What are options and how do you trade them?

Discover the fundamentals of options trading, including: what are options, which markets you can trade, what moves options prices, and how to get started with options trading in Australia. Choose from a range of expiries and trade on a breadth of markets when you trade options with us.

What is options trading?

Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a set price, if it moves beyond that price within a set timeframe.

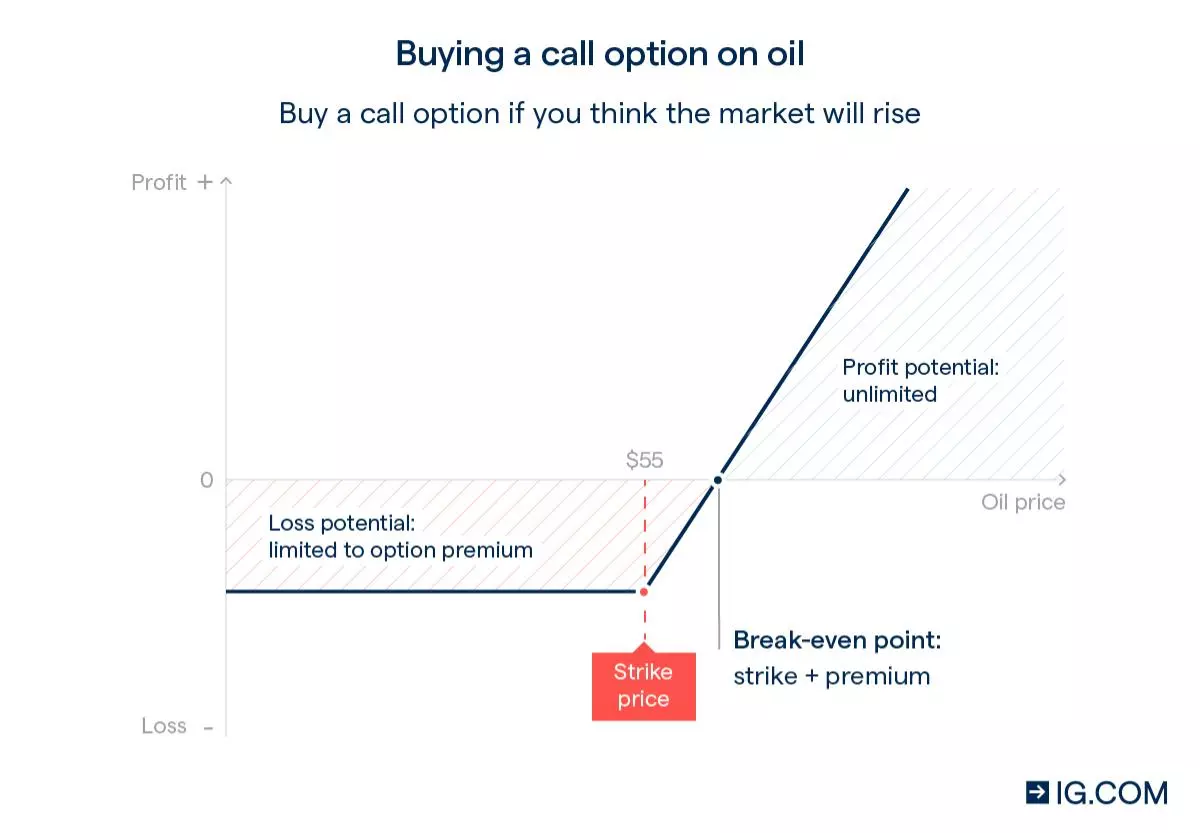

For example, let’s say that you expected the price of US crude oil to rise from $50 to $60 a barrel over the next few weeks. You decide to buy a call option that gives you the right to buy the market at $55 a barrel at any time within the next month. The price you pay to buy the option is known as the ‘premium’.

If US crude oil rises above $55 (the ‘strike’ price) before your option expires, you’ll be able to buy the market at a discount. But if it stays below $55, you don’t need to exercise your right and can simply let the option expire. In this scenario, all you’ll have lost is the premium you paid to open your position.

When you trade options with us, you’ll be using CFDs to speculate on the option’s premium – which will fluctuate as the probability of the option being profitable at expiry changes. CFDs are leveraged products, meaning you’ll pay an initial deposit (called premium) upfront to open a position. Trading options in this way can form an important part of a wider strategy. However, profits and losses are calculated based on the full position size, not your premium size.

The essentials of options trading

Take a look at the key types, features and uses of options:

What are call options?

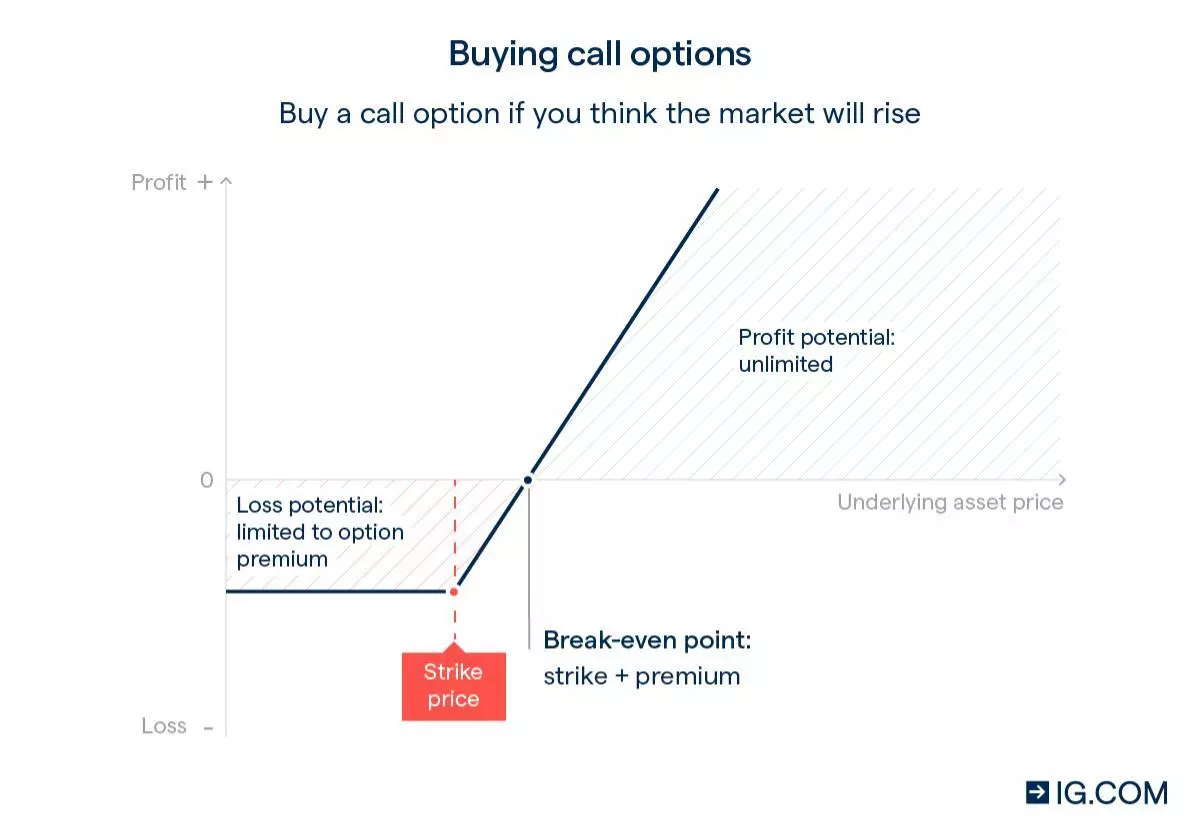

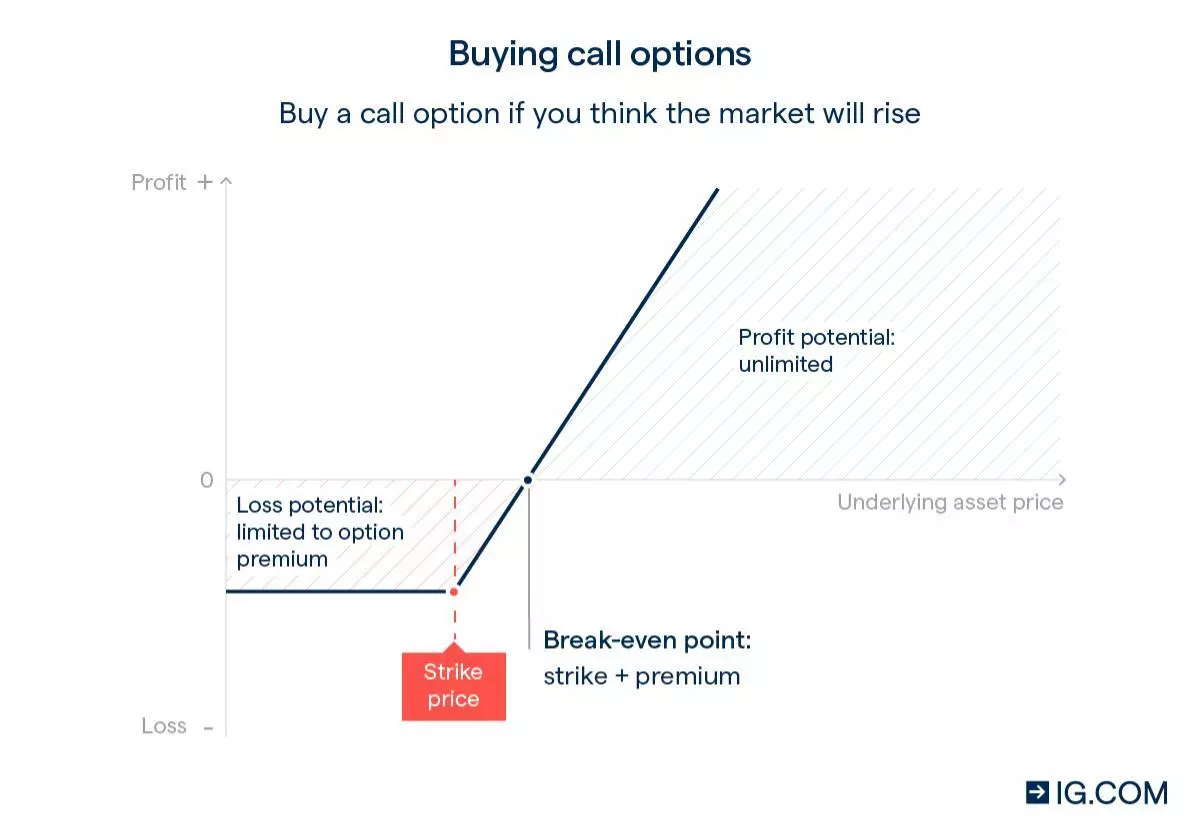

Buying a call option gives you the right, but not the obligation, to buy an underlying market at a set price – called the ‘strike’ – on or before a set date. The more the market value increases, the more profit you can make.

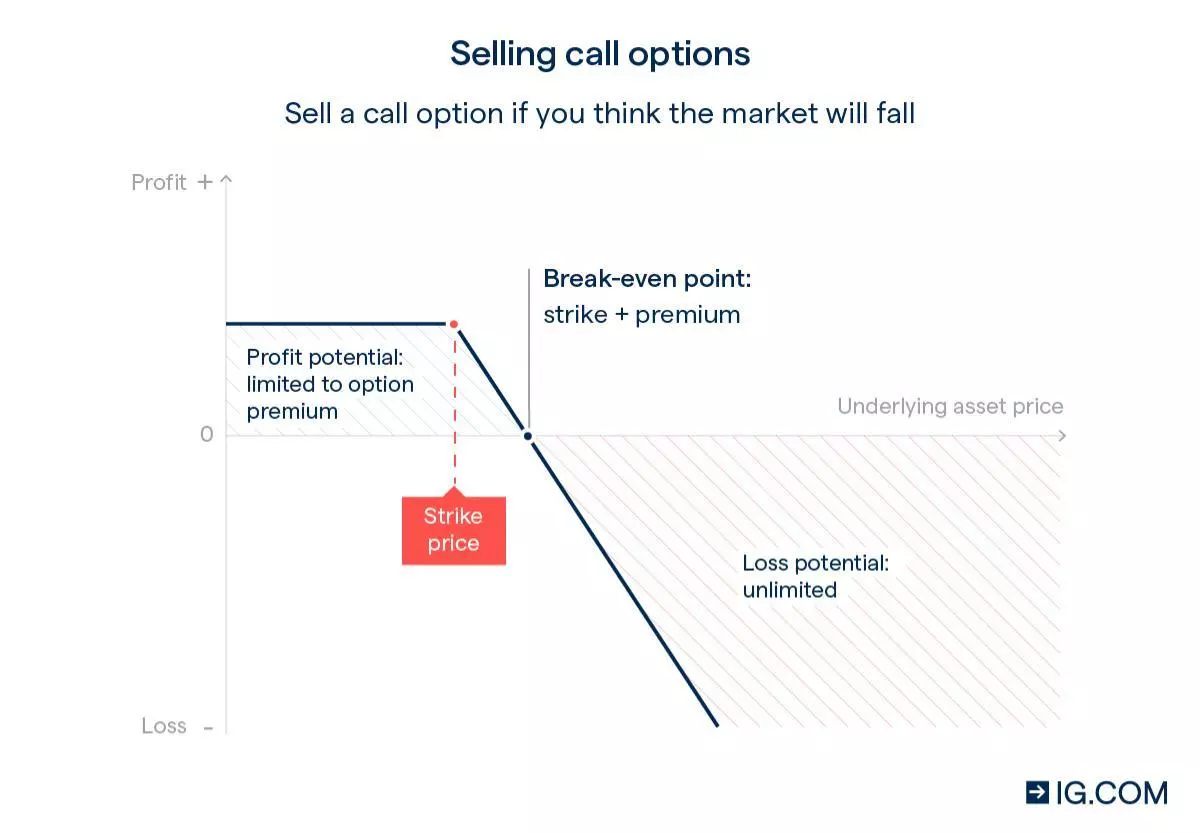

You can also sell call options. As the seller of a call option, you will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry.

You can also sell call options. As the seller of a call option, you will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry.

Options are leveraged products much like CFDs; they allow you to speculate on the movement of a market without owning the underlying asset. This means profits can be magnified – as can your losses, if you’re selling options. When buying call options as CFDs with us, you’ll never risk more than your initial payment when buying, just like trading an actual option, but when selling call or put options your risk is potentially unlimited (although your account balance will never fall below zero). Your positions will always be cash-settled at expiry. You’ll never have to deliver, or take delivery of, the underlying.

What are put options?

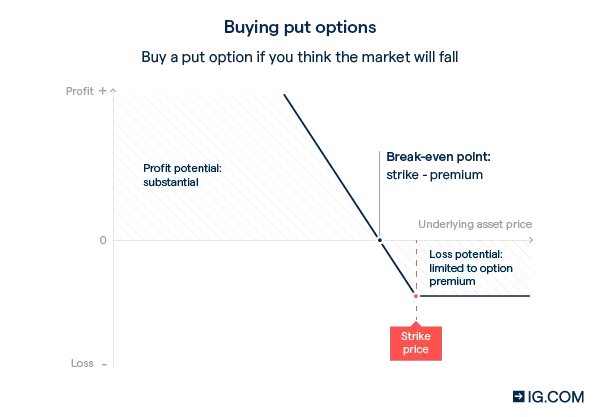

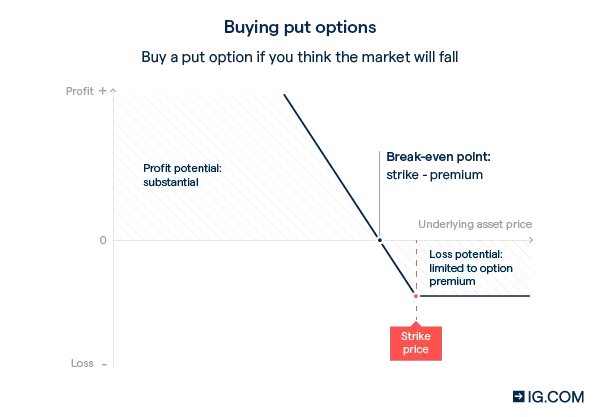

Buying a put option gives you the right, but not the obligation, to sell a market at the strike price on or before a set date. The more the market value decreases, the more profit you make.

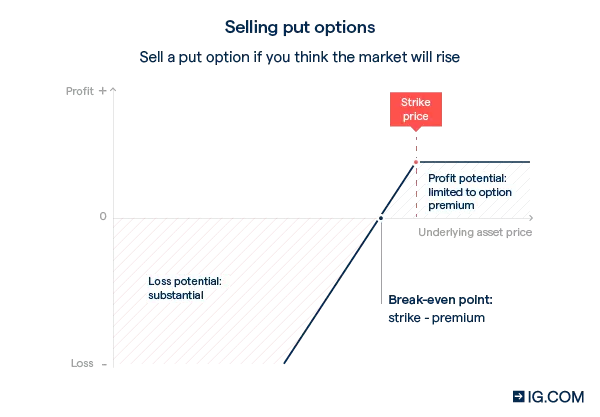

You can also sell put options. As the seller of a put option, you will have the obligation to buy the market at the strike price if the buyer exercises their option on expiry.

Options traders can use CFDs to speculate on options prices – instead of trading them directly. Since CFDs are cash-settled at close, you’ll never have to deliver, or take delivery of, the underlying. However, these are leveraged forms of trading options. This means that you’ll pay a smaller deposit (known as margin) to open your trade but will have your profits or losses calculated based on the full position size. So, you can lose (or gain) substantially more than your initial deposit. Note that when buying call options as CFDs with us, your risk is always limited to the margin you paid to open the position. But when selling call options your risk is potentially unlimited.

What is leverage in options trading?

Options are leveraged products and much like CFDs they allow you to speculate on the movement of a market without ever owning the underlying asset. This means your profits can be magnified – as can your losses, if you’re selling options.

For traders looking for increased leverage, options trading is an attractive choice. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets.

If you're a trader who's buying call or put options as CFDs with us, your risk is always limited to the margin you paid to open the position. However, it’s important to remember that when selling call or put options your risk is potentially unlimited, so an effective risk management strategy is important.

How can you hedge with options?

Hedging with options allows traders to limit potential losses on other positions they might have open.

Say you owned stock in a company, but were worried that its price might fall in the near future. You could buy a put option on your stock with a strike price close to its current level. If your stock’s price is down below the strike at your option’s expiry, your losses are limited by the option’s gains. If your stock’s price increases, then you’ve only lost the cost of buying the option in the first place.

Understand options trading terminology

Traders use some specific terminology when talking about options. Here’s a rundown of some of the key terms:

- Holders and writers: the buyer of an option is known as the holder, while the seller is known as the writer. For a call, the holder has the right to buy the underlying market from the writer. For a put, the holder has the right to sell the underlying market to the writer

- Premium: the fee paid by the holder to the writer for the option. When trading CFDs on options with us, you’ll pay a margin that works in a similar way to the premium

- Strike price: the price at which the holder can buy (calls) or sell (puts) the underlying market on the option’s expiry

- Expiration date/expiry: the date on which the options contract terminates

- In the money: when the underlying market’s price is above the strike (for a call) or below the strike (for a put), the option is said to be ‘in the money’ – meaning that if the holder exercised the option, they’d be able to trade at a better price than the current market price

- Out of the money: when the underlying market’s price is below the strike (for a call) or above the strike (for a put), the option is said to be ‘out of the money’. If an option is out of the money at expiry, exercising the option will incur a loss

- At the money: when the underlying market’s price is equal to the strike, or very close to being equal to the strike, the option is referred to as ‘at the money’

- Break-even point: when the underlying market’s price is equal to an option’s strike plus premium (for a call) or strike minus premium (for a put), your trade is at its ‘break-even point’. This means it isn’t making a profit or a loss

Identify what determines an option’s price

There are three main factors affecting the premium, or margin, you pay when you trade options. All these factors work on the same principle: the more likely it is that the underlying market price will be above (calls) or below (puts) an option’s strike price at its expiry, the higher its value will be.

When you trade CFDs on an option with us, you’ll pay a margin that works in a similar way to a traditional option premium.

- Level of the underlying market

The further below the underlying a call option's strike is, or the higher above the underlying a put option's strike is, the higher their premiums are likely to be as they are ‘in the money’ – there's more chance of them expiring with value. - Time to expiry

The longer an option has before it expires, the more time the underlying market has to pass the strike price – so an out-of-the-money option will tend to lose value as it nears its expiration date and there’s less chance of it expiring profitably. - Volatility of the underlying market

The more volatile an option’s underlying market is, the more likely it is that it will pass the strike price. So volatility tends to increase an option’s premium.

Learn about the Greeks

The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. Understanding how they work can help you calculate the risk involved with each of the variables that affect option prices.

- Delta

Delta is a measure of how sensitive an option’s price is to the movement of the underlying market. Assuming all other variables stay the same, you can use delta to work out how much impact market movement will have on the value of your option. - Gamma

A derivative of delta, gamma measures how much an option’s delta moves for every point of movement in the underlying market. - Theta

Theta measures how much an option’s price decays over time. A high theta indicates that the option is close to the expiration date; the closer the option is to expiry, the quicker the time value decays. - Vega

An option’s vega measures its sensitivity to volatility in the underlying market, or how much the option’s value will change for every 1% change in volatility. - Rho

Rho indicates how much interest rate changes will move an option’s price. If the option’s price will go up as a result of interest rate changes, its rho will be positive. If the option’s price will go down, its rho will be negative.

Pick an options trading strategy

There are numerous strategies you can use to achieve different results when you’re trading options. Popular options trading strategies include:

- Buying a call option

The simplest options trading strategy involves buying a call option when you expect the underlying market to increase in value. If it does what you expect and the option’s premium rises as a result, you’d be able to profit by selling your option before expiry. Or, if you hold your option until expiry and the underlying market is above the option’s strike price, you’ll be able to exercise your right to buy at the strike and profit in that way.

Buying call options is a popular strategy because you can’t lose more than the premium you pay to open.

- Buying a put option

Another simple options trading strategy is to buy a put option when you expect the underlying market to decrease in value. If it does what you expect and the option’s premium rises, you’d be able to profit by selling your option before expiry. You could also hold your option until expiry, and would profit if the underlying market was below the strike price.

Buying puts is popular because you can’t lose more than the premium you pay to open the position.

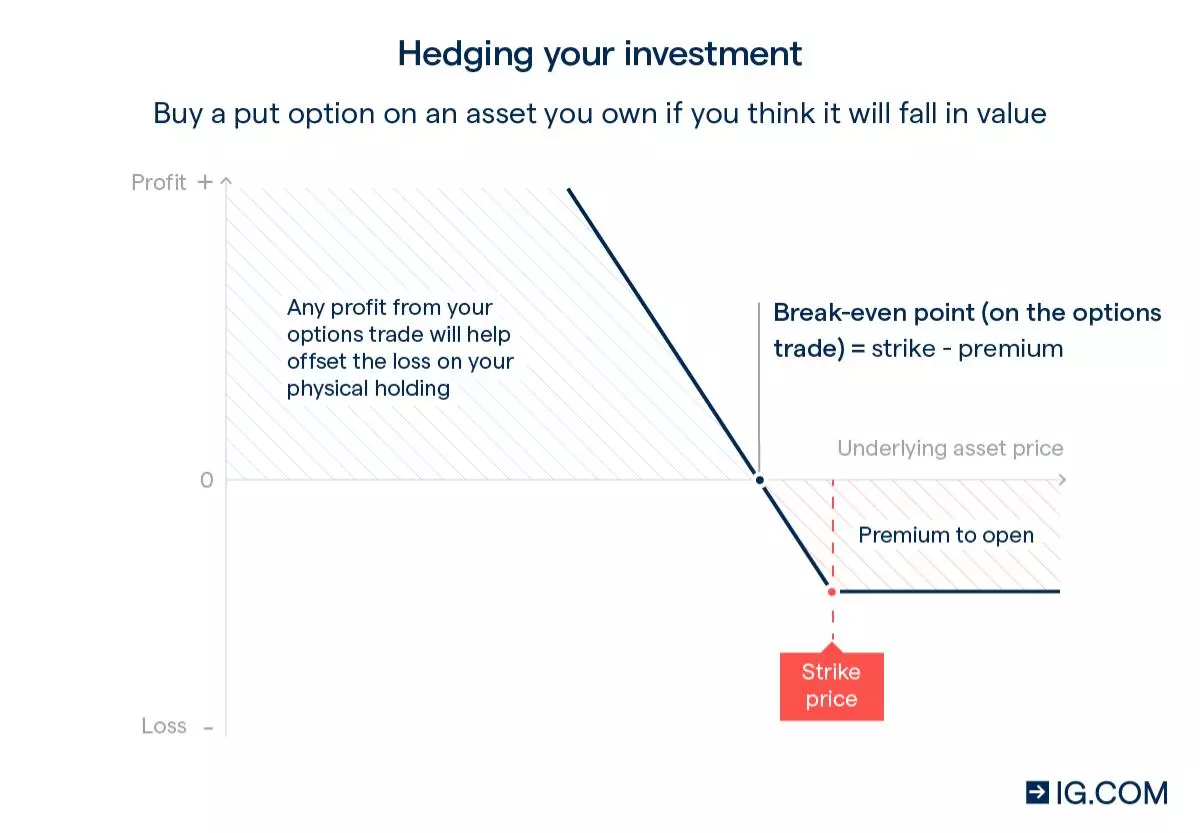

- Hedging your investment

If you own an asset and want to protect it against potential downwards market movement, you could buy a put option on the asset. This is called a married put – if the asset price drops, you would make gains on the put which would help limit your loss.

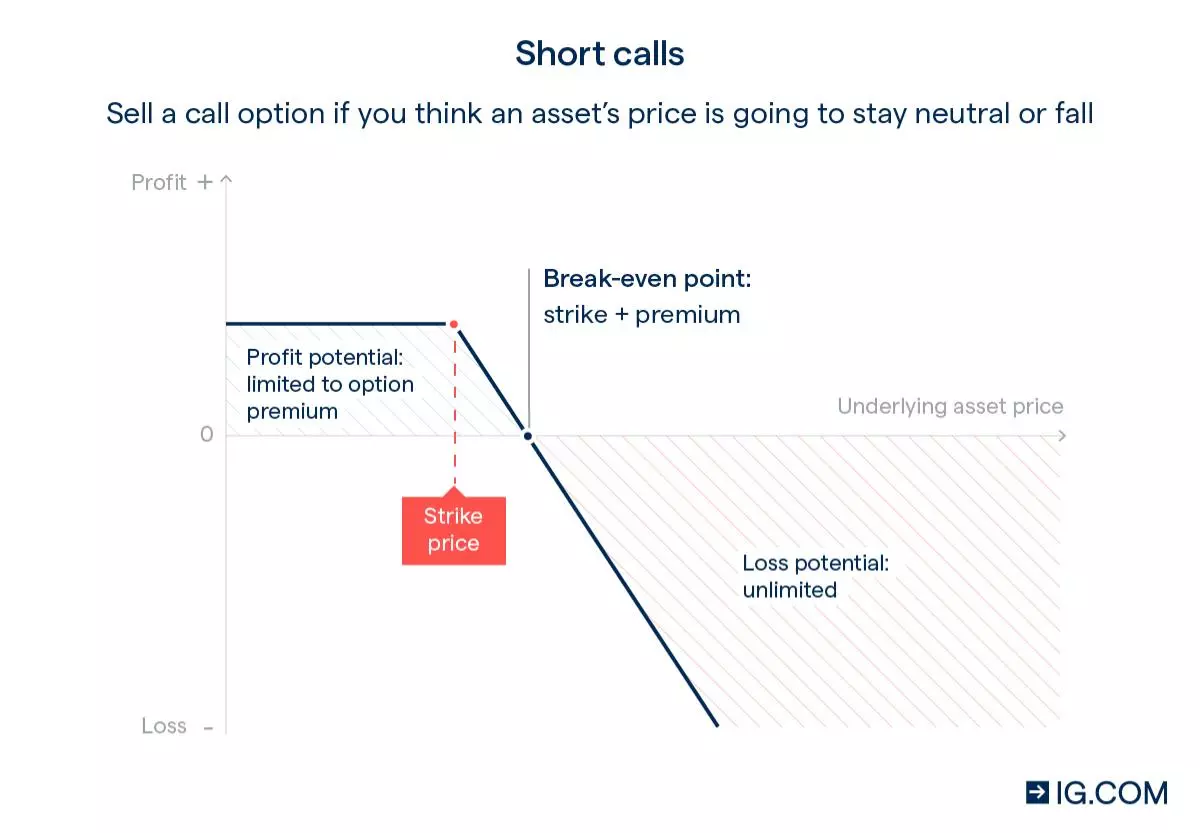

- Short calls (selling a call)

A covered call is the simplest short call position – you sell a call option on an asset that you currently own. If the price of the asset doesn’t exceed the strike price of the option you’ve sold, you keep the margin as profit. This strategy is often used to generate some income when you think an asset you hold is going to stay neutral.

Writing a call option when you don’t own the underlying asset is known as an uncovered or naked call. This is a risky strategy, as you could end up having to pay for the full cost of the asset.

- Spreads

Spreads are when you buy and sell options simultaneously. When you trade with a call spread you buy one call option while selling another with a higher strike price. Your maximum profit is the difference between the two strike prices.

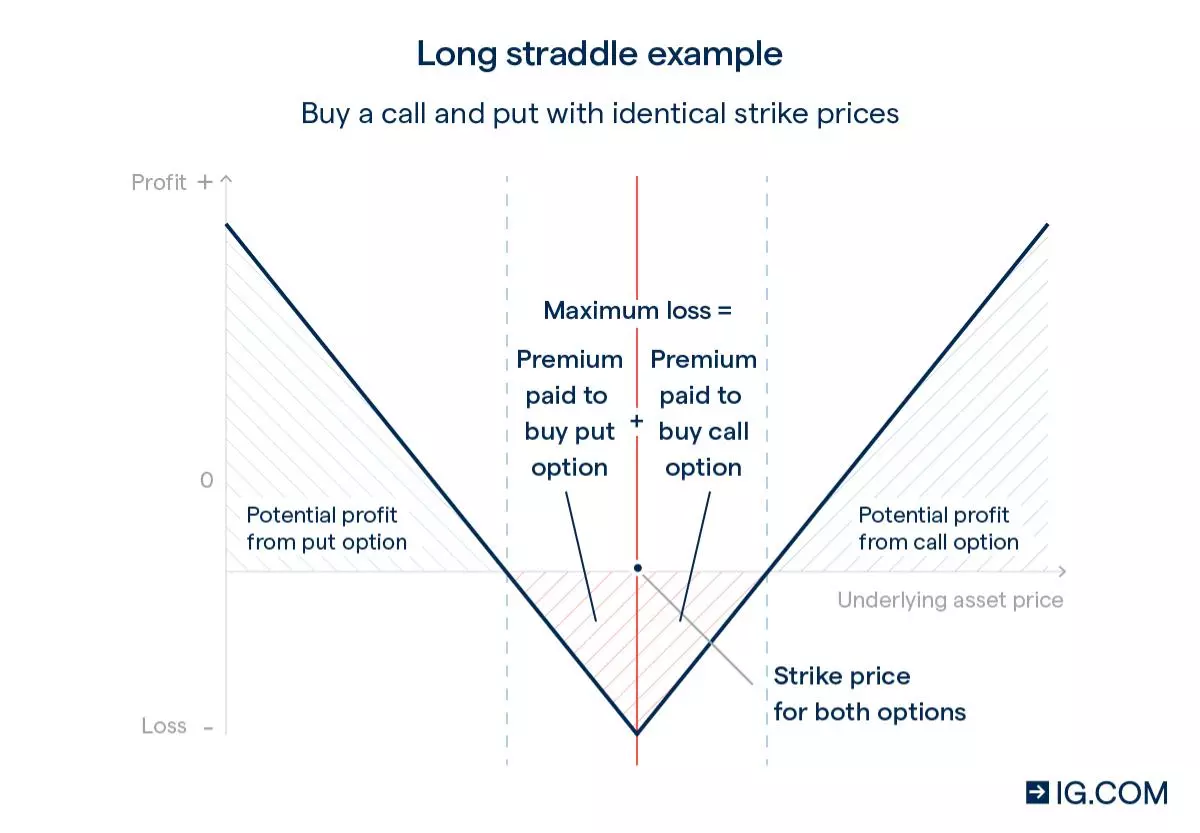

- Straddles

When you place a straddle, you buy or sell a call and a put position simultaneously on the same market at the same strike price. This gives you the potential to profit regardless of whether the market moves up or down, making them a good strategy if you expect market volatility but are unsure which way it will move.

Your break-even levels will be the strike price, plus or minus the sum of the two premiums on either side of the strike. Your maximum risk is still the price you paid to open the positions.

The break-even levels only apply if you leave your option to expire.

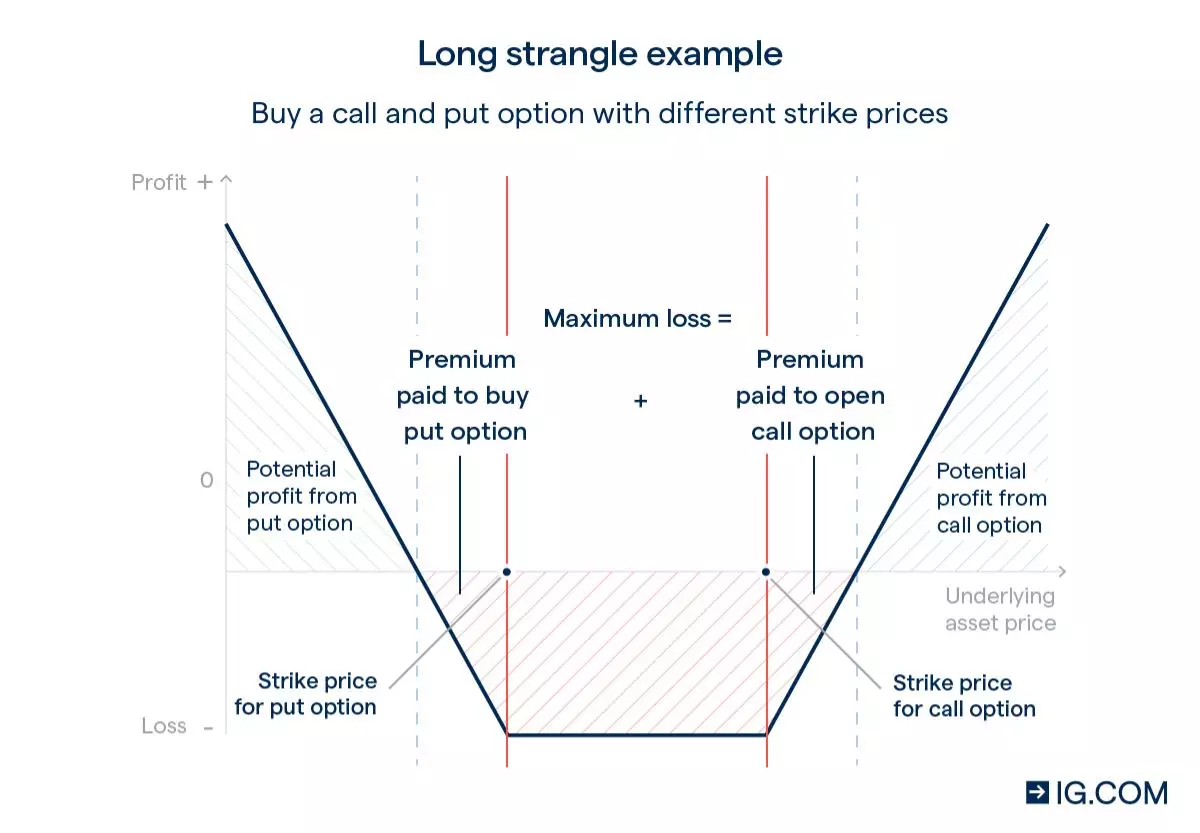

- Strangles

A strangle is very similar to the straddle above, however you buy calls and puts at different strike prices. This means that you typically pay less to open the trade, but will need a larger price movement to profit. The trade is still limited-risk.

In the above examples, if you closed your position before expiry, the closing price is affected by a range of factors including time to expiry, market volatility and the price of the underlying market.

You can find out more about options trading strategies in our strategy article.

Choose a market to trade options on

You can trade options on a huge number of markets with us.

- Forex – including majors like EUR/USD, GBP/USD, USD/CHF and EUR/GBP

- Shares – including ASX 200 shares and a selection of leading US shares

- Stock indices – including the ASX 200 and Wall Street

- Commodities – including metals and energies

Determine the time frame during which the market is likely to move

Depending on the kind of trade you’re making, you can choose between daily, weekly, monthly or quarterly options to suit your goals.

Use daily and weekly options if you want to take positions on markets quickly, but with greater control over your leverage than when trading other products – such as trading CFDs on spot markets.

If you’re looking at longer-term market movement, monthly and quarterly options mean you can take positions up to three quarters before expiry – plus you’ll know your risk upfront and usually save on funding charges.

Find out more about trading daily and weekly, monthly and quarterly options.

Decide whether to buy or sell, and place your trade

Once you know the timeframe you’re going to trade, you need to determine whether you want to buy or sell a call or put option on the market you’re trading. The type of option you trade, and whether you buy or sell, will depend on whether you want to speculate on the market rising or falling. Remember that buying options is limited-risk, while selling is not.

Once you’ve decided whether to go long or short, you can choose the strike price and premium (or margin) you want to open the position at, and place your trade.

Monitor your position

Once you’ve opened a position, you need to keep an eye on market movement and the potential profit or loss of your position.

If the option is in the money, you may wish to close it before the expiry to maximise profit. Or if you aren’t in profit you can leave your position open to expiry, and, if it fails to move into profit, only lose the price you paid to open.

Trade options with CFDs

When you trade options with CFDs, your trade mirrors the underlying options trade. A call option to buy $10 per point of the ASX with a strike price 7100 would earn you $10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position.

You need an account with a leveraged trading provider, like IG, to trade CFDs. Find out more about CFD trading.

FAQs

What is the definition of options trading in finance?

Options trading is the buying and selling of options. Options are financial contracts that offer you the right, but not the obligation, to buy or sell an underlying asset when its price moves beyond a certain price within a set time period.

Can I profit from options trading?

Yes. If you buy an option you can make a profit if the asset’s price moves beyond the strike price (above for a call, below for a put) by more than the premium you initially paid before the expiration date. Your maximum risk is the premium you pay to open.

If you sell an option you stand to make a profit if the underlying market doesn’t hit the strike price before the option expires – you profit from the premium paid to you by the holder at the outset of the trade. However, your maximum risk is potentially unlimited if the market moves in favour of the option holder.

Can I trade stocks with options?

Yes, you can trade stock options. Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date.

Can I buy a call and a put on the same stock?

Yes, there are various options trading strategies which involve simultaneously buying a put and a call option on the same market. These include straddles, strangles and spreads. Take a look at our strategy article to find out more.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.