Outlook on the BP share price ahead of Q1 earnings

Is BP in a good position to close the valuation gap with its peers?

BP profits may slow

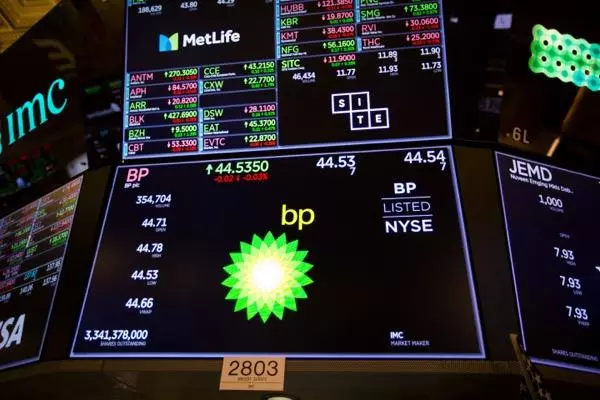

BP PLC is scheduled to report its first quarter 2024 financial results on May 7, 2024.

Analysts expect BP's profits to slow due to a lower oil price, weaker refining margins and concerns over its energy transition strategy. Despite that they still rate the oil and gas behemoth a s a ‘buy’ with a mean of estimates suggesting a long-term price target of 608.15 pence for the share, roughly 18% higher than the current price (as of 2 May 2024).

Revenues for the first quarter are forecast to be around $49,315 billion, a significant decrease from around $56,951 billion in Q1 2023 with pre-tax profits dropping from $8,535 billion in Q1 2023 to $6,371 billion in Q1 2024. Earnings per share are estimated to come in at $0.18, down from $0.27 per share last year.

These numbers have to be put into context, though: the oil price has risen by about $10 since the start of the year to around $80 per barrel which is likely to boost Q1 income, even if refining margins have decreased. Having said that, while rivals such as Shell continue to focus on fossil fuels, BP has pledged to achieve net zero emissions by 2050 – in line with the UK government’s energy transition plan - meaning it is diverting funds into green technologies instead of oil and gas projects.

This ‘green’ strategy explains BP share price’s underperformance versus its peers as it makes its shares less attractive to investors betting on a continued boom in fossil fuels.

BP, Exxon Mobil, Shell and TotalEnergies year-to-date share price comparison chart

Likely UK elections and difficulties in implementing the UK’s 2050 green energy transition strategy may lead to companies such as BP adopting a more flexible approach with the company recently stating it will “pragmatically adapt” and may increase oil and gas output until 2027 as well as grow its liquid natural gas (LNG) portfolio 9% by the end of next year. These moves should ease investor concerns about overcommitting to renewables.

Delivering shareholder value

Despite the focus on decarbonization, BP remains highly profitable and its shares trade at a price-to-earnings (P/E) ratio of just 7, far below its fossil fuel-focused peers' average of 14.6.

To address this, new CEO Murray Auchinloss has pledged to make BP a "higher value company" for shareholders. Part of this involves a 17% dividend increase to 28 cents per share, now yielding 4.3% - ahead of the FTSE 100's 3.8% average.

BP will also implement huge $14 billion share buybacks over 2023-2025, directly boosting shareholder value.

Oil price remains key value

While risks remain around falling oil prices and government pressure to accelerate decarbonization, BP looks well-positioned for the years ahead.

If supply-demand dynamics strengthen, higher oil and gas prices will boost BP's profits despite its diversification push. This could be a key driver behind a rising share price over the coming year.

With valuations still lagging rivals and new shareholder-friendly strategies being implemented, BP's current share price undervaluation looks difficult to justify. The gap seems likely to close as the markets reassess the company's strengths.

Technical outlook on the BP share price

The BP share price, up around 9% year-to-date, seems to be tracking the oil price lower but is hovering about immediate support seen around the 504.6 pence mid-April low.

BP Daily Candlestick Chart

More significant support can be seen between the November-to-February highs, the 200-day simple moving average (SMA) and 2024 uptrend line at 489.92p to 487.2p. While this support zone holds on a weekly chart closing basis, this year’s uptrend remains intact.

Since the decline from the 541.0p April peak looks technically corrective, once the current move lower has run its course, another up leg is likely to ensue. This should the take the BP share price to its October peak at 562.3p.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get commission from just 0.08% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices