Market update: analysis and outlook on crude oil, Dow 30, AUD/USD

Discover trading opportunities in volatile markets like crude oil, Dow 30, and AUD/USD using contrarian strategies and IG client sentiment, blended with technical and fundamental analysis.

Trading often pulls us to mimic the masses – buying when everyone else is euphoric, selling when fear runs high. But savvy traders recognise the potential hidden in contrarian strategies. Indicators like IG client sentiment offer a glimpse into the market's prevailing mood, potentially highlighting moments where extreme bullishness or bearishness may signal a looming reversal.

Naturally, contrarian signals aren't a crystal ball. They shine brightest when integrated into a well-rounded trading strategy. By blending contrarian insights with technical and fundamental analysis, traders gain a deeper understanding of the forces driving the market – forces the crowd might easily overlook. Let's explore this concept by examining IG client sentiment and how it might influence crude oil, the Dow 30, and AUD/USD.

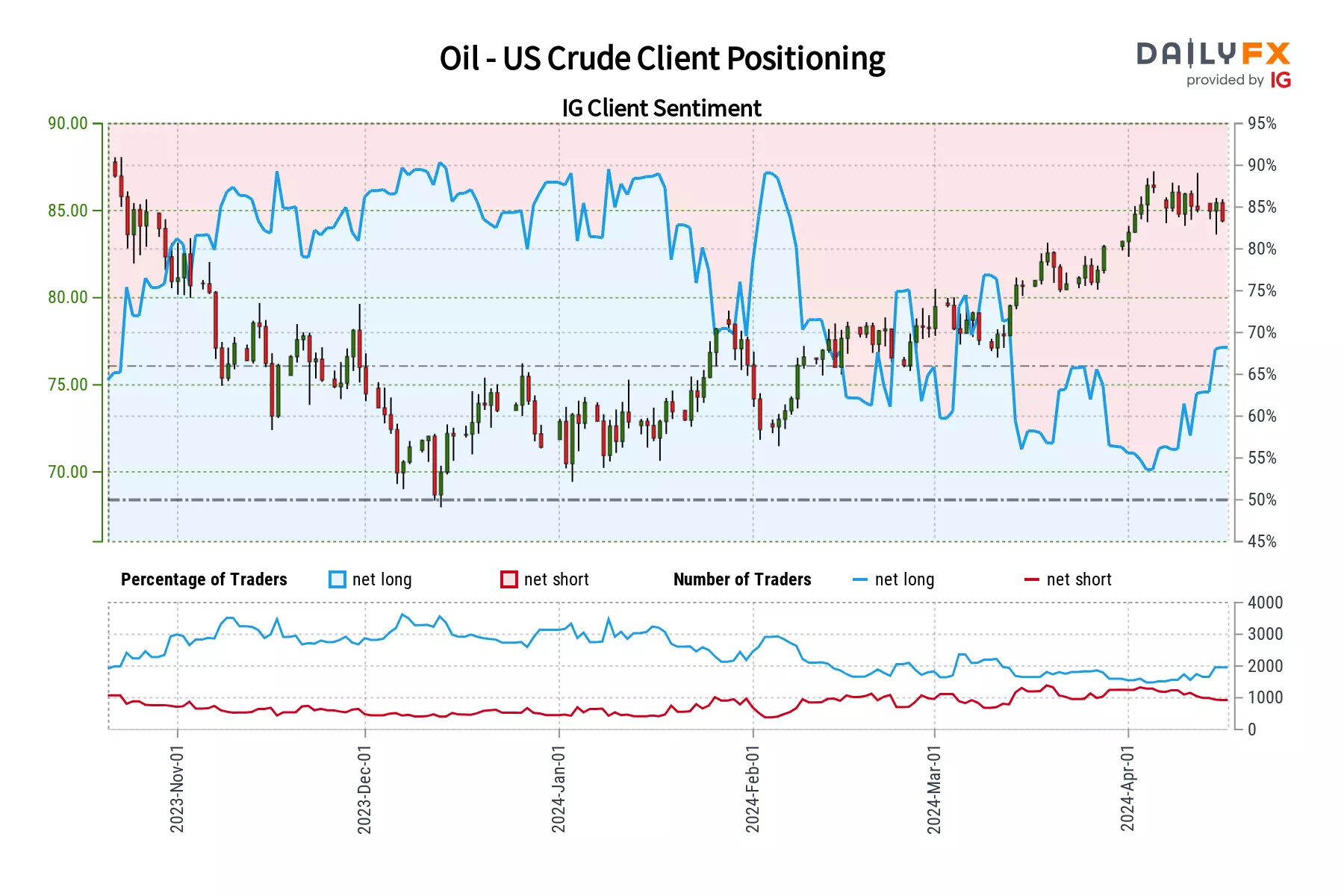

Crude oil technical analysis

IG data indicates a heavily bullish slant among traders towards WTI crude oil. Currently, 69.72% of clients hold net-long positions, resulting in a long-to-short ratio of 2.30 to 1. This bullishness has grown even stronger compared to yesterday (1.29% increase) and last week (18.07% increase).

Our strategy often incorporates a contrarian viewpoint. This widespread optimism towards crude oil suggests a potential near-term price correction to the downside. The continued surge in net-long positions further supports this bearish contrarian outlook.

Key Point: Remember, contrarian signals offer a unique perspective. However, for the most informed trading decisions, always combine them with a thorough technical and fundamental analysis of the oil market.

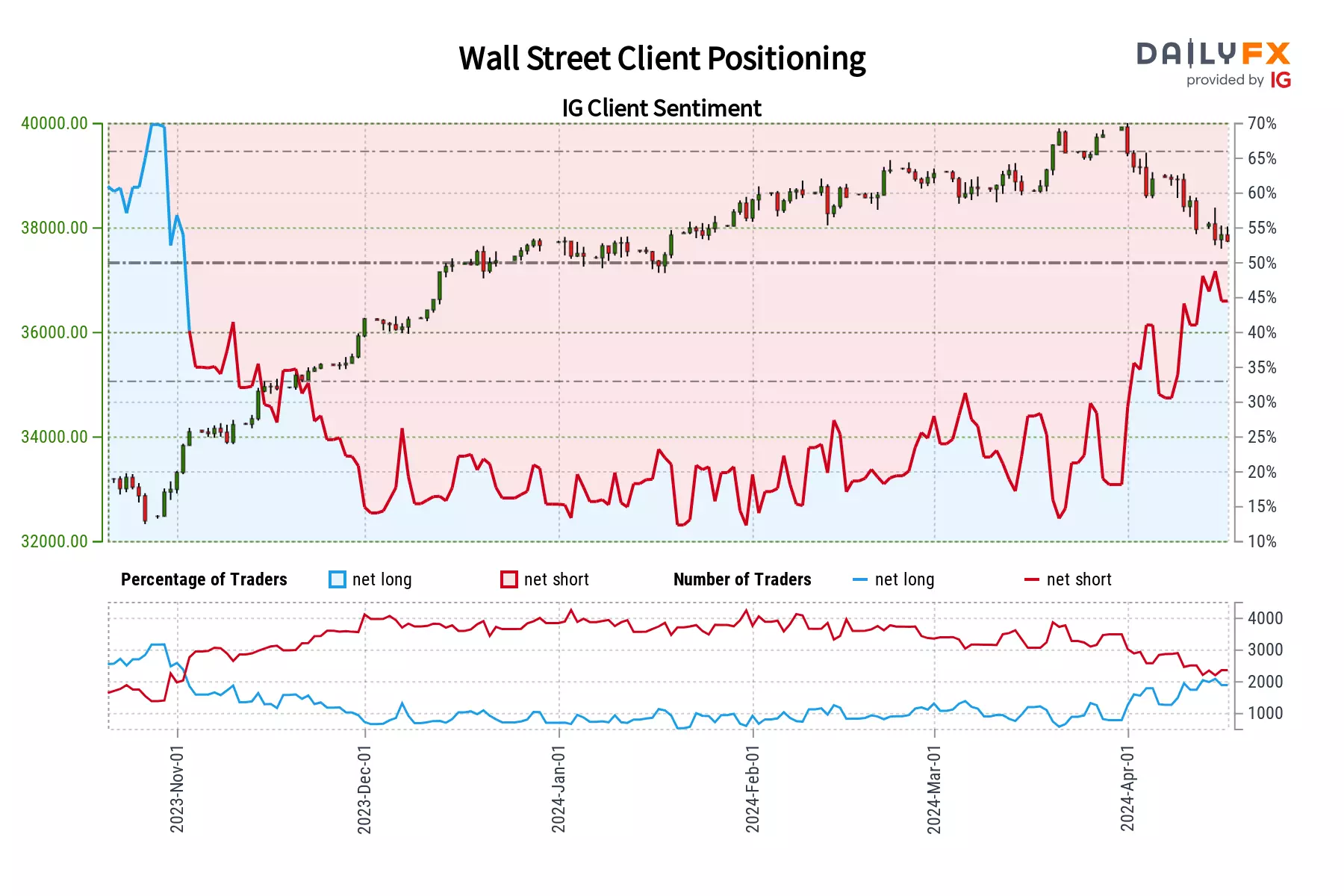

Dow 30 technical analysis

IG data reveals a bearish tilt among traders towards the Dow 30, with 58.47% currently holding net-short positions. This translates to a short-to-long ratio of 1.41 to 1. This bearishness has strengthened compared to yesterday (up 4.20%) and last week (up 6.06%).

We often employ a contrarian perspective in our trading. This prevailing pessimism towards the Dow 30 hints at a potential near-term rebound. The increasing number of net-short positions further reinforces this bullish contrarian outlook.

Important Note: Contrarian signals provide a valuable alternative viewpoint. However, for the most well-informed trading decisions, it's crucial to integrate them with a broader technical and fundamental analysis of the Dow 30.

AUD/USD technical analysis

IG's proprietary data spotlights a heavily bullish bias toward the AUD/USD pair. A substantial 81.92% of clients hold net-long positions, producing a long-to-short ratio of 4.53 to 1. This bullish sentiment has intensified compared to both yesterday (up 4.92%) and last week (up a significant 40.91%).

Our trading approach often favors a contrarian perspective. This overwhelming bullishness on AUD/USD suggests a potential continuation of the recent decline. The steady increase in net-long positions strengthens this bearish contrarian outlook.

Crucial Reminder: Contrarian signals provide a unique market lens, but they are most powerful when integrated into a comprehensive trading strategy that includes technical and fundamental analysis.

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Discover how to trade the markets

Learn how indices work – and discover a wide range of markets – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on the FTSE 100

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices