What’s on this page?

What are oil futures?

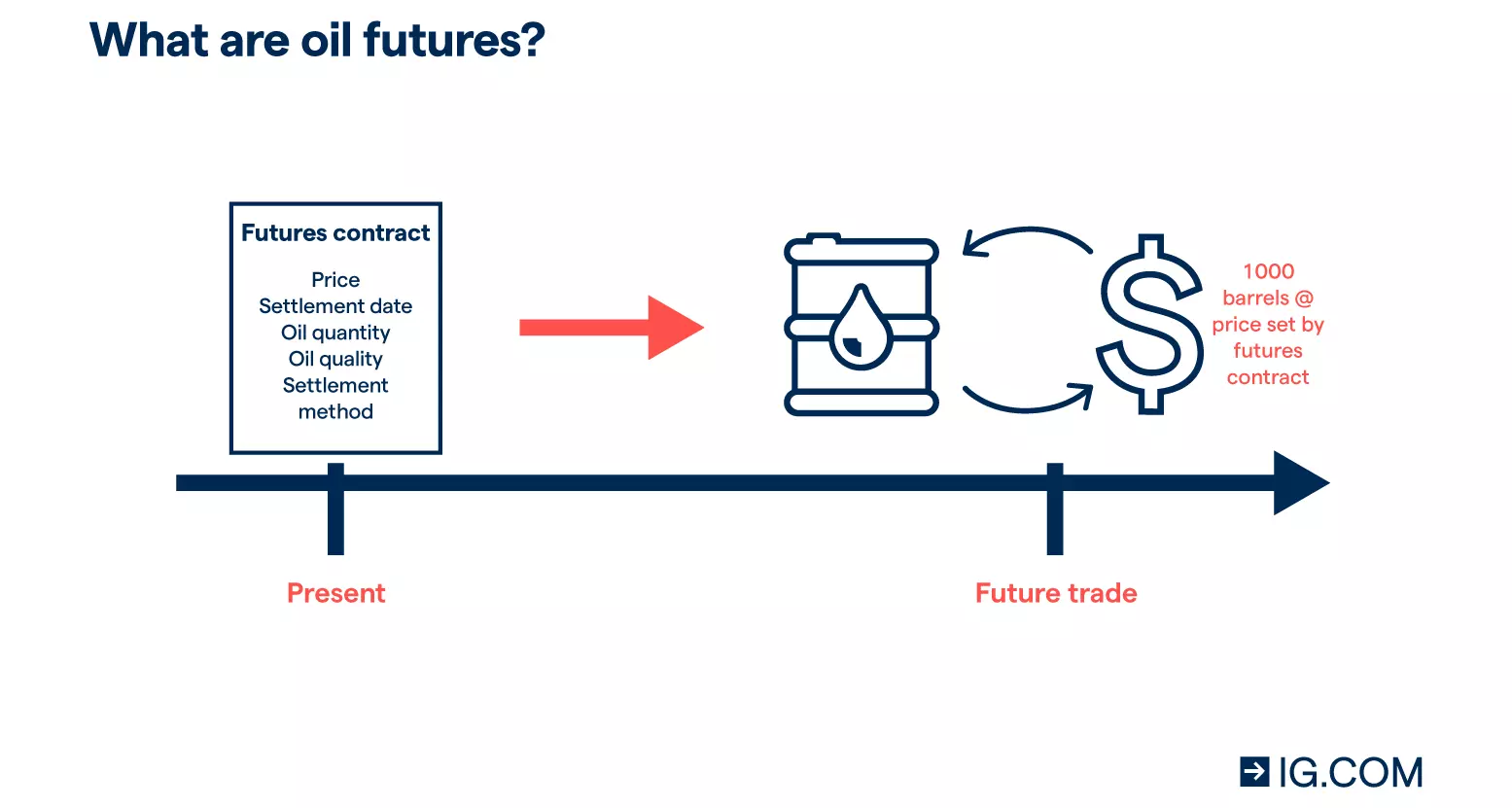

Oil futures are financial contracts in which a buyer and a seller agree to trade a specified number of barrels of oil at a fixed price set for a future date. Crude oil futures give the buyer the obligation to buy the underlying market, and the seller the obligation to sell at, or before, the contract’s expiry.

The level at which a futures contract is currently trading is also the price at which the upcoming transaction will take place. For example, if an oil future is currently listed at $75, that’ll be the level at which the asset will be traded when the contract reaches its expiry date (or ‘settles’). The person buying the oil is said to be ‘long’ on the future, while the seller is ‘short’.

The contract will clearly state the following:

- Date of settlement or expiry

- Number of barrels of oil to be traded (typically 1000 barrels)

- Quality and type of oil to be traded

- Method of settlement (physically or cash settled)

What is oil futures trading?

Oil futures trading is the act of buying and selling crude oil futures. Traditionally, you’d trade crude oil futures if you were an oil producer or used oil as an industry input. The contracts remove uncertainty from the future prices, thereby lessening risk. You can also use oil futures to speculate on oil prices.

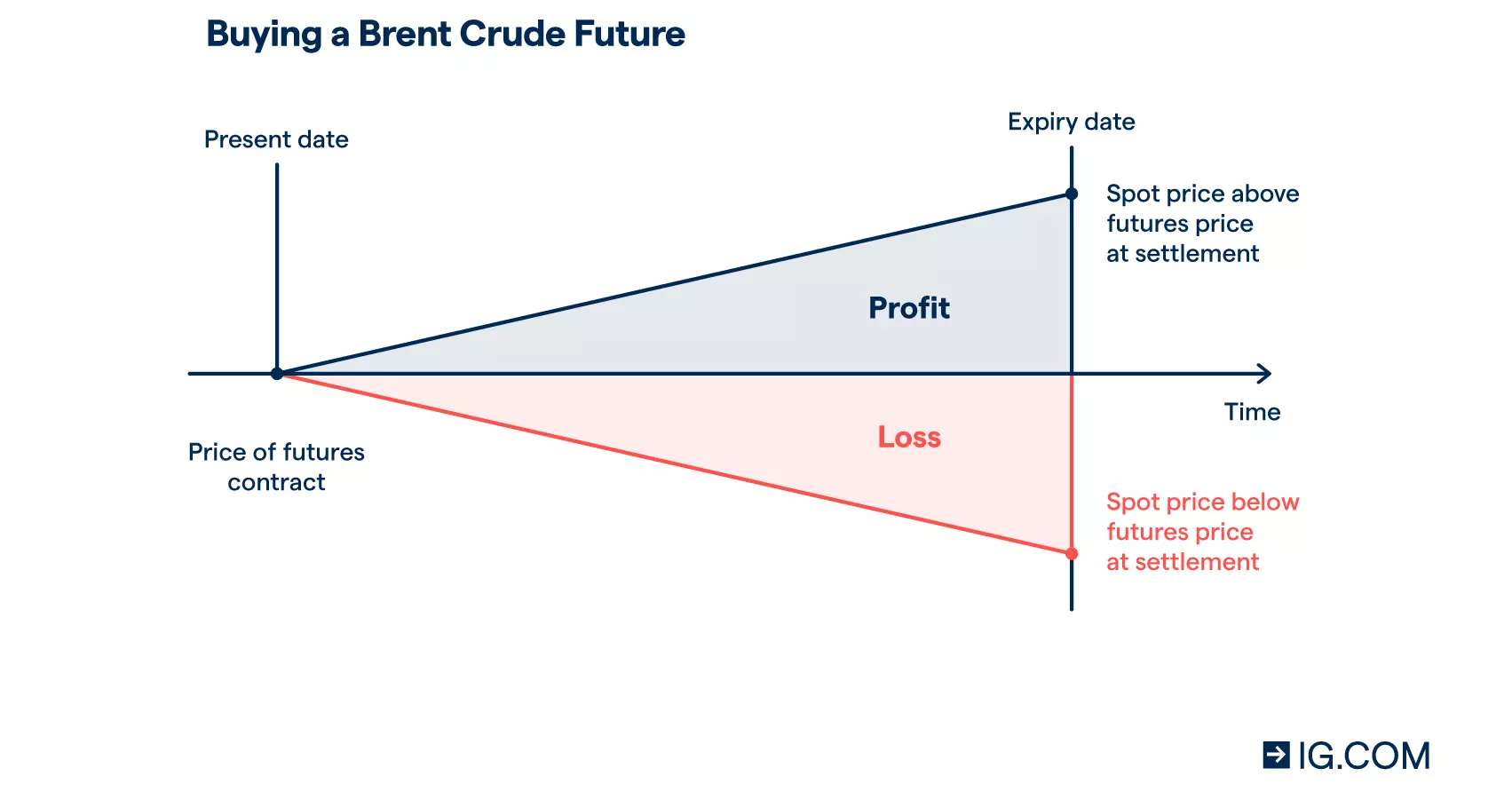

For instance, if you believe that the price of Brent crude will increase above its current spot price of $130 per barrel, you’d assume oil futures would trade higher than that – at $132.

If you decide to go long, you’d ‘buy’ an oil future. So, if your speculation is correct, and the spot price moves (as per your prediction) to $140 by expiry, you’d earn a profit of $8 per barrel on settling the contract. If, contrary to your prediction, the spot price drops to $120 by expiry, you’d have made a loss of $12 per barrel.

Futures are traded on exchanges, which standardise each contract’s terms. Listed oil futures are either settled physically or via a cash payment. When settled physically, actual barrels of oil are delivered. When settled via a cash payment, the difference between the future price and the spot market price is paid to the relevant party in the contract.

With us, you won’t have to deliver or take delivery of any physical barrels of oil. This is because you’ll trade exclusively on the prices of oil futures using CFDs that track the underlying market.

Avoid overnight funding charges

With us, futures positions have no overnight funding charges. This means that you’ll trade oil futures if you’re looking to take a longer-term position on an underlying market. Bear in mind, however, that futures have a wider spread than spot (‘cash’) positions.

Trade with leverage

CFDs are leveraged products, which means you only need to pay an initial deposit – called margin – to open a position that provides increased market exposure.

When trading with leverage, keep in mind that your profit or loss is calculated using the whole position size and not just the margin, meaning your profits and losses will be magnified.

Before trading, ensure you understand how leveraged products work and determine if you can afford to risk losing your money. Take precautions by making use of our risk management tools.

Go long or short

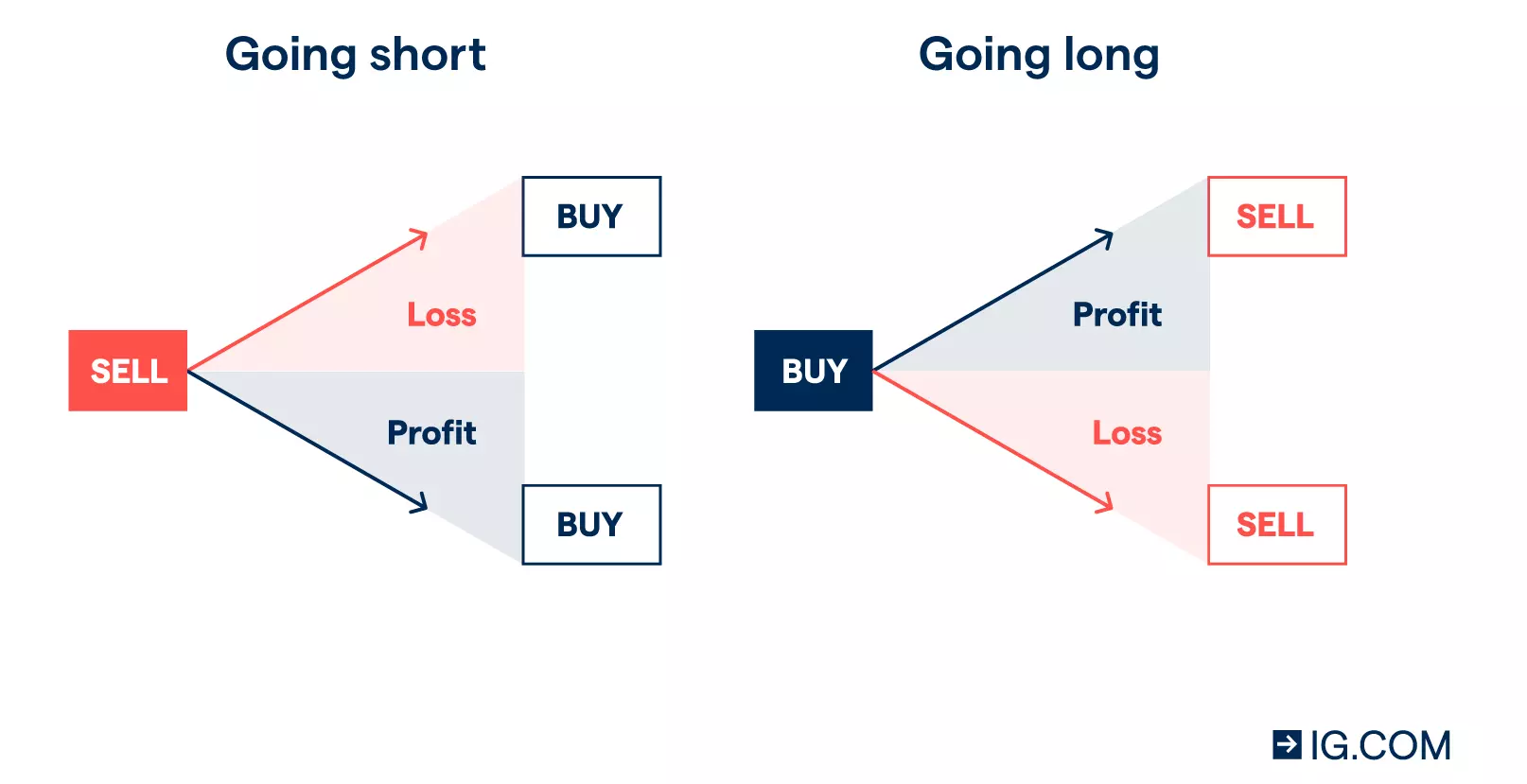

When trading oil futures, you can go either long or short. You’ll go long if you believe that the price of the underlying asset will rise, and go short if you think it’ll fall.

When trading futures via CFDs, your profit or loss is determined by the accuracy of your prediction, and the overall size of the market movement.

Hedge existing positions

Hedging with oil futures enables you to control your exposure to risk. For example, if you own shares in a Brent crude producing company and you believe it might depreciate, you could short an oil future. If your speculation is correct, the profits you make from shorting your position could offset a fraction of your losses.

Note that when hedging you’ll still incur costs, therefore it’s important that you incorporate these into your hedge calculations and projections.

Speculate on Brent crude or WTI (US crude)

When trading oil futures, you can choose from two dominant markets – Brent crude and West Texas Intermediary (WTI) known as US crude. Brent crude is produced in oil fields in Europe’s North Sea, while WTI is extracted in North America.

Brent crude is used as a benchmark when trading oil contracts, futures and derivatives internationally, while WTI is mostly used as a yardstick in Northern America.

The oils’ price differences or ‘quality spread’ are due to their varying properties. Both oils are light and sweet, making them easier to be refined and processed by petrol manufacturers.

With us, you can also trade Heating Oil and London Gas Oil.

Automatic rollover at expiry

If you’d prefer to not close your position on or before expiry, you can adjust settings in your account so these can be automatically rolled over.

By rolling over a contract’s expiry date, you delay the asset’s delivery to the following month, and subsequently avoid incurring costs and obligations associated with settling the future contract. This is often done when you don’t want to take delivery of the physical asset such as barrels of oil.

When trading CFDs, you can set up automatic rollover instructions by logging in to your account, selecting ‘rollovers’ in your ‘settings’ tab and then following the instructions. Once the rollovers have been set up on your account, you’ll receive a confirmation email.

Make sure futures are how you want to trade oil

Besides trading oil futures, you can also trade the oil spot market (called our ‘cash’ market) or oil options.

| Oil futures | Oil options | Oil spot price | |

| How it’s priced | Based on listed exchange price | Based on listed exchange price | ‘On the spot’ or current value of oil, with continuous, real-time pricing |

| Ways of trading | CFD trading | CFD trading | CFD trading |

| Can I short oil? | Yes | Yes | Yes |

| Can I speculate on negative oil prices? | Yes | Yes | Yes |

| Commodities energies markets | US crude, Heating oil, No Lead Gasoline, Natural gas, Carbon emissions | US crude, Brent crude, Heating oil, No Lead Gasoline, Natural gas, Carbon emissions | US crude, Brent crude, Heating oil, No Lead Gasoline, Natural gas, Carbon emissions |

| Costs and charges | Larger spread but no overnight funding charges | Higher premium but no overnight funding charges | Narrower spread but with overnight funding charges |

| Risk to capital | You could lose more than your deposit (margin) | Limited to premium if you buy put or call, could lose more than premium if you sell | You could lose more than your deposit (margin) |

| Expiry | Yes | Yes | No |

Understand how oil futures trading works

With us, you can trade on price movements in oil futures markets using CFDs. CFDs are traded with the contract’s value already at a specified amount ($) per point or ‘tick’ of the underlying asset’s price. Note that some CFDs are quoted in US dollars for oil.

Create your account and log in

With us, you can trade oil futures via CFDs. You can use these derivative products to speculate on rising and falling prices of oil futures.

If you’re not familiar with trading oil futures, you can open a demo account to practise with $20,000 in virtual funds. Once you’re confident, you can open a live account – with no obligation to fund or trade until you’re ready.

Pick your oil futures market and expiry

You have the flexibility to choose the oil futures markets that you’d like to trade – whether it be Brent crude, US crude (WTI), Heating Oil or London Gas Oil.

You can also choose not to close your position on or before the expiry date. This means your contract’s expiry will be automatically rolled over into the following month.

To set up automatic rollover instructions when trading CFDs on your account, go to the ‘settings’ tab and select ‘rollovers’ the follow the instructions. You’ll receive a confirmation email once the rollovers have been set up successfully on your account.

Set your position size and manage your risk

When you’re ready to take your position, click ‘buy’ to go long or ‘sell’ to go short. Then, set your position size. To manage your risk, select your limit and stop-loss levels in the deal ticket. There are various tools you can use such as normal, trailing, and guaranteed stops.

A normal stop-loss is an instruction to close your position once it hits a price that’s less favourable than the current market price. Although a useful tool, if slippage takes place your order may not be carried out at the specified price.

A trailing stop is set to automatically adjust to market movement, meaning it follows your position. It locks in your profit when the market moves in your favour and closes the position if it moves against you.

A guaranteed stop will be executed at the exact specified price. This stop works similar to a basic stop, except it’ll always be filled at your set level whether rapid price movements or gapping occur.

Place your oil futures trade

When you’re satisfied with your deal size and risk management orders, you can continue with opening your trade by clicking on ‘Place deal’. Once that’s done, you can monitor your position.

Try these next

Find out how you can trade commodities with us

Learn how to trade or invest in gold, step by step

Discover everything you need to know about futures trading with us

1 Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.