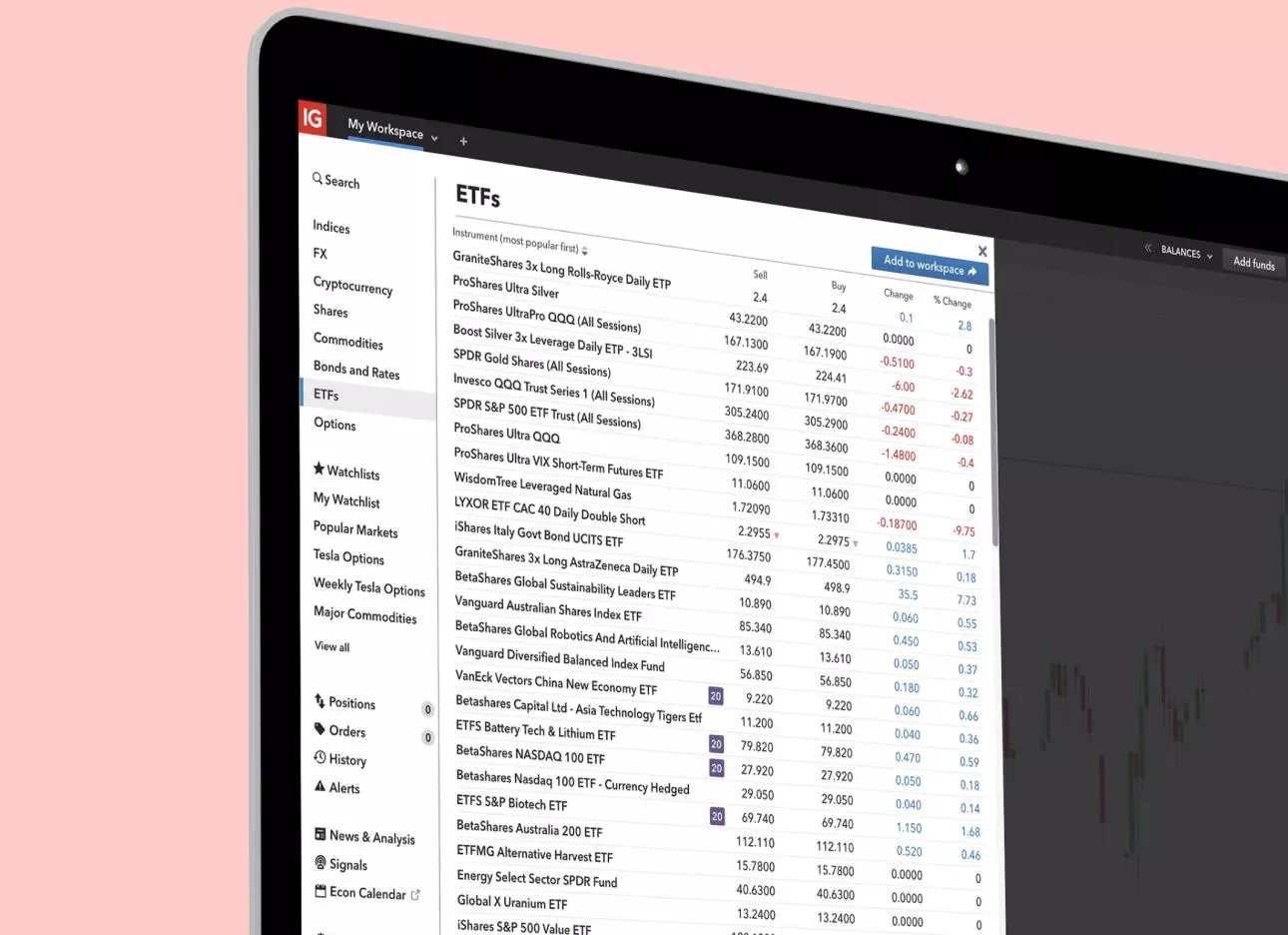

Investing is different to online trading, and you can do both with us. In addition to several investment trusts and managed portfolios, we also offer a total of over 3480 global ETF markets.

When you invest, you’ll actually buy and own the asset. This entitles you to dividend payments if the fund grants them, and you’ll earn a profit if you sell your fund share for more than you paid for it. Conversely, you’ll cut a loss if it depreciates in price.

When you trade online, on the other hand, you’ll use derivative products to speculate on the price movements of an underlying asset without ever owning the asset itself. This is because derivatives like CFDs track the price levels of the underlying – in this case, the share price of your chosen fund.

Investing in ETFs and funds

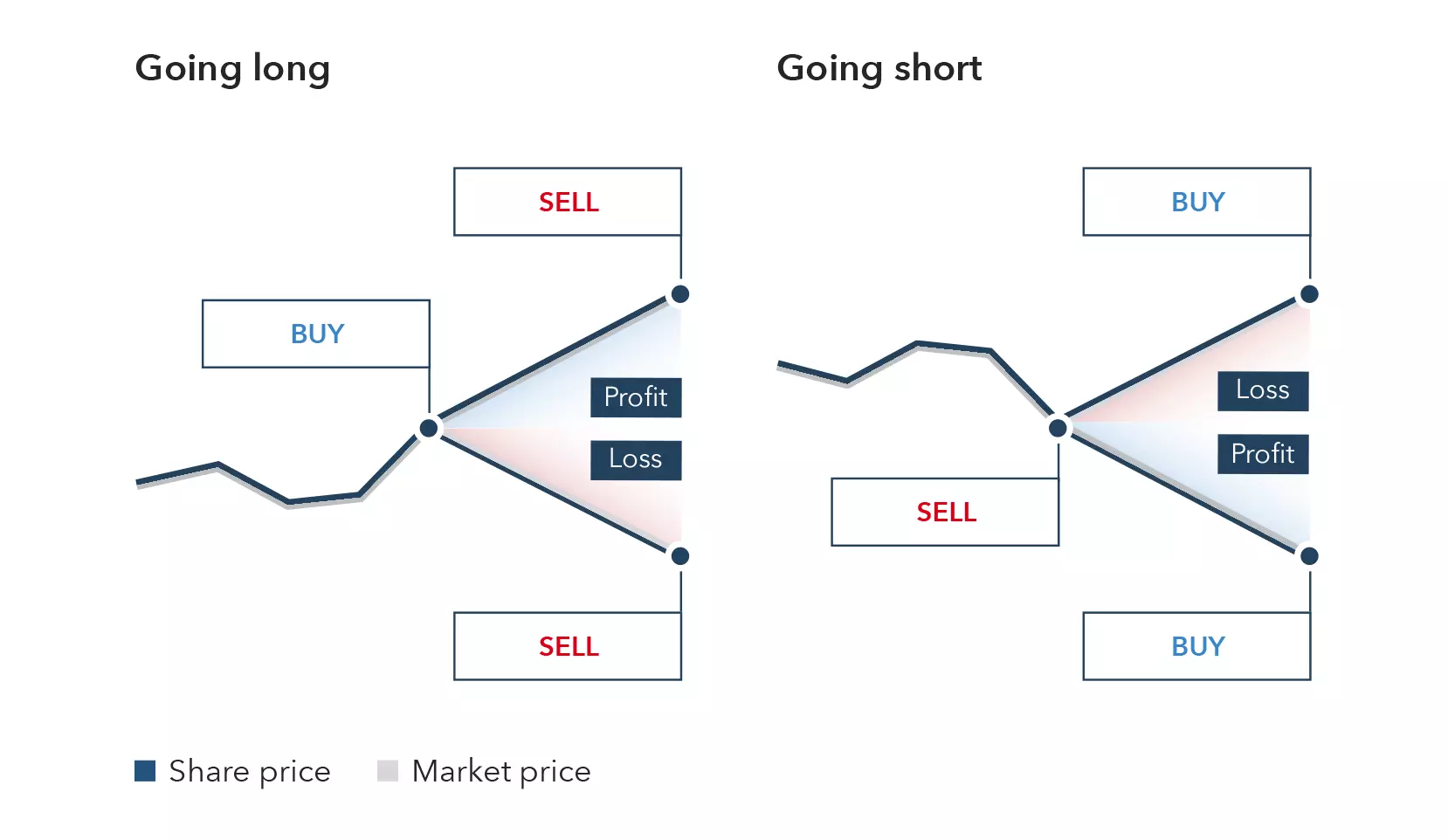

Investing is usually better suited to those willing to take a longer-term view. As you buy and hold a share when investing, you’ll be restricted to ‘going long’ (you’d aim to buy low and sell high at a later date to earn a profit).

Pay $0 commission on Aussie shares and ETFs.4 ETFs enjoy the benefit of avoiding the large performance fees typically associated with actively managed funds.

Investment trusts are also an option if you’d like an actively managed alternative to passive ETFs. Investment trusts are closed-ended funds that are allowed to borrow capital to ‘gear’ their investments. Shares of investment trusts can trade at a premium or discount to their NAV.

You can access ETFs and investment trusts through our share trading account.

Trading ETFs and funds

If you’re looking to take a shorter-term position, you could consider trading. Because you’ll use derivatives like CFDs, you’ll be able to ‘go short’ in addition to going long. Going short is the reverse of going long, enabling you to profit if you correctly predict a depreciation in a fund’s share price.

However, please note that short selling is a high-risk trading method because share prices can keep rising – theoretically, without limit. It’s essential to take steps to manage your risk.

It’s also important to note that CFDs are leveraged instruments that differ substantially from traditional investing.

When investing, as you buy and own the asset, you pay the full amount for the asset upfront. By contrast, leverage means you can open a position with a small deposit (called ‘margin’) instead of paying the full value of your position. However, loss and profit are still calculated based on the full position size and can substantially outweigh your initial margin deposit.

Once you’ve set up a live trading account with us, you’ll have over 2600 ETFs from which to choose.

Trading ETFs allows you to take a position on a wide selection of markets, including themes, sectors, industries and even the economy as a whole. However, you could also use CFDs to take positions directly on indices, commodities and currency markets.

Pick your ETF or fund

Given the variety of ETFs and funds available, you’ll have to pick an option that aligns with your trading or investing goals. There are three main things to consider when making a choice.

- The type of fund: ETF, ETC, REIT or investment trust – your fund should suit your risk appetite, trading or investment timeframe, and preferred market

- The fund’s size: Generally, the larger the fund’s assets under management (AUM), the more liquid it’ll be on-exchange. This means larger, popular funds have lower spreads, saving you money

- The structure of the fund: For example, physical ETFs use assets to track the underlying market, while synthetic ETFs use derivatives. Both have advantages and limitations which you should consider before taking a position

Popular ETFs include:

- S&P 500 ETFs

- FTSE indices ETFs

- Global ETFs

- Commodity ETFs and ETCs

- Thematic ETFs

S&P 500 ETFs

FTSE indices ETFs

Global ETFs

Commodity ETFs and ETCs

Thematic ETFs

Prices above are subject to our website terms and conditions. Prices are indicative only. All prices are delayed by at least 15 mins.

You can find all these and more on our platform. You can also use our ETF screening tool to view fund sizes, types and returns, and to download fact sheets.

Account types, costs and risks

| Way to trade or invest |

Account | Costs | Risks |

| Self-investing in ETFs |

Share trading |

Pay $0 commission per trade for US, UK3 and domestic shares.4 A 0.7% FX fee applies to international trades. Learn more

|

All investing puts your capital at risk, and you stand to receive back less than your initial investment amount. However, buying ETFs shares enables you to diversify away a portion of investment risk. |

| Trading on ETFs with CFDs |

CFDs | Commissions from 0.08% on each side of a trade, min fee of $7 for online orders Overnight funding fees on cash markets Learn more |

CFDs are leveraged derivatives. This means that the trade’s full profit or loss is calculated on the total position size, not the margin amount. Learn more about how you can manage your risk. |

Open an ETF account and take your position

We’re the best Aussie provider giving you access to over 3480 global ETF markets. You can choose to trade with either derivatives or invest. To boot, we have the award winning trading platform.5

How to invest in ETFs and funds

To invest in ETFs yourself, follow these steps:

- Create an account or log in and go to your share dealing account

- Familiarise yourself with our offering of ETFs

- Select your opportunity

- Determine the size of your investment and order type

- Open and monitor your position

How to trade ETFs and funds

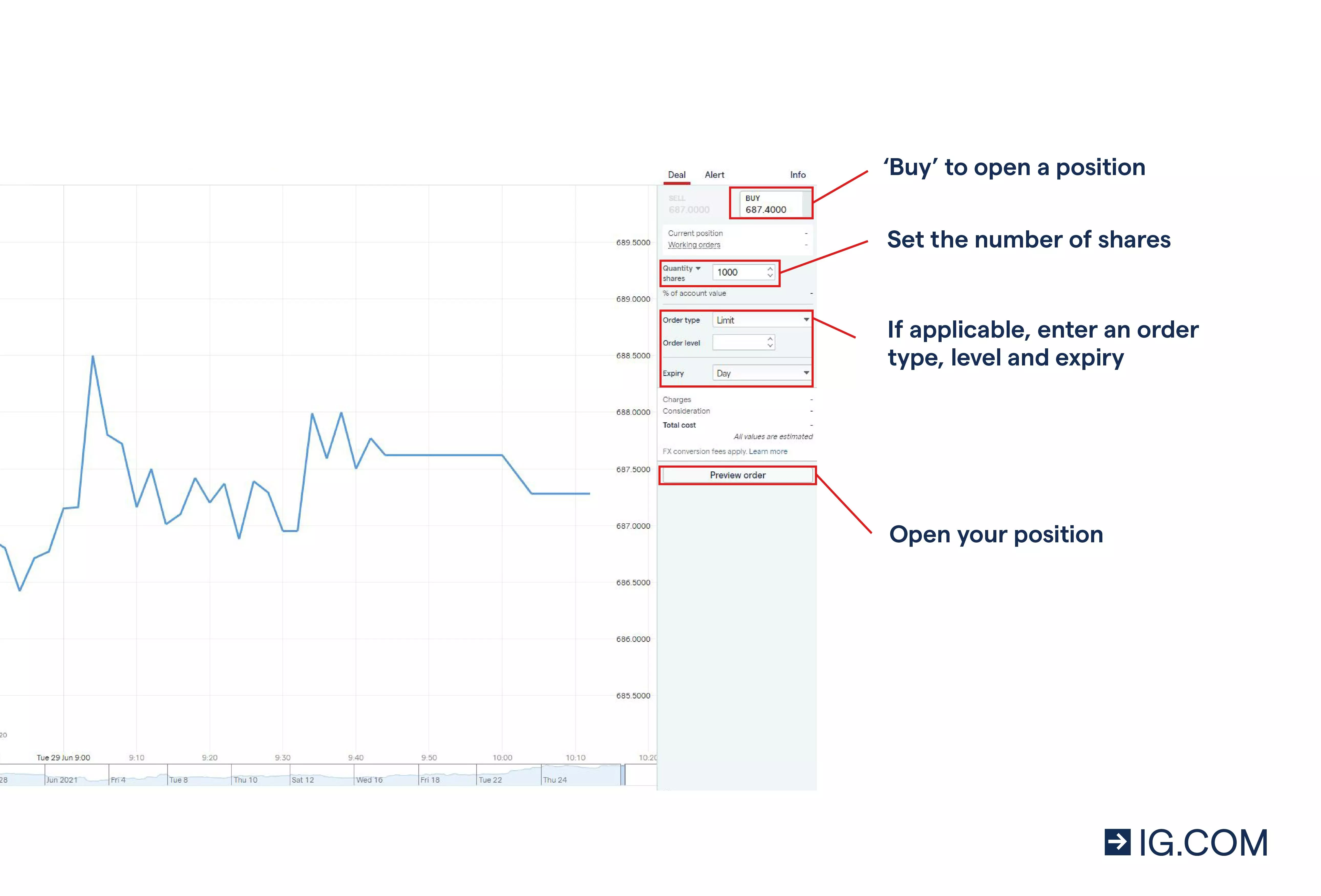

To trade ETFs or one of our other available investment funds, follow these steps:

- Create an account or log in

- Pick an ETF or fund from within our trading platform

- Select ‘buy’ to go long, or ‘sell’ to go short. Set your position size and take steps to manage your risk

- Open and monitor your position

Develop your trading and investing strategies for ETFs and funds

Successful investment and trading relies on a thorough understanding of financial markets and the correct use of established strategies.

At the same time, however, it’s worthwhile to remember that all investment involves significant risk, and that you should never risk more capital than you can afford to lose. When trading with CFDs, always bear in mind that you stand to lose more than your initial margin deposit owing to leverage.

ETF strategies

Below are some strategies you may want to learn more about before taking a position on an ETF or investment fund.

Buy-and-hold

A buy-and-hold investment strategy is suited to share dealing and our Smart Portfolios. It involves a long-term investment horizon and holding onto your investment despite any fluctuations in the stock’s value.

The theory behind a buy-and-hold strategy is straightforward. Buy an asset and hold it until you need to sell it, during which time you should have benefited from years of capital appreciation and income payments.

Dollar-cost averaging

Dollar-cost averaging involves investing smaller amounts of capital over a period of time rather than a large sum in one go. When using this strategy, you’ll be averaging out the peaks and troughs of price movements over time. Because prices rise and fall, spreading your investments out means you’ll likely achieve a lower average cost of buying each investment unit.

Sector rotation

To diversify your investments, you may want to build a portfolio that profits from different stages of the business cycle. ETFs are a possible way to implement a sector-based strategy.

Their relatively low fees allow them to be ‘rebalanced’ when necessary, and their transparency means that you’ll know exactly what the fund is investing in.

Day trading

Day trading is a technique used by traders rather than investors. It involves buying and selling financial instruments within a single trading day. Day traders attempt to take advantage of small market movements by executing a large number of trades for a relatively small profit each time. Markets suited to day trading include forex, indices and shares.

Swing trading

Swing trading aims to benefit from short-term price patterns, and assumes that prices never go in only one direction in a trend (ie even in a trend, prices will both rise and fall). Swing traders look to make money from the up and down movements that occur in a short timeframe. Essentially, traders employing this strategy will attempt to profit from the small reversals in a market’s price movement.

Short-selling

Short-selling, also known as ‘shorting’ or 'going short’, is a trading strategy used to take advantage of markets that are falling in price. The traditional way to short-sell involves selling a borrowed asset in the hope that its price will go down and buying it back later for a profit.

With us, however, you’ll go short using CFDs. Short selling is a high-risk trading method because share prices can keep rising – theoretically, without limit. Because CFDs are leveraged, you’ll also stand to lose more than your initial margin deposit. Learn more about how to manage your risk.

Hedging

Hedging could be compared to taking out an insurance policy on your securities, and is a way to mitigate your losses should the market turn against you. It’s achieved by strategically placing trades so that a gain or loss in one position is offset by changes to the value of the other.

Typically, to hedge a position, you would either take an opposite position in a closely related market (or in a closely related ETF in this example), or the same position in a market that moves inversely to your original investment.

Although hedging could lessen your risk, please take note that you’ll still incur fees on both positions.

Try these next…

Take a position on over 11,000 shares with us

Be aware of the risks associated with forex trading and understand how IG supports you in managing them

Discover the world of trading on, and investing in, themes

1 Number 1 in Australia by primary relationships, CFDs & FX, Investment Trends November 2024 Leveraged Trading Report.

2 S&P Global, 2017.

3 $0 commission applies to clients who trade on the IG share trading account and opt for the default setting of ‘instant currency conversion’. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher. Other fees and charges may apply, please see our share trading cost and charges page.

4 For all fees, please see our share trading cost and charges page.

5 Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.