Why trade or invest in themes with us?

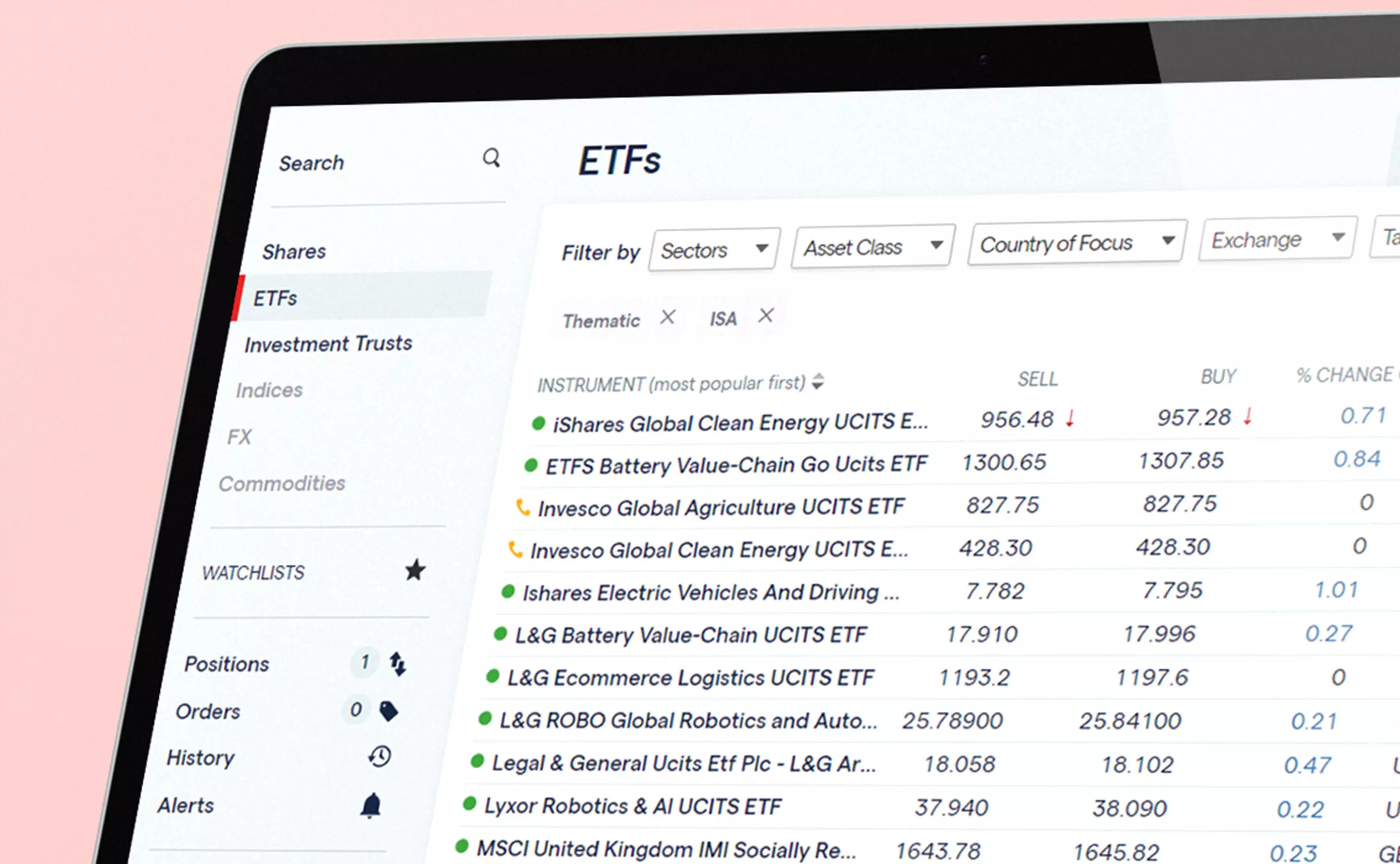

Access thousands of thematic ETFs, smart beta ETFs and baskets of our custom indices

Buy and sell international ETFs at $0 commission on an IG share trading account (0.7% FX fee applies)2

Invest in Aussie thematic ETFs and shares from $0 commission per trade3 in a share trading account

Trade the future with themes like electric vehicles, AI and robotics

Gain exposure to bespoke indices like our inflation, FAANG or FTSE 350 sectors

Use our unique market screener to find the right ETFs for you

Discover our thematic and basket CFD trading markets

- ESG

- AI

- Electric vehicles

- 5G

- Water

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

What are thematic investing and basket CFD trading?

Thematic investing is a longer-term form of gaining exposure to the movements of a specific trend or ‘theme’ such as ESG stocks, electric vehicles, robotics or any other macro event or market movement. Learn more about thematic investing

Basket trading means taking a position on a group of stocks simultaneously – for example a theme – which are all grouped together into one index, ETF or ‘basket’.

Ways to trade or invest in thematics

| Asset | Markets | How to trade or invest |

| Thematic ETFs | ETFs tracking sectors like AI or electric vehicles | CFDs, share trading |

| Custom indices (baskets) | Custom indices like the inflation, FAANG or FTSE 350 sectors | CFDs |

| Thematic shares | Shares aligned to a theme, like EV stocks such as Tesla or NIO | CFDs, share trading |

Open an account to get started trading or investing in thematic and basket CFDs

Open an account to get started trading or investing in thematic and basket CFDs

Ahead of the curve

Founded in 1974 as the first company of its kind. We’re ASIC-regulated and trusted by 320,000+ clients with the security of their money.

IG Australia is part of IG Group Holdings PLC, which is a member of the FTSE 250.

Fast, efficient online platforms

Seize your opportunity in seconds and take full control over each of your trades with our easy-to-use platform and apps.

Award-winning service

We have a dedicated team on hand to support you, and you can also benefit from knowledge-sharing with IG Community and IG Academy.

Trade themes and baskets with Australia’s best platform4

- Web-based platform

- Mobile trading app

Take control of your thematic and basket positions with our clean deal ticket, clear price charts and in-platform news and analysis.

Trade thematic and basket opportunities wherever you are, and receive trading alerts and signals on the go through email, SMS or push.

Trading or investing in thematics and baskets: the pros and cons

| CFDs | Share trading | |

| Main benefits | Low spread on thematic ETFs, unique indices and sectors to trade on, deal on rising and falling markets | Receive shareholder privileges and dividends Longer-term holding options suited to thematic investing |

| Risks | Trades are leveraged so losses will be magnified if the market moves against you. Traders can set automatic stops and guaranteed stop losses5 to control risk, but if these aren’t used, you could lose more than the initial deposit. Also, you’ll never lose more than your account balance.6 |

You could get back less than your initial investment |

| Accessible to | All clients | All clients |

| Markets | Over 17,000 markets including shares, ETFs, indices | Shares, ETFs |

| Commission | Commission on share CFDs, margin rate varies. | Buy and sell shares and ETFs from $0 commission per trade on Aussie3, US and UK shares2 (0.7 FX fee applies to international trades) |

| Platforms | Web, mobile app and advanced platforms | Web and mobile app |

| Learn more | Learn more |

Note: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Costs and charges

We are clear about our charges, so you always know what fees you will incur when you trade with us. Opening an account is free, and our charges are competitive.

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Try these next

Find out more about CFD trading with our quick guide

Discover our award-winning platforms4 and various third-party solutions

1 Number 1 in Australia by primary relationships, CFDs & FX, Investment Trends November 2024 Leveraged Trading Report.

2 $0 commission applies to clients who trade on the IG share trading account and opt for the default setting of ‘instant currency conversion’. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher. Other fees and charges may apply, please see our share trading cost and charges page.

3 For all fees, please see our share trading cost and charges page.

4 Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.

5 Stop-loss orders close your position automatically if the market moves against you. Normal stop-loss orders are free, but there’s no guarantee of protection against slippage. Guaranteed stops will close your position exactly the price you specified, but incur a premium if triggered.

6 Negative balance protection is not available to Pro clients.