EBITDAR definition

What is EBITDAR?

EBITDAR is the abbreviation of ‘earnings before interest, taxes, depreciation, amortisation and restructuring or rent costs’. It is used to analyse a company’s financial performance and profit potential where the company is undergoing a restructure or if its rent expenses are higher than average.

Learn about how to trade stocks with IG

Find out more about share trading, including how to build a trading plan and open a position.

How to calculate EBITDAR

The EBITDAR formula is calculated by adding rent and reconstruction costs to a company’s EBITDA in order to quantify a company’s rent expenses. A company’s EBITDA is calculated by adding earnings before interest, tax, depreciation and amortisation expenses back on top of net income. So, the EBITDAR formula is as follows:

Example of EBITDAR

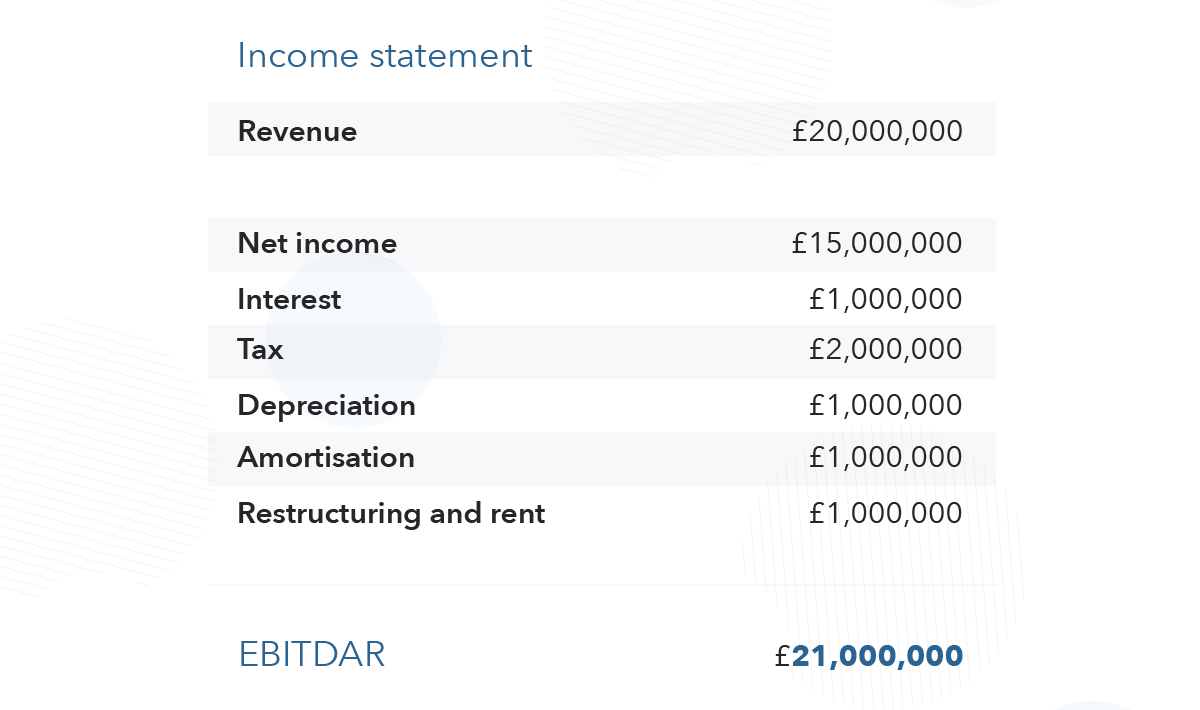

To fully explain EBITDAR, let’s take an example of an income statement. The financial information of company ABC is listed in the table below, and it shows the total profits and deductions for the given year.

The income statement gives all the necessary information to calculate the EBITDAR for company ABC, which was calculated by adding up the net income, interest, taxes, depreciation, amortisation and restructuring and rent.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.