AUD/USD hits yearly low, records major weekly loss amid US CPI and market risks

The Australian dollar falls sharply to year-low, dropping 1.76% due to strong US CPI and risk aversion, with recovery depending on Chinese GDP, commodities, Fed talks, and an Australian jobs report.

It was a frustrating end to last week, as a third consecutive month of firm US CPI data and risk aversion flows sent the AUD/USD spiralling back to year-to-date lows, locking in its most significant weekly loss (-1.76%) since last November.

The latest setback to the AUD/USD's ambitions comes just a week after it appeared that surging commodity prices, and better-than-expected global PMI data might conspire to propel the AUD/USD above .6700c for the first time in three months.

Whether the AUD/USD can regain lost altitude; this week will depend on various factors, including tomorrow's Chinese GDP data, commodity prices, risk sentiment, messaging from the host of Fed speakers scheduled to talk this week, and, of course, Thursday's crucial Australian jobs report previewed below.

What is expected from the labour force report for March (Thursday, 18 April at 11.30am)

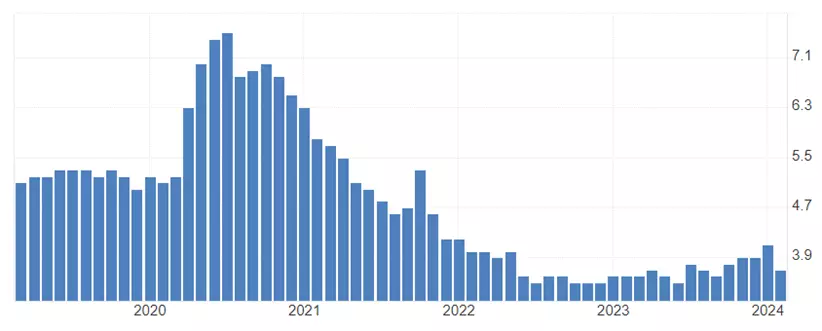

In February, the Australian economy added 116.5k jobs, versus consensus expectations of +40k. The robust increase in jobs saw the unemployment rate fall to 3.7%, the lowest since September 2023, from 4.1% prior. The participation rate ticked up to 66.7% from 66.6%. Meanwhile, the underutilisation rate, which combines the unemployment and underemployment rates, fell by 0.5 percentage points to 10.3%.

The ABS noted that the solid job growth in February followed a “larger than usual number of people in December and January who had jobs that they were waiting to start or to return to. This translated into a larger-than-usual flow of people into employment in February, even more so than in February last year.”

In March, the market expects the economy to lose 40k jobs, and the unemployment rate to rebound to 4% from 3.7%. As the seasonal noise around the holiday period begins to subside, we expect to see further evidence of cooling within the labour market emerge and reiterate our call for the RBA to cut rates by 25 (basis points) bp in August, before a second cut in November, which will see the cash rate end the year at 3.85%.

AU unemployment rate chart

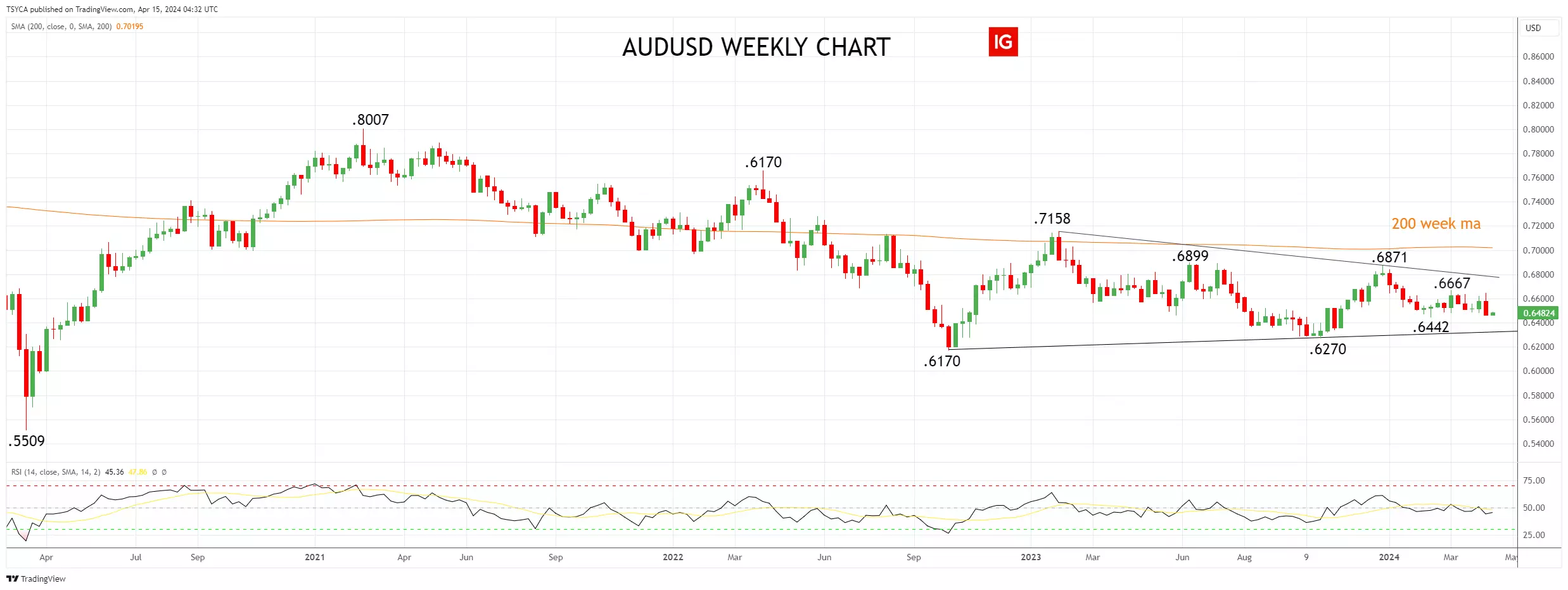

AUD/USD technical analysis

On the weekly chart, the AUD/USD continues to move sideways within a contracting multi-month bearish triangle. Downtrend resistance from the January 2023 .7158 high is currently at .6780c. Uptrend support from the October 2022 .6170 low is at .6330c.

AUD/USD weekly chart

Last week's reversal lower from Tuesday's .6644 high saw the AUD/USD cascade through several important support levels, including the 200 days moving average at .6540.

At this point, support from ahead of the year-to-date low of .6442 has halted the decline, and if the rebound does extend back above .6550ish, it likely confirms that the AUD/USD is enveloped within a .6450-6650 type range.

Aware that if support at .6442 were to give way, there is little to prevent the AUD/USD from moving lower towards weekly support at .6330.

AUD/USD daily chart

- Source TradingView. The figures stated are as of 15 April 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices