GBP/USD, EUR/GBP and EUR/USD amid BoE rate decision

Outlook on GBP/USD, EUR/GBP and GBP/USD around the BoE’s rate decision.

GBP/USD flirts with May low ahead of BoE rate decision

GBP/USD slid all the way to its May low ahead of today’s Bank of England (BoE) monetary policy decision where a fifteenth consecutive rate hike to 5.50% was expected before UK inflation for August came in lower-than-expected at 6.70% (6.20% for core inflation) and questioned this view.

A fall through today’s intraday low at $1.2305 could lead to the mid-February high at $1.2270 being revisited, together with the late January low at $1.2263.

Minor resistance is seen at the 10 April low at $1.2345 and Monday’s $1.2371 low ahead of the 200-day simple moving average (SMA) at $1.2435. While remaining below it, the bearish trend stays firmly entrenched.

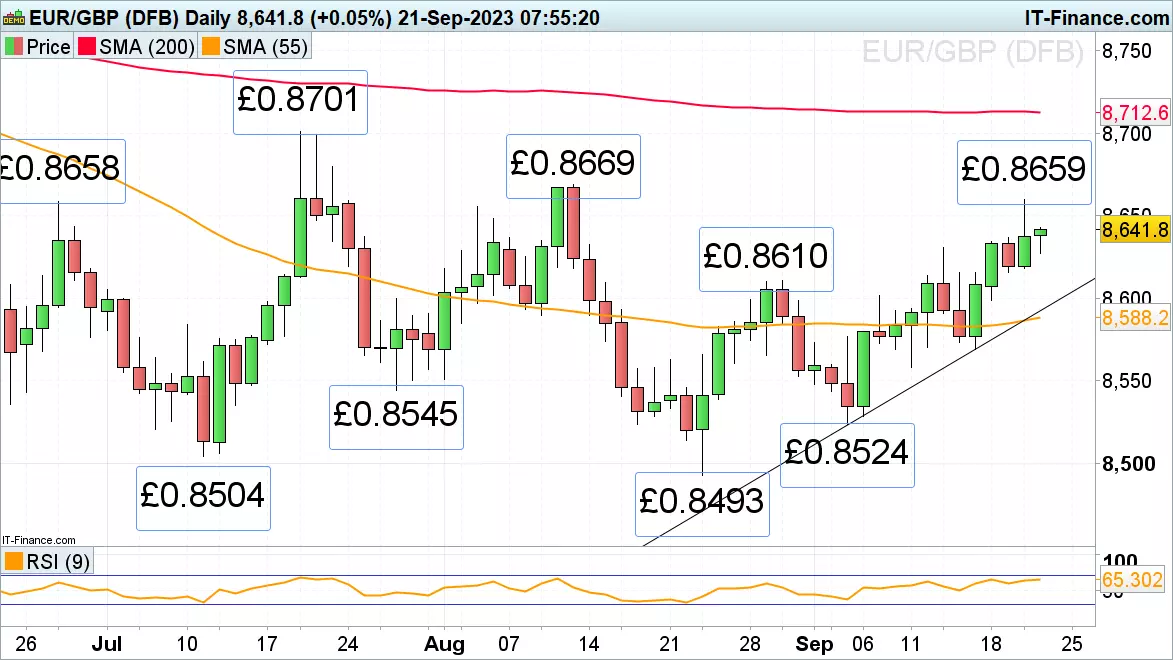

EUR/GBP traders await BoE rate announcement

EUR/GBP is heading towards the higher boundary of its June-to-September sideways trading range, having yesterday been capped by its £0.8658 late June high ahead of today’s UK central bank rate decision.

A rise above that high and the next higher £0.8669 August peak would put the July high at £0.8701 on the cards, ahead of the 200-day SMA at £0.8712.

Minor support below last week’s £0.8630 high can be spotted around the £0.8610 late August high.

EUR/USD trades in 3 ½ month lows post ECB rate hike

Earlier this morning EUR/USD briefly dropped below its $1.0636 May low to $1.0617 as multi-year high US yields lead to US dollar inflows.

A slide through and daily chart close below today’s intraday low at $1.0617 could provoke a tumble towards the January and March lows at $1.0516 to $1.0484.

As long as the currency pair remains below its last reaction high at $1.0736, seen on Wednesday, the July-to-September downtrend remains intact.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices