With CFDs, you can lose more than you deposit, you do not have ownership in the underlying asset, and you may be subject to margin close-outs if you do not maintain sufficient margin.

What is CFD options trading?

CFD options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a set price, if it moves beyond that price within a set timeframe.

With us, you’ll trade options using CFDs.

Why trade CFD options with us?

Find an option to suit you

Trade major indices, shares and FX with daily or weekly, monthly and quarterly options.

Pay zero spread on expiry

Buy and sell options with no closing spread when you hold them until their fixed expiry date.

Discover new opportunities

Develop options trading strategies using a variety of options.

Trade on volatility itself

Take a position on rising, falling and even flat markets in Australia and all over the world.

With CFDs, you can lose more than you deposit, you do not have ownership in the underlying asset, and you may be subject to margin close-outs if you do not maintain sufficient margin.

Trade CFD options with us

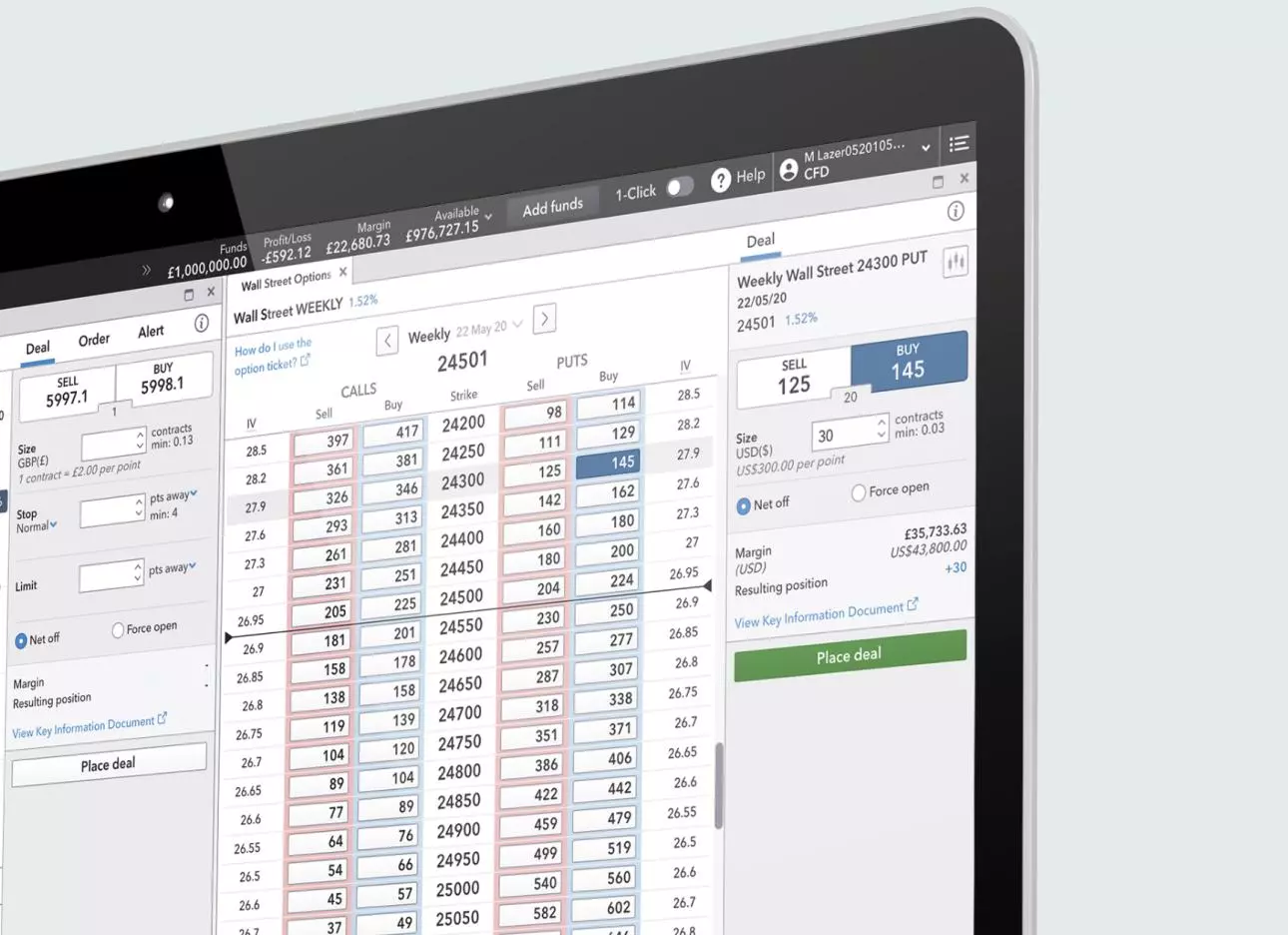

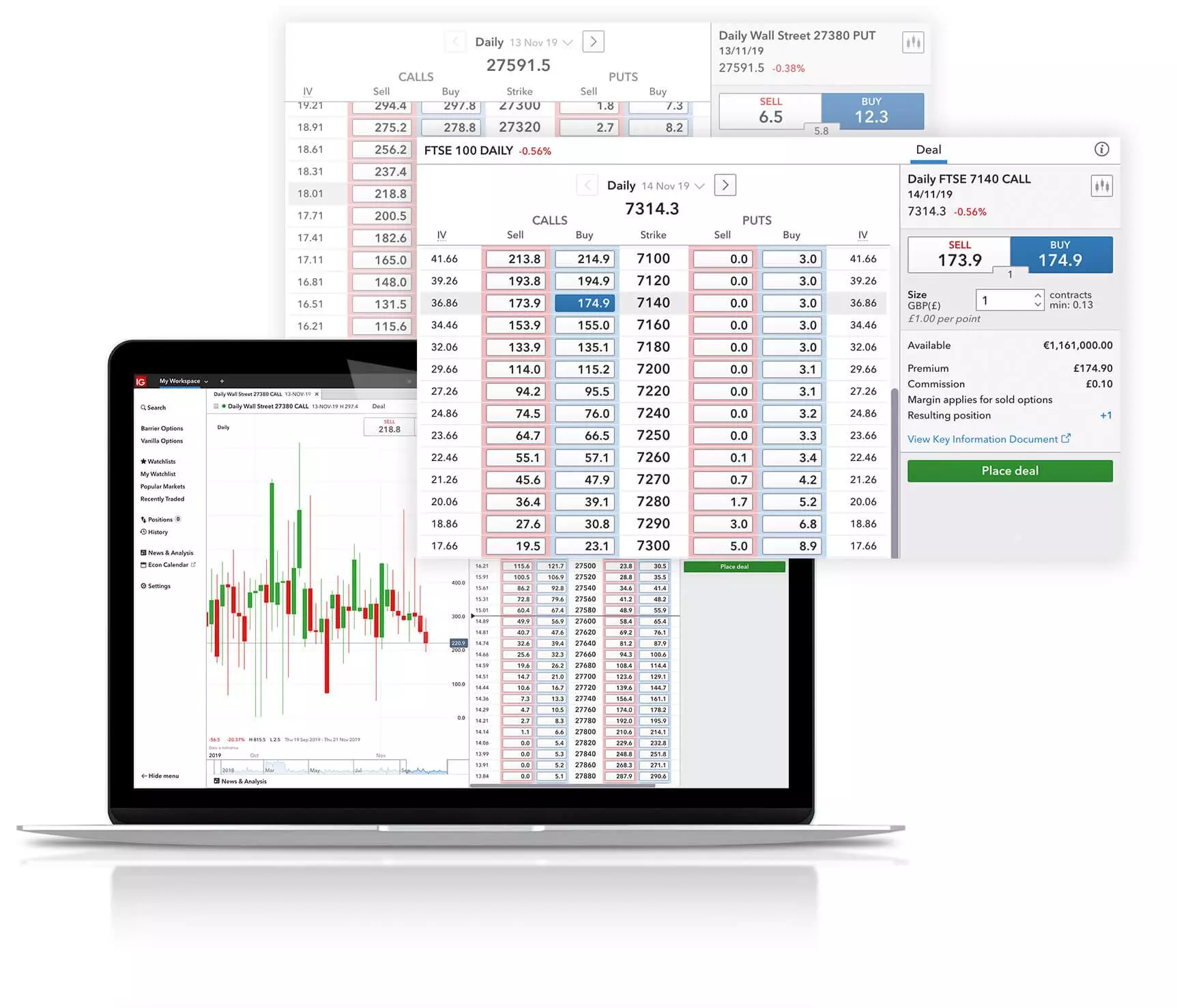

Trade options using CFDs on our award-winning trading platform.2

| CFDs | |

| Main features | CFDs are the buying and selling of contracts for difference. They are leveraged, meaning you put down a deposit to gain exposure to a position, with profit and loss calculated on the full position size. |

| Risks | Buying call or put options, your risk is always limited to the margin you paid to open the position. However, when selling call or put options your risk is potentially unlimited. |

| Accessible to | All clients |

| Traded in | Contracts |

| Commission | There will be no commission charge for CFDs, and we charge spread instead. Other fees and charges may also apply. (Except for shares) |

| Platforms | Web and mobile platforms |

| Learn more |

What are options?

Options are contracts that give you the right – but not the obligation – to buy or sell an underlying asset before a certain expiry date. You can use them to speculate on the price of a financial market, and in some cases its volatility too.

How do I trade CFD options?

- Discover how options work

- Learn the differences between buying options and selling them

- Choose a trading strategy

- Create an account

- Open your first position

Features of trading CFD options

Choose the CFD option to suit you from our daily, or weekly, monthly and quarterly timeframes.

Daily CFD options

For a highly-leveraged way to trade intraday.

Weekly, monthly and quarterly CFD options

Longer expiries, well-suited to traditional trading strategies.

Lower spreads

Trade daily options with reduced spreads – the same as on regular spot markets

No overnight funding

Pay less for long-term positions, thanks to zero overnight funding

Flexible leverage

Get the leverage you want by choosing your strike and trade size

Increased opportunity

Find opportunity on a broad range of market conditions – even flat markets

Limited risk

Cap your maximum risk when you buy daily options – you’ll never lose more than the margin you pay to open

Greater control

Develop options strategies for greater control over your trading

Greater freedom

Hold daily options positions even if the market moves against you, knowing that your risk is limited to the margin you paid to open

Guaranteed maximum risk

Trade up to three quarters ahead, with your risk limited to your opening payment (when buying)

Daily CFD options

For a highly-leveraged way to trade intraday.

Lower spreads

Trade daily options with reduced spreads – the same as on regular spot markets

Flexible leverage

Get the leverage you want by choosing your strike and trade size

Limited risk

Cap your maximum risk when you buy daily options – you’ll never lose more than the margin you pay to open

Greater freedom

Hold daily options positions even if the market moves against you, knowing that your risk is limited to the margin you paid to open

Weekly, monthly and quarterly CFD options

Longer expiries, well-suited to traditional trading strategies.

No overnight funding

Pay less for long-term positions, thanks to zero overnight funding

Increased opportunity

Find opportunity on a broad range of market conditions – even flat markets

Greater control

Develop options strategies for greater control over your trading

Guaranteed maximum risk

Trade up to three quarters ahead, with your risk limited to your opening payment (when buying)

With CFDs, you can lose more than you deposit, you do not have ownership in the underlying asset, and you may be subject to margin close-outs if you do not maintain sufficient margin.

Open a commodity CFD trading account now

Ahead of the curve

Founded in 1974 as the first company of its kind. We’re ASIC-regulated and trusted by 320,000+ clients with the security of their money.

IG Australia is part of IG Group Holdings PLC, which is a member of the FTSE 250.

Fast, efficient online platforms

Seize your opportunity in seconds and take full control over each of your trades with our easy-to-use platform and apps.

Award-winning service

We have a dedicated team on hand to support you, and you can also benefit from knowledge-sharing with IG Community and IG Academy.

Open a commodity CFD trading account now

Ahead of the curve

Founded in 1974 as the first company of its kind. We’re ASIC-regulated and trusted by 320,000+ clients with the security of their money.

IG Australia is part of IG Group Holdings PLC, which is a member of the FTSE 250.

Fast, efficient online platforms

Seize your opportunity in seconds and take full control over each of your trades with our easy-to-use platform and apps.

Award-winning service

We have a dedicated team on hand to support you, and you can also benefit from knowledge-sharing with IG Community and IG Academy.

Trade CFD options on Australia's best trading platform2

Get fast, reliable execution when you trade options on our web platform.

Take a position from any position with our trading apps – available for iOS and Android.

Try these next

1 Number 1 in Australia by primary relationships, CFDs & FX, Investment Trends November 2024 Leveraged Trading Report..

2 Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2022. Best Finance App as awarded at the ADVFN International Financial Awards 2022.