Analysts expect a gloomy Q1 earnings season

Earnings expectations have been cut back as we near Q1 earnings season, but does that set up the potential for a more positive performance this time around, potentially boosting the Dow further?

Tough Q1 earnings season expected

Stocks may have rallied hard from their 2022 lows, shrugging off a mini banking crisis in the process, but it looks like investors remain sceptical that the economy and earnings can rebound in a similar fashion.

Data from FactSet shows that earnings estimates for Q1 2023 have fallen by 6.3% since the end of 2022, compared to a ten-year average of 3.3%. This downgrade in forecasts, FactSet notes, matches up with an increase in the number of US firms issuing negative earnings guidance. 106 companies in the S&P 500 have set out negative guidance for the quarter, compared to the average of 65.

All this sets up a very negative backdrop to earnings season this time around. But paradoxically this allows room for upside surprises, with companies beating forecasts, resulting in stocks moving higher after earnings and boosting indices to new highs for the year.

What are the expectations for earnings season?

Total earnings for the S&P 500 are expected to have fallen 9.4% from the same period a year ago, though revenues are forecast to be 1.4% higher.

What effect will higher interest rates and inflation have?

More than a year of focus on inflation and higher interest rates means that these issues will continue to dominate the upcoming earnings season.

We can expect companies to remain cautious on the outlook for the year, though recent signs of a slowdown in price growth may now begin to feed through to company reporting. In addition, a tentative sense of optimism may filter through now that the pace of central bank hiking has slowed, reinforced by a sense that a recession is perhaps less likely than was the case at the beginning of the year.

Can stocks sustain gains into the rest of the year?

Stock markets have seen two quarter of gains since October, a marked change from the run of declines that dominated throughput 2022.

Crucially, valuations have moved only slightly higher for US stocks since October. The S&P 500’s PE ratio then was around 17, and it is now 19, reflecting the rise in prices. But it is not yet pricing in too much good news, and, combined with low earnings expectations, suggests that we might yet see further upside into the middle of the year, or even beyond.

Rate cuts and recession fears are going to be the big drivers outside earnings season, and we should expect commentary around this in earnings reports as well. Ultimately, the longer-term direction of earnings and stock prices will be determined by whether the US and global economies go into recession, but this earnings season will be a crucial moment for gauging whether one will arrive in 2023, or whether we might escape until later in 2024.

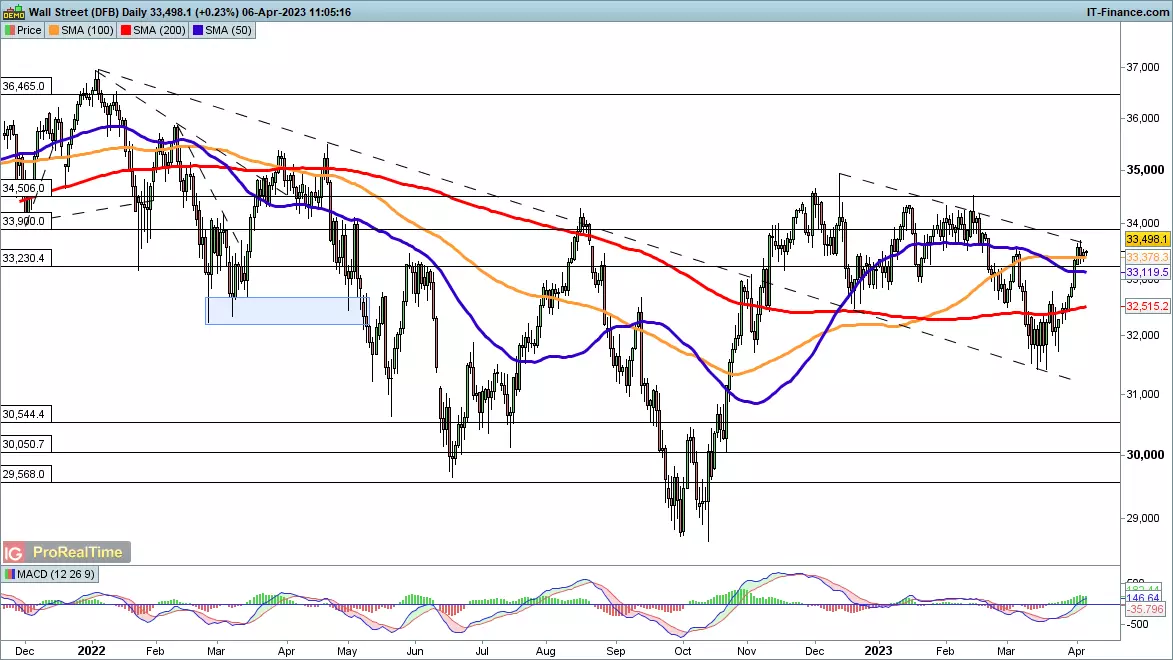

Dow Jones price – technical analysis

US stocks have had an impressive recovery from the lows of September and October, though in percentage returns they have lagged behind their European peers.

The index now finds itself at trendline resistance from the December highs, after rebounding from the March lows which saw it test trendline support. This potential descending channel is a worrying sign for bulls, but a move above 33,700 would see the channel broken to the upside and a move back to the January and February highs around 34,300 come into play.

Alternately, a reversal from trendline resistance might yet point towards a new decline towards the lower bound of the channel, and in this case that suggests a move to 31,000. Such a move would wipe out most of the gains made since last October.

Earnings season, plus Fed commentary, will be crucial to watch as we head into the second half of April and beyond, and will likely decide the fate of the current market rally into the second half of 2023.

Dow chart

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices