The Bank of Japan: First one in, last one out

High inflation could force Japan’s central bank to move.

Japan was the first one into zero interest rates and unconventional monetary policy, and it appears it will be the last one out. In this week’s IG Macro Intelligence, we assess Japan’s economic fundamentals, discuss the likelihood of tighter policy from the Bank of Japan, gauge whether the central bank could intervene again in the FX markets, and summarize the factors driving Japanese stocks to multi-decade.

Has Japan finally sleighed the deflation dragon?

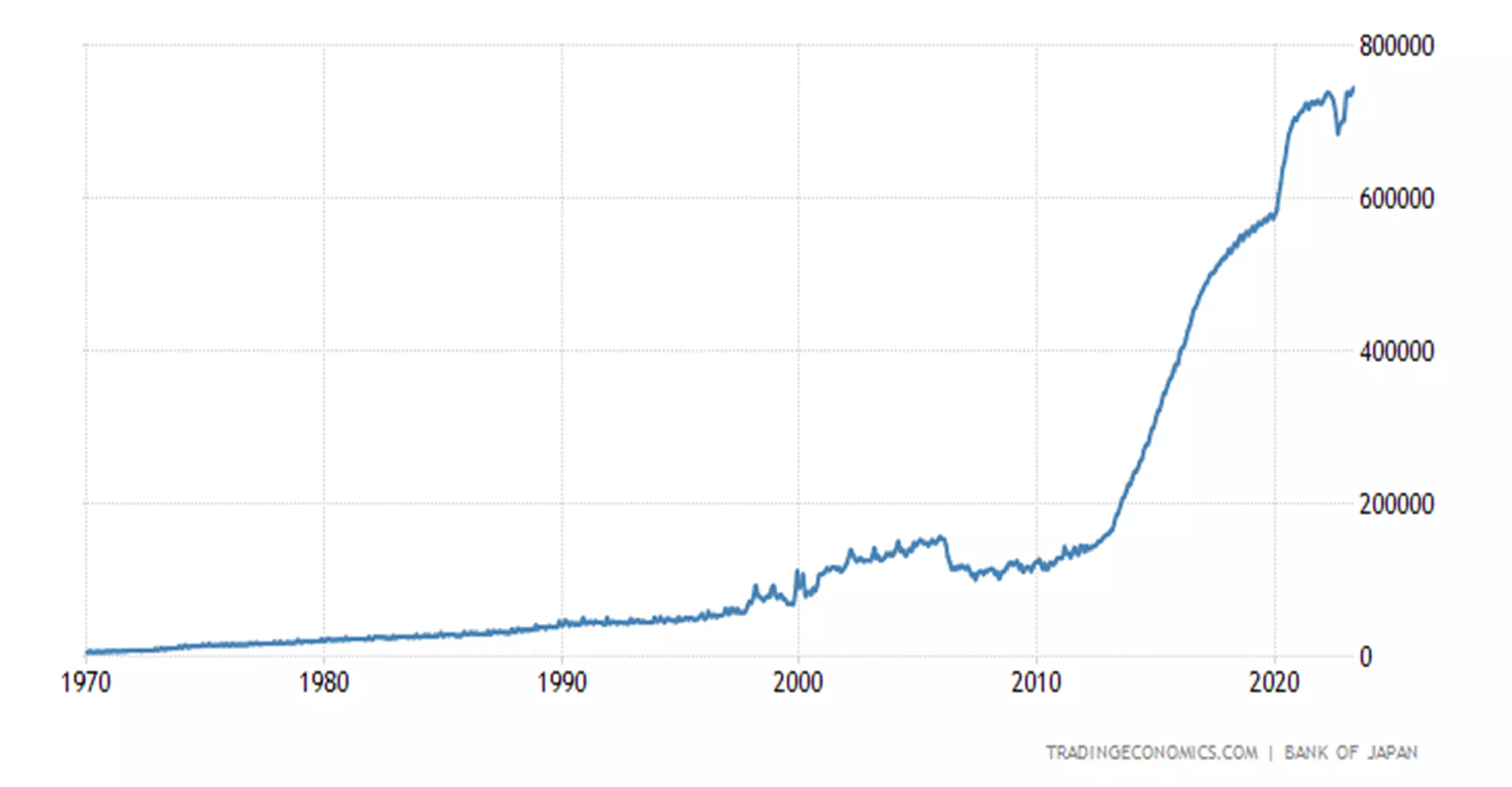

For decades, Japan has battled powerful deflationary pressures driven by a combination of massive leverage, weaker demographics, and underwhelming economic growth. The Bank of Japan was the first major central bank to embark on so-called Zero Interest Rate Policy (or “ZIRP”) and other “unconventional” monetary policies like quantitative easing. The central bank purchased trillions of Yen worth of government bonds and even corporate debt, property, and equities.

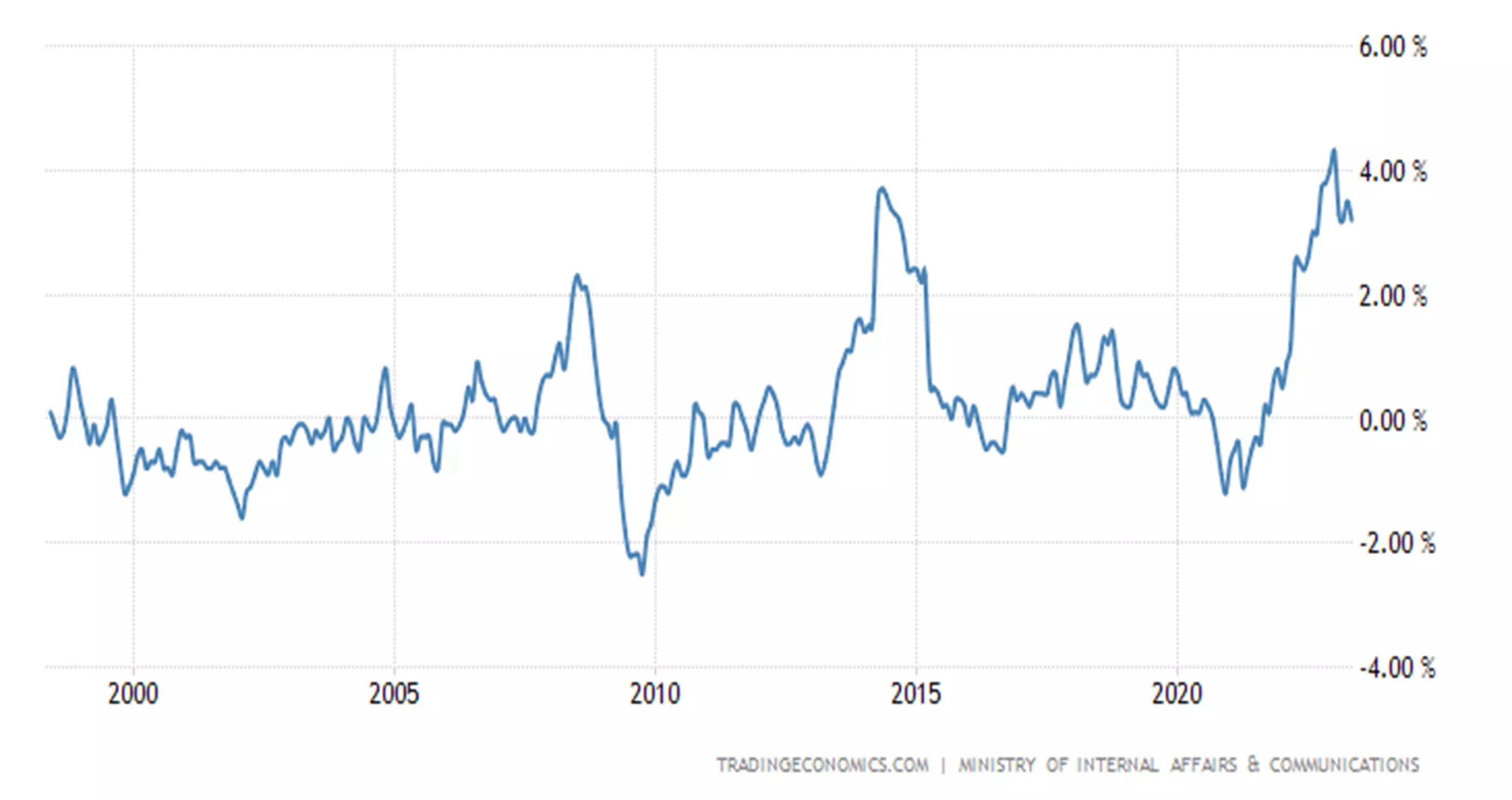

Despite this, the forces of deflation were stubborn. Before the COVID-19 pandemic, Japan’s inflation rarely reached the BOJ’s 2% target and frequently slipped into negative territory.

That all changed following the onset of the pandemic. Massive stimulus and supply disruptions worldwide led to a global inflation shock, which also managed to lift Japan’s inflation rate. Japanese Core CPI has run above 3% for over a year, peaking above 4%, with last week’s latest figure showing price growth at an elevated 3.1%.

Could the Bank of Japan tighten policy and scrap YCC?

Although consistently above the 2% target, years of undershooting its mandate have led the Bank of Japan to keep policy practically unchanged, even as other central banks tightened aggressively.

The reason for this comes back to the concept of “anchoring” expectations. For central bankers, inflation works through an expectations channel, and sustaining a healthy level of inflation is brought about making consumers and businesses believe prices will rise at a particular rate in the future. The BOJ is using this inflation shock as a way of pushing up expectations in the hope it supports a higher inflation rate in the future.

This policy does not come without risks, and it's widely believed that the Bank of Japan will tighten monetary settings at the margin to avoid “overshooting”. While it is unlikely that the central bank will tweak traditional interest rates, it will tinker with its Yield Curve Control policy, or “YCC”.

YCC is an “unconventional” monetary policy tool where a central bank will target a particular yield for one part (or, rarely, parts) of the yield curve. In the case of the Bank of Japan, it has chosen the 10-year Japanese Government Bond yield. The supposed benefit to the economy from this policy is that it keeps borrowing rates low a long way out into the future, supports asset valuations, and lowers the hurdle rates of investments.

The Bank of Japan implemented the policy in 2016. During the pandemic, it capped the yield at 0.25% before high global inflation, and subsequently, higher global bond yields forced the central bank to lift it to its current 0.50%. It’s now considered a matter of when and not if the BOJ changes the policy, with the market testing the upper limits of the target earlier this year.

The end of YCC could have huge market implications, ranging from a stronger Japanese Yen, weaker Japanese equity prices, and perhaps a massive reversal of financial flows from the rest of the world back to Japan, as Japanese investors find safer yield in domestic risk-free assets.

Will the BOJ intervene in the FX market?

The Japanese Yen has progressively depreciated over the past two years. The USDJPY rose to a 32-year high last year, mostly due to widening interest rate differentials between Japanese Government Bonds and US Treasuries. While it is the yield spread between both bonds that drives strength in the USDJPY, simply overlaying the US 10 Year Treasury yield with the pair illustrates the dynamic. This is because as the US Federal Reserve pushed rates higher, the Bank of Japan pegged interest rates a fraction above 0%.

Given the significant yield spread and the high chance the trend will continue, it’s likely that the USDJPY will continue to trend higher. It begs the question of whether the Bank of Japan will intervene in the currency market in order to defend its value and protect the economy from capital outflows, financial instability, and inflationary pressures. The central bank “jawboned” the Yen twice in 2022: once when the USDJPY traded at 135, and once when it was at 143, roughly where it is presently.

In recent days, Japan’s Finance Minister, Shunichi Suzuki, has delivered a verbal warning about the depreciation of the Yen, calling it “sharp and one-sided”. He vowed to “respond appropriately” if it persists.

The USD/JPY’s trend is to the upside as momentum points higher. Sellers will likely emerge at any test of previous resistance at 150. Meanwhile, short-term trend line support is around 141, with another key level to watch at 138.50. Primary trend line support is just below 130.

What is driving the TOPIX to multi-decade highs?

Japan’s equity market has surged this year. Year-to-date, the cap-weighted TOPIX Index has risen 20% to hit levels not seen since 1990 - around the end of the Japanese asset bubble.

Some of the move higher in Japanese stocks can be attributed to a weaker Yen. Although the correlation has fluctuated over the last two years, a weaker Yen tends to support equity prices. The mechanism is two-fold. Firstly, a lower Yen makes Japanese assets cheaper on a relative basis. Second, and perhaps more importantly, the weaker Yen supports the exporter-heavy stock market, boosting corporate earnings.

A key governance change has also supported the rally in Japan’s stock markets. The Tokyo Stock Exchange has said it will encourage companies with price-to-book ratios below one to come up with better capital management plans. The price-to-book ratio is a measure of a company’s stock price compared to the assets it owns. A low price-to-book is often an indicator a business isn’t working its assets hard enough to drive returns. It is hoped the TSE’s policy will drive greater investment and stronger growth by Japanese firms.

When looking at the Nikkei, the index appears poised for a pullback. The weekly RSI is diving from overbought territory, signifying a momentum reversal. Resistance has been formed at 34,000, while the first level of major support appears around 30,600.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Live prices on most popular markets

- Forex

- Shares

- Indices