Own actual exchange-traded funds (ETFs) via IG's custodial model¹ with our award-winning² share trading platform. Trade Australian and international shares commission-free³ (0.7% FX fee applies to international trades).

Why invest in ETFs with IG Australia's share trading platform?

Real ownership via custodial model¹

Own actual ETF shares, collect dividends and enjoy voting rights. IG manages, holds and safeguards your securities on your behalf. Unlike CFD trading, you hold the underlying assets for long-term wealth building.

$0 commission on ETFs²

- Australian ETFs: $0 commission

- International ETFs: $0 commission (0.7% FX conversion fee applies)

11,000+ ETFs and shares available

Access the world's largest ETF providers including Vanguard, iShares and BetaShares.

Ideal for long-term investing

Build diversified portfolios with ETFs that track indices, sectors and commodities. Ideal for long-term investing, including retirement planning.

How to start investing in ETFs with IG

Step 1: Open your IG share trading account (for investing)

This is IG Australia's non-leveraged share trading platform.

Step 2: Choose your ETFs

Browse our extensive selection of Australian and international ETFs with real-time pricing and detailed information.

Step 3: Buy and own

Purchase ETFs and take real ownership. Watch your portfolio grow and collect dividends.

What are ETFs and why invest in them?

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges like individual shares. When you buy an ETF through IG's share trading platform, you own a portion of a diversified portfolio that can include hundreds or thousands of underlying assets.

Key benefits of investing in ETFs:

- Instant diversification: one ETF can give you exposure to entire markets

- Lower costs: more affordable than buying individual shares in multiple companies

- Transparency: see exactly what assets your ETF holds

- Flexibility: buy and sell during market hours like regular shares

- Dividend income: many ETFs pay regular distributions to shareholders

- No commission fees: $0 commission on Australian and international ETFs3

IG share trading platform vs CFD trading platform

IG share trading platform

Own actual ETF shares via our custodial model¹, collect real dividends, no leverage risk and suitable for long-term wealth building and investing.

IG CFD trading platform

Contract for difference only, dividend adjustments, leveraged positions, short-term speculation and active trading.

Popular ETFs available for investment

Access leading ETF providers and their most popular funds:

Vanguard ETFs

Popular choices include VAS (Australian Shares), VGS (Global Shares) and VDHG (Diversified High Growth). Known for low management fees, broad market exposure and suitability for long-term investors.

iShares by BlackRock ETFs

Popular choices include IOZ (ASX 200), IVV (S&P 500) and IWLD (World Index). World's largest ETF provider with comprehensive range across all asset classes and strong liquidity.

BetaShares ETFs

Popular choices include A200 (ASX 200), NDQ (NASDAQ 100) and HACK (Cybersecurity). Australian ETF specialist offering innovative thematic funds with competitive fees.

ETF investing costs

Commission

Australian ETFs: $0 commission

International ETFs: $0 commission (0.7% FX conversion fee applies)

ETF management fees

Each ETF charges an annual management fee (typically 0.04% to 0.75%) deducted from the fund's returns.

Maintenance costs

No ongoing account maintenance costs for IG share trading accounts.

Important information and target markets

Target Market Determinations (TMDs)

Australian regulations require ETF issuers to specify which investors their products suit. Most ETFs available through IG are designed for investors with high or very high ability to bear loss. You should review the relevant TMD before investing to ensure the ETF suits your objectives, financial situation and needs.

Review TMDs from popular providers:

Investment risks to consider

- Market risk: ETF values fluctuate with underlying markets

- Currency risk: international ETFs may be affected by exchange rates

- Tracking error: ETF performance may deviate slightly from its index

- Liquidity risk: some ETFs may have wider bid-offer spreads

If you need assistance with TMDs, contact us.

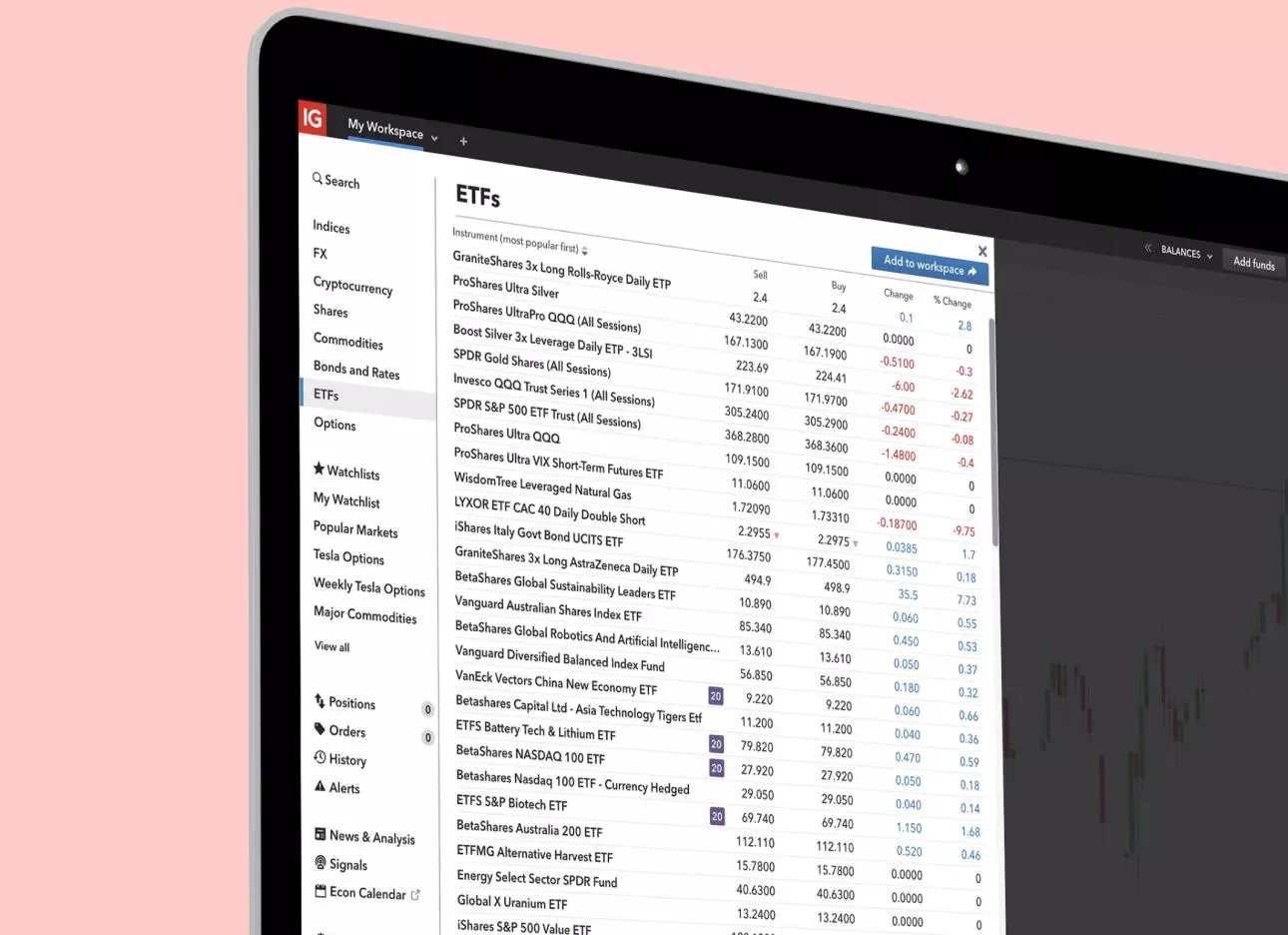

Live ETF prices

Access live ETF prices to make real-time trading decisions.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Latest ETF news and analysis

-

Bitcoin capped by technical resistance as ETF inflows and macro forces collide

2026-01-06T11:14:56+0000 -

Macro Intelligence: what Israel-Iran tensions mean for Australian energy investors

2025-06-18T06:16:55+0100

Download the IG app

Download the IG app to trade and invest in ETFs on the go.

FAQs about trading non-leveraged ETFs

What’s the difference between IG’s share trading and CFD trading?

IG’s share trading platform lets you buy and own actual ETFs and shares (non-leveraged investing). CFD trading involves leveraged derivatives, meaning you can speculate on price movements without owning the underlying asset. This page covers the share trading platform, for investors looking to directly own ETFs.

How much do I need to start investing in ETFs?

You can start by purchasing a single ETF unit. Prices vary by fund — many ASX-listed ETFs are priced around $100 per unit, while some may be higher or lower. With IG’s $0 commission on Australian and global ETFs (conditions apply), you can start with smaller amounts, making it easier to build your portfolio over time.

Can I set up automatic ETF investments?

IG doesn’t currently offer automatic or recurring investment plans. However, you can place ETF trades manually at any time through your IG share trading account.

Do I own the ETFs I buy through IG?

Yes, when you buy ETFs through IG’s share trading platform, you own the underlying securities via a custodial arrangement. This means you’re entitled to dividends and corporate actions, unlike CFD trading where you do not own the assets.

Try these next

1 - When investing with us, you'll do so via our share trading platform using our custodial model. This means that we manage, hold and safeguard securities you choose to buy and sell on your behalf. Via our custodial model, you'll be able to buy and have a stake in actual assets – for example, shares in an ASX 200-tracking ETF or ASX 200-constituent company. You'll also be entitled to dividends if any are paid, and granted voting rights if applicable.

2 - Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.

3 - $0 commission applies to clients who trade on the IG share trading account and opt for the default setting of ‘instant currency conversion’. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher. Other fees and charges may apply, please see our share trading cost and charges page.