Earnings per share definition

What is earnings per share (EPS)?

Earnings per share (EPS) is an important metric in a company’s earnings figures. It is calculated by dividing the total amount of profit generated in a period, by the number of shares that the company has listed on the stock market.

EPS is used to determine the value attached to each outstanding share of a company. On exchanges, the amount of profit made by companies and the number of shares they have listed can vary, so EPS gives a per-capita way of evaluating each business. It is also a way for analysts to compare companies to each other and see which has higher earnings figures.

How to calculate earnings per share

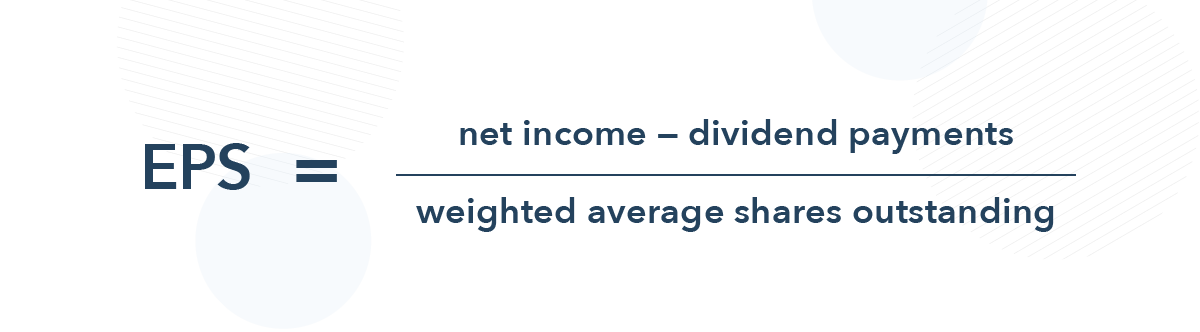

To calculate a company’s earnings per share, you would first need to calculate its net profit by taking net income and subtracting any dividend payments. Then you’d divide that figure by the number of outstanding shares, which is usually a weighted average over the period.

The formula for calculating EPS is:

EPS example

Let’s say you want to buy the shares of XYZ Industries, which currently has a total net income of $900,000. If the company has 75,000 shares in circulation, this would give an EPS of $12 ($900,000/75,000).

What does earnings per share tell traders?

Earnings per share is a very important factor when examining a business’s fundamentals. Generally, it is a good indicator of whether a company is considered profitable or not. EPS is also used to calculate the company’s price-to-earnings ratio, or P/E ratio. This can help traders to identify the value of a company and its shares, as well as the growth prospect for that business.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.