Market update: Crude oil price surge in focus after Hamas attacked Israel, retail bets remain bullish

Crude oil prices gapped upward, ended Monday 4.35% higher; Hamas’s attack on Israel may have oil disruption implications and retail bets are still net-long, what are key levels to watch?

Crude oil prices increased at Monday’s open and closed the session 4.35% higher, marking the best single-day performance since early April. This followed weekend developments as Hamas attacked Israel, inflating supply disruption woes. According to Bloomberg, the outbreak “threatens to embroil both the US and Iran”. The latter has recently been a contributor of extra supply this year.

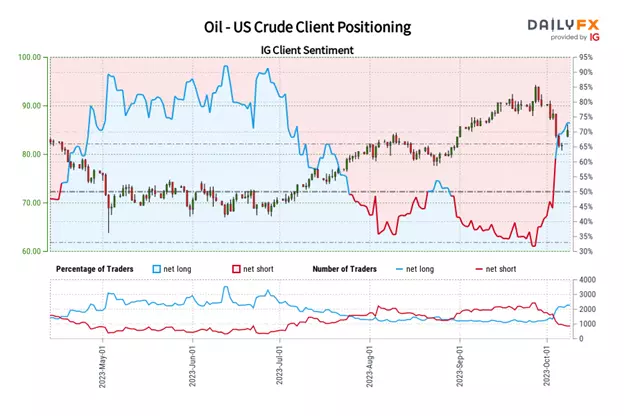

In response, retail traders have been increasing upside exposure in crude oil as of late. This can be seen via IG client sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, while supply disruption fears may offer near-term support, increasingly bullish retail bets may serve as a bearish prospect for oil.

Crude oil sentiment outlook - bearish

According to IGCS, about 73% of retail traders are net-long crude oil. Since most of them remain biased to the upside, this continues to hint that prices may fall down the road. This is as upside bets increased by 19.36% and 94.04% compared to yesterday and last week, respectively. With that in mind, recent changes in IGCS offer an increasingly bearish contrarian trading bias.

IG crude oil sentiment chart

Crude oil technical analysis

Looking at the daily chart, WTI bounced off the 38.2% Fibonacci retracement level of 82.99 following recent fundamental developments. This also undermined the breakout under the 50-day moving average, which has since been reversed. Resuming the uptrend entails a push above the 92.62 – 94.98 resistance zone. Meanwhile, breaking under support exposes the midpoint of the retracement at 79.29.

Crude oil daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Speculate on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

Put learning into action

Try out what you’ve learned in this commodities strategy article in your demo account.

Ready to trade commodities?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Deal on our wide range of major and niche commodities

- Protect your capital with risk management tools

- Get some of the best spreads on the market – trade Spot Gold from 0.3 points

Inspired to trade?

Put what you’ve learned in this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices