What is bitcoin? Everything you need to know

Bitcoin is what comes to mind when most people think of cryptocurrencies. We’ve put together a cover-all-bases guide to bitcoin, from what it is and why it’s valuable, to why bitcoin is so volatile and whether it’s safe.

What is bitcoin?

Bitcoin is a decentralised digital currency – known more commonly as a cryptocurrency. Bitcoin is the largest cryptocurrency in the world in terms of market cap, but also in terms of name recognition and desirability for those seeking exposure to the crypto market.

There is also another definition for bitcoin, which is for ‘Bitcoin’ with a capital ‘B’. This definition is associated with the peer-to-peer network that underpins the entire system, while bitcoin with a lowercase ‘b’ is associated with the coins themselves.

So, while you can own bitcoins and it might cost you ten bitcoins to buy a new car, you might also think that Bitcoin’s infrastructure needs updating.

Who created bitcoin?

Satoshi Nakamoto is credited as being the person or persons who created bitcoin. But, this is a pseudonym, and no one knows who Nakamoto really is. Despite this, it was the name on the initial white paper that proposed the concept of bitcoin back in 2008 – ‘Bitcoin: A Peer-to-Peer Electronic Cash System’.

Nakamoto left the project in 2010 without ever revealing much about who they were. But, the departure of the person or persons behind bitcoin is of little consequence to current developers and coders who remain. According to bitcoin’s website: ‘the identity of bitcoin's inventor is probably as relevant today as the identity of the person who invented paper’.1

How does bitcoin work?

Bitcoin works as a decentralised peer-to-peer virtual currency. What does that mean? Well, ‘decentralised’ means that there isn’t an overarching body that regulates bitcoin transactions. Instead, bitcoin operates according to a majority-rules principle, whereby a transaction won’t be considered valid until at least 50% of the machines on the network have verified it.

‘Peer-to-peer’ means that you can send bitcoins to other users on the network without having to go through any middlemen – such as a bank or third-party payment mediator. Instead, you might say that you wanted to buy a pizza using bitcoin, and you’d see who was willing to sell pizza to you while accepting bitcoin as a form of payment.

‘Virtual currency’ means that no physical, tangible bitcoins exist. There are no metal bitcoins out there that you can hold in your hand like you can with US cents or British pound coins, and there likely never will be. Instead, every new bitcoin is created entirely electronically.

Example of how bitcoin works

At a very basic level, bitcoin works in the same way as many other currencies around the world. It can be exchanged for goods and services with vendors who accept it as a form of payment. Bitcoins are stored in digital bitcoin wallets, not entirely dissimilar to the wallet in your pocket.

If you wanted to buy something with bitcoin, you’d go to your bitcoin wallet and choose to send an agreed amount of bitcoins to a vendor. Bitcoin transactions use a ‘private key’ to confirm the exchange of coins between wallets – which helps to increase security.

Once a transaction has been completed, it is lumped together with other completed transactions into a ‘block’, which is then assigned a unique signature – called a ‘hash’. The hash is a very important part of how bitcoin works, and simply put, it is formed using all the transaction data contained in one particular block, condensed down into a readable and easily-distinguishable code.

Once a block has a hash, it is broadcast to the network for verification and if it is determined to be valid, it is added to the ‘blockchain’ for everyone else on the network to see. Now, while these words might seem like jargon, they’re each defined in more detail later in the article.

What is bitcoin mining?

Bitcoin mining is the process of collecting bitcoin transactions into blocks, and then generating a hash for that block. It is performed by ‘miners’, who use computers – known as ‘mining nodes’ – in a race to be the first to generate a hash for a new block of transactions.

Think of a ‘block’ in bitcoin as, quite literally, a collection of transactions that have been grouped together. To create a block, a few things need to happen.

Firstly, a miner will need to verify that a transaction is possible. This is done by checking that the person using bitcoin to buy something on the network has enough funds to complete the transaction. This involves cross-referencing the details of this transaction against the previous transaction history stored in the existing blockchain.

Once they’ve verified that this transaction is possible by establishing that the buyer has enough coins to complete the purchase, the miner will collate a group of legitimate transactions together to form a block.

Next – and this is the tricky bit – a miner will attempt to generate a hash for this new block of legitimate transactions. The hash is unique to this block and its transaction data, so no two hashes are ever the same.

After a hash has been created, there is a cryptographic mathematical proof that the transactions in this block are valid – and once the proof has been verified by 50% of the network, the block is added to the blockchain. As a whole, the network will only generate a new hash once every ten minutes or so, and the hash difficulty is increased as new machines join the system.

How are bitcoins created?

Bitcoins are created as a reward for the first miner to create a hash for a block of transactions. This means there is a race between the miners to be the first to generate a hash and receive this block reward.

The reward halves every four years or so, which is roughly the time it takes to create 210,000 blocks. After the most recent bitcoin halving that took place in May 2020, the reward for bitcoin mining was 6.25 bitcoins per block.

New coins are added to the winning miner’s bitcoin wallet, and they are free to exchange them with other users on the network. This creates more transactions which will need to be collected into blocks and assigned hashes, resulting in more bitcoins being released into the system.

This process will continue until the entire supply of bitcoins is in circulation. Currently, this supply is capped at 21 million, and estimates state that it won’t be until 2140 that the last bitcoin is mined.

What is a bitcoin node?

Bitcoin nodes can be separated into four categories: mining nodes, light nodes, full nodes and super nodes. Mining nodes perform a different function to the other three, and it’s mining nodes which are rewarded with new bitcoins for collecting transactions into blocks and generating the block’s hash.

Light, full and super nodes act as the custodians of the blockchain – the public record of every bitcoin transaction that has ever taken place. It is the job of the light, full and super nodes to maintain the network and to ensure that each block that is added to the blockchain is valid.

Mining nodes

Bitcoin mining nodes produce blocks of transactions. They aren’t responsible for maintaining the blockchain. Instead, they are responsible for collecting transactions into blocks and generating a hash for that block.

After a mining node has created a new block and that block has been given a hash, it is sent to the network of light, full and super nodes to validate it and add it to the blockchain.

When people talk about nodes in bitcoin, they often mean mining nodes – not realising that there’s a distinction between mining nodes as hash generators, and the light, full and super nodes as block verifiers and custodians of the blockchain.

Light nodes

Light nodes are used to validate portions of the blockchain. They don’t hold complete versions of it as that function is fulfilled by full nodes. But light nodes are connected to full nodes, and they serve as an extra layer of security for the entire network.

If a full node is hacked or tampered with, then the light nodes that connect to it help to determine that the transaction data for that portion of the blockchain is now false, and confirm which version of the blockchain the full node should be using.

Full nodes

Full nodes are responsible for maintaining, validating and distributing copies of the entire blockchain. Because of this function, full nodes are the go-to point for verification of blocks (they verify the cryptographic mathematical proof that is created when a block is given a hash).

Once 50% or more of the full nodes have agreed that the mining node has generated a correct hash, the block is added to the blockchain.

And, because each full node carries its own local version of the blockchain, a change to one local blockchain will need to be verified by a majority of the other full nodes to be valid.

Full nodes are able to validate transactions all the way back to the first block on the blockchain – known as the genesis block. They do this using ‘proof of work’, which is explained later.

More full nodes is a good thing for the blockchain network, because more full nodes means that the system is more decentralised, which in turn makes it harder to hack and forge information on the blockchain.

Super nodes

Super nodes are full nodes with a high number of incoming and outgoing connections to other nodes on the network. These nodes are informational relay points which ensure that every full node has the same version of the entire blockchain in their local database.

How to mine bitcoin

To mine bitcoin, you’ll need to operate a mining node that collects and processes bitcoin transactions into blocks – and which has enough computational power to have a realistic chance of being the first to generate a hash. Because of this, mining nodes are expensive to run, requiring a powerful computer and a lot of electricity to maintain.

To negate these costs and increase their chances of success, miners can combine their resources into a ‘mining pool’ which combines their individual power and resources into one. This maximises their ability to be the first to create a block of transactions and generate a hash to earn the reward of new bitcoins.

How long does it take to mine bitcoin?

The speed at which bitcoins are mined is determined by the scalability of the network. There’s more on scalability and how it’s a problem for the bitcoin network later on. At the time of writing (15 June 2020), it took an average of six to ten minutes for a block to created and added to the blockchain.

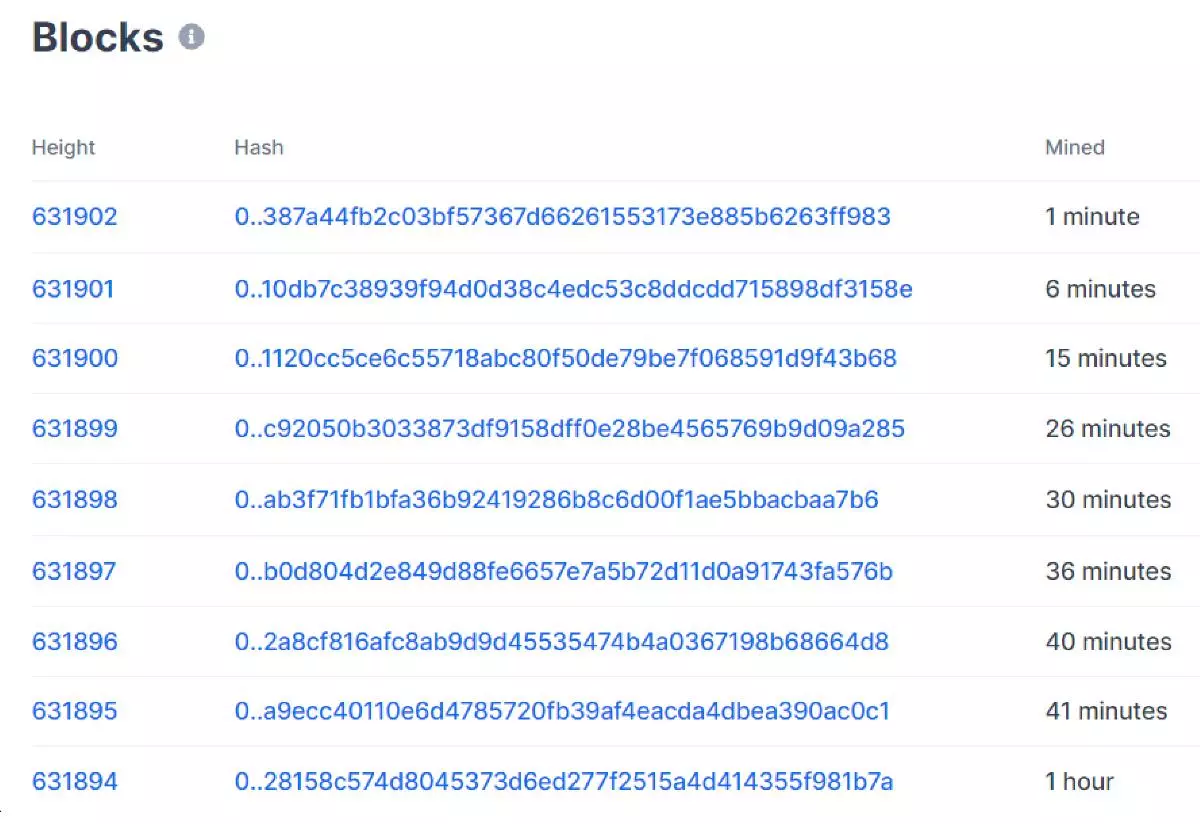

You can see a screengrab from the blockchain verification system below.

The ‘Mined’ column is how long ago the last block was created by the nodes. Some take longer or shorter than others to be created, but the average time is between six to ten minutes.

The ‘Height’ is the block number, meaning that in this particular screengrab, the most recent block to be mined was number 631,902.

The ‘Hash’ is the unique code given to that single block, and a block is only complete once it has a legitimate hash – at which point it can be added to the blockchain. The hash represents the sum of every piece of data for each transaction in a block (known as the input data).

As mentioned already, no two hashes are the same, and changing one piece of input data will result in a completely different hash – meaning that it is impossible for hashes to be tampered with or duplicated.

What is bitcoin proof of work?

The proof of work is essentially the process by which the transactions in a block are validated – and once the proof of work has been established and the transactions in a block are valid, the entire block is added to the blockchain.

Proof of work in a general sense is a piece of data which is difficult to produce in terms of time, complexity and expenditure, but relatively easy for other users on the network to read, understand and verify once it has been created. In Bitcoin’s blockchain, the proof of work is the hash that is given to each new block.

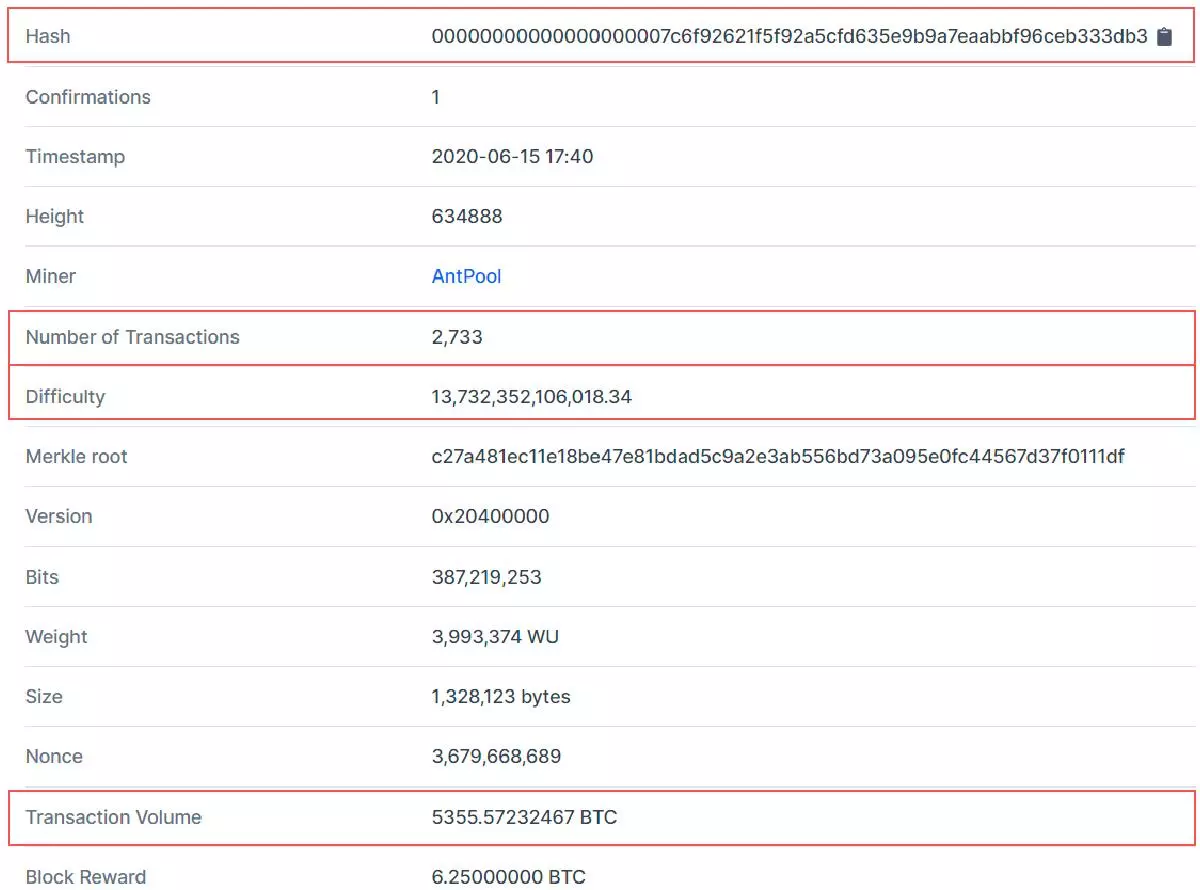

In the screengrab below, the hash is the first row of data.

As has been previously touched on, the hash is the sum of all the data in a block – condensed down into a readable and easily-distinguishable code. It is the hash which gives validity to the proof of work, because changing just one bit of input data will result in a completely different hash – therefore requiring a totally different proof of work to establish this block’s credibility.

Some other interesting metrics from the screengrab are the number of transactions contained in this block (2733), and the transaction volume (5355.57232467 BTC) – which is how many bitcoins were used in all the different transactions for this one single block.

But, perhaps the most interesting metric is the difficulty. This is what puts the ‘work’ into proof of work, because the chance of being the first to create a hash for this single block was 1 in 13,732,352,106,018 (or close to 14 trillion).

It is this difficulty level which makes it almost impossible for a conventional computer to be the first to create a hash, and it is why miners will often pool their resources together to maximise their chances of success.

What is the blockchain?

The blockchain in Bitcoin is the public record of all bitcoin transactions that have ever taken place. Once a block and its hash has been verified by at least 50% of the network of light, full and super nodes, it is added to the blockchain for every other user to see.

This transparency is one of the most attractive aspects of the Bitcoin network because it means that everything that has ever happened on the network – every transaction, every change to the system, every bitcoin ever spent – is available for everyone to see, all the way back to the first block ever created (known as the genesis block).

So, while bitcoin and the Bitcoin network might not be subject to regulation by organisations such as the Financial Conduct Authority (FCA) or the Security and Exchange Commission (SEC), the blockchain acts as the unofficial regulator and record of bitcoin transactions.

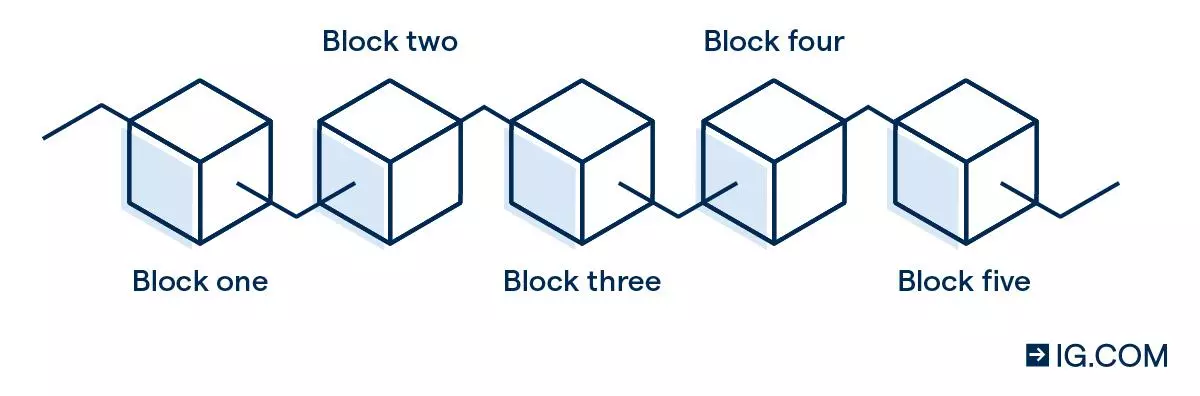

The easiest way to imagine the blockchain is rather crudely, as a chain of blocks. Each block of transactions is connected to the previous block of transactions, because the latest block contains the previous block’s hash.

Bitcoin double spending

An early concern with digital currencies was the problem of double spending. That is, when someone manages to spend the same coin in more than one transaction at the same time.

Double spending with cryptos would undermine trust in the system, because it means that someone would not receive payment for selling a service or a good. Plus, just like with counterfeit paper money, double spending in bitcoin would also cause inflation and lead to the coin’s devaluation.

But, thanks to the verification process carried out by the light, full and super nodes – paired with the transparency of the blockchain and accessibility of transaction information – forging the details of a transaction is almost impossible.

The only way that it’d be possible – and this is a real rarity in the cryptocurrency world – is if a single user or group of users was able to control a majority of the nodes on the network. If this happened, then the person or group would be able to approve illegitimate transactions by brute force.

They could undo any transactions that took place while they were in control of the network, enabling them to double spend existing bitcoins. They could also go back through the blockchain and change the details of old transactions.

But, any blocks that came after this edited block would also have to be edited because the newest block contains the hash of the previous block. Therefore, these hackers would effectively be creating a new transaction history for the entire blockchain from the point at which they changed the transaction data of an old transaction.

With the amount of nodes that are currently at work validating transactions – and the different layers of verifications provided by light, full and super nodes – a ‘51% attack’ as it is colloquially known is unlikely to ever happen. And, as more nodes are added to the network for verifications, the network itself becomes more decentralised.

This will make it even harder for a single person or group to gain control of a majority of the nodes on the network and to date (15 June 2020), a 51% attack has never occurred on Bitcoin’s network.

What is a bitcoin fork?

When people talk about a ‘bitcoin fork’, they could be talking about one of two things. Firstly, they could be talking about a change to the underlying Bitcoin software – known as a ‘software fork’.

Secondly, they could be talking about a ‘blockchain fork’ in which there is a fork in the Bitcoin blockchain. To properly explain bitcoin forks, let’s start by looking at software forks – which can be defined as either a ‘soft fork’, or a ‘hard fork’.

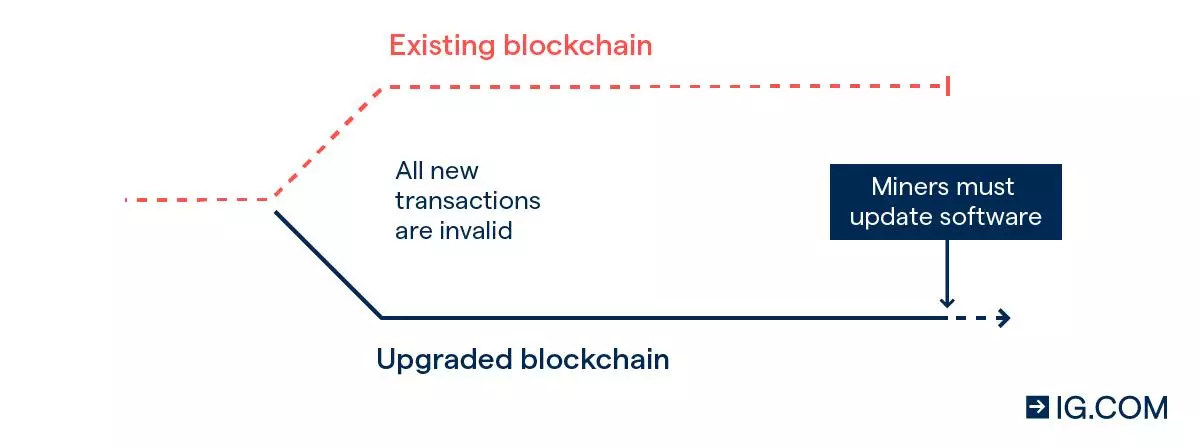

Bitcoin software ‘soft fork’

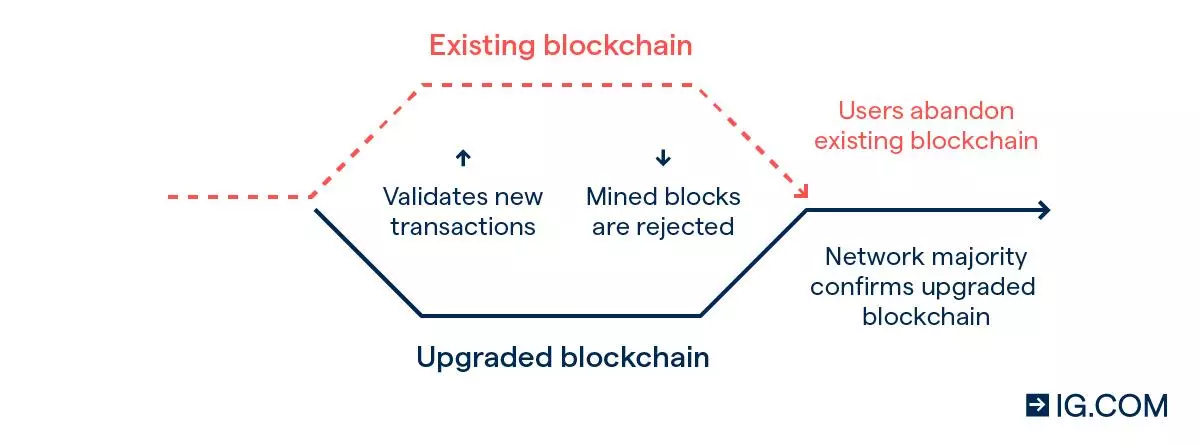

In a ‘soft’ software fork, the new system is still ‘backward compatible’ with the old system. What does ‘backward compatible’ mean? In this context, it means that the new, upgraded blockchain becomes responsible for validating blocks of transactions, but the old blockchain will still recognise and record these transactions. However, the new blockchain won’t recognise any blocks mined using the old programs on the existing blockchain.

Bitcoin software ‘hard fork’

A ‘hard’ software fork goes one step further by introducing new software which isn’t backward compatible with the legacy network. This means that all transactions must be processed on the new blockchain, and any miners using outdated software must update it.

If a hard fork isn’t resolved by users reaching a consensus, then a new cryptocurrency will be created. Some examples of this include the hard forks that created bitcoin cash and bitcoin gold.

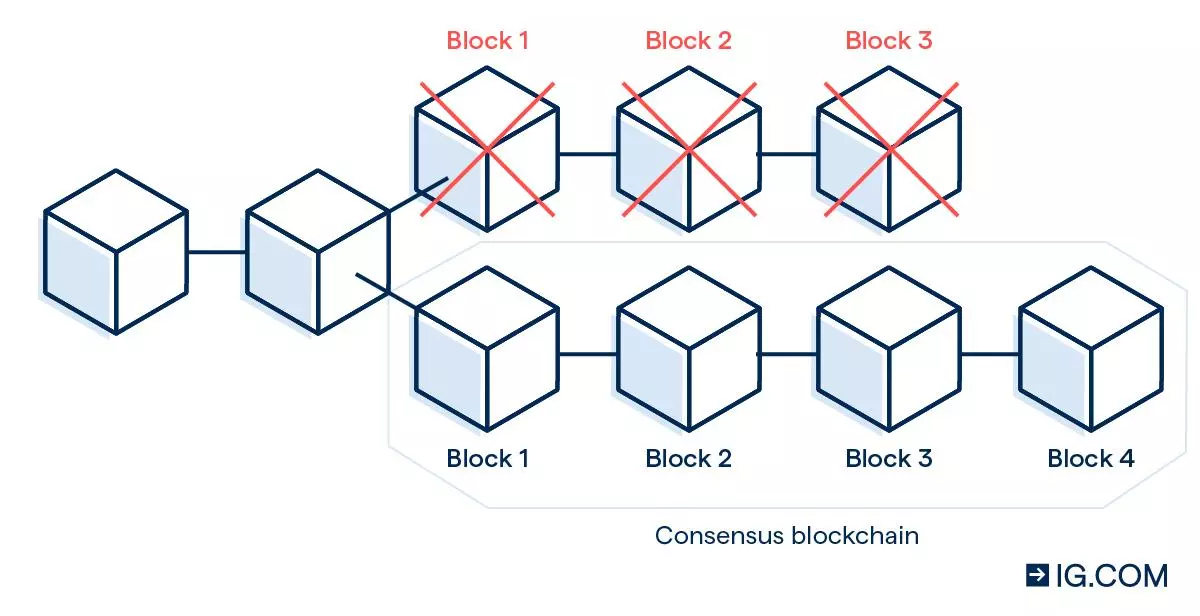

Blockchain fork

A blockchain fork is different to the two types of software fork. A blockchain fork happens when two or more miners create separate blocks at exactly the same time – creating two competing versions of the blockchain.

A blockchain fork is often resolved quickly because the nodes will verify one version of the blockchain faster than the other. The first one to be verified by a majority of the nodes will become the consensus blockchain, and new transactions will be added to this version going forward.

Bitcoin’s scalability problem

The Bitcoin scalability problem has become an issue as the coin has gained in popularity in recent years. Put simply, the scalability problem is the limit that applies to the rate at which the network can process bitcoin transactions.

The problem stems from the fact that blocks are limited in terms of size and frequency. If you were to make a payment today, you’d have to wait for between six to ten minutes for your payment to process – assuming your transaction made it into the first block to be mined.

This is slow compared to other forms of payment that are available such as debit or credit card transactions. On average, the confirmation software behind Visa credit cards can process 2000 transactions per second, with a peak rate of 56,000 transactions per second.2

If bitcoin is going to catch on and really stand a chance of contending with more established forms of payment in the modern world, then the network will need to combat the scalability problem. This is what people are often talking about when they say that the Bitcoin infrastructure needs updating.

Why is bitcoin valuable?

Bitcoin’s value depends on its popularity, which is heavily influenced by factors including:

- The volatility that has made bitcoin famous

- The finite supply of bitcoins, which means that its price is heavily influenced by fluctuations in demand

- The buzz around bitcoin as a relatively new market

- The long-term potential of cryptocurrencies in general

- The fact that bitcoin sits at the top of the cryptocurrency market in terms value and market capitalisation

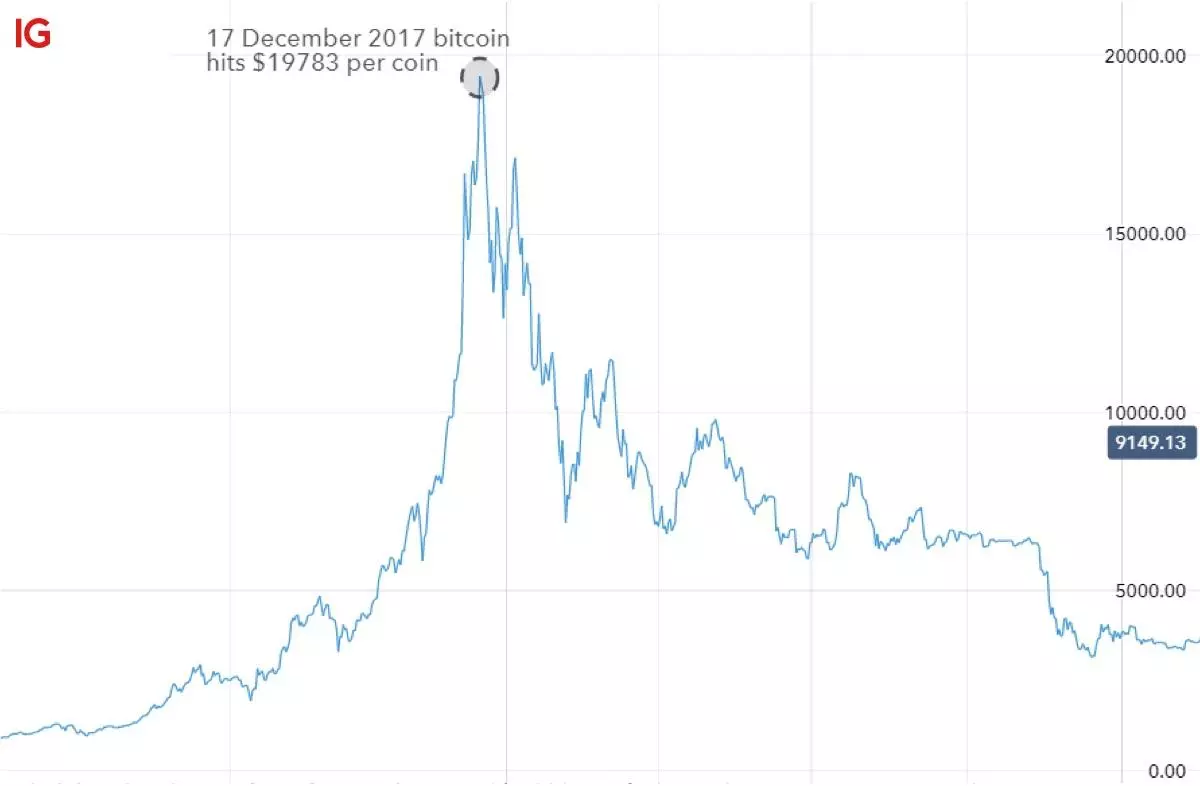

Why is the bitcoin price volatile?

Bitcoin’s price is volatile because of the shifting factors of supply and demand. The coin has been liable to dramatic swings in demand in recent years, with many now claiming that the initial ‘bitcoin boom’ – which saw the coin achieve its highest price in history back in 2017 – is over.

Supply – while less of a factor than demand – is no less important in explaining the coin’s volatility. Supply in this sense doesn’t mean the total number of bitcoins available to be mined, it means that total number of coins that are currently being exchanged on the market.

Dramatic and sudden shifts in the supply of coins that are currently being exchanged and traded – rather than those being held onto – can greatly affect the current market price of bitcoin. For example, in the bitcoin world, ‘whales’ are people who hold a lot of bitcoins.

If one of these whales decided to dump their coins into the market, the sudden and dramatic increase in supply would likely cause the price of bitcoin to drop and volatility levels to spike. This is assuming that demand remains the same.

The sudden increase in coins that are available to be exchanged would cause liquidity to rise – which again would impact bitcoin’s volatility. That’s because the market for buying and selling coins directly is usually illiquid compared to the market for trading on bitcoin’s price movements, but the current market price of bitcoin is based on the market for buying and selling coins directly.

Bitcoin’s liquidity

Bitcoin’s liquidity is one of the primary concerns when approaching this market. It’s no secret that compared to more conventional markets such as forex, bitcoin (and crypto in general) suffers from a lack of liquidity.

Some people are simply unfamiliar with the frameworks that underpin bitcoin. Terms like blockchain, mining and nodes can turn even the most savvy market analyst off, let alone your everyday trader. As a result, bitcoin – and the wider crypto market in general – just doesn’t attract the same interest as better established and easier-to-understand markets.

This is a problem, because lower liquidity could mean that you will find it harder to find someone to take on the other side of a bitcoin trade. As a result, there are significant and sudden increases and decreases in bitcoin’s price – which feeds into the volatility which has made the coin famous.

Why do people buy bitcoin?

People buy bitcoin because they are optimistic about its market outlook. Optimism isn’t necessarily misplaced when talking about bitcoin’s price.

Given the coin’s inherent volatility, dramatic upward movements can happen in a very short space of time. For example, the price spiked almost 900% in five days back in July 2010, and the price increased by almost $2000 between 15 December 2017 and 17 December 2017.

With a finite supply of bitcoins available – capped at 21 million – people who are choosing to buy bitcoin are betting on an increased demand in the coming years. This, coupled with a finite supply would cause the price of bitcoin to rise, meaning that optimistic market participants could stand to realise big profits if their predictions are correct.

That said the total 21 million bitcoins won’t be mined until 2140, and who’s to say what will happen in over 100 years?

How is bitcoin used?

Bitcoin is used as a currency in a variety of different transactions. Travel companies, food dispensaries and the Xbox marketplace are just some of the venues that accept bitcoin as a form of payment.

The first ever commercial bitcoin transaction was in 2010 for two pizzas, for which the recipient paid 10,000 BTC. At the height of their value in December 2017, those same 10,000 bitcoins would have been worth $197,830,000.

Bitcoin also attracts speculators looking to take a position on the future price movements of the crypto. This involves using derivatives to trade bitcoin’s price movements in an attempt to generate a profit – without owning any of the underlying coins and without having to get involved in the intricacies of the Bitcoin network.

Learn more about using derivatives to speculate on bitcoin’s price

Can you convert bitcoin to cash?

Bitcoins can be converted to cash at bitcoin exchanges. In return for one bitcoin, you’ll receive the current market value of the coin in cash.

One thing to note when talking about bitcoins, and cash, is the separate cryptocurrency bitcoin cash. Even though bitcoin cash was created after a hard fork in the bitcoin software, it is a completely different entity to bitcoin, and the two coins have drastically different values on the market.

At the time of writing (15 June 2020), one bitcoin token was worth £7247.81. Meanwhile, one bitcoin cash token was worth £181.75.

Is bitcoin safe?

Bitcoin safety can be interpreted in two different ways. The first way relates to exchange accounts, wallets and private keys. When you buy bitcoin from an exchange for example, you’ll need to take responsibility for the safety of your own wallet and account – and you’ll also need to ensure that your private key remains known only to you.

The second way that people talk about bitcoin safety is in relation to speculating on bitcoin’s price without owning the underlying coins. Safety is always a contentious issue when talking about the financial markets, because if you choose to trade – regardless of the market – your capital will be at risk. But, with trading, you won’t have to worry about private keys or exchange accounts, because you don’t need them.

That said, there are a range of tools available to enable you to control your risk when trading bitcoin.

Stop-loss orders for example will prevent your losses on a bitcoin trade from running by setting a predetermined level at which a losing position will close. Meanwhile, limit orders will lock in your profits and protect you from future downward movements.

Stops can be subject to slippage however, and to avoid this, you could use a guaranteed stop – which will always close your position at the predetermined level.3

Learn more about stops and limits

But, in terms of transaction security, bitcoin is considered safe. That’s because every transaction that takes place on the Bitcoin network is completely transparent, and the information is available to every user instantaneously thanks to the public record contained in the blockchain.

The verification process carried out by the nodes means that a new block will not be added to the blockchain without unanimous agreement, which also makes forging information and creating false transactions very difficult.

Finally, the decentralised nature of bitcoin means that the network will get safer as more and more miners and nodes join the system – which will serve to both boost the verification process as well as the consensus agreement principle that the system is built on.

How can you profit from bitcoin?

There are three ways you could profit from bitcoin: buying it from an exchange, trading on its value with financial derivatives, or mining coins. Let’s take a look at each in turn.

Buying bitcoin through an exchange

Buying bitcoin through an exchange means that you will be taking direct ownership of physical bitcoins. As a result, you’ll profit if the price of bitcoin rises. If the price fell to below what you initially paid for the bitcoins, it’d constitute a loss if you chose to close your position.

People will buy bitcoin through an exchange in order to use it in transactions on the network. They can be added to a bitcoin wallet, and you’ll be able to use them with other users on the network as a form of payment if they’re accepted by the vendor.

You’ll need to pay the full value of the coins upfront to take ownership, and you may struggle to find a willing counterparty because bitcoin exchanges often struggle with liquidity.

Trading bitcoin derivatives

Trading bitcoin derivatives means that you’ll be speculating on the current market value of bitcoin with financial derivatives like CFDs. You won’t take ownership of any bitcoins, and they won’t be added to the balance of your bitcoin wallet if you have one.

However, trading derivatives is one of the main ways that people get exposure to the bitcoin market price. They can go long and speculate on the price rising, but they can also go short and speculate on the market value of bitcoin falling.

There are many bitcoin trading platforms available for trading bitcoin derivatives. Why not choose our web-based platform or mobile trading app?

Learn more about how to trade bitcoin

You’ll be able to open a bitcoin position with leverage, meaning that you’ll receive full market exposure for an initial deposit – called margin. With us, the margin requirement on bitcoin is 50% of the full value of the trade.

Bitcoin CFD trading

Trading bitcoin CFDs enables you to offset profits against losses for tax purposes – making CFDs particularly useful for hedging risk.

Find out more about CFD trading

We’ve included a table of benefits of trading bitcoin derivatives with us or buying bitcoin through an exchange below.

| Trading bitcoin derivatives with us | Buying bitcoin through an exchange | |

| Cost to get exposure to bitcoin | Margin for retail clients is 50% of the total value of the coin(s) | Full market cost of the coin(s) |

| Short selling | Yes | No - unless there is a willing counterparty |

| Regulation | We're a FTSE 250 company, fully authorised and regulated by the FCA | No dedicated regulatory body in place |

| Execution | 0.0014 second execution speed and access to our unique deep liquidity | Dependent o exchange liquidity levels |

| Restrictions on funding and withdrawing | None, withdrawing or adding funds is free and instant | You may be charged fees and encounter restrictions on adding or withdrawing funds |

| Overnight funding charge | Yes | No |

Note: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Bitcoin mining

If you’re looking to mine bitcoin for a profit, then you’ll need to consider the operating costs and likelihood of payoff if you set up your own mining system. The risk is that you’ll spend a lot of money on computers and electricity but with a low probability of being the first one to produce a block’s hash, which means you might not get any rewards.

As a result, many miners will pool their resources together to stand a better chance of success. This is called a mining pool – where multiple individual miners come together to boost their chances of being rewarded with bitcoins.

Bitcoin laws and regulations

Bitcoin is perhaps notorious for not having a central regulatory body which oversees the transactions that take place. This is maybe what turns people off the idea of bitcoin, because there is no bank or government agency to fall back on.

But, bitcoin is arguably less open to outside influence than these organisations are because of the way in which transactions are verified on the network.

That said, many countries and territories around the world have different laws and regulations that govern the creation, possession and use of bitcoin within their borders.

Learn more about bitcoin laws and regulations

Is bitcoin legal?

The legality of bitcoin changes depending on the geographic jurisdiction. In the majority of territories, bitcoin is legal tender for at least some transactions. However, in some places it is banned completely – mainly due to the lack of central bank control that the bitcoin network enjoys.

Moreover, concerns have been raised about illegal activity being facilitated by bitcoin and blockchain technology. This is because the real world identity of the users on the network is kept anonymous, using private keys and signatures to interact with other users to complete transactions.

As a result, it has been stated that terrorist organisations or crime syndicates can use this anonymity as a way to carry out illicit and otherwise illegal activities such as money laundering. To combat this, some countries around the world designate bitcoin as a commodity – which makes it subject to taxes on income.

Bitcoin regulations around the world

For the most part, bitcoin regulations around the world permit the use of the digital currency in transactions between two willing participants – one who is willing to use bitcoin to buy a product, and one who is willing to accept bitcoin as a form of payment.

In some places though, bitcoin is under a blanket ban. For example, Egypt’s national legislature banned bitcoin as haram – meaning that it is against Islamic law. Likewise, fellow North African nation Algeria has declared the purchase, sale, use and possession of digital currencies including bitcoin as illegal.

Some of the other countries that have banned digital currencies including bitcoin are Nepal, Pakistan, Bolivia and Ecuador.

But, these countries are the exception rather than the rule. For the most part, particularly in Western nations including the US, UK and all EU member states, bitcoin is a valid form of currency in peer-to-peer transactions.

Interestingly, some countries including Canada, Russia, China and Saudi Arabia have a two-tier system of legality for bitcoin. This means that while bitcoin is legal to possess, mine and exchange, it is not legal tender and cannot be used in the place of national currencies.

Pros and cons of bitcoin

We’ve listed some of the pros and cons of bitcoin below:

Pros of bitcoin

- It operates using a decentralised peer-to-peer network. While some might say that this makes outside regulation impossible, others will say that this makes the network inherently self-sufficient and secure

- The lack of outside influence means that the Bitcoin network can function exactly how it is meant to, without influence from banks or other financial institutions

- The layers of validation needed for a new block to be added to the blockchain makes forging information incredibly difficult

- In years to come, and with capped supply, bitcoin could become a much sought-after currency in its own right. For this to happen, the scalability problem will need to be addressed, and people will need to see bitcoin as a serious contender with present day fiat currencies

Cons of bitcoin

- The network’s scalability problem is perhaps one of the biggest obstacles to overcome in order to compete with more established forms of payment

- It’s unlikely that the coin will catch on as a form of payment around the world until it can compete with major credit and debit card providers on transactions per second

- Bitcoin’s liquidity issue feeds into its volatility, with low liquidity causing prices to move quickly and more dramatically up or down than other markets

- Some people might see the deregulated nature of the system as an enabler for criminal activity and money laundering – which damages bitcoin’s mass market appeal

Bitcoin summed up

- Bitcoin is a decentralised peer-to-peer virtual currency

- It is mined by bitcoin miners using mining nodes, who receive bitcoin as a reward for collecting and processing bitcoin transactions into blocks

- These blocks are then verified by light, full and super nodes

- When a block is verified, it is added to the blockchain

- The blockchain is a public record of every bitcoin transaction that has ever taken place

- There is no single regulatory body that oversees the bitcoin network, but rather, the network is maintained independently by its users

- There is a finite number of bitcoins that will ever be created – set at 21 million which is expected to be reached by the year 2140

- You can buy bitcoin through an exchange, or you can speculate on its price movements rising and falling with financial derivatives like CFDs

- You can trade these with us by creating an account today

2 Kyle Croman et al. ‘On Scaling Decentralised Bitcoins’, 2016

3 A premium will be incurred if a guaranteed stop is triggered.

4 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.