What is thematic investing and how do you get started?

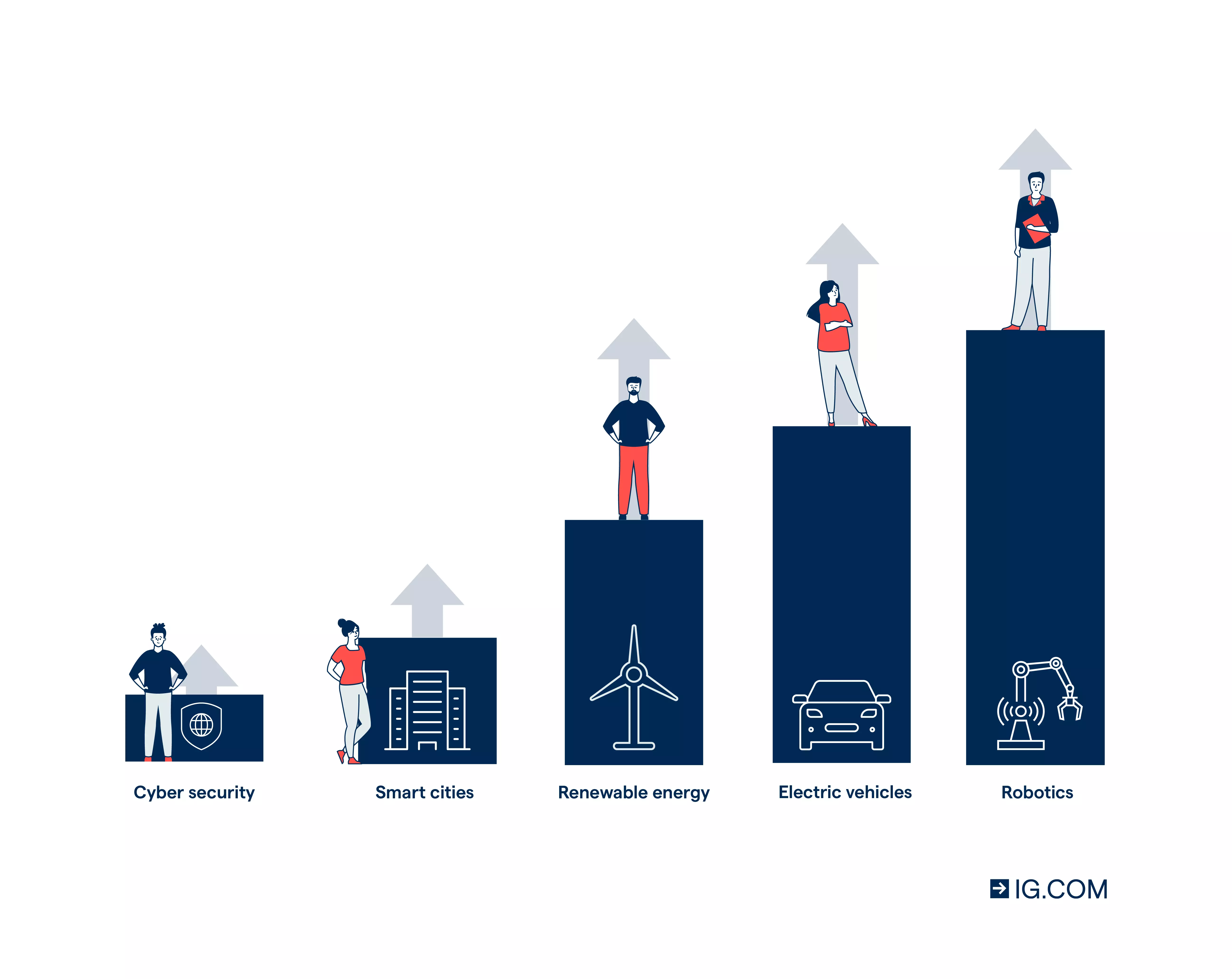

Thematic investing is a strategy driven by global trends. Themes include climate change, robotics, AI, electric vehicles and more. Learn more about thematic investing with us, Australia’s No.1 CFD trading provider*

What is thematic investing?

Thematic investing is an investment strategy based on global trends or themes believed to be disrupting the market. Many investors believe that these themes (for example, AI or electric vehicles) have the potential to generate above-average market returns in the future.

Thematic investing is sometimes seen as a type of impact investment – using themes that may contribute to the advancement of various technologies or structural shifts within economies.

Thematic investing is aligned to structural shifts like digital economies and smart cities. It can also include sustainable investing that can be done through environmental, social and corporate governance (ESG), food revolutions and clean energy etc, depending on what you believe in.

How does thematic investing work?

Thematic investing works the same as other types of investments, but it focuses in a single theme – such as renewable energy or robotics. This is usually done through thematic investment funds and ETFs based on themes you believe will generate above-average returns in the long term. However, thematic investment can also be done by investing in a collection of individual shares.

Thematic investing vs basket and sector trading

Since thematic investing is long term you will benefit from share trading, allowing you to own assets for a long period and earn dividends. Share trading is the buying and selling of ETFs or company shares, usually with the intention of making a profit or earning income from dividends.

Thematic investing centres around themes. It is gaining exposure to movements of specific trends such as ESG, electric vehicles, AI or macro-level market movements.

Basket trading, on the other hand, takes a position on shares grouped together into one index or ‘basket’.

Sector trading gives exposure to a specific area of the economy. When trading baskets or sectors you speculate on the price of a basket or related shares without taking ownership of the underlying shares.

With us, you can invest in themes via share trading – ie buying and owning specific shares or ETFs outright.

If you’re not interested in traditional buy-and-hold investing, you can use leveraged products like CFDs to get access to themes, basket or sector assets and ETFs without owning them. Plus, you can trade upward and downward price movements.

However, be cautious and manage your risk since trades are leveraged, which will result in magnified losses if the market moves against you. In other words, you could lose more than your initial deposit. To control your exposure to risk you can set automatic stops and guaranteed stop losses.2

Why do people invest thematically?

When investing in thematic shares or ETFs, you can:

- Invest in the future: you’re likely to identify macro trends and structural shifts you believe may lead to high growth in the future. For example, you may think that investing in cybersecurity companies or shares may yield high reward in the longer term

- Contribute to innovation: future trends often bring unique solutions for some of the world’s problems. For example, health technology and bio-engineering advances have brought to life the integration of robotics to human biology with the creation of bionic limbs for amputees

- Support what you believe in: if you back ethical and green investing, and care about the impact of business on the planet and society, you might find ESG investing to be aligned to your investment strategy

How to get started with thematic investing

Pick themes to focus on

It’s important to do your own research and due diligence on global trends and identify the themes that have been performing in line with your investment or trading strategy.

Let’s say, for example, you decide to invest in electric cars, fintech and robotics. While you may be tempted to merely choose the theme because you have seen a boom in those industries over recent years, you’d do well to first research and monitor its market performance over time, versus taking things at face value.

Choose how you want to invest

There are various options for you to start your journey on thematic investing, when you choose to invest with us.

You can choose to invest in ready-made funds, ETFs and investment trusts that are aligned to your chosen theme. When picking a fund, you need to choose between active and passive funds.

Investing in an active fund means you’ll be entrusting your money to a fund manager with expertise and insights on the right series of stocks, shares and investment opportunities that can hopefully beat the market and yield high returns.

When you invest in passive funds, you don’t use fund managers. This means you’ll follow the market’s movements and invest in ETFs or choose a basket of stocks and shares that mirror overall stock market performance.

Alternatively, you could invest in individual shares that are aligned to your chosen theme. This means you’d invest in an individual thematic stock. In the case of electric vehicles you could invest in one of the individual electric vehicle manufacturers such as Tesla or NIO rather than a group of stocks - as would be the case with thematic ETFs.

Note that your risk is greater as it’s spread across fewer companies. It is also harder to build your own thematic portfolio by picking stocks, but it does give you more freedom.

Remember to keep an eye on the news to find out which thematic companies might be listing soon. You can trade secondary market IPOs and more on our platform.

Consider the benefits and risks of thematic investing

Invest in something you care about. This can even be a theme you think will beat the market. You can invest in a theme easily in one click (with an ETF).

However, beware that a current boom in a specific theme is not guaranteed to be a prudent investment in the future. Ten years into its existence, the Société Générale’s World Solar Energy Index was suspended and the share price fell by 80%. This was mainly because over the years China started dominating the solar manufacturing market. This shows that potential growth must be accompanied by sound technical and fundamental analysis and risk management.

Discover our thematic and basket trading markets

- AI

- Electric vehicles

- 5G

- Water

- Robotics

- Clean energy

- US tech

- ESG

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Make your thematic investment

Take the step towards your thematic investing journey by opening a share trading account on our award-winning platform.1 Buy and sell Aussie,3 US and UK shares and ETFs from $0 commission per trade (0.7% FX fee applies to international trades)4

How to start investing in thematic shares and ETFs

Monitor global themes or trends and pick the themes to focus on

Choose how you want to invest in your chosen themes

Consider the benefits and risks of thematic investing

Use a share trading account to make your thematic investment

FAQs

What does a thematic investing strategy look like?

A thematic investment strategy will look different for every trader. You should build a portfolio focused on your theme of choice, based on your own analysis and risk appetite.

Is ESG considered thematic investing?

ESG is a trend that you could choose when considering thematic investing. The aim is to invest in assets that actively support positive change in the areas (environmental, social and governance).

People invest in ESG to align their financial markets activity with their values. This means that they’re unlikely to, for instance, contribute their capital to companies with a track record of negative impacts on the environment.

What accounts can I use to start thematic investing?

You can open a share trading account with us to start thematic investing. You can also transfer your shares from your current provider, with no charges for electronic shares. With no sign-up or exit fees, we can offer you the perfect home for your portfolio.

* Number 1 in Australia by primary relationships, CFDs & FX, Investment Trends November 2024 Leveraged Trading Report.

1 Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.

2 Stop-loss orders close your position automatically if the market moves against you. Normal stop-loss orders are free, but there’s no guarantee of protection against slippage. Guaranteed stops will close your position exactly the price you specified, but incur a premium if triggered.

3 For all fees, please see our share trading cost and charges page.

4 $0 commission applies to clients who trade on the IG share trading account and opt for the default setting of ‘instant currency conversion’. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher. Other fees and charges may apply, please see our share trading cost and charges page.