Investing essentials

When investing with us, you’ll use a share trading account to buy assets like shares, funds or bond ETFs to own, with the aim of making a profit over time.1 There are two ways to make money from an investment – when the value of the asset appreciates and from dividend payments – if the company grants them.

How to start investing: shares, ETFs and bonds

How to invest in shares

Discover how to buy and own company shares. There are 11,000+ international shares you can invest in to own a piece of the company.

How to invest in ETFs and funds

Use exchange traded funds (ETFs) to invest in a collection of shares that fit a particular theme to get exposure through a single point of entry.

How to invest in bonds

Learn how to buy and sell corporate and government bonds and bond ETFs to diversify your portfolio and receive interest on the investment for the duration of the term.

How to invest in property

Learn more about buying income-producing real estate assets that are publicly listed and get dividend payments paid out to investors from rental income.

Our investment product in Australia

Share trading (traditional investing)

As a company’s market value goes up and down, so does the price of its shares. Investing means buying and taking ownership of a company’s shares, so you can sell them on to make a profit if their value rises.

Smart Portfolios

Reach your financial goals sooner. Choose from a wide range of tailored portfolios that suit your risk profile and are expertly handled by our wealth managers.

How to invest in bonds

Learn how to buy and sell corporate and government bonds and bond ETFs to diversify your portfolio and receive interest on the investment for the duration of the term.

How to invest in property

Learn more about buying income-producing real estate assets that are publicly listed and get dividend payments paid out to investors from rental income.

Latest investment news

-

Alphabet earnings preview: will cloud and AI justify the $4 trillion valuation?

2026-02-03T05:21:30+0000 -

Amazon Q4 2025 earnings preview: AWS growth and cash flow concerns under spotlight

2026-01-29T02:44:44+0000 -

Tesla Q4 2025 earnings preview: Optimus and robotaxi progress amid margin pressure

2026-01-21T06:16:06+0000

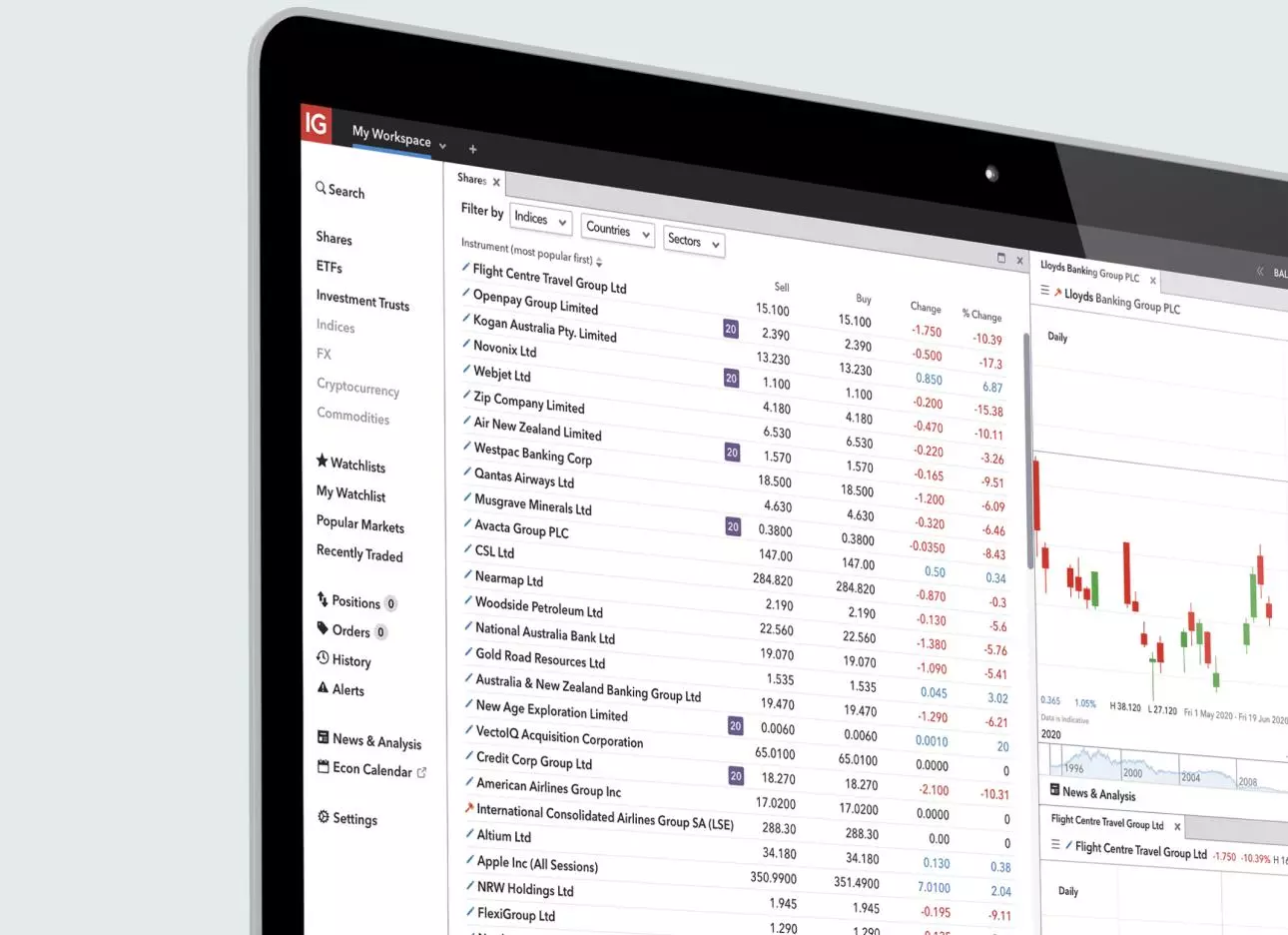

Live share, ETF and bond ETF prices

Invest in thousands of global brands, ETFs and bonds ETFs using our share trading account and earn dividend payments if the company grants them. You can buy and own a small piece of the brands you love and have voting rights on company matters. We offer more than 11,000 markets that you can invest in.

Prices above are subject to our website terms and conditions, and prices are indicative only.

Extended hours share prices

Take advantage of multiple investment opportunities when the market has closed so that you don’t miss out on getting exposure.

Trade 700 US shares 24/52. Our extended hours offering gives you access to the most popular US shares, ETFs and bond ETFs when there’s a lot of volatility in price due to the low number of active investors.

When there’s volatility, there tends to be a lot of risk involved in investing after-hours. This is because there’s reduced liquidity and wider spreads, which can move the price quickly in either direction. You’ll have to take necessary steps to manage your risk.

Here’s a list of top US shares you can trade after hours with us:

Prices above are subject to our website terms and conditions, and prices are indicative only.

Investing resources for traders in Australia

- Improve your knowledge base on how investing works using our extensive resource tools that are available on IG Academy

- Stay in the know on everything that’s happening in different markets by checking out our news updates before you get exposure

- Learn more about different investment strategies and styles you can use when investing, and learn how to improve your chances of success

Fast execution on a huge range of markets

Enjoy flexible access to 11,000+ domestic and international shares and ETFs, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our award-winning trading app*

Feel secure with a trusted provider

With more than 51 years of experience, we’re proud to offer a truly market-leading service

*Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.

Fast execution on a huge range of markets

Enjoy flexible access to 11,000+ domestic and international shares and ETFs, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our award-winning trading app*

Feel secure with a trusted provider

With more than 51 years of experience, we’re proud to offer a truly market-leading service

*Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.

What is investing?

Investing is buying and holding an asset with the aim of making a profit in the long run when the market price has appreciated. You can invest in shares, ETFs, bonds and more.

How can beginners start investing in Australia?

You can start investing in Australia by picking the asset you want exposure to and researching its performance over time. You’d then open a share trading account that gives you access to over 11,000 markets with us. To get exposure, you’d go long and commit the full value of your position upfront.

How can I choose the best investment platform?

When looking for the best investment platform, you need to consider the types of investments it offers, the fees charged, the usability of the platform and customer support to clients.

Explore the ins and outs of share trading and learn how to get started.

Find out what you'll pay when investing with us using our share trading account.

Find all the important documents you need to start share trading with us.

1 When investing with us, you’ll do so via our share trading platform using our custodial model. This means that we manage, hold and safeguard securities you choose to buy and sell on your behalf. Via our custodial model, you’ll be able to buy and have a stake in actual assets – for example, shares in an ASX 200-tracking ETF or ASX 200-constituent company. You’ll also be entitled to dividends if any are paid, and granted voting rights if applicable.

2 Trading hours run from Monday 10am to Saturday 7am (AEST). During daylight savings, hours shift to Monday 9am to Saturday 6am (AEDT).